(Oct. 22, 2021) An “S” for “market sensitivity” is now part of the NCUA exam rating system, thanks to a unanimous vote by the agency board at its Thursday meeting – and long-term advocacy by NASCUS – bringing the agency in line with a policy already adopted by more than half of all state regulators.

The rule also redefines the “L” component (liquidity risk) of the rating system.

The new rating – which effectively renames the rating system “CAMELS” – will take effect April 1, 2022.

Adding the “S” component, according to NCUA, will allow the agency and federally insured credit unions to better distinguish between liquidity risk (“L”) and sensitivity to market risk (“S”). Also, the amendment will enhance consistency between the regulation and supervision of credit unions and other financial institutions.

The CAMELS proposal was issued in January and approved for public comment on a unanimous NCUA Board vote. As proposed, the rule would bring NCUA’s rating system up to date with a change that banking regulators incorporated decades ago and satisfy a recommendation the agency’s inspector general has been recommending for about the past five years.

More than five years ago, NASCUS wrote to NCUA urging the change and adding the “S” component. “NASCUS and state supervisory agencies encourage NCUA to consider earlier adoption of ‘CAMELS,’” NASCUS’ Lucy Ito wrote in the June 2016 letter to the board. “We again note that the separation of the ‘S’ component does not require a credit union to develop additional management system enhancements where market risk is already appropriately identified, measured, monitored and managed as part of the ‘L’ component.”

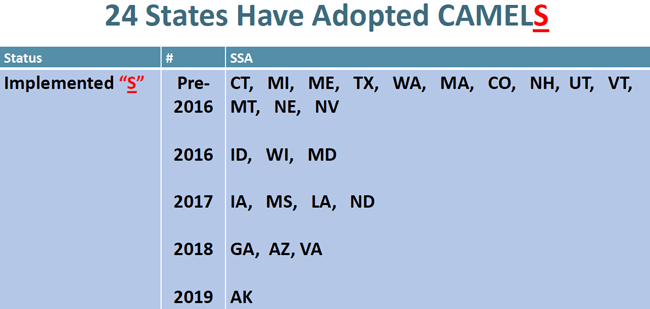

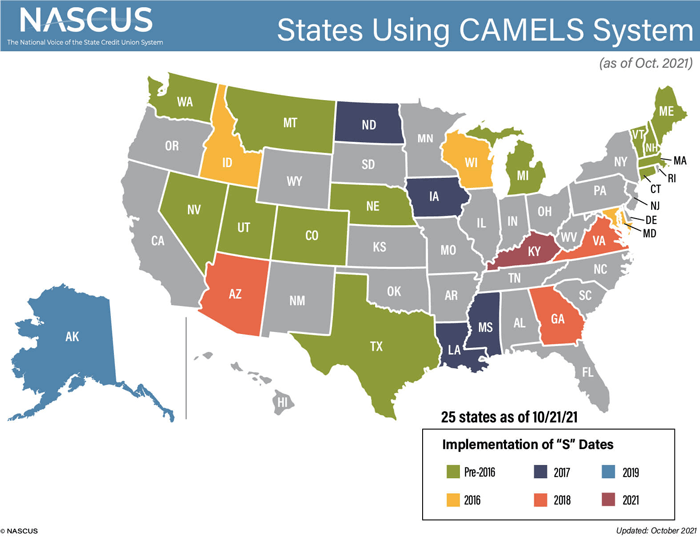

She also noted that in states that have adopted CAMELS (now totaling 25 – up from 16 when Ito penned the letter in 2016), that regulators and credit unions have reported positive outcomes with nearly no additional regulatory burden.

In its comment letter filed last spring, NASCUS said there is no need to “reinvent the wheel and develop a credit union CAMELS Rating System that diverges from the established CAMELS system currently in use in bank supervision and in the states that have adopted CAMELS for credit union supervision.”

In the final rule commentary issued Thursday, NCUA stated that the updated rating system is based on (and consistent with) the Uniform Financial Institutions Rating System (UFIRS) system used by NCUA and the banking regulators. However, the commentary noted, NCUA has made certain minor, non-substantive modifications to the rating descriptions to clarify and better reflect supervision of credit unions. “Notwithstanding this slight divergence from UFIRs, the Board has determined that the NCUA’s revised rating system is consistent with the other financial supervisors,” NCUA said.

Agency staff also told the board that, in their view, the new rule will have little, if any, impact on the 20 state regulators (and their credit unions) that do not yet have the S component in their exam ratings.

LINKS:

Final Rule: CAMELS Rating System

NASCUS comment: Notice of Proposed Rulemaking Regarding CAMELS Rating System

(Oct. 22, 2021) NASCUS President and CEO Lucy Ito congratulated the NCUA Board for finalizing an “S” component (for market sensitivity) to the CAMEL rating system (making it now “CAMELS”) at its Thursday meeting (and adjusting the “L” component, accordingly, for liquidity). She also thanked Board Member Hood for responding to NASCUS’ recommendation to introduce the change, which he did early this year – something NASCUS has advocated for years.

“To date, 25 states have implemented CAMELS and two additional states are scheduled to do so by Jan. 1,” Ito said. “Without exception, all states that have already adopted CAMELS report a very smooth and seamless transition for credit unions including smaller asset sizes as all credit unions are already monitoring market risk under the L component. Indeed, under CAMEL, credit unions can be ‘dinged’ unfairly. If their liquidity and sensitivity to market risk are rated differently, the lower rating will prevail for the L component. The addition of the ‘S’ component will not only be fairer, it will also position both credit unions and examiners to more effectively monitor and evaluate interest rate risk as the U.S. enters an uncertain interest rate environment.”

(Oct. 15, 2021) Finalizing a proposed – and contentious — rule on expanded lending and services provided by federal credit union (FCU) credit union service organizations (CUSOs) highlights the scheduled agenda for next week’s meeting of the NCUA Board.

In other action, the board will consider finalizing a rule that would add an “S” (Sensitivity to Market Risk) component to the existing CAMEL rating system and redefine the “L” (Liquidity Risk) component, thus updating the rating system from CAMEL to CAMELS.

The CUSO rule was proposed at the beginning of the year. It would deem as permissible for CUSOs the origination of any type of loan that an FCU may originate; and grant the NCUA Board additional flexibility to approve permissible CUSO activities and services. The agency also sought comments on broadening FCUs’ authority to invest in CUSOs.

But, from the beginning, the proposal has been controversial. It was released Jan. 14 on a 2-1 vote of the NCUA Board, with then-Board Member (now Chairman) Todd Harper dissenting. Harper, making his objection, noted the NCUA’s lack of direct supervisory authority over CUSOs and indicated the proposal raised potential consumer protection concerns. He said such a rule “will create a Wild West within the credit union space,” affording “little accountability for consumer protection” as CUSOs could exceed the restrictions applied to FCU lending in areas such as interest rate, loan term, and repayment.

Shortly after that board meeting, Harper was named chairman of the three-member board by the newly inaugurated President Joe Biden (D). He replaced current Board Member Rodney Hood in the position.

Since then, the proposal stalled. It was originally issued with a March 29 comment deadline (about 60 days after its proposal). The agency then extended the comment period another 30 days.

Last month, the board agreed to consider finalizing the rule (along with two other outstanding proposals) in upcoming board meetings over three months; the CUSO rule was the first on the list. However, controversy again dogged the proposed CUSO rule, as it (and the other two rules, to be considered in November and December) were approved for future, final consideration on a vote of 2-1, with Harper again dissenting. In doing so, he reiterated his concerns about the potential of the proposed CUSO rule for growing an “already unregulated space within the credit union system, with little accountability for protecting consumers and credit unions.”

In its comment filed on the proposal (on April 30), NASCUS noted as a key concern with the proposal that possible, additional reporting requirements for state credit unions could be a result of a finalized rule. NASCUS noted that the proposal could influence state credit unions considering collaborating with FCU investors in the formation and ownership of a CUSO, — which prompted the association to comment.

In some states, NASCUS pointed out, CUSOs owned by state credit unions already hold expanded lending power. The association noted, however, that the NCUA proposal could end up requiring additional reporting requirements that don’t today exist for SCUs. “NASCUS opposes extension of any additional reporting requirements to SCU CUSOs resulting from an expansion of FCU powers,” the association wrote.

The CAMELS proposal was put forth in January (the same meeting at which the CUSO proposal was issued) and was approved for public comment on a unanimous vote by the board. The proposal would bring the NCUA’s rating system up to date with a change that banking regulators incorporated decades ago and satisfy a recommendation the agency’s inspector general has been recommending for about the past five years.

Nearly five years ago, NASCUS wrote to NCUA urging the change and adding the “S” component. “NASCUS and state supervisory agencies encourage NCUA to consider earlier adoption of ‘CAMELS,’” NASCUS’ Lucy Ito wrote in the June 2016 letter to the board. “We again note that the separation of the ‘S’ component does not require a credit union to develop additional management system enhancements where market risk is already appropriately identified, measured, monitored and managed as part of the ‘L’ component.”

She also noted that in states that have adopted CAMELS (now totaling 24 – up from 16 when she wrote the letter), that regulators and credit unions have reported positive outcomes with nearly no additional regulatory burden.

In its comment letter filed last spring, NASCUS wrote that moving expeditiously on adding a “market risk sensitivity” component to the credit union examination system – that is, adding an “S” to “CAMEL” – would better align NCUA with state credit union and federal banking regulators that have already made the move. However, NASCUS added, there is no need to “reinvent the wheel and develop a credit union CAMELS Rating System that diverges from the established CAMELS system currently in use in bank supervision and in the states that have adopted CAMELS for credit union supervision.” NCUA has proposed definitions and components of the criteria to be used in assigning the “S” and “L” ratings.

Also on the agenda for Thursday’s meeting is a board briefing on cybersecurity. The NCUA Board meeting is scheduled to get underway at 10 a.m., and to be live-streamed via the Internet.

LINKS:

Board Agenda for the October 21, 2021 Meeting

NASCUS comment: Notice of Proposed Rulemaking Regarding CAMELS Rating System

NASCUS comment: Proposed Rule, Credit Union Service Organizations (CUSOs) – RIN 3133–AE95

(June 18, 2021) Other new and proposed rules that should be coming up for action soon by the NCUA Board were also outlined in the spring 2021 regulatory agenda published recently by the agency (via the White House Office of Management and Budget (OMB)). Those include:

- A proposed rule to integrate an NCUA equivalent (the Complex Credit Union Leverage Ratio, CCULR) to the community bank leverage ratio (CBLR) into NCUA’s capital standards, perhaps as soon as next month. The CCULR is modeled on the bank ratio adopted by federal banking agencies in 2019, which removes requirements for calculating and reporting risk-based capital ratios for most banks with less than $10 billion in assets, more than 9% in risk-based capital, and that meet certain risk-based qualifying criteria. Banks meeting the criteria can “opt-in” to use the CBLR. NASCUS, in a comment letter last month, said the state system supported further development of the CCULR, noting that it would allow both the 2015 risk-based capital and subordinated debt rules to take effect.

- A final rule (as soon as September) updating the CAMEL exam rating system, including adding an “S” (for “sensitivity to market risk”). NASCUS filed comments on the proposal in early May, urging the agency to move “expeditiously” on adding the S component, which, NASCUS wrote, would better align NCUA with state credit union and federal banking regulators that have already made the move.

- A final rule (perhaps by the end of this summer) expanding CUSO lending activities. In its comment letter in March, NASCUS noted possible, additional reporting requirements for state credit unions if the proposal were made final. In some states, NASCUS pointed out, CUSOs owned by state credit unions already hold expanded lending power. The association noted, however, that the NCUA proposal could end up requiring additional reporting requirements that don’t today exist for SCUs. “NASCUS opposes extension of any additional reporting requirements to SCU CUSOs resulting from an expansion of FCU powers,” the association wrote.

- Revision of regulation prohibiting a federally insured credit union (FICU) from making golden parachute and indemnification payments to an institution-affiliated party under certain circumstances. According to the rule list, the proposed rule would improve the organization and clarity of the regulation and would include a section on merger-related financial arrangements. It also would amend the regulation to assist FICUs in the identification and processing of golden parachute payments. The proposal is scheduled by October or later.

LINK:

OMB Agency Rule List – Spring 2021 (NCUA)

(May 14, 2021) Moving expeditiously on adding a “market risk sensitivity” component to the credit union examination system – that is, adding an “S” to “CAMEL” – would better align NCUA with state credit union and federal banking regulators that have already made the move, NASCUS wrote in its second significant comment letter this week.

Under a proposal issued in January, the examination rating system would be known as “CAMELS” and redefine the “L” component (for “liquidity risk”) to measure interest rate and liquidity risk more precisely. NASCUS wrote that the change is something the state system has long urged the agency to make, and the association fully supports the proposal.

While the change would align NCUA with state agencies (24 of which have adopted their own CAMELS system), and other federal regulators, NASCUS wrote, there is no need to “reinvent the wheel and develop a credit union CAMELS Rating System that diverges from the established CAMELS system currently in use in bank supervision and in the states that have adopted CAMELS for credit union supervision.” NCUA has proposed definitions and components of the criteria to be used in assigning the “S” and “L” ratings.

The state system supports implementing the CAMELS Rating System as proposed, NASCUS said, and incorporating the definitions, components, and criteria from the Uniform Financial Institutions Rating System (UFIRS), first adopted in 1997 by members of the FFIEC (with the exception of NCUA).

“Without question, the prevailing supervisory consensus is that distinguishing between the management of funds and the sensitivity to interest rate risk is a more precise and transparent method for evaluating risk.,” NASCUS wrote. “Furthermore, it is our understanding that the implementation of the CAMELS Rating System in the states where it was adopted was achieved with very little disruption to the affected credit unions and is in fact preferred by many of those same credit unions.”

NASCUS noted that adopting the revised CAMELS system will result in some costs to the agency (such as making corresponding changes throughout the agency’s rules and regulations and within agency systems and documents, as well as requiring training for examiners). “However, the benefits of measuring a credit union’s condition more precisely as well as NCUA’s aligning with its federal and state peers in adopting CAMELS far outweigh any costs,” NASCUS concluded.

LINK:

NASCUS comment: Notice of Proposed Rulemaking Regarding CAMELS Rating System

(March 12, 2021) After a delay of nearly two months since approval, two proposals from NCUA – on simplifying rules for risk-based capital and on adding an “S” to the exam rating system – have been finally opened for 60-day comment periods, following publication this week in the Federal Register. Comments on both proposals are due for both May 10.

On Jan. 14, the agency board approved the two proposals to be issued for comment. The proposal on simplifying risk-based capital – an advance notice of proposed rulemaking (ANPR) adopted on a 2-1 vote with (then) Board Member Todd Harper dissenting – outlines two approaches to simplifying risk-based capital requirements.

Under the first, the agency contemplates replacing the risk-based capital rule with a risk-based leverage ratio requirement, which would use relevant risk attribute thresholds to determine which complex credit unions would be required to hold additional capital. The second approach would retain the risk-based capital rule (approved in 2015 and revised numerous times, with two delays in effective dates, and now set to take effect Jan. 1, 2022) but would enable eligible complex FICUs to opt in to a “complex credit union leverage ratio” (CCULR) framework to meet all regulatory capital requirements.

The CCULR approach would be modeled on the “community bank leverage ratio” (CBLR) framework implemented under the 2018 economic growth and regulatory relief law.

The proposal on adding an “S” – for “market sensitivity” – to the agency’s CAMEL examination rating system is aimed at ensuring the agency’s exams of credit unions include a specific look at market-risk sensitivity. In conjunction with this would be a modification in the review of credit union liquidity and asset/liability management for the “L” in CAMEL.

In January, NCUA said the proposal would bring the agency’s rating system up to date with a change that banking regulators incorporated decades ago. It would also satisfy a recommendation the agency’s inspector general has been advancing for about the past five years. It was approved for comment unanimously by the agency board.

To date, 24 state credit union regulatory agencies have adopted the “S” for state-chartered credit unions.

LINKS:

NASCUS summary: ANPR, Simplification of the RBC Requirements (Parts 702 & 703) (members only)

NASCUS summary: Proposed rule: CAMELS Rating System (members only)

(Feb. 5, 2021) Three summaries of recent NCUA proposals were posted this week by NASCUS, dealing with the addition of a new component to the examination rating system, lending by CUSOs, and the agency’s communications program.

More specifically, the summaries (which are available to members only) outline:

- A proposal to add an “S” (for market sensitivity) to the CAMEL rating system. At its January meeting, the NCUA Board voted unanimously to issue a proposal (for a 60-day comment period) to add the component to its rating system — an addition long supported by NASCUS for the federal regulator – especially since 24 states have already incorporated the component into their own exams. The proposal would also redefine the “L” (Liquidity Risk) component in the existing rating system. According to NCUA, if adopted, the rule would likely take effect in the first quarter of 2022. The agency said that the proposal would provide greater clarity and transparency regarding credit unions’ sensitivity to market risk and liquidity risk exposures once adopted. “The proposed addition would make the NCUA’s rating system more consistent with the other financial institution regulators’ ratings system both at the federal and state levels,” the agency said. NASCUS President and CEO Lucy Ito said, when the proposal was issued last month, that state examiners have observed for some time that the extended low-yield environment may encourage greater risk taking by financial institutions. “We urge the agency to finalize this proposal as soon as possible following the comment period and as soon as practicable following necessary technical re-programming,” she said.

- A plan to allow CUSOs to make any loan a federal credit union (FCU) can make. Also at its January meeting, the board issued a proposal (for a 30-day comment period) that would add to the agency’s list of permissible CUSO services the expanded lending powers. The proposal expands the list of permissible loans by CUSOs from only business loans, consumer mortgage loans, student loans, and credit cards to any type of loan an FCU may originate, including, for example, automobile and small-dollar (payday) loans – the two types NCUA said would likely draw the newest involvement by CUSOs.

- A “request for information” (RFI) from credit unions on NCUA’s communications methods. Earlier last month, the NCUA released the RFI (for a 60-day comment period) on its communications processes in an effort, it said, to “promote efficiency and increase transparency.” Specifically, the agency said, the RFI “seeks public input on how the agency can maximize efficiency and minimize burdens associated with obtaining information on federal laws, regulations, policies, guidance, and other materials relevant to federally insured credit unions.” The RFI contained questions about the effectiveness of its press releases, social media content, and the timing and frequency of agency communications. There are also questions related to improving the agency’s websites, online data resources, and the delivery and format of supervisory guidance, NCUA said.

LINKS:

Summary: Proposed Rule, CAMELS Rating System

NASCUS Summary: Proposed rule, CUSOs (part 712)

Summary: Request for Information, NCUA Communications & Transparency

(Jan. 15, 2021) Adding an “S” for “market sensitivity” to the examination rating system for NCUA was proposed unanimously by the agency Board Thursday, an addition long supported by NASCUS for the federal regulator – especially since 24 states have already incorporated the component into their own exams.

The proposal would also redefine the “L” (Liquidity Risk) component in the existing rating system – and change the name to “CAMELS” (from the existing “CAMEL”).

Nearly five years ago, NASCUS wrote to NCUA urging the change and adding the “S” component. “NASCUS and state supervisory agencies encourage NCUA to consider earlier adoption of ‘CAMELS,’” NASCUS’ Lucy Ito wrote in the June 2016 letter to the board. “We again note that the separation of the ‘S’ component does not require a credit union to develop additional management system enhancements where market risk is already appropriately identified, measured, monitored and managed as part of the ‘L’ component.”

She also noted that in states that have adopted CAMELS (now totaling 24 – up from 16 when she wrote the letter), that regulators and credit unions have reported positive outcomes with nearly no additional regulatory burden. She stated that, in practice, state supervisors have continued to use the same examination procedures for assessing liquidity and interest rate risks. However, she wrote, by rating the “L” and “S” components separately—rather than in a combined component—state regulators have been able to provide better information to credit unions to clearly delineate analysis between liquidity risk and interest-rate risks.

Both Board Chairman Rodney Hood and Member Todd Harper mentioned NASCUS’ position on the S component, or the June 2016 letter, in their remarks – and stressed the importance of reaching out to the state system to discuss the proposal.

NCUA said that the proposal issued Thursday (for a 60-day comment period) would likely take effect in the first quarter of 2022 if adopted.

The agency asserted the proposal would provide greater clarity and transparency regarding credit unions’ sensitivity to market risk and liquidity risk exposures once adopted. “The proposed addition would make the NCUA’s rating system more consistent with the other financial institution regulators’ ratings system both at the federal and state levels,” the agency said.

The agency indicated that separating the “S” and “L” component ratings will allow NCUA to enhance:

- Monitoring of sensitivity to market risk and liquidity risk in the credit union system;

- Communication of specific concerns to individual credit unions; and

- Allocation of resources.

“In general, the NCUA Board expects that adopting a sixth CAMELS rating component will not have any adverse effect on a credit union’s CAMEL composite rating,” the agency wrote in its proposal. “The proposed separation of sensitivity to market risk and liquidity risk into individual CAMELS rating components will reduce potential rating inconsistencies.”

LINK:

Notice of Proposed Rulemaking, Parts 700, 701, 703, 704 and 713, CAMELS Rating System

(Jan. 15, 2021) Lucy Ito praised the NCUA Board for moving forward on expansion of the rating system to include the “S” component. “We’re almost at the finish line – but we are willing and able to keep working with the agency to complete the process, and see this change made in time to be effective in 2022,” she said. “The state system is driving toward this goal out of a desire to have consistent standards set across the credit union system, and to reduce risk. For some time, state examiners have observed that the extended low-yield environment may encourage greater risk taking by financial institutions. We urge the agency to finalize this proposal as soon as possible following the comment period and as soon as practicable following necessary technical re-programming.”