Sept. 20, 2019 NASCUS Report

Posted September 20, 2019THIS WEEK: NCUA adopts some state system changes to supervisory committee audit rule; board issues new payday, bylaws rules for FCUs; Letter outlines LICU secondary capital; Summary looks at ‘2ndchance’ proposal; CFPB makes complaint database plans; bureau will ‘continue mission’ despite court challenge; On the road – and more!

NCUA hears state system on changes

to supervisory cmte. audit final rule

A new rule on supervisory committee audits at federally insured credit unions (FICUs) was approved by the NCUA Board Thursday, which includes changes recommended by NASCUS during the proposal stage.

The rule, adopted unanimously by the three-member board during its regular monthly meeting for September, is intended to clarify audits by the committee according to the agency. According to NCUA, the final rule updates outdated provisions of existing regulation and provides flexibility to FICUs with less than $500 million in assets. NCUA said the new rule also continues to ensure appropriate financial oversight.

The agency noted that the new rule:

- Replaces the outdated Supervisory Committee Guide Audit alternative to a financial statement audit and replaces it with a simplified appendix to the regulation;

- Eliminates two types of audits federally insured credit unions seldom use; and

- Eliminates a 120-day deadline for receiving a third-party audit report and gives credit unions the ability to negotiate a delivery date.

In its comment letter earlier this year on the proposal NASCUS had pointed out that, while supervisory committees are a mandatory element of federal credit union governance, not all states require credit unions to have a supervisory committee. “In some states, the mandatory audit functions of the credit union are overseen by an Audit Committee, and in others it is left to the credit union’s board to determine how best to oversee the annual audit,” NASCUS wrote.

The agency found merit in that argument. In its final rule, NCUA noted that “If state law or regulation does not require FISCUs chartered in the state to have a supervisory committee or an audit committee, then the credit union’s board of directors is responsible for the requirements attributed to the supervisory committee in this regulation.”

NASCUS, in its comment letter, also told the agency that including Bank Secrecy Act/Anti-Money Laundering (BSA/AML) in an audit would be redundant. The agency agreed and decided not to include that topic in the appendix to the rule.

(In the brief video – click on the arrow to play — NCUA Board Chairman Rodney Hood discusses the impact of the rule on state-chartered, federally insured credit unions, and Board Member Todd Harper discusses the BSA/AML change in the final rule.)

However, NASCUS also indicated that more study of the final rule is necessary to determine its costs to the state system. For example, in its comment letter, NASCUS had told the agency that the association was not convinced that adding a subject area such as pay and benefits to the Appendix A audit requirements “would produce enough supervisory value to justify the increased cost for credit unions.”

In its final rule, NCUA said it emphasizes that “the purpose of the supervisory committee audit is to reconcile the mathematical computations related to compensation, and whether they are consistent with authorized compensation plans, but not to judge the appropriateness of the level of compensation.”

NASCUS President and CEO Lucy Ito said the association acknowledges NCUA’s efforts to provide federally insured credit unions with greater flexibility. However, she said the state system would closely examine the final rule to determine if it will lead to increased costs to credit unions. “We continue to hold that an increase in costs must be justified by the supervisory value provided,” she said.

LINK:

NCUA Final Rule, Part 715, Supervisory Committee Audits

Board adopts FCU rules for payday loans, bylaws

In other action, the NCUA Board:

- Approved, on a split vote of 2-1 (with Board Member Todd Harper dissenting) to approve a new alternative payday alternative loans (PALS II) for federal credit unions (the rule does not apply to state-chartered credit unions). NASCUS urges state credit unions to look to state law and state regulation for their ability to make the loans. NCUA, in a statement, said its new rule gives federal credit unions the ability to offer more payday alternative loan options. The rule does not replace the agency’s existing payday alternatives loan option (known as PALS I). It does, however, allow federal credit unions to: have a minimum term of one month with a maximum of 12 months; make a PALs II loan immediately upon the borrower’s establishing membership; and, in a restriction, offer only one type of PALs loan to a member at any given time.

- Approved, unanimously, an update to its bylaws for FCUs (which also don’t apply to state-chartered CUs). The agency said that, for example, the update provides detailed guidance to help FCU officials, employees, and members “better understand bylaw provisions, including a credit union’s ability to limit services to a disruptive or abusive member.”

NASCUS’ Ito noted that, in the case of the payday loan rule, state-chartered credit unions should look to state law and state regulation for their ability to make these types of loans. In the case of the bylaws changes, Ito urged state-chartered credit unions to review their states’ bylaw requirements.

LINKS:

Final Rule, Part 701, Payday Alternative Loans II

Final Rule, Part 701, Appendix A, Federal Credit Union Bylaws.

Letter outlines secondary capital accounts for LICUs

Authority of low-income-designated credit unions (LICUs) to offer secondary capital accounts is outlined in a supervisory letter this week by NCUA, which updates the framework the agency uses to analyze and approve or deny secondary capital plans.

The letter to agency field staff noted that secondary capital accounts have served as a valuable resource to some LICUs, enabling them to provide much-needed lending and other member services to underserved communities. “Many LICUs have a record of prudently using secondary capital to increase regulatory capital levels to protect against future losses and serve as a foundation for strategic initiatives and growth,” NCUA wrote.

However, the agency added, some planned uses of secondary capital can be complex and involve higher risk.

The supervisory letter, the agency said, reflects that the agency scales its expectations and review based on the complexity and risk associated with a LICU’s secondary capital plan. “The NCUA’s analysis of secondary capital plans is intended to ensure that LICUs comply with applicable laws and regulations and that secondary capital plans represent safe and sound endeavors,” the letter stated.

LINK:

Guidance to NCUA Staff on Evaluating Secondary Capital Plans

Summary looks at ‘2nd chance’ proposal

A summary of NCUA’s proposal on “second chances” through exceptions to employment restrictions has been posted on the NASCUS website – just in time for those preparing their comments on the proposal by next week’s deadline (Sept. 27).

The proposal would remove a number of “disqualifying offenses” from the list of those that are invoked when the agency prohibits an individual who has been convicted of a crime (or crimes) involving dishonesty from participating in the affairs of a federally insured credit union. The proposal, made at the July meeting of the NCUA Board, would affect both federally insured, state-chartered credit unions and federal credit unions.

More specifically, the proposal would remove from the list of disqualifying offenses: insufficient funds checks of aggregate moderate value, small dollar simple theft, false identification, simple drug possession, and isolated minor offenses committed by covered persons as young adults.

NCUA Board Chairman Hood, in July, said he was personally committed to more initiatives such as the “second chance” proposal, and told credit unions to “expect more coming from this agency to work with second-chance individuals.” The IRPS was released with a 60-day comment period.

The NASCUS summary is available for members only.

LINK:

NASCUS Summary: Exceptions to Employment Restrictions (members only)

CFPB outlines plan for ‘enhancing’ complaint database

Enhancements that will include modified disclaimers regarding published data, more prominence for answers to common financial questions, and information to assist those who want to contact companies directly for answers to their specific questions are among the “enhancements” CFPB plans for its consumer complaint database.

This week, the agency announced the enhancements, which grew at least partly out of last year’s “requests for information” (RFIs) about various CFPB programs and policies (including the complaint database). The bureau issued 12 RFIs in 2018, receiving nearly 90,000 comments – more than a quarter of those (nearly 26,000), according to CFPB, were about the consumer complaint database. That was the second-largest group of comments received (comments on the agency’s “supervision program” came in first, at more than 55,000).

Director Kathleen Kraninger, noting the database “has not been without controversy” since its inception, said in a statement this week that, after considering comments received last year, “we are announcing the continued publication of complaints with enhanced data and context that will benefit consumers and users of the database while addressing many of the concerns raised.”

Anticipated changes to the bureau’s complaint website to provide disclosures on the nature of complaints as well as resources to consumers include:

- More prominent display of disclosures to make it clear that the Consumer Complaint Database is not a statistical sample of consumers’ experiences in the marketplace;

- Highlighting the availability of answers to common financial questions for consumers to help inform them before they submit a complaint; and,

- Highlighting consumers ability to contact the financial company directly to get answers to their specific questions.

All previously disclosed fields, including consumers’ narrative descriptions of their complaints, will continue to be published, the agency said. But other changes are afoot in the coming months, such as: exploring expansion of a company’s ability to respond publicly to individual complaints listed in the database, and; studying ways to put the complaint data in context of other data, such as by incorporating product or service market share and company size.

The bureau said it has handled more than 1.9 million complaints since 2012 when the database was launched, with more than 5,000 financial companies responding through the process, “providing timely responses to 97% of the more than 1.3 million complaints sent to them for response.”

LINK:

Consumer Financial Protection Bureau to Enhance Consumer Complaint Database

Despite court challenge, bureau ‘will continue mission’

The CFPB has no plans to stop its work – even though it has told leaders in Congress it will no longer defend a provision in the law limiting a president’s ability to remove the director only for cause, the bureau’s director said this week.

In a speech, bureau Director Kraninger noted her recent decision to no longer defend the provision in the Consumer Financial Protection Act limiting the president’s discretion to only fire the director “for cause.” The provision was challenged as unconstitutional in a suit brought by Seila Law, a law firm specializing in debt relief that was the target of a “civil investigation demand” (CID) by CFPB in 2017. The Trump administration has recently asked the Supreme Court to review the case.

Kraninger made three points about the effect of the bureau no longer defending the “for cause” provision:

- Uncertainty regarding the constitutionality of the CFPA’s removal provision has caused “unnecessary delay” in bureau enforcement and regulatory actions.

- The bureau (and Kraninger) “remain fully committed to fulfilling the Bureau’s statutory responsibilities. We will continue to defend the actions that the Bureau takes now and has taken in the past.”

- If the court does hold that the for-cause removal provision is unconstitutional, that should not affect the bureau’s ability to carry out its mission. “As the brief in Seila Law explains, Congress directed that should any provision of the Bureau’s statute be found unconstitutional, the remainder of the Act will not be affected,” she said.

LINK:

Director Kraninger’s Speech at the National Consumer Empowerment Conference in Rosemont, Illinois

ON THE ROAD: In TN, visiting the system;

in CO, at Directors’ Conference

Above left: NASCUS CEO Lucy Ito was in Tennessee this week for the Tennessee Department of Financial Institutions (DFI) Credit Union Task Force meeting in Nashville at the governor’s residence, discussing the latest state and federal issues. (from left): Volunteer Corporate CU CEO Jeff Merry, TN DFI Commissioner Greg Gonzales, Ito, and TN Credit Union League President and CEO Fred Robinson. Above right: It’s a full, and intense, house at the NASCUS Colorado Executive Forum held this week in Lone Tree, Colo. (at left, at Canvas CU, Lone Tree, Colo.), an annual session hosted by the Colorado Division of Financial Services, the Mountain West Credit Union Association and NASCUS. The focus on the one-day is on key credit union topics at both the federal and state levels. Upcoming NASCUS education events through the end of October include: Oct. 3: Ohio Directors’ College (State Library of Ohio, Columbus); Oct. 22: Michigan Industry Day (Sheraton Ann Arbor hotel, Ann Arbor); Oct. 24: NASCUS 101 Member Orientation Webinar.

LINK:

NASCUS upcoming education events/Fall ‘19

BRIEFLY: Looking ahead to a new OTR; new MI CU will be first in 3 decades!

Also at its meeting this week, the NCUA Board heard a report that the net income for the National Credit Union Share Insurance Fund (NCUSIF) is $79.1 million. NASCUS’ Itosaid the association anticipates “NCUA’s overhead transfer rate reviewin 2020 and are hopeful that the agency will continue to employ a ‘principles-based approach’ while balancing emerging systemic risks and returning excess funds to credit unions” … And just to be clear: Superbia Credit Union– which was officially chartered last week in Michigan – is the first state credit union chartered in that state in more than 30 years – three decades! The credit union, which is intended to serve members of the LGBTQ community across the nation, is the first issued by Michigan since 1986, and the first state-chartered CU since at least 2016 (in Texas). The credit union hopes to open its doors for business in early 2020.

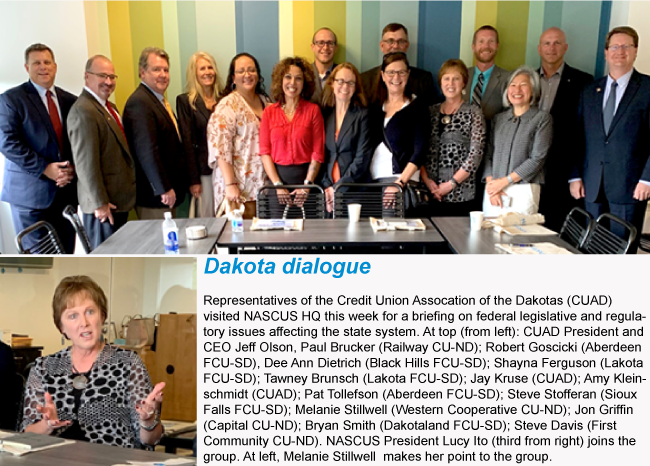

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.