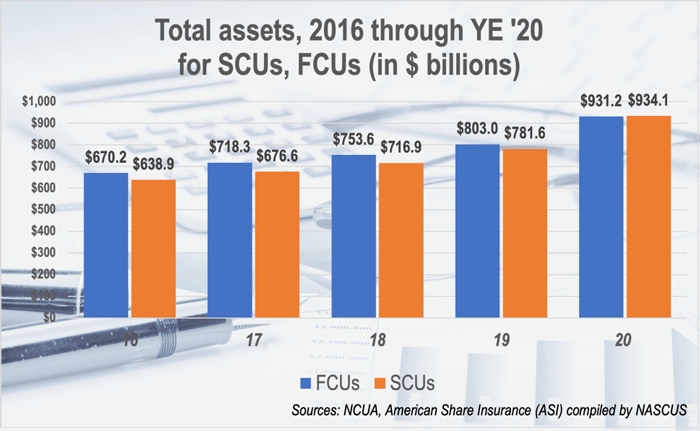

States push beyond 50% of assets, as savings surged during 2020

(March 5, 2021) After inching closer and closer for years, the total amount of assets held in state-chartered credit unions has exceeded that of federally chartered credit unions, with state charters now holding slightly more than 50%, according to numbers released by NCUA and compiled by NASCUS this week.

The numbers, gleaned from year-end call reports for both federal- and state-chartered credit unions (including federally and privately insured institutions), show state-chartered credit unions with $934.1 billion in assets, compared to $931.2 billion for federals. Overall assets held by credit unions are now approaching $2 trillion ($1.84 trillion). (State chartered statistics are from NCUA call reports for federally insured, state-chartered credit unions, and from American Share Insurance (ASI) Inc. for privately insured credit unions.)

“Credit union members, in response to the financial impact of the coronavirus crisis, clearly decided to hold onto or build their savings over the last year, when the pandemic’s impact became fully apparent,” said NASCUS President and CEO Lucy Ito. “Clearly, those members determined that state-chartered credit unions were a safe and sound place to maintain their savings – including their stimulus payments — reflecting the confidence in state credit unions built through responsible leadership by credit union boards and management and the careful supervision of state regulators.”

Assets at state charters grew by 19.5% over the last year, compared to 15.9% for FCUs. State system credit union memberships advanced by 3.8% (to 58.6 million); FCUs saw their memberships rise by 2.8% (to 63.1 million), for a grand total of 121.7 million memberships.

The number of credit unions continued a long slope downward, with 2,020 state charters (down 44 from year-end 2019), and 3,185 FCUs (down 98 from the end of last year). There were 5,205 credit unions at the end of 2020.

In other statistics, NCUA reported for federally insured credit unions:

- Insured shares and deposits rose $242 billion, or 19.8%, in 2020 from the previous year – a big driver of the increased assets at credit unions.

- Total loans outstanding were up $55 billion, or 4.9%, from the previous year (to $1.16 trillion); the loan-to-share ratio dropped to 73.2% at the end of 2020, down from 84% at the end of 2019 (before the pandemic’s impact was apparent).

- Net income was down $2.1 billion during 2020 compared to 2019, to $12 billion. NCUA said the decline was due primarily to a jump in provisioning for loan and lease losses or credit loss expenses.

- The return on average assets (ROAA) was 70 basis points (bps) at the end of 2020 – down from 93 bp at year-end 2019. However, NCUA pointed out that the median return on average assets across all federally insured credit unions at the end of 2020 was 40bp, down 20bp from the end of the previous year.

- The return on average assets for federally insured credit unions was 70 basis points in the fourth quarter of 2020, down from 93 basis points in the fourth quarter of 2019. The median return on average assets across all federally insured credit unions was 40 basis points, down 20 basis points from the fourth quarter of 2019.

LINK:

NCUA Releases Q4 2020 Credit Union System Performance Data