Aug. 16, 2019 NASCUS Report

Posted August 16, 2019THIS WEEK: A dynamic 2019 Summit; ‘Document of cooperation’ signed; NCUA’s Hood lauds cooperation; Ito talks conversions, more, in report; Subordinated debt proposal on tap? — and more!

IN THE PHOTOS: Clockwise, from top left: KY’s Charles Vice makes his point; NASCUS President and CEO Lucy Ito offers the “state of the state system;” NASCUS EVP and General Counsel Brian Knight exhorts a group about legislative and regulatory issues; NASCUS Regulator Board Chairman John Kolhoff (TX) offers his views; NASCUS Credit Union Advisory Council Chairman Rick Stipa shares some thoughts; IA’s Katie Averill participates in a panel discussion; NCUA Board Chairman Rodney Hood discusses NCUA/state regulator cooperation.

2019 State System Summit

Discussion, ideas, dialog highlight conference

Cogent discussion, enlightened ideas, intense dialog and new (and renewed) friendships are all ingredients of the successful mix for this year’s NASCUS State System Summit in San Francisco. For four days (ending today), representatives of the state credit union system from around the nation gathered at the Westin St. Francis Hotel on Union Square to discuss the latest issues and developments within the state system, talk over ideas for addressing those topics, and share their own experiences.

Among the highlights of this year’s event: The signing of the “Document of Cooperation” between NASCUS and NCUA; remarks of NCUA Board Chairman Rodney Hood stressing the continued good relationship between state and federal regulators; NASCUS President and CEO Lucy Ito’s presentation on the “state of the state system;” presentation of the 2019 Pierre Jay Award to Mary Hughes, acting director for the Idaho Department of Finance – and much more. (ID’s Mary Hughes Thursday accepts the 2019 Pierre Jay Award from NASCUS, state system.)

Among the highlights of this year’s event: The signing of the “Document of Cooperation” between NASCUS and NCUA; remarks of NCUA Board Chairman Rodney Hood stressing the continued good relationship between state and federal regulators; NASCUS President and CEO Lucy Ito’s presentation on the “state of the state system;” presentation of the 2019 Pierre Jay Award to Mary Hughes, acting director for the Idaho Department of Finance – and much more. (ID’s Mary Hughes Thursday accepts the 2019 Pierre Jay Award from NASCUS, state system.)

The Summit features 18 hours of educational sessions, presentations and discussions for the more than 150 attendees. Sessions at the event included the federal legislative outlook for state credit unions, effective enterprise risk management, interstate branching, addressing sexual harassment claims, the latest in compliance trends, cannabidiol (CBD) and hemp banking, the credit union of the future.

(From left: NCUA Board Chairman Hood and NASCUS Regulator Board Chairman Kolhoff sign the “Document of Cooperation” as NASCUS CEO Ito happily shares in the moment.)

First ‘document of cooperation’ in 12 years signed

Ensuring the safety and soundness of the credit union system, fostering an environment of innovation, prosperity, and success for all system stakeholders, and maintaining a strong cooperative relationship between the state regulatory system and the NCUA are the aims of a new cooperation agreement between state and federal regulators, signed this week in San Francisco.

NASCUS Regulator Board Chairman John Kolhoff, and NCUA Board Chairman Rodney Hood, signed the new “Document of Cooperation” Wednesday at the 2019 NASCUS Summit. NASCUS and NCUA last signed such an agreement in 2007.

“The Document of Cooperation is a recommitment to the principles of partnership and cooperation between NCUA, state credit union regulators and NASCUS,” said Kolhoff, who is commissioner of the Texas Credit Union Department. “A strong relationship between state and federal regulatory agencies will both increase the efficiency and effectiveness of the supervisory programs and foster a healthier regulatory environment for credit unions.”

Hood, in remarks to the Summit audience, said a solid relationship between among the state and federal regulators is essential, “based on mutual respect.”

The newly signed document is the result of extensive work by the NCUA-State Supervisor Working Group, which has been working on several projects related to shared supervision. Representing the state system in the effort were John Kolhoff (TX), Steve Pleger (GA), Kim Santos (WI), Katie Averill (IA), Dudley Gilbert (OK), Anthony Rogers (TN), Lucy Ito, NASCUS President and CEO and Brian Knight, NASCUS Executive Vice President and General Counsel.

“We appreciate Chairman Hood and NCUA publicly committing to engage with state regulators and NASCUS,” said NASCUS President and CEO Lucy Ito. “While the Document of Cooperation recognizes the distinct roles that state regulators and NCUA have in supervising credit unions, it acknowledges what we at NASCUS have always known – cooperation among state regulators and NCUA is critical to bolster a robust dual charter framework that benefits consumers and the broader credit union system.”

LINK:

NASCUS press release: State regulators, NCUA sign cooperation agreement at NASCUS Summit

Hood: state regulators ‘valuable partners,’ notes cooperation

State regulators are valuable partners with NCUA, often providing cogent advice and ideas for NCUA’s consideration on a broad range of issues, the chairman of the NCUA Board told the NASCUS Summit audience Wednesday.

“In my first meeting with the entire NCUA staff, I said, ‘the NCUA should take every opportunity to cooperate with state regulators in regulating and supervising federally insured, state-chartered credit unions and the NCUA should maintain a strong partnership with state regulators and reduce or eliminate unnecessary duplication of efforts,’” NCUA Board Chairman Hood said. “In that regard, I am happy to be here today to build on these efforts.”

Hood told the group that work and cooperation between state and federal supervisory authorities has “clearly demonstrated its merits.”

The NCUA Board chairman updated the group on actions of the NCUA-State Regulators Working Group, formed two years ago (including the “Document of Cooperation”). “One of the group’s primary charges is to look for ways to reduce or eliminate unnecessary overlap between the prudential regulators of federally insured state-chartered credit unions and the insurer, the NCUA. The goal is reducing the regulatory burdens wherever possible on federally insured, state-chartered credit unions while maintaining safety and soundness,” he said. “Let’s be clear: The goal is not to simply get rid of regulations for the sake of getting rid of regulations. The goal is to create a regulatory system that is effective, but not excessive or duplicative.”

Among the actions:

- The launching of a three-year (one full alternating exam cycle) pilot program to evaluate three exam options: Alternating lead, alternating with limited participation and alternating among state and federal examiners. He noted that regulators in California, Florida, New Hampshire, Oklahoma, South Carolina, and Texas, are participating in the pilot. “To date, I can report the group has already received significant positive feedback,” he said.

- Development of a new framework for cooperation and coordination among NCUA regions and state regulators, which includes procedures, practices, and protocols to coordinate state and federal activities in supervising federally insured state charters.

- Development (and signing) of the updated “Document of Cooperation” between NCUA and NASCUS.

For the future, Hood said the group is working toward:

- A cataloging of examination procedures and practices of the state regulators and NCUA with the goal of promoting best practices to strengthen the examination program;

- Development and rollout of the new Modern Examination and Risk Identification Tool (MERIT, the agency’s new system that examiners will use to aid in evaluating credit unions), scheduled for release as early as fall 2020; and

- Identifying best practices in conducting joint exams aimed at reducing or eliminating unnecessary overlap and “providing federally insured state-chartered credit unions with a more seamless examination experience.”

LINK:

NCUA Chairman Rodney E. Hood Remarks before the NASCUS State System Summit

Conversion trend a ‘wake-up call’ for state charters

A “wake up call” in the form of accelerating conversions of state to federal charters is now ringing for the state credit union system, NASCUS President and CEO Lucy Ito told the 2019 State System Summit audience Wednesday.

During her presentation about “the state of the state system,” Ito asked “how competitive is your state’s charter relative to the federal or other state charters?”

“It is not a competition between federal and state, but it is a competition for the charter to evolve,”she said.

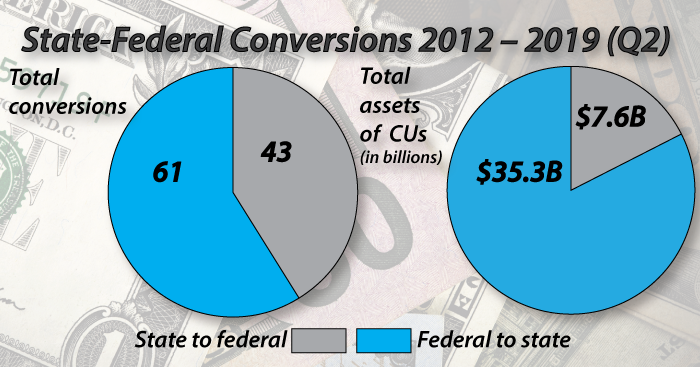

To illustrate the thrust of her question, Ito presented statistics on state-to-federal (and vice versa) charter conversions since 2012. Between 2012 and 2015, she said, there were 40 federal-to-state conversions, equal to about $27 billion in assets.

For state-to-federal conversions during the same time period, she showed, there were only eight charter switches (equal to about $1.7 billion in assets).

But the trend flipped beginning in 2016, Ito said, running through 2018. Conversions of federal to state charters totaled 16 during that period; conversions of state to federal, however, totaled 32. She acknowledged that 15 of the state-to-federal changes were in Mississippi, where the credit unions converted to take advantage of lower operating fees being charged, at the time, by NCUA.

The drivers for the conversions, Ito also pointed out, differ for state and federal credit unions. For the state-to-federal changes, the motivation is typically access to interstate banking for the once-state credit unions. On the federal-to-state conversions, she said, the credit unions are typically looking for more flexible field of membership rules than the federal charter offers. (She noted that Alaska, Iowa, Michigan and Washington have “effective” statewide fields of membership; other states are working on theirs.)

“I worry about the state system overall if we’re handcuffed by field of membership, whether state or federal,” said Ito. “We do need to think about how antiquated is the concept of field of membership when people access their financial services today and people feel closer to someone who lives across the country or across the world or feels a stronger bond with someone digitally than they do with someone locally.”

Although federal-to-state conversions still made up nearly 60% (58.6%) of all conversions between 2012 and the second quarter of this year, Ito urged the state regulators and credit union representatives to study their states’ charters for their relative competitiveness with other credit union charters, both federal and state.

In other comments, Ito pointed out:

- State credit unions are the largest financial institutions (by deposits) in six states (Florida, Suncoast and Vystar Credit Unions; Idaho, Idaho Central; Iowa, Green State; Minnesota, Wings Financial; New Hampshire, Service; Washington, BECU).

- State credit unions are dominant in the emerging (and controversial, in some quarters) trend of credit unions acquiring banks. Ito noted that, since 2012 (when a federal credit union acquired a bank, a first for credit unions of any charter), 24 bank purchases have been completed by state credit unions, and five by FCUs. This year alone, she noted, there are have been 10 CU purchases of banks (a one-year record).

Subordinated debt proposal by year’s end?

Look for the NCUA Board to consider a proposal on subordinated debt before year’s end, a key NCUA staff member told the Summit audience Thursday.

But don’t expect the proposal to be a slam dunk.

NCUA Deputy General Counsel Lara Daly-Sims said staff is working to present to the NCUA Board the proposal on subordinated debt – a form of alternative capital for credit unions facing risk-based capital requirements – by the end of this year.

In June, as the agency staff was proposing to the board a delay in the risk-based capital rules (to 2022, rather than 2021), they underscored that the delay would give the board time to consider other changes in the capital rules, including subordinated debt, capital requirements for asset securitization, and an equivalent to the community bank leverage ratio (CBLR) developed by the federal banking agencies for banks and thrifts.

At the Summit, however, Daly-Sims indicated that the subordinated debt proposal may have a tough road ahead. She told the group subordinated debt for credit unions will be a “heavy lift” in any event.

NASCUS has long held that subordinated debt should be a part of the risk-based capital framework because it encourages well-managed credit unions to attract additional loss-absorbing forms of capital that they would otherwise forego. In June, NASCUS President Ito said “the point of risk-based capital rulemaking is to increase the capital buffer standing before the share insurance fund and subordinated debt is wholly consistent with that goal.”

In other comments, Daly-Sims predicted no action by the NCUA Board this ear on any rule affecting credit union service organizations (CUSO), although such action is “possible” next year, she said.

Start planning now for next year – in New York City (Aug. 9-12)

Mark those calendars now for the 2020 NASCUS State System Summit – less than one year away in New York City! The headquarters for next year’s event is the New York Marriott Downtown hotel, just blocks away from Wall Street. As with past Summits (including this year’s), next year’s event will focus on exchange between regulators and credit union practitioners, with discussion of the key issues affecting the state credit union system. Watch the NASCUS website for more information on the 2020 Summit.

CUs advised: Reg Z changes take effect Jan. 1

Credit unions are on notice by NCUA that the CFPB has issued a final rule adjusting 2020 thresholds and fee caps under parts of the Truth in Lending Act (TILA, Regulation Z), according to a notice sent to federally insured credit unions this week.

NCUA advised credit unions that the final rule adopted by the bureau Aug. 1 amends Reg Z thresholds and fee caps in 2020 for several parts of TILA. Products affected, the agency said, include credit cards, qualified mortgages and loans under the Home Ownership and Equity Protection Act of 1994.

The credit union regulator noted that, for credit card accounts under the Credit Card Accountability Responsibility and Disclosure Act, CFPB increased by $1 the amount for the safe harbor for both first violation and subsequent violation penalty fees.

“The amendments raise the loan amount trigger for HOEPA coverage,” NCUA wrote. “They also increase the maximum points and fees thresholds under the qualified mortgage and HOEPA provisions. The qualified mortgage thresholds are tiered according to loan size.”

CFPB set on Aug. 1 the Reg Z dollar-amount triggers (for Jan. 1) as:

Open-end consumer credit plans under TILA: The threshold that triggers requirements to disclose minimum interest charges will remain unchanged at $1 in 2020.

Open-end consumer credit plans under the CARD Act amendments to TILA: The adjusted dollar amount for the safe harbor for a first violation penalty fee will rise $1 to $29. The adjusted dollar amount for the safe harbor for a subsequent violation penalty fee will rise $1 to $40.

HOEPA loans: The adjusted total loan amount threshold for high-cost mortgages in 2020 will rise to $21,980 (up from $21,549). The adjusted points-and-fees dollar trigger for high-cost mortgages in 2020 will be $1,099 (up from $1,077).

Qualified mortgages: Loans in the QM category provide creditors with certain protections from liability under the ability-to-repay (ATR) rule. The maximum thresholds for total points and fees in 2020 will increase to:

- 3% of the total loan amount for a loan greater than or equal to $109,898;

- $3,297 for a loan amount greater than or equal to $65,939 but less than $109,898;

- 5% of the total loan amount for a loan greater than or equal to $21,980 but less than $65,939;

- $1,099 for a loan amount greater than or equal to $13,737 but less than $21,980; and

- 8% of the total loan amount for a loan amount less than $13,737.

LINK:

CFPB Announces Adjusted 2020 TILA Fees and Thresholds

FASB opens comment period for CECL delay

The effective date would be delayed to 2023 for compliance with the “current expected credit loss” (CECL) accounting standard (and model), under an exposure draft issued Thursday by the Financial Accounting Standards Board. Comments are due by Sept. 16. Last month, the FASB voted to issue the proposed one-year extension, which means that credit unions (and most lenders) wouldn’t have to comply until 2023, if the proposal is made final. The board had previously extended the compliance date to 2022 just last fall (a one-year extension from the previous date). The proposed extension is subject to public comment by the FASB, following the board’s procedure. However, the extension for the accounting standard — which is intended to improve financial reporting by requiring timelier recording of credit losses on loans and other financial instruments held by financial institutions and other organizations – is likely to supported and ultimately adopted. Outcry from a number of organizations about the standard (including from bank and credit union organizations), as well as political pressure from members of Congress, has been intense over the last several months.

LINK:

Exposure draft: Proposed Accounting Standards Update (including CECL)

BRIEFLY: NASCUS seeks director for research, analytics

NASCUS continues to expand its professional staff, now looking for a director of research and analytics. The incumbent for the new position will use various data sources and survey tools to collect and analyze data for the credit union system, including regulatory agencies. For more, see the NASCUS “Career Opportunities” page on the new NASCUS website.

LINK:

NASCUS career opportunities

Information contact: Patrick Keefe ([email protected])

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.