Sept. 6, 2019 NASCUS Report

Posted September 6, 2019THIS WEEK: States effectively hold half of all CU assets; Proposed rule ahead on CU bank purchases?; For one CU, acquisition means members benefit; In wake of court decision, phase-in seen for FOM rules; Home lending down, but closed-end still leads — and more!

States now effectively hold half

of CU assets, see memberships grow

State-chartered credit unions have reached their largest shares in four years of both credit union assets and memberships– 49% (for $753 billion) and 48% (57.4 million), respectively — according to mid-year numbers released by NCUA this week, and numbers for privately insured credit unions compiled by NASCUS.

Overall, according to the numbers released by NCUA and compiled by NASCUS (as of June 30), all credit unions held $1.5 trillion in assets with more than 119 million members in the 5,421 credit unions serving American consumers.

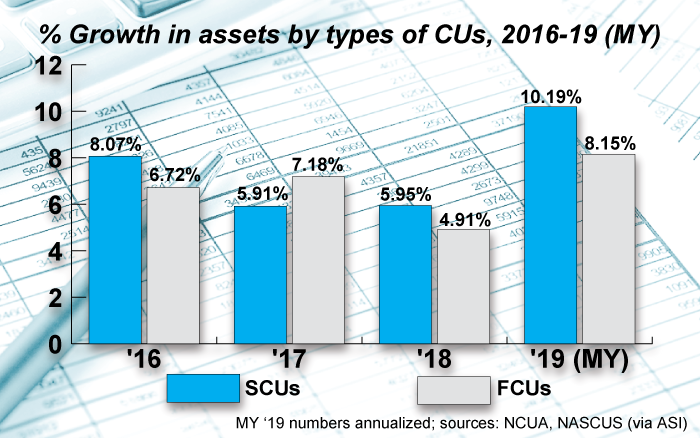

Growth at state-chartered credit unions, the numbers show, was vigorous in the first half of the year. According to the NASCUS-compiled figures, SCUs expanded their assets at an annualized rate of just under 10.2%, compared to just more than 8% (annualized) at federal credit unions.

Memberships also expanded slightly more rapidly at the state institutions, increasing at an annualized rate of 3.6%; FCUs grew memberships at 2.9% (annualized).

“Clearly the dual-chartering system is working as intended, fostering robust state and federal systems,” said NASCUS President and CEO Lucy Ito. “On the state side, it could only happen with strong and enlightened supervision among state regulators, and personal commitment by credit union boards and practitioners to continued and safe and sound service to their members and their communities.”

Other numbers released by NCUA this week show:

- The number of credit unions continues to decline, with 3,335 FCUs and 2,086 SCUs at midyear, down from 3,376 and 2,113 at the end of 2018.

- Net worth ratios for federally insured credit unions (FICUs) remained about the same at mid-year 2019 as at year-end 2018 at 11.27%; return on average assets was up slightly at 97 basis points (compared to 92 bp at year-end ’18).

- The overall loan-to-share ratio continues to be tight at 83.3%, but looser than at year-end (which was 85.6%).

- The overall delinquency rate was 63 bp, down from 71 bp at year-end; net charge-offs (as a percent of average loans) was 56 bp, about the same as year-end 2018 (58 bp).

LINK:

NCUA Releases Q2 2019 Credit Union System Performance Data

Hood says proposed rule would clarify bank purchases

Clarifying a credit union’s responsibilities when acquiring a bank will be the subject of a proposed rule by NCUA, the chairman of the agency’s board said in an interview this week with the Wall Street Journal. Chairman Rodney Hood told the publication, in a story published Tuesday about credit union acquisitions of banks, that he plans to introduce the proposal “later this year” to make the clarification.

Hood told the Journal that “credit unions should make sure that they are acquiring a bank that comports with their existing field of membership and the lines of business they are operating in.” NCUA and state regulators (in the case of a bank acquisition of a state credit union), along with federal and state banking regulators, generally need to approve the acquisitions prior to their completion.

Some in the banking industry have bitterly complained about the increasing incidence of credit unions’ buying banks, typically through “purchase and assumption” arrangements. According to numbers compiled by S&P Global Market Intelligence, 12 bank acquisitions by credit unions have been announced this year; nine were announced the previous year. From 2013-17, there were 12 total.

Over the past week, the first bank acquisition by a credit union in Colorado was announced: Elevations CU of Boulder said it was acquiring the assets of Greeley, Colo.-based Cache Bank & Trust ($121 million of assets).

Future acquisitions of banks (typically those classified as “community banks”) by credit unions may also hinge partly on the continued profitability of banks. According to the FDIC, which like NCUA released mid-year financial results for financial institutions it insures this week, the 4,873 community banks it insures reported net income of $6.9 billion in the second quarter, up $522.7 million from a year earlier. Growth in net interest income (up 5.1% to $19.3 billion) and noninterest income (up 4.8% to $4.7 billion), as well as gains on securities sales (up 654.8% to $233 million) drove the annual increase in profitability, the FDIC said.

For CU, bank acquisition builds membership, extends benefits

Also quoted in the Journal story this week was Vystar Credit Union President and CEO Brian Wolfburg (who also serves on the NASCUS CU Advisory Council). Wolfburg acknowledged the business case for acquiring banks, but also noted the benefits extended to new credit union members (and former bank customers).

“We see opportunitiesto expand our network, bring in new products to the table, and get a good return on investment,” said Wolfburg, whose credit union closed its first bank acquisition in August, the Journalreported.

But the Jacksonville, Fla.,credit union leader also noted the benefit to his members of investment return. “When we earn more, it does not get stripped out through shareholders, it goes to our members,” he said.

‘Phased approach’ on membership rules vowed

A phased approach to implementing the impact on federal credit union membership rules of a federal court’s decision last month will be taken by NCUA, Board Chairman Hood said this week.

In a statement, Hood said the agency’s phased approach to implementing the Aug. 20 decision by the U.S. Court of Appeals for the D.C. Circuit (in American Bankers Association v. NCUA) is necessary because the court’s ruling remains subject to requests for further review.

In its Aug. 20 ruling, the court said NCUA holds “vast discretion to define terms because Congress expressly has given it such power.” However, the court also stated that the authority is not boundless. “The agency must craft a reasonable definition consistent with the Act’s text and purposes,” the court stated.

Hood said this week that “in the near future” the agency would consider a limited proposal to address the definition of local community. The federal court, in its decision, focused on the definition of “Core-Based Statistical Areas” that do not include the urban core.

Hood also said that, for credit unions serving rural districts, the agency will permit federal credit unions to submit applications seeking expanded rural districts serving geographic regions that encompass up to 1 million people and that meet the other requirements set forth in the agency’s field-of-membership rules. “The NCUA will act on such applications at the appropriate time,” Hood said.

He also noted that the D.C. Circuit upheld that portion of NCUA’s 2016 rule which allowed charters serving “Combined Statistical Areas,” or a portion thereof, subject to a 2.5-million person limit. “We will announce further guidance on this issue shortly,” he said.

He said that the agency anticipates issuing a proposed rulemaking with a public comment period.

Although the court’s decision only applies to federal credit union membership rules, state supervisors have interest in the ruling for its impact on their own FOM rules.

LINK:

Chairman Hood: NCUA Will Take Phased Approach to Implement FOM Rule

Closed-end mortgage loans still lead (although fewer made)

Nearly 60% of applications for home loans were approved by credit unions, banks and other lenders in 2018, according to figures published this week by federal regulators. However, fewer loans were originated last year (by fewer lenders) than in 2017.

According to the Home Mortgage Disclosure Act (HMDA) mortgage lending data published by the FFIEC, closed-end loans still accounted for most loans approved, for 82% of the 7.7 million loans OK’d in 2018; open-end loans accounted for only 14.3% of all loans approved.

Overall, the HMDA report stated that, in 2018, just under 13 million loan applications were submitted; 7.7 million loans were ultimately originated (about 59% of loan applications made).

The HMDA report also noted that the number of reporting institutions declined by about 2.9% in 2018 from the previous year to 5,683, and that the total originated loans decreased by about 924,000 between 2017 and 2018, or 12.6%. Refinance originations decreased by 23.1% from 2.5 million. However, home purchase lending saw a slight increase (by 0.3%) to 4.3 million.

LINK:

FFIEC Announces Availability of 2018 Data on Mortgage Lending

Report: Credit card debt service levels near 10-year low

Debt service burdens from credit cards are near the lowest level in more than a decade, the CFPB said in a report last week. Late payment and default rates have risen modestly but remain below pre-recession levels, the agency added, in its report titled The Consumer Credit Card Market, a congressionally mandated biennial report regarding the consumer credit card market. Last week’s report was the fourth the agency has produced under requirements of the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) of 2009.

Those results, the agency noted, come in the face of increased credit card spending. Since 2015, consumers have more than doubled credit card spending, with only modest balance growth, the agency said. “The great majority of credit card spending results in consumers obtaining rewards, and surveys indicate rewards are the primary factor consumers consider in choosing a credit card,” CFPB said.

LINK:

The Consumer Credit Card Market

Regulators seek ‘standardized’ approach to cybersecurity

Use of a standardized approach for assessing and improving cybersecurity preparedness was emphasized by federal financial institution regulators last week in a joint letter. Issued via the FFIEC, the regulators’ letter noted that firms adopting a standardized approach are better able to track their progress over time, and share information and best practices with other financial institutions and with regulators. “Institutions may choose from a variety of standardized tools aligned with industry standards and best practices to assess their cybersecurity preparedness,” the letter states. These tools include, the letter states, the FFIEC Cybersecurity Assessment Tool, the National Institute of Standards and Technology Cybersecurity Framework, the Financial Services Sector Coordinating Council Cybersecurity Profile, and the Center for Internet Security Critical Security Controls. The letter notes that none of the tools are examination programs and regulators take a risk-focused approach to examinations. As cyber risk evolves, examiners may address areas not covered by all tools, the letter states.

LINK:

FFIEC Encourages Standardized Approach to Assessing Cybersecurity Preparedness

Summary provides highlights of hemp guidance

NASCUS has developed a summary of NCUA’s guidance that allows federally insured credit unions to provide the “customary range” of financial services – including loans — to legally operating hemp businesses in their fields of membership.The guidance was published last month; the summary is available to members only. When the guidance was issued, NASCUS issued a statement commending NCUA’s action, but also advising caution for credit unions. Association President and CEO Lucy Ito said the agency’s guidance on serving lawful hemp businesses provides credit unions with “helpful clarification and given the added complexity of hemp-related compliance, credit unions must weigh the potential exposure when deciding to serve hemp businesses.”

LINK:

NASCUS Summary: NCUA Interim Hemp Guidance (members only)

Get more from the state system with NASCUS 101

NASCUS 101, a half-hour (no charge) webinar that brings together members, prospective members or anyone else interested in NASCUS to better understand the unique tools and benefits NASCUS offers, will be offered Oct. 24 from 2-2:30 p.m. ET. The half-hour, packed-with-information program also offers attendees an opportunity to hear from their peers in NASCUS—a member network of state regulators, credit unions, credit union leagues, and other system supporters—and how they leverage their NASCUS membership. The webinar ends with a Q&A session. Advance registration required; sign up today!

LINK:

Agenda, registration for Oct. 24 NASCUS 101 webinar (no charge)

BRIEFLY: Welcome to new members, associate; NCUA leader names confidential assistant

Welcome to new NASCUS-member credit unions Point West of Portland, Oregon($94 million in assets), where Amy Nelson is the CEO, and; CN/IC Employees of Memphis, Tenn. ($8 million in assets), where Sandra Griffis is CEO. Welcome also to the National Association of Credit Union Service Organizations (NACUSO)as an associate member; Jack Antonini is the President and CEO… Hallie Williams, a former staff member to retired Sen. Bob Corker (R-Tenn.),has joined the personal staff NCUA Board Chairman Rodney Hoodas “confidential assistant,” as of Aug. 26.

LINK:

Williams Chosen as Confidential Assistant to NCUA Chairman Hood

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.