Accreditation

NASCUS Accreditation Program

NASCUS Accreditation Program

The NASCUS Accreditation Program was adopted in 1989 to administer and assure the quality standards of states’ credit union examination and supervision. Modeled on the university accreditation concept, the program applies national standards of performance to a state’s credit union regulatory program.

The accreditation process includes disciplined self-evaluation, peer review and ongoing monitoring. Administered by the NASCUS Performance Standards Committee (PSC), this process measures a state regulatory agency’s ability and resources to effectively carry out its regulatory and supervisory programs.

To earn NASCUS prestigious accreditation, a state supervisory agency must demonstrate that it meets accreditation standards in these five areas:

- Agency Administration & Finance

- Personnel & Training

- Examination

- Supervision

- Legislative Powers

Download: NASCUS Accreditation Manual [PDF]

- Appendix A: Performance Standards Committee Charter

- Appendix B: NASCUS PSC Accreditation Decision Policy

- Appendix C: NASCUS Accreditation Agreement (Sample)

- Appendix D: CSBS AOS Guide – AOS Agency Training | CSBS

- Appendix E: SEQ/SERA – 2022-NASCUS-SERA-SEQ.pdf

Additional information on becoming NASCUS Accredited is available upon request, including associated fees, general benefits, a program description with what to expect during the review, and more. Please contact John Kolhoff, SVP of Policy and Supervision, to request a packet and schedule a consultation.

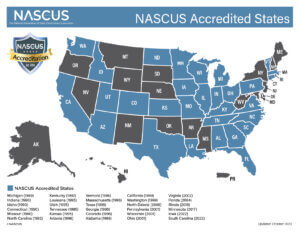

NASCUS Accreditation Map: [PDF] or [JPG]

NASCUS Accreditation Map: [PDF] or [JPG]

The considerable benefits of accreditation for state agencies include creating a benchmark of standardized regulatory procedures and best practices as well as a methodology for measuring effectiveness.

Accreditation is credible evidence of an agency’s capabilities. It provides recognition of the professionalism of a state agency’s regulators, supervisors and staff. It may also provide the impetus and support for legislation that modifies and/or modernizes state law.

Accreditation benefits state-chartered credit unions as well. Accreditation means that the state regulatory agency met the highest levels of regulatory proficiency.

What states are saying:

“Our department routinely examines the financial firms operating in Vermont to ensure their compliance with our laws. Accordingly, it is important for independent experts to examine our department’s operations to ensure we are following best practices and providing the highest level of service to Vermonters,” said Vermont Commissioner Michael Pieciak. “I am proud of our team for receiving Accreditation.”

“The value of NASCUS accreditation to the Idaho Department of Finance’s credit union examination team and overall department operational and human resources policies cannot be overstated,” stated Idaho Director Patricia Perkins. “It is vitally important that our stakeholders have confidence that we are held to the highest standards nationally and continue to meet those standards in subsequent reaccreditation exercises.

Indiana Director Tom Fite explained, “Accreditation establishes an independent measure of quality control for each accredited agency, and equally important Accreditation establishes benchmarks that drive regulatory consistency. Our efforts to achieve these established benchmarks drive us to remain current with the best-known supervisory processes and practices deployed nationwide. Standards are transparent and best practices shared, yielding greater consistency across the State system. Accreditation pushes the Indiana DFI to provide best in class supervisory support to Hoosiers.”

North Dakota Commissioner Lise Kruse expressed, “The accreditation process ensures that our DFI meets comprehensive organizational and performance standards. Accreditation assures the public and industries we regulate the competency and effectiveness of our DFI. It also provides independent validation of the quality of our work and the faithfulness to our mission. We appreciate the work of the accreditation team and are grateful to NASCUS for their reaccreditation.”

Click here to learn more about NASCUS’s Committees and their impact on the credit union system.

NASCUS Congratulates the Accredited State Agencies

- Michigan (1989)

- Indiana (1990)

- Idaho (1990)

- Connecticut (1990)

- Missouri (1990)

- North Carolina (1992)

- Kentucky (1992)

- Louisiana (1995)

- Utah (1995)

- Tennessee (1995)

- Kansas (1995)

- Arizona (1996)

- Vermont (1996)

- Massachusetts (1996)

- Texas (1996)

- Georgia (1996)

- Colorado (1996)

- Alabama (1998)

- California (1999)

- Washington (1999)

- North Dakota (2000)

- Pennsylvania (2001)

- Wisconsin (2001)

- Ohio (2001)

- Virginia (2002)

- Florida (2004)

- Illinois (2016)

- Minnesota (2017)

- Iowa (2022)

- South Carolina (2023)