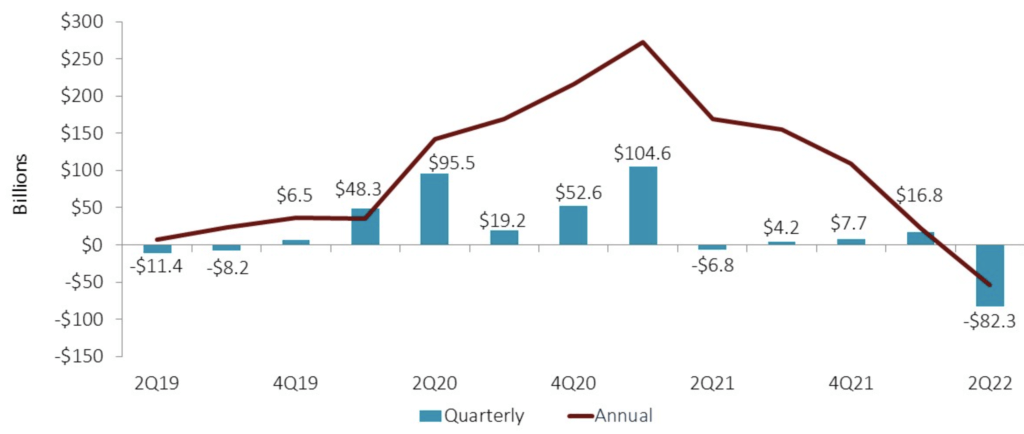

CALLAHAN GRAPH OF THE WEEK: Liquidity Takes A Dive As Lending Ticks Up

Ongoing growth in home and auto lending means the industry is gradually shedding the high liquidity levels brought on by pandemic relief programs.

Courtesy of CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

Take Aways

- The federal government took a variety of steps to provide economic relief during the first year of the pandemic, including distributing trillions of dollars directly to consumers. As a result, credit union shares grew at record rates – well outpacing loan growth – leading to sizeable increases in liquidity. However, with the pandemic now mostly in the rearview mirror, credit unions are beginning to unwind the liquidity built up during the crisis. Credit unions reported 6.6% quarterly growth in outstanding loan balances as of 2Q22, well outpacing share growth over the same period, leading to liquidity outflows of $82.3 billion since March. This is a large change from 1Q22, when liquidity moderately increased by $16.8 billion.

- As economic activity expands, this liquidity is being converted from cash into impactful loans. Overall, the dollar value of loans rose by $86.6 billion in the second quarter, increasing total loans by 6.6%. This expansion was driven by credit union members taking out loans for first mortgages (up $26.8 billion this quarter, or 5.36%) and used cars (up $18.4 billion this quarter, or 6.72%). Both growth rates are five-year highs. The loan-to-share ratio has increased from 70.22% in March to 74.73% at the half-year mark.

- Not only is this loan growth helping members purchase homes and cars, it also translates to an impact on earnings for credit unions. As cash balances are converted into loans, credit unions increase earnings off the higher yield. Net interest margin is beginning to tick up, rising 10 basis points from the end of March to 2.67%.

- Rising interest rates make it unclear whether this record loan demand will continue. However, the effects of the economic reopening and federal relief funds on the demand for auto and home financing has certainly led to a repurposing of credit union liquidity.