March 18, ’16 NASCUS Report

Posted March 18, 2016Top state regulators gather for wide-ranging talks

Top state credit union regulators from across the nation met in Washington this week to discuss key issues, including hearing from their counterpart at the federal agency, retiring NCUA Board Chairman Debbie Matz. The nearly 60 state supervisory leaders discussed issues ranging from the overhead transfer rate to the new Current Expected Credit Loss (CECL) Model from the Financial Accounting Standards Board (FASB). Among the highlights of the meeting:

- NASCUS President and CEO Lucy Ito outlined key issues for state regulators and the NCUA, including the Overhead Transfer Rate (OTR), coordination across regions, an 18-month examination cycle, development of new field of membership regulations, supervisory guidance under the new member business lending regulation, and supplemental capital under the new risk-based capital rule.

- NCUA’s Matz reviewed top issues before her agency, including the OTR, the new member business lending rule, interest-rate risk and cybersecurity.

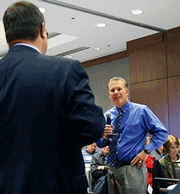

U.S. Rep. Denny Heck (D-Wash.) and a member of the House Financial Services Committee told the group that state regulators need more resources to do their jobs. “I like the dual charter system,” he said. He also noted that he supports risk-based regulation, rather than regulation by size of institution. (At right, Heck (left) talks about Washington state with Doug Lacy-Roberts, Washington Division of Credit Unions.)

U.S. Rep. Denny Heck (D-Wash.) and a member of the House Financial Services Committee told the group that state regulators need more resources to do their jobs. “I like the dual charter system,” he said. He also noted that he supports risk-based regulation, rather than regulation by size of institution. (At right, Heck (left) talks about Washington state with Doug Lacy-Roberts, Washington Division of Credit Unions.)- Ken Welch and Chuck Kelly of CliftonLarsonAllen estimated that a final version of the CECL model would be released as early as the second quarter of this year, and that the effective date won’t be before 2019, but will be by 2021.\

- John Kolhoff of the Michigan Department of Financial Institutions and Mary Beth Quist of the Conference of State Bank Supervisors (CSBS) gave an overview of supervision of technology service providers (TSPs), noting in particular that cybersecurity is taking up much of the activities of the FFIEC. Quist urged state regulators in particular to pay attention to shared application software reviews (SASRs) developed under TSP reviews.

- Block chain expert Carol van Cleef of law firm Manatt, Phelps and Phillips detailed the new “digital currency” (including Bitcoin), noting that the new methods of payments and public ledger technology are “the revolution we are about to see.”

- Bill Hampel, CUNA chief policy officer, presented his organization’s findings from its study on “regulatory burden,” which found that the cost to credit unions of regulation was 64 basis points of total assets in 2014 (or $7.2 billion). See related item below on CUNA exam survey.

Other presentations included an update by FinCEN, a case history of a bank purchase by a credit union, an overview of the CFPB’s recent activity in consumer compliance, an outline of NCUA incorporation of the FFIEC’s Cybersecurity Assessment Tool (CAT) into its exam program, and insights of the U.S. Treasury into state and federal information sharing in defending the U.S. financial infrastructure.

MBL RULE OUTLINED IN LATEST SUMMARY

Reflective of the 31 pages in the March 14 Federal Register occupied by the new member business/commercial lending final rule adopted by the NCUA Board in February, NASCUS has published a substantial summary of the regulation, focusing on the needs and interests of states. For example, with regard to state regulation of business lending, the summary notes that the rule explains that federally insured credit unions in a given state are exempted from compliance with section 723.10 of the rule if the state supervisory authority administers a state commercial and member business loan rule for use by FISCUs in that state, provided the state rule at least covers all the provisions in this part and is no less restrictive. (That “no less restrictive” conclusion, the summary notes, is based on NCUA’s determination). Additionally, the summary notes that states which currently have exemptions from NCUA’s MBL rule are grandfathered in under the final rule. Any modification to those rules must be consistent with NCUA’s MBL rule, the summary notes; however, modification of one part of an existing NCUA-approved state rule will not cause other parts of the rule to lose their grandfathered status. The summary points out that NCUA will issue supervisory guidance with the new rule before most of it takes effect (at the beginning of 2017).

LINK:

NASCUS Summary, NCUA Final Rule/ Member Business Loans; Commercial Lending

NEW BIZ LENDING SCHOOL TAKES 2-DAY LOOK AT NEW RULE

Our two-day school on the new “principle-based” member business lending rule June 7-8 in New Orleans presents full-day modules focusing on MBL underwriting (for the first day) and MBL credit administration (on the second day). We offered this program because we know it is imperative that both state credit union examiners and practitioners have strong backgrounds in the philosophy and nuances of the new rule, before most of it goes into effect in 2017, so they may become intimately familiar with the rule and how it affects credit unions in their states. Developed and conducted by Redmond, Wash.-based Hipereon Financial Training and Consulting – one of the top training firms concentrating on proper business lending practices – both days of the school will be led by Hipereon President and CEO Jim Devine. Day one takes a close look at the MBL review and approval process, including loan approval authority policies and development of an MBL review committee. Day two concentrates on business lending credit administration, including assessing staff background and experience, and member business services deposit products and services, as well as review of fee-based services.

LINK:

NASCUS 2016 MBL School, June 7-8, New Orleans

CFPB LEADER OFFERS LITTLE ON FUTURE OF ‘HOLD HARMLESS’ FOR TRID

The CFPB’s enforcement of the Truth in Lending Act/Real Estate Settlement Procedures Act integrated mortgage disclosure rule (TRID) remains “corrective and diagnostic” for lenders making good-faith efforts to comply with the new disclosure requirements, Bureau Chief Richard Cordray told the House Financial Services Committee this week. However, when asked by Rep. Brad Sherman, D-Calif., to consider extending the “hold harmless” period for the provision, Cordray wouldn’t agree or disagree to do so. He added that the conversation about the issue with the mortgage industry “remains ongoing.” In a comment letter last year to the bureau, NASCUS noted that state regulators were concerned about the readiness of small financial institutions to switch to the new integrated disclosure, also known as the “know before you owe” rule. NASCUS told the agency that additional time was necessary to ensure a smooth transition.

EXAM SURVEY SHOWS FEDERAL ON PAR WITH STATES IN SATISFACTION

Credit union “overall satisfaction” with their examinations showed in a CUNA survey for the first time in its brief history that ratings for federal and state exams were about even. In past surveys, states always out-rated their federal counterparts. The CUNA/League 2015 Exam Survey Report (published last month), which includes responses from about 10% of all credit unions, found that state credit unions rated their overall exam satisfaction at 3.7 (on a five-point scale, with 1 being “very dissatisfied” and 5 being “very satisfied.”). Federal credit unions gave the same rating for their overall satisfaction. In the three previous surveys (which have been conducted annually since 2012), state exams rated higher each time (at 3.7, 3.6 and 3.6) than the federal (at 3.5, 3.4 and 3.4). Joint exams, however, continued to rate lower than state- or NCUA-only exams (at 3.1, 3.2, 3.3 and 3.3). Overall, the survey found that more CU CEOS are satisfied with their exams (65%) than dissatisfied (21%), which are the highest levels of overall satisfaction since the survey’s inception, according to CUNA. Additionally, the survey found that exams conducted by state examiners remain substantially less likely to include documents of resolution (DORs) than exams in which NCUA is involved.

BRIEFLY: NCUA Board meets; OTR comment; ‘About NASCUS’ video

The NCUA Board has three items on its agenda for Thursday’s (March 24) meeting in Alexandria, Va. – Consideration of a final rule on permissible investment activities/bank notes (which would expand FCU authority to invest in this area); a report on its enterprise solutions modernization program, and; the corporate stabilization fund quarterly report. The meeting gets underway at 10 a.m. at agency headquarters … Development of the NASCUS comment letter on the OTR is underway, which is taking an analytical approach to the issue with a focus on fairness and solutions for the future. More details to come after the end of this month … Looking for an easy way to help others appreciate what NASCUS does for its members? Try our new “About NASCUS” video on the website, which runs just under 1.5 minutes. It’s easy to share!

The NCUA Board has three items on its agenda for Thursday’s (March 24) meeting in Alexandria, Va. – Consideration of a final rule on permissible investment activities/bank notes (which would expand FCU authority to invest in this area); a report on its enterprise solutions modernization program, and; the corporate stabilization fund quarterly report. The meeting gets underway at 10 a.m. at agency headquarters … Development of the NASCUS comment letter on the OTR is underway, which is taking an analytical approach to the issue with a focus on fairness and solutions for the future. More details to come after the end of this month … Looking for an easy way to help others appreciate what NASCUS does for its members? Try our new “About NASCUS” video on the website, which runs just under 1.5 minutes. It’s easy to share!

LINK:

About NASCUS video

Information Contact:

Patrick Keefe, NASCUS Communications, [email protected] or (703) 528-5974

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.