States keep steady holding half of all assets at end of 3Q

(Dec. 11, 2020) State credit unions maintained their hold of half of all credit union assets during the third quarter, according to the latest quarterly financial results released by NCUA late last week, and other results compiled by NASCUS.

However: asset growth for all charters of credit unions – state (federally and privately insured) and federal – dropped off considerably during the third quarter.

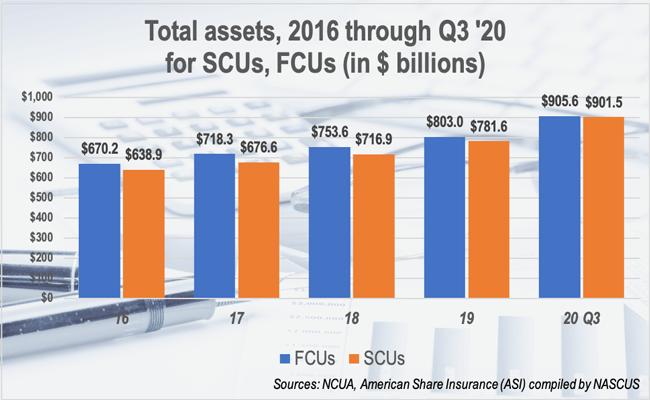

According to the third-quarter results from NCUA (and results from privately insured credit unions collected by private insurer American Share Insurance (ASI) and compiled by NASCUS), state credit unions (SCUs, federally and privately insured) held $901.5 billion in total assets, up 15.3% since the beginning of the year. That accounts for 49.9% of all credit union assets. Federal credit unions, (FCUs) meanwhile, held $905.6 billion in assets, up 12.8% from the year’s start – and accounting for 50.1% of all assets. There were 2,027 SCUs, and 3,213 FCUs, at the end of the third quarter.

Much of the asset growth, however, occurred in the first half of the year – particularly the second quarter – and asset growth slowed in the third quarter. For example, assets for SCUs expanded from year-end 2019 by 12.6% in the first six months of the year (about 8.4% in the second quarter), but only by about 2.7% from the second to the third quarter. FCUs saw a similar growth pattern, with asset growth at mid-year of 10.9% from the end of 2019, but only 1.8% from the second to third quarter.

An influx of savings spurred by stimulus checks to individuals (which were largely recorded in the second quarter), and by payments for enhanced unemployment insurance (UI) and through the Paycheck Protection Program (PPP) payments to workers, is attributed to the asset growth. There were no additional stimulus checks in the third quarter, and enhanced UI came to an end during the quarter.

“Although the 2,037 state-chartered credit unions make up only about 39% of all credit unions across the nation, they have an outsize influence on the lives of their nearly 60 million members who trust these institutions to safeguard their savings and provide them with needed financial services,” said NASCUS President and CEO Lucy Ito, referring to the more than 48% of all credit union members who belong to SCUs.

Other results from the third quarter results show:

- SCU memberships have grown by 3.3% since the beginning the year (1.4% during the third quarter, adding more than 810,000 memberships). FCUs have expanded their memberships by 2.2% since year-end 2019, and less than 1% in the third quarter for 600,000 memberships. Since the end of last year, more than 3.3 million memberships have been added, for a total of 125 million.

- The number of credit unions continued to drop through the first three quarters of the year, with 5,240 reporting their financial results at the end of the third quarter – 107 fewer than at the end of 2019. Of those, 37 were SCUs and 70 FCUs.

LINK:

NCUA Releases Q3 2020 Credit Union System Performance Data