At long last, joining 25 states, NCUA adopts ‘CAMELS’

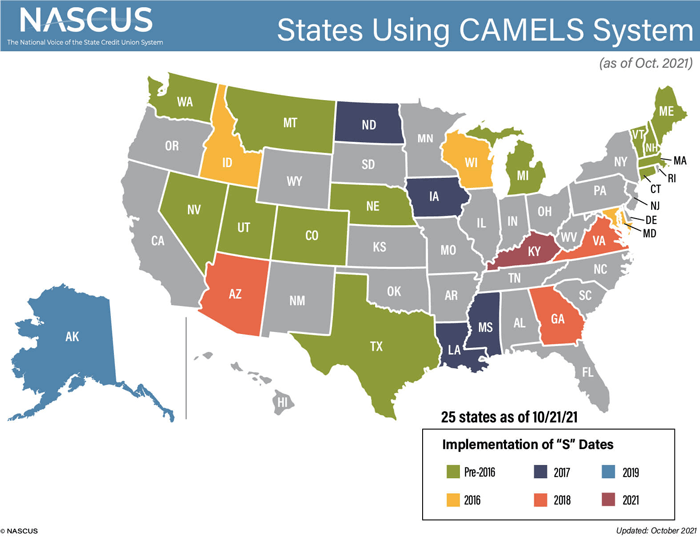

(Oct. 22, 2021) An “S” for “market sensitivity” is now part of the NCUA exam rating system, thanks to a unanimous vote by the agency board at its Thursday meeting – and long-term advocacy by NASCUS – bringing the agency in line with a policy already adopted by more than half of all state regulators.

The rule also redefines the “L” component (liquidity risk) of the rating system.

The new rating – which effectively renames the rating system “CAMELS” – will take effect April 1, 2022.

Adding the “S” component, according to NCUA, will allow the agency and federally insured credit unions to better distinguish between liquidity risk (“L”) and sensitivity to market risk (“S”). Also, the amendment will enhance consistency between the regulation and supervision of credit unions and other financial institutions.

The CAMELS proposal was issued in January and approved for public comment on a unanimous NCUA Board vote. As proposed, the rule would bring NCUA’s rating system up to date with a change that banking regulators incorporated decades ago and satisfy a recommendation the agency’s inspector general has been recommending for about the past five years.

More than five years ago, NASCUS wrote to NCUA urging the change and adding the “S” component. “NASCUS and state supervisory agencies encourage NCUA to consider earlier adoption of ‘CAMELS,’” NASCUS’ Lucy Ito wrote in the June 2016 letter to the board. “We again note that the separation of the ‘S’ component does not require a credit union to develop additional management system enhancements where market risk is already appropriately identified, measured, monitored and managed as part of the ‘L’ component.”

She also noted that in states that have adopted CAMELS (now totaling 25 – up from 16 when Ito penned the letter in 2016), that regulators and credit unions have reported positive outcomes with nearly no additional regulatory burden.

In its comment letter filed last spring, NASCUS said there is no need to “reinvent the wheel and develop a credit union CAMELS Rating System that diverges from the established CAMELS system currently in use in bank supervision and in the states that have adopted CAMELS for credit union supervision.”

In the final rule commentary issued Thursday, NCUA stated that the updated rating system is based on (and consistent with) the Uniform Financial Institutions Rating System (UFIRS) system used by NCUA and the banking regulators. However, the commentary noted, NCUA has made certain minor, non-substantive modifications to the rating descriptions to clarify and better reflect supervision of credit unions. “Notwithstanding this slight divergence from UFIRs, the Board has determined that the NCUA’s revised rating system is consistent with the other financial supervisors,” NCUA said.

Agency staff also told the board that, in their view, the new rule will have little, if any, impact on the 20 state regulators (and their credit unions) that do not yet have the S component in their exam ratings.

LINKS:

Final Rule: CAMELS Rating System

NASCUS comment: Notice of Proposed Rulemaking Regarding CAMELS Rating System