One of my biggest pet peeves in all of finance is the overdraft fee. I first wrote in 2019 that we were moving to a world of no overdraft fees. This was before major banks changed anything in response to the fintech push for no overdraft fees.

By 2021, it was clear that we had reached a tipping point on overdraft fees as many major banks either eliminated the practice or reduced the amount of their fees. This is partly due to the CFPB and their targeting of so-called “junk fees” like overdrafts. This has resulted in a dramatic drop in overdraft revenue for banks.

With this backdrop, I was interested in receiving an update from the Financial Health Network on overdraft fees as part of their annual FinHealth Spend Report (the full report will be out later this month). This report examines household spending on various financial products such as overdraft, payday and pawn, credit cards, and auto loans.

There were some very interesting findings in this report:

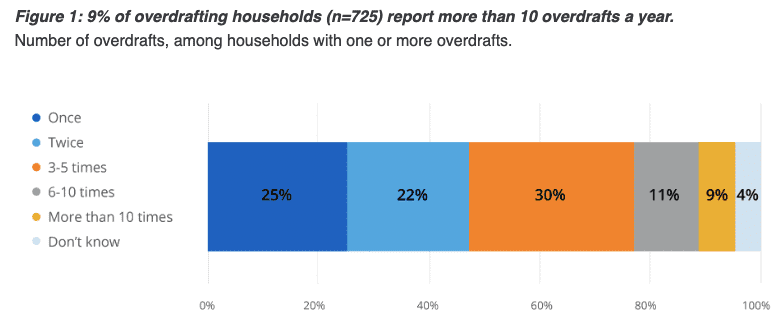

- 17% of U.S. households reported having overdrafted in 2022, unchanged from 2021

- 46% of Financially Vulnerable households reported paying an overdraft or NSF fee in 2022

- 9% of U.S. households that overdraft reported doing so more than ten times

It is the last point I want to focus on here. For the population who overdraft a lot (more than ten times a year), 35% of them said their last overdraft was intentional. So, they are using their bank account for short-term and costly funding. If you are talking APRs, this type of funding can go as high as 18,000%—no wonder the CFPB is cracking down on the practice.

For small transactions, those less than $25, 60% of respondents would have rather had their transaction declined than send them into an overdraft. But that means 40% of people are fine paying a $35 fee for overdrawing their account by less than $25.

We are moving towards a better system for overdrafts

Many fintech companies offer short-term financing when money is needed. Dave pioneered this product, but companies like Chime, Varo, MoneyLion, and Current all offer affordable small-dollar financing or fee-free overdrafts.

The report also shared that 81% of households overdrafted more than 10 times in 2022 prefer to incur a fee rather than have the purchase or payment declined. So, these people living on the financial edge are happy to pay a fee, but they really need a program that helps them get back on their feet.

It feels like we are in a transition period right now. The old overdraft system has been chipped away by fintechs, with many banks now jumping on board to offer no overdraft fees. But we are not yet where the most financially unstable people can rely on their financial institutions to provide inexpensive options.

I want to see a world where no financial institution can make significant money in fees off the most vulnerable subset of their customer base. It should no longer be expensive to be poor. We are on our way to this world, but more work needs to be done. This new report from the Financial Health Network makes that clear.

Courtesy of Peter Renton, FintechNexus

The Consumer Financial Protection Bureau (CFPB) today released a new issue spotlight on the expansive adoption and use of chatbots by financial institutions. Chatbots are intended to simulate human-like responses using computer programming and help institutions reduce the costs of customer service agents. These chatbots sometimes have human names and use popup features to encourage engagement. Some chatbots use more complex technologies marketed as “artificial intelligence,” to generate responses to customers.

Communities across the nation are working to prevent and respond to elder financial exploitation, which threatens the financial security of millions of older adults each year.

The Consumer Financial Protection Bureau (CFPB) helps state and local organizations create and develop Elder Fraud Prevention and Response Networks, often working with partners to host in-person convenings of local or regional stakeholders.

But what happened during the COVID-19 pandemic, when people were no longer able to convene in person? When reported fraud and scams hit an all-time high? And what happens when scammers target traditionally underserved populations? Here is how the CFPB and elder justice advocates adapted to meet the moment.

DUBLIN, Ireland–Social enterprise funder Community Finance Ireland (CFI) has announced plans to collaborate with this country’s credit unions on a co-lending project to help enhance lending to charities and sporting groups.

According to the Independent, the Irish League of Credit Unions (ILCU) has facilitated the relationship with CFI to provide an option for credit unions to bolster lending activities to local community organizations.

‘Vibrant & Thriving Communities’

“The work done by these community organizations such as charities, sporting organizations and voluntary groups at local level is integral to developing vibrant and thriving communities,” Malone told the Independent. “CFI has already been working with a number of credit unions in co-funding appropriate community lending projects. Working with CFI, we will adopt a co-lending approach to assist in spreading the risk for larger loans where it may not have been possible to proceed with on a solo basis, and also leverage CFI’s significant expertise.”

Dónal Traynor, CEO of CFI, told the Independent that engaging with the credit unions underpinned its ambitions to make a social impact across the island of Ireland.

On May 30, 2023, NCUA’s Office of Inspector General issued its semiannual report to Congress covering the six-month period October 2022 through March 2023.

The report provided a general recap of the NCUA, and its OIGs, activities over the six-month period, including: highlights of the conditions present in the federally insured credit union industry, structural changes within NCUA, legislative highlights, audit activity as well as a listing of unimplemented MLR or Audit recommendations outstanding.

Highlights of the report NASCUS believes most relevant, with report page reference for detailed review, include:

AMAC Reestablished as an Independent Office

Page 6

- On December 1, 2022, the Asset Management and Assistance Center (AMAC) was pulled out of the Southern Region and made into an independent office under the Field Program Offices. Offices are still located in Austin, Texas. Previous Deputy Cory Phariss (formerly under Southern Region Director Keith Morton) was named AMAC’s new president and now provides independent advisement to the NCUA Board on managing recoveries for the NCUSIF, implementing liquidation payouts, etc.

Charles Vice Selected as Director of Financial Technology and Access

Page 6

- On January 3, 2023, former Kentucky Commissioner Charles Vice as named the Director of Financial Technology and Access, a newly established office created to advise the NCUA Board on fintech developments, cryptocurrency, blockchain and distributed ledger technology as well as methodologies to enhance NCUA’s virtual supervision processes and promote technology and other innovations in the industry.

OIG-22-07 FY 2022 Independent Audit of the NCUA’s Compliance with FISMA 2014

Page 13

- CliftonLarsonAllen (CLA) performed a review of 20 OMB required core metrics in five security function areas (Identify, Protect, Detect, Respond, and Recover) to determine the effectiveness of the NCUA’s information security program (ISP) and the respective maturity levels. CLA concluded the NCUA ISP achieved an overall level 4- Managed and Measurable maturity level, complied with FISMA, and achieving the minimum to be considered effective overall. Weaknesses noted included the ineffective implementation of a subset of selected controls, especially four new weaknesses that fell in the risk management, identity, access management, and configuration management domains of the FY 2022 core metrics and resulting in four new recommendations to strengthen its ISP.

NCUA Audits Currently In Progress

Page 15

- OIG audits currently in process include: NCUA’s Contracting Officer’s Representative (COR) Program; NCUA’s BSA Act Enforcement; Preventing and Detecting Cyber Threats (firewall and SIEM solution effectiveness); NCUA’s Quality Assurance Program and NCUA’s Federal Chartering Activities.

Unfulfilled Recommendations Currently Outstanding

- A material number of the unaddressed recommendations outstanding relate to NCUA Information Technology Systems and/or continuity of operations. The following is not an exhaustive list of recommendations outstanding but those considered most substantial.

OIG-22-09 Audit of the NCUA’s Continuity of Operations Program (COOP),

Page 14

- As the result of a self-initiated audit of the NCUA’s COOP it was determined a full failover test of NCUA’s IT network should be initiated to ensure potential weaknesses are identified and corrected. Further, the Office of Continuity and Security Management (OCSM) and the Office of the Chief Information Officer (OCIO), the two main offices involved in the COOP and security matters, should work to improve communications between their respective offices. Four recommendations within the report were provided to address the issues identified.

Material Loss Review Significant Recommendations on Which Corrective Action Has Not Been Completed

Page 17

- OIG-18-07 FY2018 Federal Information Security Modernization Act Compliance, recommendation #8 – Enforcement of policy to remediate patch and configuration related vulnerabilities within agency defined timeframes.

- OIG-22-06 Audit of the NCUA’s Minority Depository Institutions Preservation Program, Recommendation #2 – Implement and document appropriate policies and procedures to validate whether minority depository institutions continue to meet the minority depository institution definition.

Unfulfilled Recommendations Over 6 Months Old.

Page 18

- OIG-18-07 FY2018 Federal Information Security Modernization Act Compliance, Recommendation #6—OCSM to complete employee background reinvestigations; #8 – Enforcement of policy to remediate patch and configuration-related vulnerabilities within agency defined timeframes; #9 — OCIO to implement a process to detect and migrate unsupported software to supported platforms; #10 – OCIO to implement a process to identify authorized software in its environment and remove unauthorized software.

- OIG-19-10 NCUA Federal Information Security Modernization Act of 2014 Audit; Recommendation #4 – Implement, test, and monitor standard baseline configurations for all platforms in the NCUA IT environment in compliance with established NCUA security standards and document approved deviations from the baseline.

- OIG-21-06 Audit of the NCUA’s Governance of Information Technology Initiatives, Recommendation #1 – Document and publish IT Investment Management policies and procedures to include definitions, roles, responsibilities, and processes associated with IT governance and selecting, controlling, and evaluating information technology investments.

- OIG-21-09 NCUA Federal Information Security Modernization Act of 2014 Audit, Recommendation #1 – Review Supply Chain Risk Management NIST guidance and update plans, policies, and procedures.; Recommendation #2 – Document and implement a plan to deploy multifactor authentication to address increased risks with personnel teleworking without a PIV card; Recommendation #5 – Complete and issue policies to implement the Controlled Unclassified Information (CUI) program; Recommendation #7 – Redacted recommendation under 5 U.S.C. 552 (b)(7)(E).

Recommendations for Corrective Action Made During the Reporting Period

Page 21

- OIG-22-07 NCUA Federal Information Security Modernization Act Audit, Recommendation #1 – Enforce the process to validate that expired MOUs and those expiring are prioritized for review, update, and renewal; Recommendation #2 – Conduct a workload analysis with OCIO and document a staffing plan to allocate sufficient resources to improve its ability to perform remediation of persistent vulnerabilities caused by missing patches, configuration weaknesses, and outdated software; Recommendation #3 – Analyze technologies employed within NCUA operational environment and document a plan to reduce the wide variety of different technologies requiring support and vulnerability remediation; Recommendation #4 – Implement a solution that resolved the privileged access management vulnerability.

OIG-22-09 Audit of NCUA’S Continuity of Operations Program

Report on Non-Material Losses to the NCUSIF

Page 22

- Over the covered six-month period, limited reviews of four failed credit unions that incurred losses to the fund in amounts less than $25 million. The initial reviews indicated none of the losses warranted conducting additional audit work as they (1) were not unusual circumstances or (2) reasons identified for failure are already addressed in recommendations to the agency in the MLR Capping report or other MLR reports.

Join Us On September 7, 2023

NASCUS, the Colorado Department of Regulatory Agencies Division of Financial Services, and the GoWest Credit Union Association invite you to join us on Sept. 7, 2023, for the Colorado Executive Forum.

Join us for a collaborative one-day session that unites industry leaders, system stakeholders, credit unions, and board members. Explore and discuss the pressing issues facing our industry today. Expand your network, gain insights into solutions for evolving challenges, and engage in collaborative discussions on the future of the state system.

Take advantage of this opportunity to be part of a meaningful dialogue. Register now and contribute to shaping the future of our industry!

This is an in-person event. All times are MST.

Location

Canvas Credit Union Community Room

10000 Park Meadows Drive,

Lone Tree, Colorado, 80124

Event Pricing

$199 NASCUS Members

$299 Non-members

Courtesy of By Nick Timiraos, Wall Street Journal

Stubbornly high inflation and tight labor markets led Federal Reserve officials to signal they could raise interest rates at their next meeting despite a greater likelihood of a recession later this year.

The fallout from the failures of two midsize banks led Fed officials to consider skipping a rate increase at their meeting last month, but they concluded regulators had calmed stresses enough to justify a quarter-point rate rise, according to minutes of the March 21-22 gathering released Wednesday.

For the first time since officials began lifting rates a year ago, the Fed staff forecast presented at the meeting anticipated a recession would start later this year due to banking-sector turmoil, the minutes said. Previously, the staff had judged a recession was roughly as likely to occur as not this year.

Looking ahead, the minutes hinted at potential policy divisions, with some officials pointing to greater risks of a sharper-than-anticipated slowdown and others highlighting the prospect of firmer inflation this year.

Officials concluded that given the strength of price pressures and the demand for labor, “they anticipated that some additional policy firming may be appropriate” to bring inflation down to the central bank’s 2% goal, the minutes said. They also said they would pay close attention to bank lending conditions as they weigh their next move.

The latest rate rise brought the Fed’s benchmark federal-funds rate to a range between 4.75% and 5%. All 18 officials who participated in last month’s meeting supported the increase, the minutes said. New economic projections released then showed nearly all expected they would lift rates one more time this year. Most of them expected to hold rates steady after that, provided the economy grows little this year and labor demand cools.

Over the past year, the Fed has raised rates at its fastest pace since the early 1980s to combat inflation that jumped to a 40-year high last year. Until recently, officials had signaled that they were likely to keep raising lifting rates until they saw more conclusive evidence that economic activity and price increases were slowing.

The rate outlook became much more uncertain after banking-system stresses flared last month, beginning March 9 when panicked depositors pulled money from Silicon Valley Bank, which regulators closed the following day. Regulators closed a second institution that also faced a run, Signature Bank, on March 12 and intervened aggressively to shore up confidence in the banking system.

Many Fed officials anticipated “there would be some tightening of credit conditions, and that would really have the same effects as our policies do,” Fed Chair Jerome Powell said at a news conference March 22. “If that did not turn out to be the case, in principle, you would need more rate hikes.”

Inflation moderated somewhat last month, the Labor Department said Wednesday. The consumer-price index rose 0.1% in March and by 5% over the previous 12 months, the smallest annual increase in nearly two years. But core prices, which exclude volatile food and energy items and which central bankers see as a better gauge of underlying inflation, rose 0.4% in March and by 5.6% over the previous year, up from 5.5% in February.

The Fed fights inflation by slowing the economy through raising rates, which causes tighter financial conditions such as higher borrowing costs, lower stock prices and a stronger dollar, which curb demand.

“While the full impact of this policy tightening is still making its way through the system, the strength of the economy and the elevated readings on inflation suggest that there is more work to do,” San Francisco Fed President Mary Daly said in a speech Wednesday.

The question ahead of the Fed’s May 2-3 meeting is whether officials place more emphasis on anecdotes and surveys of credit conditions if they signal a pullback in lending, which could call for forgoing an increase or raising rates while signaling a pause, or whether they place more weight on economic data that might show less effect on credit availability but be more dated.

Philadelphia Fed President Patrick Harker said Tuesday he has long anticipated the central bank would need to raise the fed-funds rate above 5% “and then sit there for a while.”

Last year, supply-chain healing offered a compelling reason to think price growth would slow. This year, the case for inflation falling depends more squarely on declines in the demand for labor and consumer spending. “If you don’t see demand moving [down], it is hard to envision how you think inflation is going to” slow, Richmond Fed President Tom Barkin told reporters on March 30.

“You have to have a theory of why inflation’s going to come down if you think it is going to come down,” he said.

Courtesy of PYMNTS.com

The words “systemic” and “risk” have been on everyone’s lips in the past few weeks.

The words “systemic” and “risk” have been on everyone’s lips in the past few weeks.

And for Big Tech, at least, the regulatory gaze will only widen, eyeing the payments ambitions of the biggest platforms, and whether new payment types — stablecoins among them — might scale enough on those platforms to be a cause for vigilance.

The Consumer Financial Protection Bureau (CFPB) efforts may get renewed vigor in the wake of the fact late last month federal appeals court ruled that the CFPB’s funding via the Federal Reserve is constitutional.

And this week, appearing on Yahoo Finance Live, CFPB Director Rohit Chopra gave some insight into the areas ripe for consideration and review — and perhaps some new regulations too.

He said the Financial Stability Oversight Council has the authority to “designate certain payment activities [including] payment clearing and settlement as either systemic or likely to become systemic.”

Among the payment methods that need to be examined, per Chopra’s commentary: stablecoins, which could conceivably start “riding the rails of a Big Tech platform or a card network.”

Who’s on the Platform and Who’s Not

“There are some questions we have,” he said of the platforms, “about how do some of these services decide to kick a merchant off or kick a user off? How are they actually using all the data that they’re collecting through our phones and through what we buy?”

He noted that beyond the ability to craft targeted ads, there may be a “move to a world with personalized pricing.”

The regulators, he said, have been looking, and will continue to look, at the cloud services offered by Big Tech players — with particular concern around the risks tied to outage or attacks by fraudsters and hackers, non-state and state actors alike. The risks extend to healthcare, energy and other sectors, he said.

“It’s hard to know what specific tools we’ll use,” he told the finance site, as to what guardrails, regulations and policies may be on the horizon.

As reported by PYMNTS in recent weeks, the drumbeat for stablecoin regulation is likely to grow louder after the stablecoin USDC briefly lost its dollar peg. USDC dipped to as low as 86 cents after the issuer of the stablecoin, Circle, said that some of the funds backing the stablecoin were held at Silicon Valley Bank.

Big Tech’s financial services roadmaps may be determined in part by open banking, where as banks share account data and other details (with consumer permission), they can offer a range of financial products. There’s also, of course, the ability for Big Tech to apply for banking licenses. Apple’s latest push into buy now, pay later (BNPL), with Apple Pay Later, is but one of the more recent examples of the lines blurring between payments, providers and platforms.

$3.5 Million Available; Credit Unions Should Review Eligibility Before Applying.

$3.5 Million Available; Credit Unions Should Review Eligibility Before Applying.

Credit unions eligible for Community Development Revolving Loan Fund grants in 2023 can apply between May 1 and June 30, the National Credit Union Administration announced today.

“This year, we have new opportunities for credit unions that are considering applying for a 2023 CDRLF grant,” NCUA Chairman Todd M. Harper said. “Congress more than doubled the CDRLF funding for 2023 and added minority depository credit unions as eligible institutions. So, both low-income credit unions and minority depository institutions can now use CDRLF grants to build capacity, invest in their communities, reach under-resourced populations, and provide their members with products and services to strengthen their economic security.”

The agency will administer approximately $3.5 million in CDRLF grants to the most-qualified applicants, subject to the availability of funds. Grants will be awarded in five categories:

- Underserved Outreach (maximum award of $50,000) — Helping credit unions expand safe, fair and affordable access to financial products and services to underserved communities and improve the financial well-being of their members;

- MDI Capacity Building (maximum award of $50,000) — Preserving MDI credit unions and increasing their ability to thrive and serve minority populations;

- Consumer Financial Protection (maximum award of $10,000) — Ensuring credit unions have the resources and expertise to protect credit union members, raise awareness of potential frauds, and facilitate access to fair and affordable financial services;

- Digital Services and Cybersecurity (maximum award of $10,000) — Providing assistance to credit unions to modernize information and security systems to better protect themselves and their members from cyberattacks; and

- Training (maximum award of $5,000) — Strengthening credit unions through succession planning, leadership development, staff education, and professional development.

During this year’s funding round, the NCUA is also piloting two new grant initiatives that eligible credit unions may apply for:

- Impact Through Innovation (maximum award of $100,000) — A pilot initiative addressing underserved communities by focusing on banking deserts, affordable housing, credit invisibles, and fintechs; and

- Small Credit Union Partnership (maximum award of $100,000) — A pilot initiative helping small credit unions pool their resources to help them achieve their growth objectives.

Interested credit unions are encouraged to read the Notice of Funding Opportunity(opens new window). Grant requirements, application instructions, and other important information are available on the grants program page of NCUA.gov. Grant applications must be submitted online through the NCUA’s CyberGrants portal(opens new window). Credit unions with other questions about CDRLF grants may contact the NCUA’s Office of Credit Union Resources and Expansion at [email protected].

Eligibility Requirements

The 2023 CDRLF grant round is open to credit unions with either a low-income designation or certification as a minority depository institution. A credit union applying for a CDRLF grant must have an active account with the System for Award Management, or SAM, and a unique entity identifier number they will receive when they register for a SAM account.

Credit unions with an existing registration with SAM must recertify and maintain an active status annually. There is no charge for the SAM registration and recertification process. SAM users can register or recertify their account by following the instructions for registration(opens new window).

Credit unions with additional questions about the low-income designation may contact the NCUA’s Office of Credit Union Resources and Expansion at [email protected]. Questions about the MDI designation or the NCUA’s MDI Preservation Program should be sent to [email protected].

PUBLISHED CFPB launches Small Business Lending (SBL) Help

PUBLISHED CFPB launches Small Business Lending (SBL) Help

The CFPB issued the small business lending rule. You can read the rule on the CFPB website. To help financial institutions implement and comply with the small business lending rule, the CFPB is launching a dedicated regulatory and technical support program called SBL Help. SBL Help can provide oral and written assistance to financial institutions about their data collection and reporting obligations under the final rule.

You can submit your questions to SBL Help here: https://sblhelp.consumerfinance.gov/.

SBL Help is the latest resource from the CFPB to help financial institutions implement and comply with the small business lending final rule. As announced last week, the CFPB published a small business lending implementation and guidance webpage, which contains several regulatory implementation resources about the final rule, and a small business lending data webpage, which contains several technical resources about submitting small business lending data to the CFPB.

The CFPB plans to publish additional resources to help financial institutions implement and comply with the small business lending final rule. The CFPB has published a video that introduces the types of implementation and compliance support it provides and the timeline these materials are typically released.

You can watch the Introduction to Regulatory Implementation and Guidance video here: https://www.youtube.com/watch?v=cKc_BBxqOwM.

The CFPB took action against James R. Carnes and Melissa C. Carnes, both individually and as co-trustees of the James R. Carnes Revocable Trust and the Melissa C. Carnes Revocable Trust for hiding money through a series of fraudulent transfers in order to avoid paying more than $40 million in restitution and penalties for illegal payday lending activities. James Carnes attempted to evade a CFPB order requiring him and his company, Integrity Advance, to make harmed consumers whole and pay penalties to the CFPB’s victims relief fund. The CFPB is seeking injunctive relief, as well as asking the court to award a money judgment for the value of the fraudulently transferred funds.

James Carnes was the chief executive officer of Delaware-based Integrity Advance, a short-term, online lender. James Carnes and Melissa Carnes reside in Mission Hills, Kansas, which is also the principal place of administration of their revocable trusts.

PUBLISHED CFPB Issues Guidance to Address Abusive Conduct in Consumer Financial Markets

Policy statement details post-financial crisis prohibition on illegal abusive conduct

The Consumer Financial Protection Bureau (CFPB) issued a policy statement that explains the legal prohibition on abusive conduct in consumer financial markets and summarizes over a decade of precedent. The CFPB leads enforcement and supervision efforts to identify and end abusive conduct against consumers. In 2010, in response to the financial crisis, Congress passed the Consumer Financial Protection Act, and created the prohibition on abusive conduct. The Act tasks the CFPB, federal banking regulators, and states with the responsibility to enforce the prohibition, and puts the CFPB in charge of administering it. The policy statement will assist consumer financial protection enforcers in identifying wrongdoing, and will help firms avoid committing abusive acts or practices.

More than 78,000 consumers harmed by College Financial Advisory and Student Financial Resource Center will receive checks in the mail this month.

Learn more about the case and redress payments

In 2015, the CFPB filed a complaint in federal court against College Financial Advisory and Student Financial Resource Center for illegally charging millions of dollars for sham financial services. Global Financial Support, Inc. is a California corporation owned by Armond Aria that operated under the names College Financial Advisory and Student Financial Resource Center. According to the CFPB complaint, Aria and his businesses sent millions of deceptive solicitation packets to students and their families claiming to apply for financial aid services and to match prospective students with targeted financial aid assistance programs for a fee, and mispresented that students would lose their opportunity to receive financial aid unless they paid the company and applied by a stated deadline. In reality, consumers did not receive what they paid for, while the company reaped millions of dollars from the scheme. Learn more about the enforcement action.

The total distribution amount is $4,737,472.17, and the money will come from the CFPB’s Civil Penalty Fund.

Courtesy of Candice Choi, Wall Street Journal (click here to listen to the story)

John Bovenzi is part of the small club of people who have run a failed U.S. bank, a group whose membership expanded by two this month when regulators swooped in to take over Silicon Valley Bank and Signature Bank.

John Bovenzi is part of the small club of people who have run a failed U.S. bank, a group whose membership expanded by two this month when regulators swooped in to take over Silicon Valley Bank and Signature Bank.

In 2008, Mr. Bovenzi, a longtime Federal Deposit Insurance Corp. staffer, took the helm at the failed mortgage lender IndyMac. What he discovered, and what likely faces executives running the latest failed banks: Deposits flood out, but few come in. The employees who haven’t left are looking for other jobs. It is possible some of the remaining higher-ups are responsible for what went wrong—and might even be questioned by law-enforcement officials.

“So that’s a little twist—you’re relying on people, but at the same time, investigators want to talk to everybody,” Mr. Bovenzi said.

Until the failures of SVB and Signature, IndyMac was the second-biggest bank failure in U.S. history, behind Washington Mutual. Now the two recent collapses have bumped IndyMac into fourth place.

Like IndyMac, both SVB and Signature were taken over by the FDIC. Unlike with IndyMac, the FDIC was able to draw on a roster of seasoned banking executives it had assembled in recent years for such emergencies. Tim Mayopoulos, former chief executive officer at Fannie Mae and a former top executive at Bank of America Corp., jumped in at SVB. Greg Carmichael, a former Fifth Third Bancorp chief, parachuted into Signature.

When IndyMac failed as its home loans soured, the FDIC didn’t have a reserve corps of bank executives. It fell to Mr. Bovenzi, the agency’s chief operating officer, to take over.

Mr. Bovenzi and a team from the FDIC flew to IndyMac’s headquarters in Pasadena, Calif., on a Thursday, fanning out to different hotels and avoiding use of government-issued identification. “We didn’t want the whole town to know it was filled with people from the FDIC the night before [the bank] was going to close,” he said.

When the FDIC team arrived at IndyMac’s offices the next day, Mr. Bovenzi said IndyMac’s management didn’t seem surprised—the CEO had already cleaned out his office.

The FDIC shut down the bank’s branches soon after, which was before the end of the business day on the West Coast. That caused a headache when newspapers carried photos of customers banging on the doors of bank branches, desperate to get their money out.

On the first weekend after seizing the bank, the FDIC team’s priority was to separate insured and uninsured deposits in advance of an expected influx of customers on Monday morning. Unlike with Silicon Valley Bank and Signature, regulators only backed insured deposits, which at the time were capped at $100,000. (Later, the FDIC raised the limit to $250,000.)

Mr. Bovenzi’s other pressing goal: telegraphing to the public through media interviews that insured deposits were safe. It was a tough sell given the public angst over IndyMac.

“The only story that drew more attention that weekend was the birth of twins to Angelina Jolie and Brad Pitt,” Mr. Bovenzi wrote in a book about his experiences at the FDIC.

Another challenge: Mr. Bovenzi, who was then 55, had never worked at an actual bank, having started at the FDIC after graduate school. He said his deep knowledge of deposit insurance made him believe he could stabilize a chaotic situation.

“He just exuded so much confidence,” said Arleas Upton Kea, the FDIC’s head of internal operations at the time and one of the agency staffers who flew out to IndyMac. “And having people keep their money in financial institutions is all about maintaining confidence.”

Even so, Mr. Bovenzi’s reassurances didn’t initially work.

“When we opened Monday morning, there was a bank run,” Mr. Bovenzi said. “There were lines at all the branches of IndyMac.”

It was hot in Pasadena that July, but Mr. Bovenzi still looked the part of a government official in suit and tie when he went outside to try to convince people that they didn’t need to stand in line. People were mostly calm, but refused to budge.

The bank eventually handed out numbers to customers giving them a time when they could return to withdraw money. That thinned the lines but didn’t slow withdrawals. Over the first few weeks, customers drained about $3 billion in deposits, Mr. Bovenzi said.

At the same time, regulators were trying to keep employees and put together retention packages for those who stuck it out. Not everyone was asked to stay. The loan-origination offices were shut down as the lender’s focus shifted to servicing existing mortgages.

“We weren’t interested in making new loans,” Mr. Bovenzi said. “That’s what got the bank in trouble in the first place—all the subprime mortgages.”

Mr. Bovenzi, now 70, recalls that as the new chief he moved into the ousted CEO’s corner office, which was on the sixth floor, with expensive art and floor-to-ceiling windows looking out to the San Gabriel Mountains. The former CEO’s company car, a Mercedes, was still in the parking lot. Mr. Bovenzi said he refrained from driving it. The car became one of the first IndyMac items the government sold.

Down the hallway, Mr. Bovenzi passed a man sitting in an office. “At one point, I went over and asked him, ‘Well what do you do?’ And he says, ‘Well I’ve got a gun, I’m here to guard the office and the CEO,’” said Mr. Bovenzi, citing threats the company had been getting.

Like the Mercedes, that employee was soon gone.

Over time, the situation stabilized. Mr. Bovenzi was able to fly home more to see his wife, Erica, more often. At first, he told her that IndyMac would be a short-term assignment. “He comes home and he says he’s going to California for a couple of weeks, and that wasn’t true,” said Ms. Bovenzi, who was a deputy general counsel at the FDIC at the time.

It wasn’t until March 2009 that regulators sold IndyMac. Mr. Bovenzi left the FDIC soon after, joining Oliver Wyman, a management-consulting firm.

Today, the Bovenzis run a financial-services consulting firm in Alexandria, Va. Mr. Bovenzi expects Silicon Valley Bank’s eventual sale to be much quicker than that of IndyMac. Already, the FDIC announced that New York Community Bancorp’s Flagstar Bank would take on most of Signature’s deposits.

Still, Mr. Bovenzi warned of unexpected twists. At IndyMac, Lehman Brothers was hired to advise on the sale of the lender. Soon after, the investment bank itself collapsed in dramatic fashion.

“It was one more thing that can go wrong,” Mr. Bovenzi said.

CFPB Issues Determination that State Disclosure Laws on Business Lending are Consistent with the Truth in Lending Act

The Consumer Financial Protection Bureau (CFPB) announced it has determined that state disclosure laws covering lending to businesses in California, New York, Utah, and Virginia are not preempted by the federal Truth in Lending Act. The CFPB examined the state disclosure laws to determine if they were inconsistent with and preempted by the Truth in Lending Act. After analyzing public comments on its preliminary determination, the CFPB affirms there is no conflict because the state laws extend disclosure protections to businesses and entrepreneurs that seek commercial financing. Read more

PUBLISHED MAR 24, 2023

CFPB Want to Know About Your Experiences with Data Brokers

We often don’t get to choose the companies that control our most personal and sensitive information. Data brokers is a term to describe those companies that collect, aggregate, sell, resell, license, or share our personal information with others.

Data brokers play a decisive role in our financial lives, impacting whether we’re able to buy a home or find a job. The CFPB wants to hear from the public about the business practices of data brokers and how those practices have directly affected people’s lives. We have released a Request for Information to understand the full scope and breadth of the industry and whether all data brokers are playing by the same rules.

Congress passed the Fair Credit Reporting Act in response to concerns about how companies were creating and selling detailed dossiers of consumers’ personal information. Our inquiry seeks information about data broker business practices employed in the market today to inform the CFPB’s efforts to administer the law, including planned rulemaking under the FCRA. Read more

Courtesy of Saul Ewing LLP, JDSupra

On March 7, 2023, the U.S. Department of Housing and Urban Development (the “HUD”) Secretary, Marcia L. Fudge, issued a public memorandum (the “Memo”) expressing concern over a lack of transparency in fees charged to residential tenants. The Memo calls on housing providers and state and local governments to adopt policies promoting fairness and transparency of fees charged to renters, citing President Biden’s urging that federal agencies “crack down” on so-called “junk fees” across the economy, including housing. The referenced fees include application fees, move-in fees, late fees, high-risk fees or security bonds, and convenience fees for online payments. The Memo also expresses continued concern over tenant screening practices, and commits to releasing best practices on the use of such reports to be developed with several other agencies.

What You Need to Know:

- On March 7, 2023, HUD Secretary Marcia L. Fudge issued a memorandum continuing to highlight concerns over “junk fees” and tenant screening practices that inhibit fairness and transparency in rental housing.

- Secretary Fudge offered four specific policies to promote fairness and transparency for renters, including eliminating and/or limiting application fees, allowing a single application fee to cover multiple applications, eliminating duplicative, excessive and/or undisclosed fees, and more clearly identifying total recurring monthly costs to tenants.

- HUD, the Consumer Financial Protection Bureau, the Federal Housing Finance Agency, the Federal Trade Commission, and the U.S. Department of Agriculture will collaborate to release best practices on the use of tenant screening reports, including the importance of communicating whether such reports are used to reject applicants or increase fees and providing applicants with the opportunity to address inaccurate information therein.

Secretary Fudge’s memo is yet another follow-up to the Biden-Harris Administration’s Blueprint for a Renter Bill of Rights that was designed to promote fairness and equity in rental housing. She urges all housing providers and state and local governments to take actions to ensure that only actual and legitimate fees are assessed to renters. She also endorsed specific policies that HUD hopes to see implemented across all rental housing providers and property management companies, including:

- Eliminating rental application fees or limiting application fees to only those necessary to cover actual and legitimate costs for services;

- Allowing a single application fee to cover multiple applications on the same platform or across multiple properties owned by one housing provider or managed by one company across providers;

- Eliminating duplicative, excessive, and undisclosed fees at all stages of the leasing process such as administrative fees and other processing fees in addition to rental application fees; and

- Clearly identifying bottom-line amounts that tenants will pay for move-in and monthly rent in advertisements of rental property and in lease documents, including all recurring monthly costs and their purpose.

Secretary Fudge also reiterated that HUD will coordinate with the Consumer Financial Protection Bureau, Federal Housing Finance Agency, Federal Trade Commission, and U.S. Department of Agriculture to collectively develop and release best practices on the use of tenant screening reports, including the importance of communicating whether such reports are used to reject applicants or increase fees and providing applicants with the opportunity to address inaccurate information therein.

The Memo is yet another indicator of the heightened scrutiny owners/operators of rental housing are facing at the federal, state and local levels surrounding pass-through costs and other fees charged to tenants and the use of tenant screening reports. Housing providers should continue to evaluate the need to revise their existing policies and practices surrounding these issues given the ongoing “whole of government effort” to “crack down” on industry-wide practices and the derivative Fair Housing Act and other statutory implications.