Weed Legalization: Here’s Where States Stand in 2023

Courtesy of Tanya Kaushal, YahooFinance

Weed legalization has become increasingly common in the U.S., despite the fact that marijuana is still illegal on a federal level.

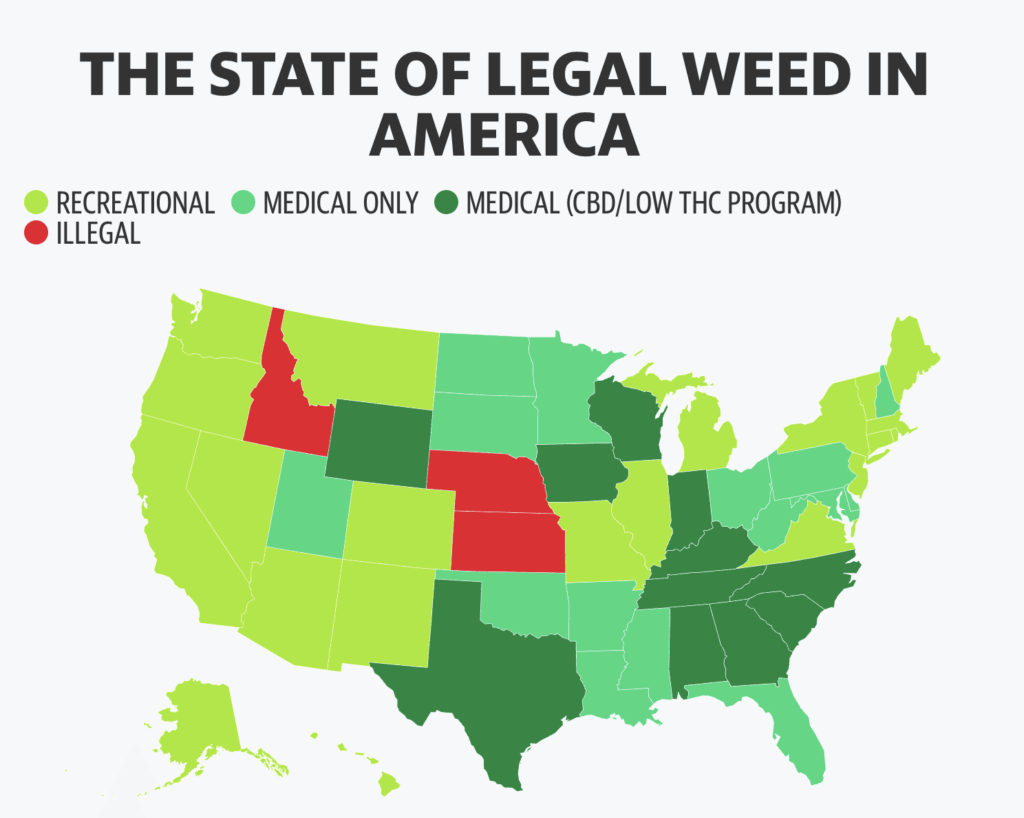

As of April 20, 20 states and the District of Columbia have legalized weed for recreational use while 27 states allow it for varying medicinal purposes. Three states — Idaho, Kansas, and Nebraska — prohibit it entirely.

SOURCE: NATIONAL COUNCIL OF STATE LEGISLATURES

Among the states that have legalized weed to any degree, “none of these states have ever repealed or even rolled back their laws, and public support for these policies has never been higher,” Paul Armentano, deputy director of Norml, a non-profit lobby for cannabis legalization, told Yahoo Finance. “That is because these policies are largely working as politicians and voters intended, and they are preferable to prohibition.”

A strong majority of Americans support the legalization of cannabis. An October 2022 survey from Pew Research found that 59% of adults support legalizing marijuana for both medical and recreational use while 30% support it solely for medical use.

There is clear bipartisan support for legalization: A January 2023 poll conducted by the Coalition for Cannabis Policy, Education and Regulation found that 68% of likely Republican voters support federal cannabis reform.

“It is time for lawmakers, and federal lawmakers in particular, to set aside their ‘canna-bigotry’ and comport the law in a manner that is consistent the available science, majority public opinion, and the plant’s rapidly changing cultural status,” Armentano said.

Armentano added that it is important for cannabis policy to “legalize, regulate, and educate,” which helps reduce the risks associated with cannabis abuse and an unregulated market.

Register today: 2023 Cannabis Banking Symposium

Register today: 2023 Cannabis Banking Symposium

Join us June 27-28, 2023, for our signature cannabis banking event. Network with state and federal regulators, credit union leaders, cannabis experts, and industry stakeholders in a two-day, collaborative deep-dive into the cannabis banking landscape environment.

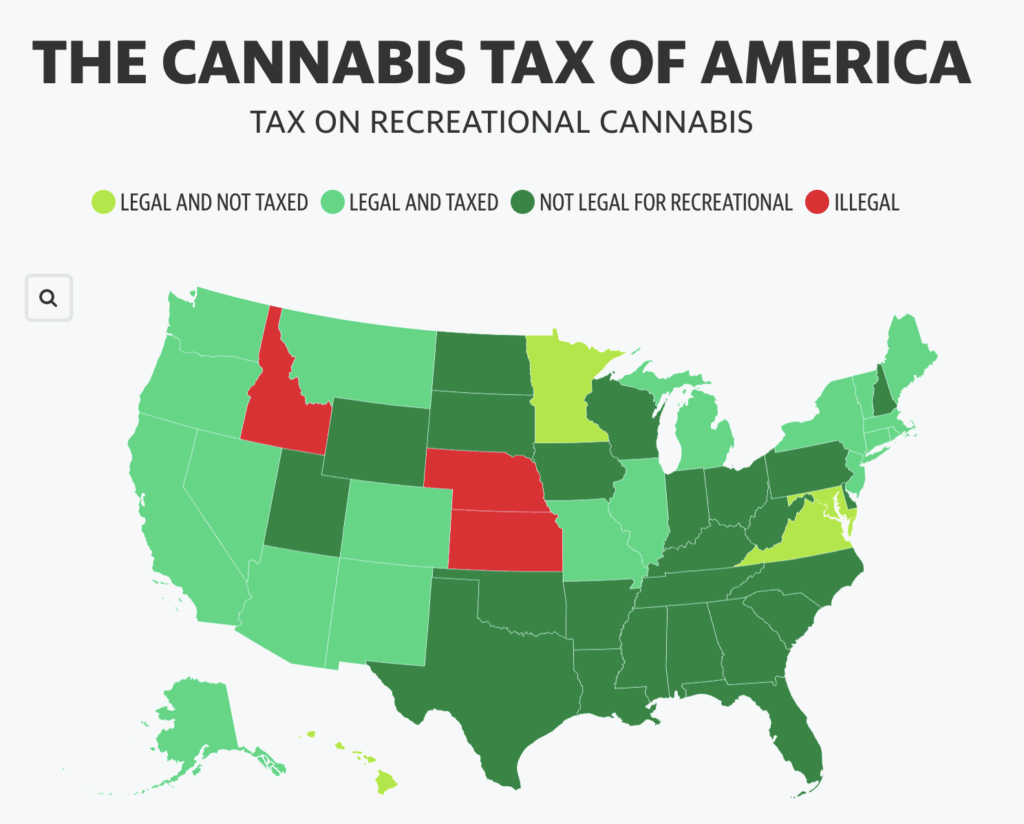

SOURCE: URBAN INSTITUTE • Hawaii, Maryland, and Virginia recently legalized recreational cannabis but taxation hasn’t begun yet.

The cannabis tax

National and global cannabis demand is increasing. It is projected that the U.S. cannabis market could see sales reaching $57 billion to $72 billion by 2030, according to a report from New Frontier Data.

States that have legalized marijuana have used the opportunity to generate revenue.

So far, 19 states levy a “cannabis tax” for the sale of recreational weed. Between July 2021 and June 2022, 11 states collected up to $774 million in state cannabis taxes, the highest being Washington and Colorado on a per capita basis.

“The main lesson we’ve learned so far from state cannabis taxes is that tax design matters,” Adam Hoffer, director of excise tax policy at the Tax Foundation, told Yahoo Finance. “The revenue potential from cannabis taxes is significant. A simple, low-rate, and low-cost tax system has the potential to raise significant amounts of revenue, while simultaneously decreasing social harms from cannabis by bringing illicit market transactions into a legal market framework.”

Hoffer explained that many states have opted for an “ad valorem tax” or a “sales tax based on the transaction price.” This tax relies on the value of the product and typically changes every year, most commonly used for properties. It fluctuates based on market prices.

With a larger cannabis supply chain, if the price falls, tax collection will fall too. Hoffer explained that taxes “based on product weight and potency would have far less volatility.”

There are currently five states — Alaska, Colorado, Maine, Nevada, and New Jersey — that use a weight-based cannabis tax. Aside from New Jersey, which taxes the different parts of the cannabis plant based on potency, the other four states tax the grower directly, according to the Urban Institute.

Still, federal cannabis policy views the drug as illicit, and therefore, the varying taxation in states has resulted in losses for cannabis businesses. Last year, the largest publicly-traded cannabis companies in total lost $550 million.