THIS WEEK: NASCUS makes three points about OTR in budget briefing; NCUA gives ‘2nd chance’ green light … issues residential appraisal proposal; ‘S’ component hurdle cleared; Updates finalize CECL date delay; LIBOR ‘fallback’ language issued; Overdraft rule may be on horizon; House, Senate panels set December schedules; State regulator panel set up – by FDIC; ON THE ROAD: In AZ; BRIEFLY: About hemp in ID, Retirement for NCUA general counsel, NASCUS Report early next week

NASCUS presses three issues

about OTR at budget briefing

Improved transparency about the Overhead Transfer Rate (OTR), consistency in distributing the OTR among credit unions, and the cost allocation of NCUA’s supervision of credit union service organizations (CUSOs) and third parties toward the OTR were the top three points pressed by NASCUS during its presentation at the NCUA Budget Briefing Wednesday.

NASCUS President and CEO Lucy Ito laid out the key points on behalf of the state system during her presentation. Specifically, she said the state system urges NCUA to consider:

- Providing greater transparency about what drove the OTR down in 2018, down in 2019 — but up in 2020.

- Adopting better consistency in distributing the OTR among all credit unions, in order to evaluate the equity of the OTR methodology overall.

- Re-visiting the cost allocation of NCUA’s supervision of CUSOs and third parties under the OTR, in particular by allocating at least 25% of the agency’s CUSO and third party workload hours to NCUA’s safety and soundness responsibility as charterer/prudential regulator of federal credit unions.

In written comments to the NCUA Board focusing on the OTR, Ito said NASCUS has arrived at two realizations and attendant requests. First: that it would be helpful and constructive for the agency to publish its annual OTR summary in conjunction with the agency’s annual budget justification document. “We ask that the NCUA Board consider issuing the two documents in tandem,” she said.

In this 14-minute video, NASCUS President and CEO Lucy Ito offers the state system view during NASCUS testimony at Wednesday’s NCUA budget briefing. Joining her at the public testimony table is Mike Schenck, chief economist for the Credit Union Natl. Assn. (CUNA). Click on the image to view the video.

Second, she wrote, it is unclear how federal examiner hours are calculated and to what extent state examiner hours are calculated and valuated. “In the interest of transparency and federal-state interdependency, NASCUS would welcome the opportunity to review with NCUA its valuation process of federal examiner and state examiner hours,” she stated. She added that NASCUS is “prepared to cooperate with NCUA on the valuation method so that NASCUS and other stakeholders can appreciate the circumstances that contribute to NCUA examiner hours spent on federal versus state charters which in turn drive the OTR up in some years and down in others.”

She stated that “it is reasonable” that in some years NCUA would spend relatively more time on state-chartered credit unions’ supervision or assessment of risk. “It would be helpful to understand the swings in either direction,” Ito state. “Open sharing and mutual appreciation can only foster greater federal-state trust and collaboration.”

Regarding the cost allocations for CUSOs and other third parties, NASCUS said it does not agree that 100% of its time and costs associated with supervising these agencies is insurance related, arguing instead that the majority of NCUA’s oversight of those entities is more related to compliance issues. NASCUS instead recommended NCUA allocate only 25% of its workload to supervise CUSOs and third parties to its Title I” federal credit union chartering and prudential regulator function.

Following the public testimony (which was also offered by representatives from the National Assn. of Federally Insured Credit Unions (NAFCU) and the Credit Union Natl. Assn. (CUNA)), NCUA Board Member Todd Harper told Ito that he agreed the agency needed to provide more transparency about the OTR, and agreed to work toward that end.

Board Member J. Mark McWatters reminded the audience that NCUA is funded by credit unions’ money and that NCUA must balance being good stewards of credit unions’ funds with safety and soundness. And, Chairman Rodney Hood assured the witnesses that NCUA would seriously consider their observations and recommendations as well as written comments submitted by the agency’s Dec. 2 deadline.

LINK:

NCUA 2020/2021 Budget Presentation

NCUA gives OK to ‘2nd chance’ initiative …

Persons convicted of minor offenses, including those who were young adults at the time, would no longer need a waiver to get a job at a credit union from the federal regulator, the agency’s board decided unanimously Thursday.

The final interpretive rule and policy statement (IRPS) adopted unanimously by the three-member National Credit Union Administration (NCUA) Board will take effect 30 days after publication in the Federal Register. The policy was dubbed the “second-chance initiative” by NCUA Chairman Rodney Hood.

The second-chance initiative, as adopted, means that convictions or program entries for offenses involving insufficient funds checks of aggregate moderate value, small dollar simple theft, false identification, simple drug possession, and isolated minor offenses committed by covered persons as young adults will not require an application for a waiver from the NCUA to serve at a credit union.

Also under the new policy, the agency’s two regional directors are delegated authority to approve or disapprove credit union-sponsored applications for those individuals seeking work but who still must obtain a waiver (the NCUA Board will still be able to review applications that were denied at the regional level).

In approving the policy, NCUA Board Member Todd Harper quoted the comment letter submitted by NASCUS on the issue. He pointed out that the association wrote “NCUA has taken a measured approach that balances mitigating risk to a federally insured credit union with providing a meaningful second chance to individuals who having committed a prior indiscretion have paid their debt to society and seek gainful employment.” “I very much agree,” Harper said.

Following the board’s decision, NASCUS’ Lucy Ito said the association supports the second-chance initiative, and that in addition to promoting social justice, “the policy reduces regulatory burden and provides regulatory clarity for credit unions.”

Earlier this week, the Federal Deposit Insurance Corp. (FDIC) proposed codifying in its regulations a similar policy (in effect since 1998) which sets the criteria for providing relief for individuals with convictions for certain low-risk (“de minimus”) crimes, forgoing the need for a waiver application.

LINK:

Final IRPS 19-1, Guidance Regarding Prohibitions Imposed by Section 205(d)

… issues proposal on residential real estate appraisals

A proposed rule raising the threshold for mandatory appraisals on residential real estate from $250,000 to $400,000 – which would match, if approved, the appraisal level set by federal banking agencies just last month – was issued Thursday by the NCUA Board on a 3-0 vote.

In issuing the proposal, the agency said even though the new threshold would be $400,000, federally insured credit unions (FICUs) would still be required to obtain written estimates of market value of the real estate collateral that is consistent with safe and sound banking practices in lieu of an appraisal for those loans under the threshold.

In addition, the proposed rule would explicitly incorporate the existing statutory requirement that appraisals be subject to appropriate review for compliance with the Uniform Standards of Professional Appraisal Practice.

However, NCUA staff told the board credit unions could still seek appraisals as they wish. Staff said the proposal is also consistent with the final rule, effective on Oct. 9, issued by federal banking regulators (the Federal Reserve, the Federal Deposit Insurance Corp. (FDIC), and the Office of the Comptroller of the Currency (OCC)) that increases the threshold level at or below which appraisals are not required for residential real estate transactions from $250,000 to $400,000.

The staff additionally told the board that the proposed higher threshold would exempt (based on year-end 2018 results) an additional 46,000 mortgages (valued at $14.2 billion) from appraisal requirements (or 18% of all total first mortgages at FICUs). According to NCUA, based on the 2018 numbers, 11% of first mortgages would be above the $400,000 threshold ($8.3 billion in loans).

NASCUS’ Lucy Ito said that, even though the proposal aligns NCUA with the other banking regulatory agencies, “NASCUS will closely review the rule to evaluate potential positive and negative impacts on both state system safety and soundness and state credit union regulatory burden.”

LINK:

Proposed Rule, Part 722, Real Estate Appraisals

‘Hurdle’ cleared in making ‘S’ component available

At least one of the information technology “hurdles” has been cleared in the effort to establish an “S” component in the CAMEL rating system for FICUs, NCUA’s inspector general said in his semiannual report to Congress issued this week.

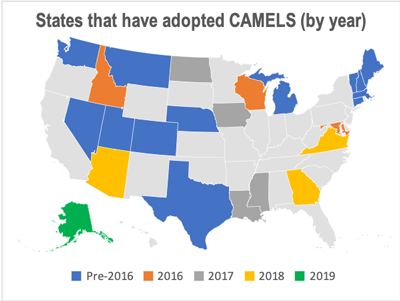

In the report, the agency’s Office of Inspector General (OIG) said NCUA management incorporated the ability to assign and capture the “S” (for market-rate sensitivity) component as an optional part of the CAMEL rating during the new exam application released in September. “The change clears one of the IT hurdles to adopt the ‘S’ rating if the Board so chooses, and to capture the ‘S’ rating for federally insured state-chartered credit unions in the states where the state regulators have adopted the ‘S’ rating,” the OIG report states. (NASCUS has determined that 24 states have adopted the “S” component in their rating system.) “Management indicated that should the Board choose to adopt the ‘S’ rating, they will be in a position to consider the necessary policy changes.”

The report also notes that NCUA management, through a system change in place by mid-2020, will be incorporating the ability to assign and capture the “S” component as an optional part of the CAMEL rating. The agency is targeting final implementation of the S component by the end of 2021, the report states.

LINK:

NCUA OIG Semiannual Report to Congress (April 1 – Sept. 30, 2019)

Updates finalize CECL effective date delays

Various effective date delays for accounting standards on current expected credit losses (CECL) were finalized late last week by the accounting industry’s standards-setting group, one of which pushes the date to January 2023 for smaller financial companies, including credit unions, privately held banks and others.

The Financial Accounting Standards Board (FASB) said it issued two Accounting Standards Updates (ASUs): ASU 2019-10, “ASU No. 2019-10, Financial Instruments—Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842):Effective Dates,” and “ASU 2019-09, Financial Services—Insurance (Topic 944): Effective Date.”

ASU 2019-10 finalizes various effective date delays for private companies, not-for-profit organizations, and certain smaller companies (in particular, the privately held banks and most credit unions) applying CECL. The other, ASU 2019-09, finalizes insurance standard effective date delays for all insurance companies that issue long-duration contracts, such as life insurance and annuities.

The date under 2019-10 represents a one-year extension by FASB for the credit unions and banks, from January 2022 to January 2023.

Group issues LIBOR ‘fallback’ language for ARMs

Recommended fallback language for residential adjustable-rate mortgages referencing the London Interbank Offered Rate (LIBOR) – a widely used, but soon-to-be-phased-out (by 2021), reference rate – was issued this week by the Alternative Reference Rates Committee (ARRC). The fallback language is designed to provide greater clarity to consumers, even though most ARMs contain language allowing the note holder to choose a new index.

The ARRC is a group of private-market participants convened by the Federal Reserve Board, other federal financial regulators and industry groups to identify risk-free alternative reference rates for US dollar LIBOR, including the Secured Overnight Financing Rate (SOFR), the group’s preferred LIBOR replacement.

The language, according to ARRC, covers triggers for introducing new rates and a spread-adjusted replacement index based on SOFR. The fallback is designed for voluntary use; it’s the fifth set of recommended contract fallback language issued by ARRC to help the financial industry phase out LIBOR.

Late last week, both Fannie Me and Freddie Mac announced they have adopted the ARRC-recommended language for U.S. dollar-denominated, closed-end, residential ARMS, and would update their uniform ARM notes in the first quarter of next year.

LINK:

ARRC Releases Recommended Fallback Language for Residential Adjustable-Rate Mortgages

Resolution of overdraft rule may be in offing

Overdraft protection may be inching its way back into the CFPB regulatory plan – but it’s not clear precisely when, according to the fall 2019 rulemaking agenda posted by the agency this week.

The agency said in a blog post this week that it is “carefully reviewing” comments received from its review (announced in May) of the 2009 overdraft rule. The review collected comments over 45 days and was aimed at collecting information about the impact of the rule on credit unions and small banks. (According to the bureau, the rule limits the ability of financial institutions to assess overdraft fees for paying automated teller machine [ATM] and one-time debit card transactions that overdraw consumers’ accounts.)

“The Bureau is carefully reviewing the comments it received as part of the analysis required to support its determination pursuant to section 610 of the RFA (Regulatory Flexibility Act) that the (overdraft) rule be continued without change, amended, or rescinded,” the agency wrote.

The bureau announced the RFA on overdraft May 13. According to the bureau then, the notice sought “comment on the economic impact of the Overdraft Rule on small entities. The public will have 45 days to comment after publication of the notice in the Federal Register.”

Among other items, the CFPB regulatory agenda includes:

- Two new agenda items on loan originator compensation and use of electronic channels for originating and servicing credit card accounts. The bureau said the items were generated by last year’s “Call for Evidence” on 12 separate topics, “and various other outreach to stakeholders.”

- Assessment of its regulations to consolidate various mortgage origination disclosures under the Truth in Lending Act and Real Estate Settlement Procedures Act (the TILA-RESPA Integrated Disclosures [TRID]). The CFPB said it must issue a report by October 2020 with the results of its assessment. Comments will be due Jan. 21.

- An RFA review of the Regulation Z rules implementing the Credit Card Accountability Responsibility and Disclosure Act of 2009.

LINKS:

CFPB fall 2019 rulemaking agenda

Lawmakers set action (or lack thereof) following Turkey Day

The House Financial Services Committee will come back after Thanksgiving for two hearings of interest to state credit unions – but the Senate Banking Committee is apparently deferring action, to next year, on another key issue: cannabis banking. On Thursday, the House panel said it would host hearings on Dec. 4 and 5 about (respectively) “Oversight of Prudential Regulators: Ensuring the Safety, Soundness, Diversity, and Accountability of Depository Institutions?” and on “Promoting Financial Stability? Reviewing the Administration’s Deregulatory Approach to Financial Stability.” No witness lists were yet available.

Meanwhile, the Senate Banking Committee has scheduled its own oversight hearing of financial regulators for Dec. 5, but has indicated that no votes of the panel next month will address cannabis banking (supported by NASCUS), pushing any action to the New Year.

LINKS:

Chairwoman Waters Announces December Committee Schedule

Senate Banking Committee Oversight of Financial Regulators

FDIC sets up state regulator committee

The federal insurer of bank deposits wants to hear more from state regulators of banks and is moving to set up a committee to help improve communications channels. The FDIC Board voted to establish the Advisory Committee of State Regulators (ACSR) at the agency. The agency said the new group will consider current and emerging issues that have potential implications on the regulation and supervision of state-chartered financial institutions. The group’s focus, the FDIC said, will be on safety and soundness and consumer protection issues, the creation of new banks, cyberattacks or money laundering risks, and other issues. The committee will be composed of regulators of state-chartered financial institutions from across the United States, including its territories, or other individuals with expertise in the regulation of state-chartered financial institutions.

LINK:

FDIC Board Approves Establishment of Advisory Committee of State Regulators

ON THE ROAD: In AZ, talking BSA/AML – and issues with regulators

Melisa L. Kallestad, director of compliance and lending education for the Credit Union Natl. Assn. (CUNA) addresses the opening session of the 2019 NASCUS/CUNA Bank Secrecy Act (BSA) Certification Conference, in Tempe, Ariz., this week. The four-day conference – the premiere education event about BSA compliance and anti-money laundering (AML) efforts by credit unions – exposes participants to the latest about BSA, the recent changes affecting the law’s implementation and industry best practices to help maintain compliance. Attendance at the program also offers participants the opportunity to certify or recertify for the Bank Secrecy Act Compliance Specialist (BSACS) designation.

Meanwhile, while in the Grand Canyon State attending the BSA session, Lucy Ito visited with Arizona Department of Financial Institutions (DFI) Interim Superintendent Scott Greenberg and Credit Union Division Manager Marie Corral. The DFI will be merging with the Arizona Department of Insurance July 1, 2020, into the new Department of Insurance and Financial Institutions effective July 1, 2020

LINK:

NASCUS Education opportunities/2019-20

BRIEFLY: Idaho takes action on hemp transportation; Retirement for NCUA GC; NASCUS Report out next Wednesday (not Friday)

Idaho Gov. Brad Little ( R) this week issued an executive order to resolve conflicts between state and federal law related to the interstate transportation of hemp across his state. The order is intended to serve as a stopgap measure until the state legislature enacts a more permanent solution. The action was taken in the wake of adoption last month of interim final federal rules regulating production of hemp in states that have legalized it. Those rules, Idaho has pointed out, likely conflict with Idaho law regarding transportation of hemp across the state … Mike McKenna, general counsel for NCUA since 2011, has retired, the agency announced this week. He has been replaced in an “acting” capacity by Deputy General Counsel Frank Kressman while a search for a replacement proceeds, the agency said. McKenna joined the NCUA in 1989 and had served at various times as a staff attorney, senior policy advisor, deputy executive director, and deputy general counsel. Kressman joined the NCUA in 1998 as a staff attorney, the agency said … NASCUS Reportwill be published on Wednesday next week (rather than Friday), in observance of the Thanksgiving holiday.

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.