March 15, 2019 NASCUS Report

Posted March 15, 2019At GAC, state system out in force

with meetings, greetings — and top issues

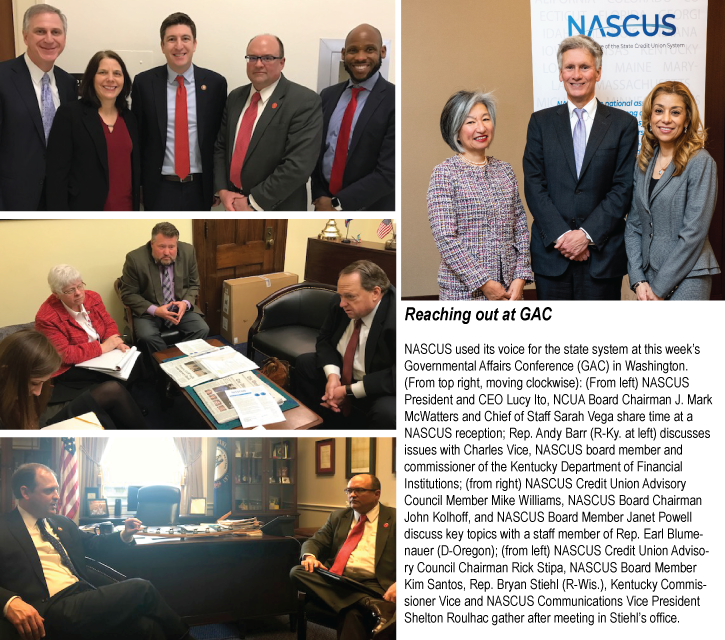

Lawmakers, federal regulators, credit union trade groups, credit union industry groups and more were all in touch with NASCUS this week as its leadership and staff participated in the largest annual gathering of credit union advocates and supporters in Washington, D.C.

The Governmental Affairs Conference (GAC) of the Credit Union National Assn. (CUNA) served as the venue for the NASCUS meetings. According to reports, the GAC drew more than 5,000 participants – including broad representation from the state credit union system.

Among those with whom NASCUS met with over the course of the four-day gathering: American Association of Credit Union Leagues (AACUL), National Association of Federally-insured Credit Unions (NAFCU), CUNA Mutual Group, and the National Association of Credit Union Service Organizations (NACUSO). NASCUS also sat down with representatives of NCUA and the Treasury Department. And, leaders of the association and staff discussed federal legislative issues key to the state system directly with selected lawmakers.

Top items on NASCUS’ discussion list included: NCUA Board reform (calling for at least one board member with state credit union supervisory experience on the NCUA Board, and an increase in the board size from three to five members); deference to state law in data breach notification legislation (where the state law is more stringent); clarity for serving legal marijuana businesses, and; a comparable exemption from the 21% excise tax on pre-existing executive compensation contracts for non-profits (such as state credit unions) in parity with for-profit entities for which pre-existing executive compensation contracts have been grandfathered.

“We had substantive discussions with each group and individual,” said Lucy Ito, NASCUS president and CEO. “In each case, the state system was met with strong respect and consideration. There is always more work to do – but our read from this week is that our messages were heard and appreciated.”

In addition to the meetings and discussions, NASCUS also hosted a reception in conjunction with the national meeting for the credit union system, drawing a unique group of state regulators and NCUA leaders, as well as representatives of state and federal credit unions, corporate credit unions, credit union service organizations (CUSOs), state leagues, and CUNA. NCUA Board Chairman J. Mark McWatters addressed group underscoring value of dual charter system.

STRONG SHOWING FOR STATE REGULATORS

A record number of state regulators were in attendance at this year’s GAC, showing their strong interest in and support of the future of the credit union system at large. Among the attendees: John Kolhoff, NASCUS chairman and commissioner, Texas Credit Union Department; Mary Ellen O’Neill, director, Financial Institution Division, Connecticut Department of Banking; Steve Pleger senior deputy commissioner, Georgia Department of Banking & Finance; Rose Conner, administrator, North Carolina Credit Union Division; Kim Santos, director, Wisconsin Office of Credit Unions; Janet Powell, manager, credit union program, Oregon Div. of Finance and Corporate Securities, Dept. of Consumer and Business Services; Charles Vice, commissioner, Kentucky Department of Financial Institutions. All are NASCUS Board members.

Also attending: Katie Averill, superintendent of credit unions, Iowa Department of Commerce, CU Division; Amy Hunter, director, Washington Division of Credit Unions; Denice Schultheiss, director, Michigan Office of Credit Unions.

PUB FEATURES NASCUS’ LEADER FOR INT’L WOMEN’S DAY …

On the eve of this week’s GAC, NASCUS’ Lucy Ito was featured late last week in the Credit Union Journal, a trade publication, in honor of International Women’s Day, celebrated last week (March 8). In the piece, the NASCUS leader discussed how NASCUS works to advance the role of women in the credit union movement, and gave kudos to those women who have contributed to her career.

In the latter area, Ito pointed to past and current state regulators Linda Jekel (recently retired from the WA Department of Financial Institutions Division of Credit Unions), Mary Ellen O’Neill (CT Department of Banking) and Mary Hughes (ID Department of Finance). “All have served as role models for straight-shooting, pragmatic, and creative problem-solving—assuring safety and soundness while fostering growth,” she told the publication.

Industry leaders earning shout outs from the NASCUS executive included Diana Dykstra of the CA/NV Credit Union Leagues, Teresa Freeborn of Xceed Federal Credit Union, Consultant Sarah Canepa Bang, and Shruti Miyashiro of Orange County’s Credit Union.

She also pointed out how NASCUS works as an organization for women’s advancement in credit unions. “As one of the few women leading a national credit union organization, I understand both the opportunities and challenges women face in the industry,” she said. “NASCUS routinely scans its own staff, elected leadership, regulators and credit union executives for visibility opportunities. Also, we include not only our women leaders and staff, but also our men leaders and staff in engagement with the World Council of Credit Unions’ Global Women’s Leadership Network events. Advancing women in the industry is not just a women’s issue.”

… ‘COLLISION’ OPENS DOOR TO DISCUSSION OF FUTURE

Also this week (and again in connection with the GAC), NASCUS’ Lucy Ito participated in the “Underground Collision,” an event held in advance of the credit union meeting and hosted by consulting firm Mitchell Stankovic and Associates. The event included credit union executives and other leaders who discussed the future of the cooperative financial institutions in achieving their social mission. Ito addressed the business model that best fits the credit union cooperative model, including the idea of breaking up credit unions – which she rejected. “The credit union movement is still tiny when compared to banks; credit unions have about $1.5 trillion in assets, and banks have more than $18 trillion,” she told the group. “So breaking up credit unions would mean losing our collective scale. My fantasy is to have every single credit union participating in shared branching and shared ATMs. And we should remember there was a time when people said if we offered share drafts we would no longer be credit unions.”

SENATE GIVES NOD TO TWO NEW NCUA BOARD MEMBERS …

Rodney E. Hood and Todd M. Harper were confirmed by the Senate late Thursday to two seats on the NCUA Board, which (once they are sworn into office) will bring the board up to its full three-member complement for the first time since 2016. Republican Hood will take the place of Democrat Rick Metsger, whose term ended in August 2017 (he has been serving as a holdover since then). Harper – a Democrat — takes the seat formerly held by former Chairman Debbie Matz, who left the board in 2016. Hood’s term runs until August 2023; Harper’s term runs until April 2021. Current NCUA Board Member J. Mark McWatters is serving a term that ends in August of this year.

In a statement, NASCUS President and CEO Lucy Ito called the new board that will result once Hood and Harper take office as perhaps “the most qualified in NCUA history,” citing their professional backgrounds. She detailed: McWatters’ 4.5 years on the NCUA Board and more than 30 years’ experience as a lawyer and CPA in financial services; Hood’s previous, four-year service on the NCUA Board, plus his work in community development at Bank of America, Wells Fargo and JPMorgan Chase banks; Harper’s previous service as an NCUA senior executive and advisor to two board chairs, as well as his experience as a subcommittee staff director on Capitol Hill.

“The newly constituted board bodes well not only for NCUA, but also for the broader credit union system. We congratulate Mr. Hood and Mr. Harper and look forward to continuing our positive working relationship with Chairman McWatters and to developing strong relationships with the new Board Members.”

… WHILE FORMER BOARD APPROVES FINAL LENDING RULE

The NCUA Board – meeting Thursday for just 22 minutes, and for the last time with Board Member Rick Metsger– approved a final rule on loans and lines of credit to members, which the agency said was designed to make the regulation “more user friendly.”

The final rule, effective 30 days after publication in the Federal Register, does the following according to the agency:

- For federal credit unions: identifies in one section all maturity limits that apply to different types of their loans;

- For all federally insured credit unions: clarifies that the maturity date for a “new loan” under generally accepted accounting principles (GAAP) is calculated from the new date of origination; and

- regarding the limits for loans to a single borrower or group of associated borrowers, provides cross-citations to the specific loan participation and commercial loans limits in the general limit section of the regulation.

NASCUS, in its comment letter on the proposal, recommended that the agency retain in the final rule a provision that allows states to seek an exemption for federally insured, state chartered credit unions (FISCUs) if the prudential regulator of that state promulgates similar rules. NCUA preserved that provision in the final rule.

LINK:

Loans to Members and Lines of Credit to Members

METSGER, MCWATTERS LAUD COOPERATION

Earlier in the week, during the GAC, NCUA Board Chairman J. Mark McWatters and outgoing Board Member Rick Metsger told credit union representatives that their cooperative approach to regulation paid dividends to the credit union industry.

Metsger and McWatters, appearing during a GAC joint session, told the gathered credit union representatives that they oversaw reform and modernization during their tenure at NCUA (Metsger previously served as board chairman). That allowed both the agency and credit unions, McWatters said, “to navigate a rapidly evolving financial services marketplace while still maintaining safety and soundness.”

Metsger had some words of advice for credit unions: that they consider their product and service mix to ensure they are able to meet their members’ future needs.

McWatters’ term expires in August. Metsger’s term concluded in August 2017; he has been serving in holdover capacity.

LINK:

NCUA release: NCUA Board’s Partnership Transformed Regulatory Structure

REPORT NOTES ALTERNATING EXAM PROGRAM PILOT AS HIGHLIGHT

A program involving NASCUS that developed an alternating examination pilot program for state and federal regulators — and which got underway this year — is among the highlights noted by NCUA in its annual report issued this week.

The report notes that the pilot — developed by NASCUS and its six state regulator members with NCUA — is designed to provide insight into how an alternating examination program can improve coordination and optimize federal and state resources, “while still maintaining the safety and soundness of federally insured, state-chartered credit unions.” The report states that the program “will also explore potential improvements that can lead to better consistency and communication between the NCUA, as the insurer, and the prudential state regulatory agencies.”

In other areas, the NCUA report notes that it took 97 enforcement actions against FISCUs in 2018 (out of a total 278 taken against all federally insured credit unions in 2018 – or 35%). That’s fewer enforcement actions taken against FISCUs in 2017, when 99 enforcement actions were taken.

The actions in 2018 against FISCUs were: 69 unpublished Letters of Understanding and Agreement (LUAs); 14 preliminary warning letters; nine conservatorships, and; five cease-and-desist orders.

Last year’s numbers were much lower than those reported in 2014, according to the report, when 454 enforcement actions were taken, 36% of those against FISCUs (or 164 actions). Those included 139 LUAs, according to the report.

LINK:

NCUA Releases 2018 Annual Report

MARIJUANA BIZ BANKING BILLS IN PLAY

Legislation to allow credit unions to safely serve their members’ related needs in states where marijuana is legal was introduced in the House last week, setting the stage for more discussion and – perhaps – a vote on the floor.

H.R. 1595, the Secure and Fair Enforcement (SAFE) Banking Act of 2019, was introduced by Rep. Ed Perlmutter (D-Colo.) with Reps. Denny Heck (D-Wash.), Steve Stivers (R-Ohio), and Warren Davidson (R-Ohio). To date, the bill is co-sponsored by 113 other House members.

The legislation proposes to give legal cannabis-related businesses access to financial institution services and exempt from federal prosecution (or investigation) those financial institutions and their employees solely for providing services to state-authorized cannabis-related businesses. According to the bill text, it would “harmonize federal and state law concerning cannabis-related businesses and allow these businesses access to banking services,” according to a draft of the bill. Last month, the House Financial Services Committee held a first-ever hearing on cannabis-related banking, as well as the legislation.

There are other cannabis-related bills pending in the Congress, among them H.R. 1119 and S.421, the “Responsibly Addressing the Marijuana Policy Gap Act of 2019.” Offered (in the House) by Rep. Earl Blumenauer (D-Oregon) and (in the Senate) by Sen. Ron Wyden (D-Oregon), the legislation would (among other things) prohibit federal credit union and banking regulators taking actions against a credit union or bank “solely because the depository institution provides or has provided financial services to a marijuana-related business,” and as long as the institution is providing service to legal cannabis-related businesses under state law.

LINKS:

HR 1595 – Secure and Fair Enforcement (SAFE) Banking Act of 2019

H.R.1119 – Responsibly Addressing the Marijuana Policy Gap Act of 2019

S.421 – Responsibly Addressing the Marijuana Policy Gap Act of 2019

CFPB PAYDAY LOAN RULE, MLA TOP TOPICS AT SENATE HEARING

Revisions to the payday lending rule, and supervisory authority over the Military Lending Act (MLA), were two points of focus for senators during a hearing with the director of the CFPB this week. In a hearing that was dominated by Democrats (only four Republicans appeared at the hearing to ask questions, out of 13 total on the committee), CFPB Director Kathleen (“Kathy”) Kraninger told the Senate Banking Committee that she has an “open mind” regarding revisions to the payday rule, and reiterated her call to Congress that it give CFPB explicit authority (through legislation) to supervise for MLA compliance.

The Democrats were skeptical of both, criticizing the CFPB’s proposed payday loan rule provisions and voicing angst over the MLA issue. On the revisions to the “Payday, Vehicle Title, and Certain High-Cost Installment Loans” (the payday rule), which would remove mandatory underwriting provisions of the regulation, senators chastised Kraninger saying the change would only increase profits to payday lenders. But the CFPB director held her ground, saying the bureau “has a responsibility to look at the full record” of the rule, and a court stayed the rule’s implementation after the bureau pledged a “reconsideration of its process” in developing the regulation.

On MLA supervision (which the bureau said last year it would cease conducting supervisory exams over because it lacked specific authority to do so), Kraninger noted she has written to the speaker of the House and vice president asking them to consider draft legislation that she said would give her agency clear authority to supervise for compliance. But the senators told her she already had the authority. ““I am frankly appalled that you have decided that MLA is not in your supervisory authority,” Sen. Jack Reed (D-R.I.) said.

MARK YOUR CALENDARS FOR NASCUS 101 (APRIL 25)

Don’t forget that the official NASCUS 101 Member Orientation is coming on April 25, a one-hour (no charge) webinar that brings together members, prospective members or anyone else interested in NASCUS to better understand the unique tools and benefits NASCUS offers. Attendees also hear from their peers—a member network of state regulators, credit unions, credit union leagues, and other system supporters—and how they leverage their NASCUS membership. The webinar ends with a Q&A session. Advance registration required; sign up today!

LINK:

Agenda, registration for April 25 NASCUS 101 webinar (no charge)

BRIEFLY: Congratulations to award winners; UDAAP findings listed in first CFPB highlights for ’19

Congratulations to 2019 Herb Wegner Award Winners Diana Dykstra, president and CEO of the California and Nevada Credit Union Leagues; Crystal Long, president and CEO of Government Employees CU (in El Paso, Texas) and; Nusenda Credit Union (New Mexico). The California and Nevada Credit Union Leagues, as well as GECU are NASCUS members … Findings of unfair, deceptive, or abusive acts or practices connected to auto loan servicing, deposits, mortgage servicing, and remittances are described in the winter 2019 edition of the Consumer Financial Protection Bureau (CFPB) Supervisory Highlights. The highlights, and all recent CFPB reports, are listed on the NASCUS website under our CFPB pages.

LINK:

NASCUS CFPB news, updates

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.