From Callahan: Subordinated Debt Levels Surge After Regulatory Changes

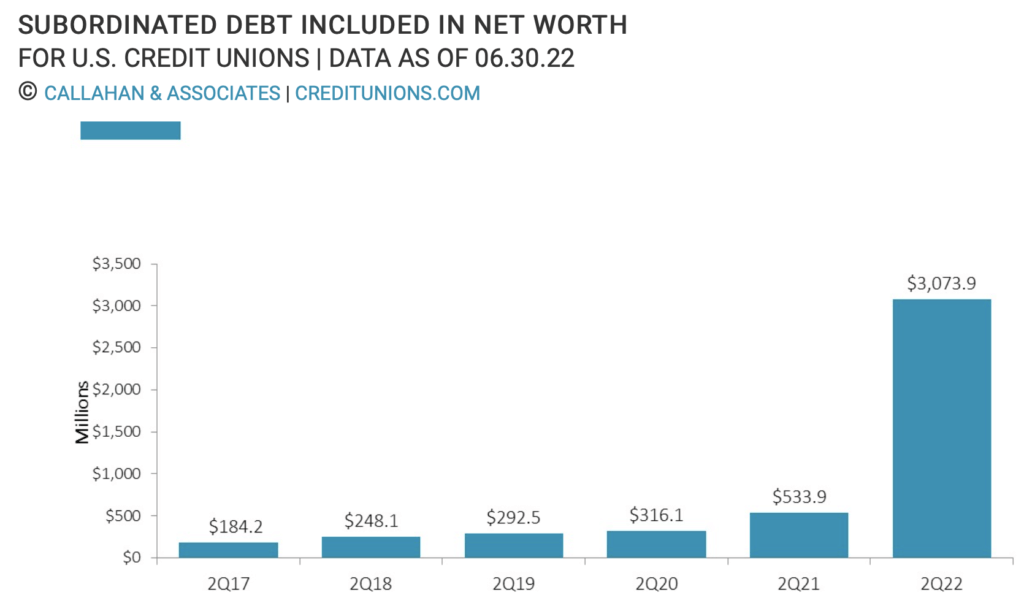

Aug. 22, 2022 — Updated rules from the National Credit Union Administration have resulted in a massive jump in the number of credit unions issuing subordinated debt and the overall dollar amount.

- Recent changes to regulations from the National Credit Union Administration have resulted in a surge in the number of credit unions issuing subordinated debt and the dollar amount being issued.

- Low-income credit unions (LICUs) have at times issued subordinated debt to expand their operations, typically using the capital for lending expansion and servicing, or for the acquisition of newer and more efficient financial technology. The advantage of subordinated debt is that credit unions can make loans or provide other services to members with borrowed money that is counted as net worth and thus not counted against their capitalization.

- Recently, the NCUA expanded the number of credit unions eligible to issue subordinated debt to include complex credit unions (those with more than $500 million in total assets) and newly chartered credit unions. This change was made in conjunction with the release of new regulatory capitalization ratios — risk-based capital and the Complex Credit Union Leverage Ratio — which are also designed for complex credit unions. Although only LICUs are permitted to include subordinated debt in net worth, complex and new credit unions can use it to bolster the new RBC value. By allowing these credit unions to issue subordinated debt, the NCUA is providing these institutions with a new route to adjust to the new regulatory thresholds.

- This new capitalization-requirement rules spurred a 170.8% quarterly increase in the dollar value of subordinated debt issued by credit unions industrywide. Alongside dollar growth, the number of credit unions using this tool to increase net worth is also expanding. As of the second quarter of 2022, 132 credit unions have issued subordinated debt. This is up from 86 institutions in the first quarter of 2022 and 80 in the fourth quarter of 2021, before the regulatory changes took effect. This increase has been driven by larger credit unions issuing subordinated debt as net worth: 64 of these 132 credit unions are complex credit unions, up from 44 in the fourth quarter of 2021.