The Federal Reserve promotes the safety and soundness of individual financial institutions and monitors their impact on the financial system. It is responsible for supervising—monitoring, inspecting, and examining—certain financial institutions to ensure that they comply with rules and regulations, and that they operate in a safe-and-sound manner. The Federal Reserve supervises bank holding companies, savings and loan holding companies, the U.S. operations of foreign banking organizations, and state member banks of varying size and complexity.

The Federal Reserve promotes the safety and soundness of individual financial institutions and monitors their impact on the financial system. It is responsible for supervising—monitoring, inspecting, and examining—certain financial institutions to ensure that they comply with rules and regulations, and that they operate in a safe-and-sound manner. The Federal Reserve supervises bank holding companies, savings and loan holding companies, the U.S. operations of foreign banking organizations, and state member banks of varying size and complexity.

The Federal Reserve Board publishes its semiannual Supervision and Regulation Report to inform the public and provide transparency about its supervisory and regulatory policies and actions as well as current banking conditions. Previous reports are available at https://www.federalreserve.gov/publications/supervision-and-regulation-report.htm.

For more information on how the Federal Reserve Board promotes the safety and soundness of individual financial institutions and the financial system see https://www.federalreserve.gov/supervisionreg.htm.

May 24, 2023

Overdraft/NSF Revenue in Q4 2022 down nearly 50% versus pre-pandemic levels

Overdraft/NSF revenue for the fourth quarter of 2022 alone was approximately $1.5 billion lower than in the fourth quarter of 2019 – a decrease of 48% compared to before the pandemic, suggesting an annual reduction of over $5.5 billion going forward. This decrease suggests average annual savings of more than $150 per household that incurs overdraft or NSF fees; many households have saved much more.

May 24, 2023

Mortgage data shows that borrowers could save $100 a month (or more) by choosing cheaper lenders

The CFPB took a look at how mortgage rates paid by consumers vary across lenders. This phenomenon, called price dispersion, exists in virtually every segment of the mortgage market, including loans backed by Fannie Mae and Freddie Mac, Federal Housing Administration loans, U.S. Department of Veterans Affairs (Veterans Affairs) loans, as well as jumbo loans.1 We analyzed Home Mortgage Disclosure Act data from 2021 to quantify the magnitude of price dispersion.2

We found that price dispersion for mortgages is often around 50 basis points of the annual percentage rate. To put this number in context, the median loan amount in 2021 was close to $300,000 and the median interest rate was 3 percent.3 The monthly payment for such a 30-year fixed loan is $1,265. The monthly payment for a 3.5 percent interest rate loan on a loan of the same amount is $1,347 – a difference of $82 a month (a 6.5 percent higher payment). Interest rates have increased drastically since 2021, but the math remains similar in a higher-interest rate environment. Keeping the loan amount at $300,000, the monthly payments for a 30-year fixed loan with a 6.5 percent interest rate and a 7 percent interest rate are, respectively, $1,896 and $1,996 – a difference of $100 a month (a 5.3 percent higher payment). In a higher interest-rate environment, with monthly payments being much higher overall, this $100 a month difference might matter even more as borrowers potentially are more stretched to make ends meet. Read more

May 23, 2023

CFPB Action to Require Citizens Bank to Pay $9 Million Penalty for Unlawful Credit Card Servicing

Citizens failed to properly manage and respond to customers’ credit card disputes and fraud claims

Today, the Consumer Financial Protection Bureau (CFPB) reached a settlement to resolve allegations that Citizens Bank violated consumer financial protection laws and rules that protect individuals when they dispute credit card transactions. The CFPB alleges that Citizens Bank failed to properly manage and respond to customers’ credit card disputes and fraud claims. If entered by the court, the order, among other things, would require Citizens Bank to pay a $9 million civil money penalty.

Citizens Bank is a large bank headquartered in Providence, Rhode Island, with branches and ATMs in 14 states and the District of Columbia. Citizens Bank is a subsidiary of Citizens Financial Group (NYSE:CFG), which reported $222 billion in assets as of March 31, 2023, and is one of the 15 largest consumer banks in the country. The CFPB originally sued Citizens Bank in January 2020.

Federal law protects individuals from credit card billing errors and fraud. The Truth in Lending Act and the rules that implement it lay out specific steps that individuals must take to report credit card disputes and fraud claims. If a person reports a billing error or fraud, the credit card issuer is required to investigate the allegations, send certain notifications to the individual, and, when claims are valid, refund the error or fraud amount. Read more

May 25, 2023 — The NCUA Board had two items on the May agenda, the Share Insurance Fund (SIF) quarterly board briefing and a proposed rule that would amend Part 721 of NCUA Rules and Regulations specific to Charitable Donation Accounts.

May 25, 2023 — The NCUA Board had two items on the May agenda, the Share Insurance Fund (SIF) quarterly board briefing and a proposed rule that would amend Part 721 of NCUA Rules and Regulations specific to Charitable Donation Accounts.

SIF Briefing

The SIF briefing was based on quarter end, March 31, 2023. The SIF remains strong with a total income of $90.9 million and a net income of $42 million.

There were two credit union failures in the first quarter, one involuntary liquidation without a purchase and assumption and one involuntary merger. It was noted during this portion of the briefing that fraud was not a contributing factor in these credit unions. Additionally, the number of credit unions with a CAMELS rating of 4/5 increased slightly from 122 as of December 31, 2022, to 127 on March 31, 2023, while credit unions with a CAMELS rating of 3 also increased slighted from 769 to 779, and credit unions with a 1/2 rating decreased from 3,889 to 3,815. The majority of credit unions falling into categories 3, 4, and 5 were $100 million or less in assets.

Finally, the Board was presented with the projected equity ratio calculation for June 30, 2023, of 1.25 percent. It was noted during the briefing that the decrease of .5% from 1.30% reflects historical trend data over the years and is primarily due to projected growth in insured shares.

Notice of Proposed Rulemaking – Charitable Donation Accounts

The Board also unanimously approved a Notice of Proposed Rulemaking to amend the charitable donation accounts section of the NCUA’s incidental powers regulation. Specifically, the proposal would add “war veterans’ organizations,” as defined under section 501(c)(19) of the Internal Revenue Code, to the definition of a “qualified charity” in which a federal credit union may contribute to using a charitable donation account. The proposed rule will also seek comments on whether there are other groups, entities, or organizations the Board should consider adding to the definition of a “qualified charity” to inform potential future rulemaking in this area.

Currently, federal credit unions may only use a charitable donation account to fund donations to qualified charities and nonprofit entities under the Internal Revenue Code as 501(c)(3). Comments on the proposed rule will be due 60 days after publication in the Federal Register.

| Comments From the NCUA Board | |

|---|---|

Courtesy of Paige McNamee, Finextra

This is an excerpt from The Future of Risk Management and Compliance 2023 report.

In the UK and many other major economies, operational resilience remains a key regulatory focus area. The current and projected economic climate will likely be one in which many financial services firms will face external pressures, and firms need to carefully implement complex mapping and testing requirements to ensure they are able to remain within impact tolerances for each important business service.

As can be seen in the BNY Mellon graphic, operational resilience requirements in the EU and UK are due to apply for in scope firms from early 2025, making the next 24 months a period of significant preparation for financial institutions.

Firmin explains that during 2023, “operational resilience will remain a high priority – as economic downturn remains, financial pressures increase and organisations find themselves more susceptible to a range of risks, including those related to fraud – both external and internal threats. Operational resilience needs to factor the change in risk profile and be strengthened to enable the organisation to identify and manage these risks.”

Key operational risks that organisations need to consider include those relating to emerging and increased risks around sanctions, cyber threats and risks exacerbated by the cost of living crisis and economic recession. Firmin adds that there are also senior management arrangements, systems and controls (SYSC) requirements for firms to identify important business services and have measures in place to minimise consumer and market detriment cause by operational risks.

Sumit Indwar, partner at Linklaters’ Financial Regulation Group, expects regulators to be very interested in how procedures and contingency plans fare in the face of real-world pressures rather than simulated scenarios. “We may well see the crystallisation of latent risks, exacerbated by leverage and concentration. It’s in these sorts of times when the robustness of firms’ risk management platforms will be tested.”

The operational resilience rules require UK and EU firms to follow a more “prescriptive approach when preparing for disruption,” Indwar notes, as financial services authorities are becoming ever more interested in unregulated tech providers to monitor and mitigate concentration risk in the sector.

He continues that although the outcomes of the UK and EU regimes are largely aligned, the detailed requirements differ, and the challenge of implementing a global resilience strategy in a way which is compliant with local regimes is likely to present a significant headache for many firms.

For instance, the EU’s Digital Operational Resilience Act’s (DORA) concept of a risk tolerance limit is not the same as the UK definition for impact tolerance. Other jurisdictions are also developing rules aimed at building the operational resilience of their financial sectors.

As a resolution to resilience challenges, greater investment into skilled resources, technology and data will be required to meet operational resilience benchmarks.

Lauder explains: “Data will be driven by smarter, more enhanced risk management platforms, which will allow more enriched and real time data to allow better decisions to be made. All too often data is based on past events and looks back and not forward – risk management needs to be more proactive and forward looking.”

Managing consultant in fincrime at Valcon, Alistair Lauder’s key recommendations to achieving risk management include:

- ensuring risk assessments are up to date and factor in current operational risks and vulnerabilities;

- developing and implementing incident response plans to enable firms to respond swiftly to operational disruptions;

- enhancing IT infrastructures to withstand increasingly sophisticated cyberattacks from overseas organisations and state actors; and,

- conducting testing of operational resilience response plans, including disaster recovery and business continuity frameworks.

Operational resilience is not the only financial stability regulation demanding attention from banks in 2023, as Basel III begins its phasing-in period. The reforms were originally designed in response to the 2008 financial crisis, in efforts by the Financial Stability Board (FSB) to enhance prudential regulatory standards, supervision and risk management of banks.

Implementation of the measures faced a 12 month deferral, to allow banks and banks to respond to Covid-19, taking effect from the 1st of January 2021 over a five-year phasing in period. KPMG notes that banks across the EU are expressing the difficulties being faced in their efforts to balance their role of lending to the real economy, supporting transitions to green and digital finance, while meeting Basel III requirements.

Courtesy of Matt Egan, CNN

As leaders in Washington fail to make progress on a debt ceiling deal, Moody’s Analytics is warning of disastrous implications for American jobs if the United States defaults on its debt for an extended period.

Treasury Secretary Janet Yellen has forecast that the United States could run out of cash and extraordinary measures to pay its bills as soon as early June if Congress does not act.

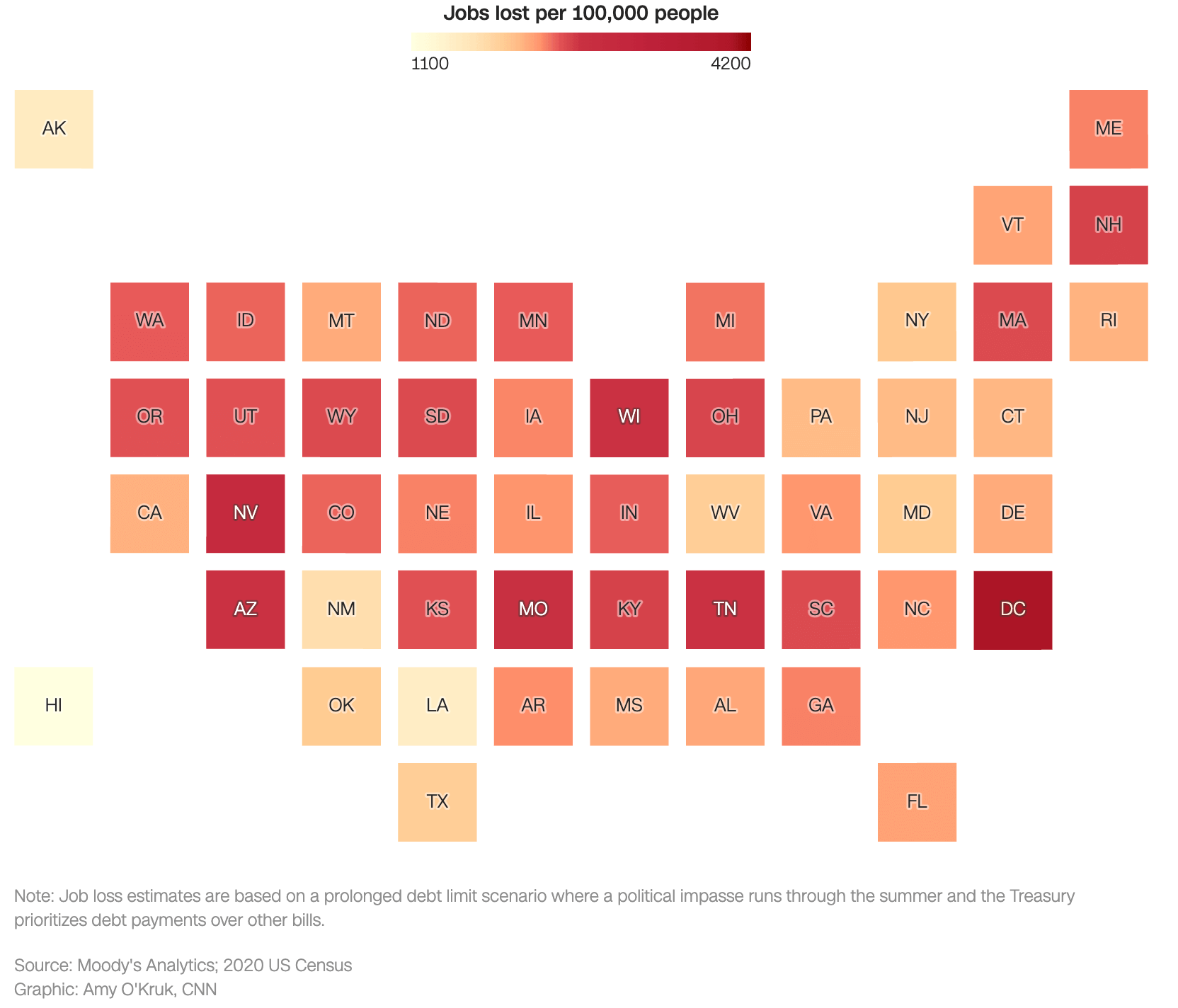

While most states would be “hit hard” by a debt limit breach, the economic pain would vary from state to state, according to projections released on Wednesday by Moody’s. It would disproportionately hurt states with large concentrations of federal workers or that have a number of jobs that rely on government funding. That includes Washington, DC, and states located near or that rely on federal institutions such as national labs or military bases such as Alaska, Hawaii and New Mexico.

A prolonged debt limit breach could cut thousands of jobs across the US

A prolonged debt limit breach could cut thousands of jobs across the US

Most state economies and DC will be hit hard if there’s a prolonged debt limit breach, particularly D.C. with its large government presence. Business- and tourist-travel-heavy states, such as Arizona and Nevada, will also be disproportionately impacted, according to Moody’s Analytics.

Soaring unemployment

The analysis spells out other widespread damage: The unemployment rate would spike to near-double digits in the District of Columbia (8.9%), California (8.7%) and Ohio (9.5%). Michigan’s unemployment rate would reach 10.8%, up from 4.1% today.

Other states that would feel significant impact are ones that rely on federal spending and aerospace, such as Virginia, Connecticut, Kansas and Washington. Moody’s said tourism-dependent states including Arizona, Florida and Nevada will eventually experience “sharp” job loss as well those that rely on auto manufacturing, like Michigan and South Carolina.

In the event of a prolonged breach of the debt ceiling, Moody’s estimates some large states would each lose hundreds of thousands of jobs. California could lose 841,600. Texas may lose 561,700. The report predicts Florida would lose 474,700 jobs, New York could shed 398,300, and Ohio, Pennsylvania and Georgia would each lose more than 200,000.

‘A real threat’

In its report, Moody’s assigns a 10% probability to a breach of the debt ceiling, up from 5% previously.

“What once seemed unimaginable now seems a real threat,” Moody’s Analytics chief economist Mark Zandi wrote in the report.

A breach is not the same thing as a default.

In an email to CNN, Zandi explained that a breach would occur if the Treasury Department fails to make a payment to any creditor on time – whether that be a Social Security recipient or the electric bill for a government building in Omaha.

A default would only occur if Treasury fails to make a debt payment on time, Zandi said.

In the report, Zandi wrote that if there is a breach, it would be “much more likely to be a short one than a prolonged one,” though even a “lengthy standoff no longer has a zero probability.”

The new warning from Moody’s comes a day after a meeting on Tuesday between President Joe Biden and Congressional leaders ended without any progress on a debt ceiling deal.

Zandi noted that although there are some emerging signs of concern in financial markets, for the most part investors “appear largely unruffled” by the estimated June 1 deadline.

“The longer it takes for financial markets to react,” Zandi wrote, “the greater the odds that lawmakers will not act in time, since market turmoil is probably what it will take to generate the political will lawmakers will need to come to terms.”

New circular addresses illegal “reopening” of deposit accounts that can hit consumers with junk fees

The Consumer Financial Protection Bureau (CFPB) issued a new circular affirming that a bank may violate federal law if it unilaterally reopens a deposit account to process transactions after a consumer has already closed it. The CFPB has observed in complaints that even after a consumer completes all the required steps to close an account, their bank has “reopened” the closed account and assessed overdraft and nonsufficient funds fees. Consumers have reported to the CFPB that financial institutions have also charged account maintenance fees upon reopening, even if the consumer was not required to pay account maintenance fees prior to account closure.

The Consumer Financial Protection Bureau (CFPB) issued a new circular affirming that a bank may violate federal law if it unilaterally reopens a deposit account to process transactions after a consumer has already closed it. The CFPB has observed in complaints that even after a consumer completes all the required steps to close an account, their bank has “reopened” the closed account and assessed overdraft and nonsufficient funds fees. Consumers have reported to the CFPB that financial institutions have also charged account maintenance fees upon reopening, even if the consumer was not required to pay account maintenance fees prior to account closure.

“When a bank unilaterally chooses to open an account in someone’s name after they have already closed it, this is a fake account,” said CFPB Director Rohit Chopra. “The CFPB is acting on all fronts to halt the harvesting of illegal junk fees.”

Closing a bank account can take significant time and effort by the consumer to complete, and the bank may require a consumer to provide a certain period of advance notice prior to closing the account to allow for the financial institution to process any pending debits or deposits. Consumers often must also settle any negative balances in their deposit account before being able to close it. Upon closure of the deposit account, the consumer may no longer have access to their account information or receive notifications of account activity.

Today’s circular confirms that banks may risk violating the Consumer Financial Protection Act’s prohibition on unfair acts or practices by unilaterally reopening closed accounts. Consumers may incur overdraft, nonsufficient funds, or monthly maintenance fees when a closed account is reopened by the bank. This practice may also enable third parties to access a consumer’s funds without consent. If reopening the account overdraws the account, banks may also furnish negative information to consumer reporting companies if consumers do not settle negative balances quickly. Consumers often cannot reasonably avoid the risk of substantial injury caused by this practice because they cannot control a third party’s attempt to debit or deposit money, the process and timing of account closure, or the terms of deposit account agreements.

The CFPB previously ordered USAA Federal Savings Bank to pay more than $15 million in consumer remediation and penalties for, among other things, violating the Consumer Financial Protection Act by reopening deposit accounts consumers had previously closed without seeking prior authorization or providing adequate notice. Today’s circular highlights for regulators that an institution’s unilateral reopening of a deposit account that a consumer previously closed can constitute an unfair act or practice under the Consumer Financial Protection Act.

CFPB Proposes New Consumer Protections for Homeowners Seeking Clean Energy Financing

The Consumer Financial Protection Bureau (CFPB) proposed a rule to implement a Congressional mandate to establish consumer protections for residential Property Assessed Clean Energy (PACE) loans.

Related reading: The CFPB issued a Notice of Proposed Rulemaking related to residential Property Assessed Clean Energy (PACE) financing. The CFPB also issued a Fast Facts Summary that provides a high-level overview of the proposed rule and an Unofficial Redline.

Additionally, the CFPB has published a report on PACE financing, which found that the loans cause an increase in mortgage delinquency and other negative credit outcomes for some borrowers.

Comments on the Notice of Proposed Rulemaking are due July 26, 2023, or 30 days after publication in the Federal Register, whichever is later.

You can access the Notice of Proposed Rulemaking, Fast Facts Summary, Unofficial Redline, and Report here: www.consumerfinance.gov/rules-policy/rules-under-development/residential-property-assessed-clean-energy-financing-regulation-z/.

On May 1st, the FDIC released a report titled “Comprehensive Overview of Deposit Insurance System, Including Options for Deposit Insurance Reform” along with a statement from FDIC Chairman Martin J. Gruenberg. The Report, the related press release and Chair Gruenberg’s statement can be found at the links provided.

On May 1st, the FDIC released a report titled “Comprehensive Overview of Deposit Insurance System, Including Options for Deposit Insurance Reform” along with a statement from FDIC Chairman Martin J. Gruenberg. The Report, the related press release and Chair Gruenberg’s statement can be found at the links provided.

The report provides a history of bank deposit insurance in the United States, outlines objectives of and possible consequences of bank related deposit insurance, tools utilized to support those objectives and address possible consequences of the three main options to consider for future deposit insurance including limited coverage, unlimited coverage and targeted coverage. Finally, the report discusses the implication of excess deposit insurance coverage and some additional options that may be meaningful.

In reviewing the three options of deposit insurance coverage, the FDIC considered the following:

- Limited Coverage or maintaining the current system of deposit insurance with the possibility of increasing the deposit insurance limit.

- Unlimited coverage or fully insuring all deposits, or

- Targeted Coverage or providing substantial additional coverage to business payment accounts without extending the same insurance to all deposits.

The report generally found that the limited coverage option does not adequately address the run risk associated with high concentrations of uninsured deposits, a trend that increased significantly since the inception of deposit insurance. Further, the review indicates that unlimited coverage would effectively remove run risk, however, its impact on bank risk-taking and earnings due to substantial assessment increases would be detrimental to the broader financial market.

While no specific insurance threshold was provided in the report, the FDIC suggests that the targeted coverage option would provide substantial additional coverage to business payment system accounts without extending similar insurance to all deposits and would provide the most effective financial stability relative to its costs. This option would present challenges related to defining the types of non-investment accounts deposit insurance should apply and could potentially decrease transparency to consumers due to increased complexity. To be effective, complimentary tools necessary to ensure effectiveness of this option would need to be implemented including:

- Considering interest rate restrictions on accounts for which additional coverage is extended;

- Consider simplification of ownership categories to decrease complexity;

- If large accounts remain partially insured require that large deposits are secured; and

- If large accounts remain partially insured, place limits on convertibility for large deposits.

The FDIC also briefly discussed excess deposit insurance coverage that could address different aspects of the current deposit insurance system and warranted consideration. While considering this parallel option, the FDIC determined that its voluntary nature was unlikely to have notable broader market effects as those institutions most needing coverage would likely be the most likely to opt out of such coverage.

NASCUS staff are currently reviewing the report and will provide updates on the issue as its progresses.