North Carolina Story Archive

Kristina Ray Appointed as Administrator of the North Carolina Credit Union Division

June 23, 2023 — The National Association of State Credit Union Supervisors (NASCUS) proudly announces that Kristina Ray has been appointed as Administrator of the North Carolina Credit Union Division, effective July 1, 2023. This follows the announcement that Rose Conner, former North Carolina Administrator and NASCUS Board Member will retire at the end of this month.

June 23, 2023 — The National Association of State Credit Union Supervisors (NASCUS) proudly announces that Kristina Ray has been appointed as Administrator of the North Carolina Credit Union Division, effective July 1, 2023. This follows the announcement that Rose Conner, former North Carolina Administrator and NASCUS Board Member will retire at the end of this month.

“I am honored to be appointed the next Administrator,” said Ray. “I look forward to using my experience in financial institution regulation to serve, promote, and support the North Carolina Credit Union Division, our 31 state-chartered credit unions, and the 3.2 million North Carolinians who are members of those institutions.” Read more

North Carolina Credit Union Division Receives 2023 NASCUS Accreditation

June 23, 2023 —The National Association of State Credit Union Supervisors (NASCUS) is proud to announce that the North Carolina Credit Union Division has earned Accreditation following a series of in-depth reviews and assessments by a panel of veteran state supervisors.

“NASCUS’ Accreditation is highly significant for our Division. It’s crucial for stakeholders to have complete confidence in our commitment to strong national standards and our consistent ability to meet those standards and processes,” commented Rose Conner, Administrator of the North Carolina Credit Union Division. “Independent professionals thoroughly reviewed our Division to establish our continued credibility and ensure we follow best practices and provide excellent service to North Carolina’s state-chartered credit unions and consumers. I’m proud of our team’s 2023 Accreditation.” Read more

North Carolina State Employees’ Credit Union Board of Directors Names New CEO

Credit union veteran Leigh Brady tapped to replace Jim Hayes

June 16, 2023 — State Employees’ Credit Union (SECU) Board of Directors announced today that Leigh Brady has been named CEO. The appointment follows the resignation of Jim Hayes, who is leaving SECU to become CEO of State Department Federal Credit Union in Alexandria, Virginia. Brady is the Credit Union’s first female CEO. Click here to read more

NC Administrator, Rose Conner Announces Retirement

NC Administrator, Rose Conner Announces Retirement

Apr. 21, 2023 — After a long career in public service with the State of North Carolina Credit Union Division, including leadership roles on the National Association of State Credit Union Supervisors (NASCUS) Regulator Board of Directors, Rose Conner has announced that she would retire on July 1, 2023. Read more

NASCUS Testimony In North Carolina: Bill to Allow Lower-Income Residents to Join Credit Unions Passes House Committee

Apr. 21, 2023 — The measure modernizes credit union statutes for the first time since the 1970s. The bill grants permission to credit unions to accept as members people below the poverty line and residents of areas with no bank branch within 200 square miles.

John Kolhoff, Senior Vice President of Policy and Supervision at the National Association of State Credit Union Supervisors, said, “North Carolina is not alone in their endeavor to modernize their credit union act. Several states have recently, or are currently, reviewing their statutory framework for credit unions. The proposed expansion of membership eligibility in House Bill 410 would bring North Carolina on par with numerous states while still more modest than some of the most inclusive state FOMs.” Read more

North Carolina’s Vizo Financial President/CEO David Brehmer Announces Retirement; Eisel Named Successor

Vizo Financial Corporate Credit Union President/CEO David Brehmer has announced his plans to retire on January 5, 2024. Brehmer has spent 44 years in the credit union movement, 29 of which have been with the corporate.

Vizo Financial Corporate Credit Union President/CEO David Brehmer has announced his plans to retire on January 5, 2024. Brehmer has spent 44 years in the credit union movement, 29 of which have been with the corporate.

“Serving credit unions in my role as president/CEO of Vizo Financial has been a great honor and the pinnacle of my long career,” said Brehmer. “While I remain energized by the work we do in serving credit unions and particularly any time I get to spend with credit unions, this appears to be an excellent time to allow new leadership to continue the progress we have made since forming Vizo Financial in 2016 when we set out to make a stronger, more financially secure corporate credit union.” Read more

Carolinas’ CDFIs awarded over $717M in grants for the betterment of underserved people, communities

Sept. 29, 2022 — In recent days, two award programs focused on community development financial institutions (CDFIs) and other designated community financial institutions have announced their respective grant recipients, which includes ten credit unions from the Carolinas.

The total amount awarded to North and South Carolina credit unions through the U.S. Department of the Treasury’s Emergency Capital Investment Program (ECIP) and CDFI Fund FY 2022 CDFI Program Technical Assistance Awards amounts to $717,709,000.

ECIP funds support the efforts of CDFIs or minority depository institutions to provide loans, grants, and other assistance to small and minority-owned businesses and consumers, especially in low-income and financially underserved communities that struggled during the COVID-19 crisis.

Recipients from the Carolinas include Latino Community Credit Union (Durham, NC), Local Government Federal Credit Union (Raleigh, NC), Marine Federal Credit Union (Jacksonville, NC), REV Federal Credit Union (Summerville, SC), Self-Help Credit Union (Durham, NC), and Self-Help Federal Credit Union (Durham, NC). View list of recipients by state.

“Being awarded ECIP funding is a game changer for REV,” said REV FCU President and CEO Jason Lee when plans to deploy the funds were first announced by the Biden-Harris Administration in December 2021. “Our mission is Growth with Purpose, and these funds allow us to increase REV’s social and net economic impact in the communities we serve.”

The Technical Assistance grants help recipients build their capacity to provide services to low-income and underserved people and communities across America. CDFIs commonly use these funds to analyze which products and services are appropriate for their target markets, develop lending policies and procedures, and build staff lending capacity. Some CDFIs also use these awards to provide new products, serve current target markets in new ways, or improve the efficiency of their operations.

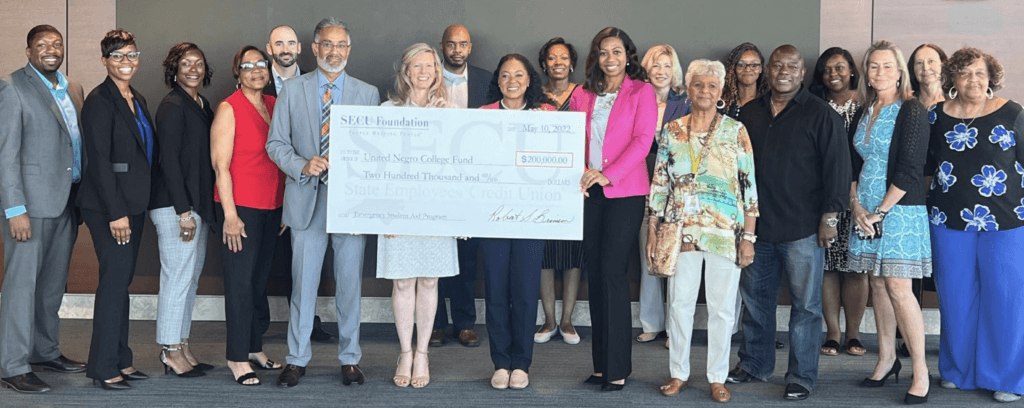

North Carolina’s SECU Foundation Awards $200,000 Grant for UNCF Emergency Student Aid Program

Earlier this month, SECU Foundation announced a $200,000 grant for UNCF (United Negro College Fund) to provide emergency

Earlier this month, SECU Foundation announced a $200,000 grant for UNCF (United Negro College Fund) to provide emergency

financial assistance for students attending one of the state’s five Historically Black Colleges and Universities (HBCUs) within the University of North Carolina System. The grant will support UNCF’s Emergency Student Aid program to ensure college students impacted by the pandemic or other unexpected hardships remain on track to graduate.

“Students attending HBCUs are receiving a high-quality education — this grant will address students’ financial insecurities and help them cross the finish line,” said Jama Campbell, SECU Foundation Executive Director. “Education has been a core focus of our Foundation from the beginning, and we are pleased to assist UNCF in their efforts as staunch advocates for education and their students’ well-being.”

“UNCF is committed to serving the needs of students across the state of North Carolina, so establishing a relationship with the SECU Foundation is a tremendous step toward making a direct impact. Keeping students enrolled and equipped to secure higher education at HBCUs will yield more young people getting to and through college,” said Natia Walker, Development Director, UNCF.

$40,000 Grant from SECU Foundation Helps Higher Ed Works Expand Resources for Education Initiative

SECU Foundation has awarded a $40,000 grant to Higher Ed Works (HEW) to help the non-partisan public charity support and promote public higher education in North Carolina. HEW will use the funding to expand resources for written and video production, helping to fulfill their mission to educate North Carolinians about the great value of the state’s public, postsecondary education. Over the next two years, Higher Ed Works will place special emphasis on promoting the North Carolina Community College System in conjunction with the ambitious goal of myFutureNC – ensuring that by 2030, two million North Carolinians have a high-quality credential or a postsecondary degree.

SECU Foundation has awarded a $40,000 grant to Higher Ed Works (HEW) to help the non-partisan public charity support and promote public higher education in North Carolina. HEW will use the funding to expand resources for written and video production, helping to fulfill their mission to educate North Carolinians about the great value of the state’s public, postsecondary education. Over the next two years, Higher Ed Works will place special emphasis on promoting the North Carolina Community College System in conjunction with the ambitious goal of myFutureNC – ensuring that by 2030, two million North Carolinians have a high-quality credential or a postsecondary degree.

“Education is one of SECU Foundation’s core focus areas, and one that we have been making a great impact in statewide since our establishment in 2004,” remarked Jama Campbell, SECU Foundation Executive Director. “Organizations like Higher Ed Works are bringing greater awareness to educational opportunities that will help North Carolinians achieve their goals and improve their economic future. We are pleased to support this organization, as we work together to promote public higher education in our state and achieve the lofty myFutureNC goal by 2030.”

“Higher Ed Works and the SECU Foundation share a mission to see that more North Carolinians benefit from the outstanding public colleges and universities in our state, so our collaboration seems only fitting,” said Paul Fulton, Chair of the Higher Ed Works Board. “We very much appreciate the support of the SECU Foundation.”

LDI’s Class of 2021 finally graduates after pandemic-disrupted year

December 9, 2021 — Eighteen credit union professionals gathered at the Rizzo Center at UNC-Chapel Hill December 7-8, 2021 for the final quarter of the Carolinas Credit Union League’s 2021 Leadership Development Institute (LDI). However, for this class of students, completion came with even greater excitement as the program they started in March 2020 finally concluded in a long-awaited celebration.

Presented in partnership with the Center for Leadership Studies (CLS) and sponsored by CUNA Mutual Group, LDI features a custom curriculum delivered by top instructors through quarterly two-day workshops. This quarter, CU Difference’s Angela Prestil and The Performance Architect’s Leesa Wallace facilitated the final workshop.

Prestil, who made her debut as an LDI instructor this year, helped students on Tuesday stretch their empathy muscles in the session, Leading with Empathy. Using a mix of arts and crafts, exercises and class discussion, participants identified their central core values, what empathetic words and phrases sound like when talking to members, empathetic missteps to avoid, and how to “walk in another person’s shoes” using empathy mapping.

NC’s new anti-skimming law highlights importance of skimming fraud prevention

RALEIGH, NC–North Carolina Governor Roy Cooper’s July 2 signing of H238, Prohibit Possession of Skimming Device added a measure of fraud mitigation for citizens and serves as reminder for credit unions and consumers in general to remain vigilant of risk and fraudster creativity.

As reported in Monday’s edition of The Advocate (NC), the bill by Rep. John Torbett (R-Gaston) categorizes as a Class I felony the simple possession of scanning devices to access, read, obtain, memorize, or store information from an individual’s financial transaction card—like a debit or credit card—with the intent to defraud.

“The League has long sought measures at state and federal levels to stop consumer data breaches, including ways to attack such use of skimmers, and applauds Rep. Torbett for this long-overdue bill,” VP of Governmental Affairs Evelyn Hawthorne noted Monday. The League had suggested similar language in 2019 to state lawmakers as they assembled that year’s version.

League Works to Update NC, SC State Credit Union Acts

April 8, 2021 — In January, the Carolinas Credit Union League helped introduce updates to both the North and South Carolina state credit union acts to improve and modernize the statutes in each state.

In North Carolina, the League worked with League members and the NC Credit Union Division to modernize the state credit union statutes. Together with Brian Knight, National Association of State Credit Union Supervisors (NASCUS) executive vice president and general counsel, the League is assessing North Carolina’s current statutes and looking to developments across the country for best practices and improvements.

Leading the project for the League is Vice President of Governmental Affairs Evelyn Hawthorne. The project is a great undertaking in scope and impact, but the benefits would be worth the resources and effort. In addition to updating antiquated provisions, the goal is to make the state charter option as robust and competitive as possible with federal charter options. Work with state- and federally-chartered League members is critical to the project’s success.

Massachusetts, North Carolina and Wisconsin Regulators Elected to the NASCUS Board

September 10, 2014 – Nashville, Tenn. – At the 2014 NASCUS Annual Meeting on Sept. 10 in Nashville, three NASCUS Board members began new three-year terms.

Childs and Boesch Continue Service on NASCUS Credit Union Advisory Council

September 10, 2014 – Nashville, Tenn. – The NASCUS Credit Union Advisory Council held its 2014 Annual Meeting on Sept. 10 in Nashville, where two state credit union CEOs began new terms on NASCUS’ Credit Union Advisory Council. The credit union membership is governed by the Advisory Council, a group of 12 directors who are credit union executives from around the country.

NASCUS Welcomes Rose Conner to NASCUS Board; Says Goodbye to Utah Regulator Orla Beth Peck

August 6, 2014 – Rose Conner, administrator of the North Carolina Credit Union Division, has been appointed to the NASCUS Board. Conner replaces Utah regulator Orla Beth Peck, who recently retired from her position as supervisor of credit unions with the Utah Department of Financial Institutions (DFI).

What’s new in your state?

Click here to submit your state-chartered credit union news stories to NASCUS today!