Key issues for states ahead outlined in presentation

(April 30, 2021) Issues and policies being pursued by the state system were outlined this week by NASCUS President and CEO Lucy Ito during a presentation hosted by CU*Answers’ “The CUSO Challenge.”

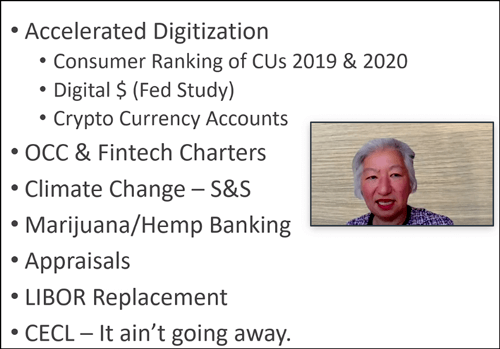

In the teleconference, Ito listed key issues being followed by NASCUS as: accelerated digitization among financial institutions (including competition from banks and others working with customers unable to leave their homes during the coronavirus crisis); the rise of new charters (including fintechs), climate change (and its impact on safety and soundness), marijuana and hemp banking (to make it safe for credit unions to serve their members with legal businesses offering those products), and other issues.

In the teleconference, Ito listed key issues being followed by NASCUS as: accelerated digitization among financial institutions (including competition from banks and others working with customers unable to leave their homes during the coronavirus crisis); the rise of new charters (including fintechs), climate change (and its impact on safety and soundness), marijuana and hemp banking (to make it safe for credit unions to serve their members with legal businesses offering those products), and other issues.

Ito also laid out NASCUS’ approach for “renovating” the Federal Credit Union Act, to bring the underlying federal line more in line with contemporary times, and to give the state system (which now represents more than half of the total assets of the entire credit union system) fair representation.

Among other things, Ito recommended separating the insurance function from the supervisory role of NCUA, a long-standing position of the association. NASCUS’ position is that the current structure of the National Credit Union Share Insurance Fund (NCUSIF) presents a potential conflict of interest within the agency unless those functions are internally separated. (NASCUS has also noted that any changes to the statutory structure of the NCUSIF should be evaluated and developed in conjunction with state regulators and credit union stakeholders, since state regulators have experience and expertise with statutory and operational construct of the bank deposit insurance fund that would help inform possible changes to the insurance fund.)

She also noted NASCUS’ support for expanding the NCUA Board from three to five members. In any event, NASCUS also supports reserving one seat on the board for a person with experience as a state credit union regulator.

Other renovations to the FCU Act mentioned by Ito included: updating field of membership, regulatory capital, member business lending and investments authorities, and considering changes to board compensation, annual meeting and member expulsion requirements.