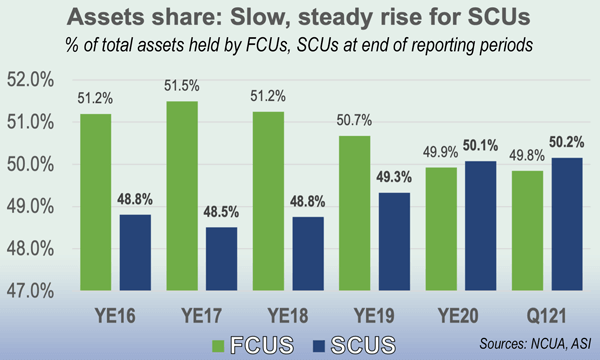

States keep more than half of assets, which neared $2 trillion at end of 1Q21

(June 11, 2021) Credit union assets mushroomed to a total of just under $2 trillion in the first quarter of the year – and state-chartered credit unions kept pace with the growth, maintaining a slight edge over federals in the share of total assets held as of March 31, according to numbers released by NCUA, and compiled by NASCUS, late last week.

(June 11, 2021) Credit union assets mushroomed to a total of just under $2 trillion in the first quarter of the year – and state-chartered credit unions kept pace with the growth, maintaining a slight edge over federals in the share of total assets held as of March 31, according to numbers released by NCUA, and compiled by NASCUS, late last week.

According to first-quarter credit union statistics culled from first quarter call reports, the nation’s 2,007 state credit unions (federally and privately insured) held 50.2% of total assets, with the 3,167 federals holding the balance. Growth of assets in the first quarter slightly favored state credit unions, which advanced their holdings by 5.85%; FCUs grew by 5.52%. Membership at the state credit unions advanced by just over 500,000 (0.83%); FCUs saw memberships grow by 900,000 (1.39%). Total membership for credit unions was 125.8 million (FCUs have the edge here, with 51.7% of all members).

As in past quarters, most of the growth in assets was centered on the largest of credit unions: those with at least $1 billion (395 credit unions). Those CUs held more than $1.4 trillion in assets and 72% of all assets in credit unions. Membership grew by 10% and net worth increased by 13.7%, according to NCUA. (The 293 credit unions with more than $500 million but under $1 billion in assets held about 10% of total assets and also saw increases in their lending, memberships and net worth).

Those results are in stark contrast with smaller credit unions (those under $500 million in assets): according to NCUA, loans, membership and net worth among those credit unions – which make up 92% of all credit unions, but hold only about 17% of all assets — declined in the first quarter, following a trend of the last several years.

NASCUS President and CEO Lucy Ito affirmed that the inflow of savings from stimulus payments and other sources was a key factor in driving up assets at credit unions that saw growth. But she also praised the management of state credit unions for ensuring their members have a haven for their savings, and that the members understand the safety and value a credit union offers.

“The numbers make it clear that credit union members recognize that their state-chartered institutions are strong, safe and resilient institutions that watch out for their members’ interests,” she said.

But she also acknowledged the struggle that smaller credit unions face in today’s environment. “State supervisory authorities are committed to doing whatever they can, in concert with safety and soundness, to give smaller credit unions their best chance to thrive,” Ito said. “Small credit unions play a key role in the lives of their members, and the state system wants that role to continue.”

Other first quarter results for federally insured credit unions (state and federal) reported by NCUA showed:

- The return on average assets for federally insured credit unions was 104 basis points in the first quarter of 2021, up from 52 basis points in the first quarter of 2020.

- Net income totaled $19.7 billion at an annual rate, up $11.3 billion (134.9%) from the same period a year ago.

- The net interest margin was $48.7 billion, 2.57% of average assets.

- Delinquency and net charge-off rates were both down, compared to a year ago: the former was 46 basis points (down 17 points from last year); the latter (as the net charge-off ratio) was 35 bp (down from 58 bp in the first quarter of 2020).

LINK:

Rising Net Income, Elevated Insured Share Growth Reported in First Quarter of 2021