In final NCUA budget appearance, Ito outlines reasons why OTR is vital

(Dec. 10, 2021) Every dollar transferred from the federal credit union savings insurance fund to fund NCUA expenses is one dollar not available to cover losses in the system and subsequently a dollar that may need to be replenished in the NCUSIF by the charging of a premium, NASCUS President and CEO Lucy Ito told the agency this week.

And that’s why it is so important for both state and federally chartered credit unions to understand and closely monitor how the agency moves money from the insurance fund and into its operating budget via the overhead transfer rate (OTR), Ito said.

Acknowledging that any discussion of the OTR is lackluster (she said, at worst, such dialog can leave stakeholders “bleary-eyed” or lull credit unions into a “deep, deep coma”), credit unions need to know and comprehend: every National Credit Union Share Insurance Fund (NCUSIF) dollar that NCUA uses to cover its expenses is one dollar less in the NCUSIF’s equity level. “This is the fundamental reason why both state and federal credit unions should take serious interest in the OTR,” she asserted.

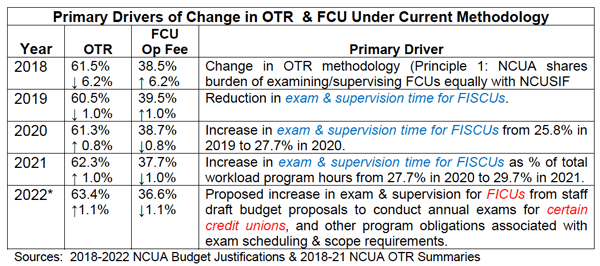

Ito made the comments this week during a public briefing and comment opportunity about the NCUA 2022 budget. The agency has proposed a 63.4% OTR for 2022, meaning that nearly two-thirds of the 2022 operating budget will be paid out of the share insurance fund (the remainder comes from federal credit union (FCU) operating fees). The operating spending plan – at $326 million — makes up 94.4% of the overall NCUA budget.

The 2022 OTR will be 110 basis points higher than the previous year’s and will be the third straight year that an increased transfer has been proposed by the agency (at 61.3% in 2020, 62.3% in 2021, and the proposed 63.4% for 2022).

Aside from taking funds from the insurance fund that could cover credit union losses, Ito said, there are two other reasons credit unions should monitor the OTR. First, NCUA’s use of NCUSIF dollars versus use of FCU operating fees to cover its expenses has the potential to imbalance the dual chartering system by disadvantaging the state system. “This is a threat to both state and federal credit unions,” she said, “because the dual charter framework is the credit union system’s most dynamic source of innovation and charter modernization.”

The third reason, she said, is the equity level of the insurance fund and the NCUA Board’s thought of raising the normal operating level (NOL) of the fund in anticipation of economic uncertainties related to the ongoing COVID-19 event. “Given the NCUA Board’s deliberations on changing the NOL to bolster NCUSIF equity, it behooves credit unions to monitor more than OTR as a mere formula used to transfer funds from the NCUSIF,” she said. “Credit unions should also be interested in what additional costs NCUA is now covering with NCUSIF dollars.”

Ito said her comments were made in the “pure spirit of state-federal regulator collaboration and in support of our shared objectives to foster a safe and sound and vibrant dual charter system that protects member-consumer best interests.”

In a nod to her impending retirement at year’s end, she thanked the board members for their “collegiality and commitment to forging a robust federal credit union system and a robust state credit union system” with state regulatory agencies during her seven-year run as NASCUS leader.

LINK:

President and CEO Lucy Ito Testifies on OTR During the 2022 NCUA Budget Briefing