Regulatory Agencies Sign Cooperative Interstate Agreement

Posted June 7, 2023FOR IMMEDIATE RELEASE

June 7, 2023

NASCUS Regulatory Member Agencies Sign a Cooperative Interstate Agreement for the Supervision of State-Chartered Credit Unions

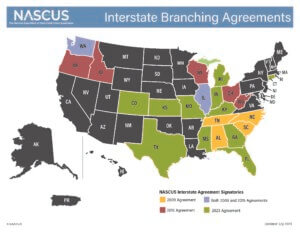

ARLINGTON, VIRGINIA – The National Association of State Credit Union Supervisors (NASCUS) proudly announces the first round of signatures to the Cooperative Interstate Agreement for the Supervision of State-Chartered Credit Unions. As of this release, signatories of the agreement include: Colorado, Connecticut, Florida, Georgia, Indiana, Kansas, Kentucky, Michigan, Mississippi, Missouri, and Texas.

ARLINGTON, VIRGINIA – The National Association of State Credit Union Supervisors (NASCUS) proudly announces the first round of signatures to the Cooperative Interstate Agreement for the Supervision of State-Chartered Credit Unions. As of this release, signatories of the agreement include: Colorado, Connecticut, Florida, Georgia, Indiana, Kansas, Kentucky, Michigan, Mississippi, Missouri, and Texas.

(Click here to view or download a PDF of the map.)

“The Connecticut Department of Banking is excited to join this cooperative state agreement coordinated by the National Association of State Credit Union Supervisors. We applaud NASCUS’ leadership in making this cooperative agreement a reality. Because of their efforts, Connecticut chartered credit unions will be more competitive with its federal counterparts and provide consumers with more options when choosing financial institutions and products. This agreement fosters collaborative relationships with other state regulators, strengthening supervision and enhancing consumer protections,” said Connecticut Banking Commissioner Jorge Perez.

The agreement, which was created in collaboration with NASCUS’s Dual Charter Resource Initiative (DCRI), is the outcome of three years of discussions with stakeholders and various NASCUS committees and working groups. NASCUS expresses gratitude to the Interstate Activities Task Force and the SSA OGC Working Group for their significant contributions toward the development of the agreement. The new agreement is meant to modernize and replace NASCUS initiated agreements signed in 1998, 2008, and 2015.

“The Cooperative Interstate Agreement is yet another illustration of the collaborative nature of credit union regulators across the nation and their mutual interest in facilitating the growth and prosperity of all state-chartered credit unions,” commented Denice Schultheiss, Michigan Department of Insurance and Financial Services, Director of Credit Unions and NASCUS Board Treasurer. “As the ability to serve broader fields of membership is being supported by constant innovation, this agreement provides essential guidance for reasonably consistent regulatory approaches to interstate activities and expansion. NASCUS continues to be invaluable in connecting regulators and state-chartered credit unions nationwide and providing forums for ongoing dialogue and innovation.”

The primary objective of the Interstate Agreement is to provide clear guidelines regarding the expansion of fields of membership and branch additions for out-of-state credit unions across participating states. Simultaneously, it aims to enhance collaboration and coordination between home and host state supervisors in overseeing and examining credit unions involved in interstate activities.

Key areas covered by the agreement include:

- The types of interstate activity covered.

- Home and host state supervisory agencies’ responsibilities related to supervision and examination.

- Communication of regulatory concerns and the filing of applications and/or notices.

Finally, the agreement broadly addresses the sharing of supervisory information and the related confidentiality of shared information under the originating supervisory agency’s respective statutes.

While the intention of the agreement is to promote cooperation and streamline the interstate supervisory process, it explicitly defines that the provisions of the agreement cannot override state laws. Furthermore, the application of the agreement is subject to the laws of both the home and host states involved, particularly concerning any multi-state credit union operating within those states.

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.