June 7, 2019 NASCUS Report

Posted June 7, 2019Supplemental capital proposed rule

should be issued, NASCUS letter advises

Supplemental capital for complex and low-income designated credit unions should be the subject of a proposed rule by the agency soon, particularly as the deadline for implementation of another key capital rule approaches at the beginning of next year, NASCUS wrote to NCUA last week.

NASCUS, in a letter, offered comments to the agency on several key areas among nearly three dozen rules that NCUA listed in its regulatory review notice earlier this year. The review looks at one-third of the agency’s rules at a time.

The NASCUS comments also addressed better organization of agency rules to clarify their impact on state credit unions, regulations for loans and lines of credit (and their place in agency regulations), rules for corporate credit unions, and state predominance in rules affecting mergers and conversions of state credit unions (see following item for more).

Regarding supplemental capital, NASCUS noted that with the new risk-based capital (RBC) rule scheduled to become effective at the beginning of next year, the agency should publish a proposed supplemental capital rule for complex and low-income designated credit unions. “In designing a supplemental capital framework for the risk-based capital rule, NCUA should focus on allowing subordinated debt instruments and design the framework in anticipation of eventual statutory changes to credit union capital requirements,” NASCUS wrote.

The association has long advocated for supplemental capital to be counted as regulatory capital (through legislative means, or through regulatory means as in rules outlining risk-based capital at credit unions). Alternative capital, NASCUS argues, would improve the safety and soundness of the credit union system and add additional protection for the National Credit Union Share Insurance Fund (NCUSIF). Some states already allow their credit unions to build capital through alternative means, but under current federal regulations (and law outside of risk-based capital) that capital cannot be counted toward their capital requirements.

In its letter, NASCUS pointed out that as long ago as November 2015, NCUA assured Congress that “[a]s part of modernizing NCUA’s risk-based capital rule, the NCUA Board was unanimous in its commitment to move forward with a separate rulemaking to allow supplemental capital to be counted toward the risk-based capital ratio. The effective date of this proposed change would coincide with implementation of NCUA’s modernized risk-based capital rule scheduled for January 1, 2019.” That date was later moved to Jan. 1, 2020.

In addition to risk-based capital, NCUA has also communicated its intention to re-visit the regulatory framework related to secondary capital for low-income designated credit unions, NASCUS pointed out in its letter. “NASCUS commends NCUA for this initiative and recommends that secondary capital rules incorporate concepts related to subordinated debt and supplementary capital,” NASCUS wrote.

In 2017, the agency issued an advanced notice of proposed rulemaking (ANPR) on the subject of supplemental capital. Recently, the agency has signaled it is preparing a proposed rule on the topic (see second item farther below).

LINK:

NASCUS Comments: Regulatory Review (2019)

Letter also looks at rules organization, more

In other comments in its letter addressing NCUA’s 2019 regulatory review, NASCUS wrote:

- NCUA should reorganize its rules to consolidate all NCUSIF rules for federally insured state credit unions (FISCUs) in one section and all rules related to the federal charter in another. “Reorganizing the rules in this manner would provide significant regulatory relief to credit unions without increasing risk to the NCUSIF,” NASCUS advised. The association pointed out that the agency’s notice for the 2019 Regulatory Review itself is an example of how the current organization of rules overly burdens FISCUs and all system stakeholders. “Not all the provisions subject to comment in this year’s review apply to FISCUs. Therefore, a reader reviewing the notice on behalf of FISCUs has to spend an inordinate amount of time determining which provisions applied to FISCUs by researching every provision within Part 741 to identify any cross references to the rules subject to this year’s review,” NASCUS stated.

- The federal regulator’s rule on loans and lines of credit to members provides another cogent example of the confusion raised by the agency’s practice of incorporation of rules affecting states by reference. “While the rule itself is extensive, only three sub-provisions apply to FISCUs. However, on their face, those provisions themselves only refer to federal credit unions, once again creating confusion to the FISCU reader,” NASCUS wrote. To clarify things, NASCUS recommended incorporating all of the rule into that section of NCUA’s regulations that affect FISCUS (or, at a minimum, NASCUS urged the agency change the references within the sub-section (c) to include FISCUs.”

- The agency should work with state regulators to perform a comprehensive review of the NCUA’s rules for corporate credit unions to identify rule changes that could help sustain the healthy growth of the overall credit union system. “At the same time, the joint NCUA/State review could identify governance and other areas where NCUA preemption of state rules for corporate credit unions might be rolled back to provide an opportunity for regulatory diversity, and corporate credit union innovation, to strengthen the corporate system itself,” NASCUS wrote. Among other things, NASCUS urged the agency to clarify that state-chartered corporate credit unions satisfy the compensation disclosure requirements in the rule by filing the IRS 990; provide corporate credit unions greater flexibility to serve as a liquidity source for natural person credit unions; exempt state corporate credit unions from board representation which limits membership to sitting CEOs, board members or top credit union financial officers; and provide greater flexibility for corporate credit unions to invest in CUSOs and other fintech opportunities

- Application of agency rules affecting merger of FISCUs as well as conversion to non-credit union status should focus on safety and soundness, “not on governance issues that are more appropriately subject to state chartering rules and regulations,” NASCUS wrote. The association noted that, for FISCUs, the manner and content of the notice to members, the means by which elections are conducted, vote thresholds, and other governance issues are matters for state law. “NCUA’s implementation of its merger and conversion rules has also been problematic,” NASCUS wrote. “Since the effective date of the 2018 merger rule, NASCUS has received comments from numerous state regulators who are frustrated with the rule’s implementation. Those frustrations include inconsistent messages from NCUA regarding the rule and unnecessary delays of common-sense mergers.” The association urged the agency to revisit its rulemaking with respect to FISCU conversions and mergers.

Agency agenda indicates ‘subordinated debt’ rule ahead

Proposed and final rules on such diverse topics as “subordinated debt/regulatory capital” and payday loans are expected to be addressed by NCUA in the coming months, according to the agency’s spring 2019 regulatory published late last month. The agency indicates it expects to issue this summer a formal proposal on subordinated debt, which can be counted toward regulatory capital for purposes of risk-based capital for some credit unions.

The agency’s most recent action on the issue was an advanced notice of proposed rulemaking (ANPR) in January 2017 about alternative capital at credit unions. The ANPR gave the public 90 days to provide input on issues related to credit unions building capital from “alternative means” (that is, other than from net income; credit unions are not stock-held). Subordinated debt is one method for credit unions to consider in building additional capital. Since the end of the comment period about two years ago, the agency has been largely mum about the issue.

However, also driving the issue is implementation of the agency’s upcoming RBC rules, which are slated to go into effect early next year. Agency leaders had expressed interest in combining the effective date of the new RBC rule with one addressing alterative capital. However, new NCUA Board Chairman Rodney E. Hood has also recently signaled that the effective date of the RBC rule could be delayed (for at least a second time) to give the agency and credit unions more time to “further study and assess its real effects on the credit union system,” according to reports of Hood’s written responses to Senate Banking Committee members.

Other issues ahead for the credit union regulator, according to the agenda:

- A proposed rule to clarify federal credit unions’ authority to purchase, sell, and pledge loans–including loan participations and eligible obligations.

- A proposed rule to amend the agency’s regulation requiring appraisals for certain residential real estate-related transactions, increasing the threshold level below which appraisals would not be required for the transactions.

- A final rule raising the threshold transaction amount for appraisals of nonresidential real estate-related transactions (from $250,000 to $1 million). The September 2018 proposal would also exempt from appraisal requirements certain transactions under $400,000 in rural areas where no state certified or licensed appraiser is available.

- A final rule on so-called “PALS II” (payday alternative loans, alternative two) which modifies current rules for the minimum and maximum amount of the loans, eliminates the minimum membership requirement, and increases the maximum maturity for these loans. (In its request for comment last year, the agency also asked for comments on a third flavor of the PALs (PALs III), which could include differing fee structures, loan features, maturities, and loan amounts.) The agency said it is working toward finalizing a PALs II rule.

- A final rule updating, clarifying, and improving Federal Credit Union bylaws.

- A final rule “modernizing” regulation on fidelity bond coverage for federal credit unions to “bring the regulation in line with current practices by federal credit unions and bond issuers.”

LINK:

National Credit Union Administration: Agency Rule List – Spring 2019

State group hears Kraninger, McWatters on key issues

State group hears Kraninger, McWatters on key issues

Key federal regulators – including CFPB Director Kathleen Kraninger and NCUA Board Member Mark McWatters – sat down this week in Denver with state credit union leaders and state regulators to discuss the top issues affecting state credit unions across the nation, including enhancements to the CU charter to ensure it’s the charter for the largest CUs, and other issues. The meeting was arranged by NASCUS. The credit union leaders in attendance were CEOs of some of the largest state-chartered credit unions in the nation. State supervisors in attendance represented some of the states with the largest number of credit unions chartered.

In the photos (from top left, counter-clockwise): CFPB Director Kraninger (left) and NASCUS President and CEO Lucy Ito share thoughts before the group. Regulators and CEOs listen intently as Kraninger speaks. (From left) NASCUS Regulator Board Chairman John Kolhoff (and commissioner, Texas Credit Union Department) joins NASCUS’ Ito in listening to NCUA’s McWatters as he discusses issues before the agency and industry. CEOS and regulators share ideas with the group. CEOs take notes as the discussion progresses.

States maintain share of nearly half of all CU assets

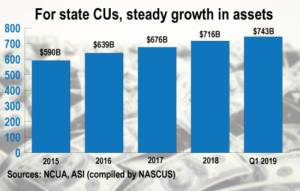

State credit unions’ share of total assets at credit unions held steady in the first quarter at nearly 49%, according to first quarter numbers compiled by NASCUS and based on reports released Thursday by NCUA.

State credit unions’ share of total assets at credit unions held steady in the first quarter at nearly 49%, according to first quarter numbers compiled by NASCUS and based on reports released Thursday by NCUA.

The first quarter numbers showed assets of SCUs were $743.7 billion as of March 31, out of the total $1.5 trillion for all credit unions (SCUs, including federally and privately insured, and federal credit unions (FCUs)). The asset figures for the privately insured CUs (PICUs) are based on call reports filed with American Share Insurance (ASI) as of March 31; all others are based on the NCUA first-quarter call reports.

SCUs held the same share of total assets as of March 31 as they did at the end of 2018.

A bit of movement, however, from last quarter’s end is indicated in the first quarter statistics. Both state and federal credit unions advanced in assets and memberships, at nearly the same rates: states grew in assets by 3.7%, federals by 3.4%; in memberships, states grew by 1.1% (to 56.8 million), federals by 0.8% (to 61.8 million).

In keeping with recent trends, the total number of credit unions continued to shrink in the first quarter, to 5,449 at the end of the quarter (down from 5,489 at the end of last year), with more federals (at 3,350) than SCUs (2,099). More federals went away in the first quarter than states, with 26 coming off the credit union rolls; 14 SCUs disappeared.

“Overall, the first quarter numbers indicate that the dual chartering system continues to ensure a solid charter choice in the credit union industry,” said NASCUS President and CEO Lucy Ito. “As envisioned over the years by those supporting both charters, states and federals continue to grow and expand, challenging one another to offer effective services tailored to their memberships in a safe, sound manner.”

LINK:

Data on the financial performance of federally insured credit unions for the quarter ending March 31, 2019

‘S’ in camel for NCUA will likely wait until 2021

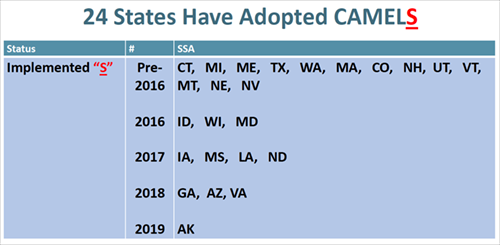

Adding an “S” for “market rate sensitivity” to NCUA’s examination rating system is unlikely to occur before year-end 2021, according to a report issued by the agency’s Office of Inspector General last week. That date is three years later than estimates from earlier last year, which predicted the component would be added at the end of 2018.

Adding an “S” for “market rate sensitivity” to NCUA’s examination rating system is unlikely to occur before year-end 2021, according to a report issued by the agency’s Office of Inspector General last week. That date is three years later than estimates from earlier last year, which predicted the component would be added at the end of 2018.

In its Semiannual Report to the Congressfor Oct. 1, 2018 to March 31, 2019, the agency’s OIG said NCUA management explained the longer time frame by noting that adding “S” to the CAMEL rating system requires public notice and comment, NCUA Board approval, and “cohering regulation and system changes.”

According to the report, agency management explained that NCUA is involved in a multi-year effort to update its legacy systems (the “Enterprise Solutions Modernization” (ESM) program). ESM is expected to include incorporating the ability to assign and capture the “S” component “as an optional part of the CAMEL rating.” The report says management expects the change to ESM to be in place by the middle of next year. After that, according to the report, the agency will then have the flexibility to adopt the “S” rating “if the Board so chooses, and to capture the ‘S’ rating for federally insured state-chartered credit unions in the states where the state regulators have adopted the ‘S’ rating.”

NASCUS has urged the agency in the past to adopt the component, noting that a number of states (nearly half to date, or 24) have already done so. In a 2016 letter to the agency, NASCUS CEO Ito wrote that in those states, regulators and credit unions report positive outcomes with nearly no additional regulatory burden. She stated that, in practice, state supervisors have continued to use the same examination procedures for assessing liquidity and interest rate risks. However, she wrote, by rating the “L” and “S” components separately—rather than in a combined component—state regulators have been able to provide better information to credit unions to clearly delineate analysis between liquidity risk and interest-rate risks.

LINK:

NCUA OIG Semiannual Report to the Congress (Oct. 1, 2018 – March 31, 2019)

Bureau issues rule delaying payday lending compliance

A final rule delaying the Aug. 19 compliance date, to Nov. 19, 2020, for mandatory underwriting provisions of the payday, vehicle title and “certain high-cost installment loans” – the 2017 payday lending rule – was issued late Thursday by the CFPB. The 15-month delay also makes certain corrections, the bureau said, to address “several clerical and non-substantive errors it has identified in other aspects of the Rule.” The delay takes effect 60 days after publication in the Federal Register(in early August).

The bureau said the delay will permit an orderly conclusion to its separate rulemaking process to reconsider the mandatory underwriting provisions. The agency said that, after reviewing comments it received when it proposed the delay, the bureau concluded at least two things:

- CFPB has strong reasons to revisit the mandatory underwriting provisions

- If the mandatory underwriting provisions went into effect while CFPB was in the process of reconsidering these provisions, “consequences would likely follow—some of which may be irreversible even if the Mandatory Underwriting Provisions were later rescinded—that the Bureau believes may prove unwarranted and may undermine effective reconsideration of the 2017 Final Rule.

The agency said that, In light of those considerations, it concluded that “it is appropriate to delay compliance with the Mandatory Underwriting Provisions for 15 months to allow time for the Reconsideration NPRM rulemaking process to be completed.”

Legislative priorities outlined for trade publication

Three key issues – including data security and clarity on cannabis banking – are at the top of the state credit union system’s list of priorities for Congress, NASCUS leader Lucy Ito told a trade publication this week. In response to a request from Credit Union Journal, Ito outlined the NASCUS/state system priorities for congressional action as:

- Data Security/Privacy Legislation: NASCUS believes that any federal legislation addressing cybersecurity and data breach notification must apply cybersecurity requirements and disclosure obligations to merchants and others that handle consumers’ personally identifiable information or personal financial information, Ito told the trade publication. “Furthermore, any federal legislation must preserve the authority of states to regulate and supervise cybersecurity and privacy protections for the benefit of their citizens by setting federal standards only as a floor, not a ceiling, for state specific protections.”

- Cannabis Banking Legislation: Ito wrote that the state system association supports federal legislation making it permissible for financial institutions to provide financial services to state-authorized cannabis businesses and to third-party businesses that serve those businesses. “To reduce the public safety hazards of cash-intensive businesses, providing a safe harbor for banking legal cannabis businesses makes sense,” she said.

- Excise Tax Technical Correction:NASCUS supports a technical correction to the 2017 Tax Cuts and Jobs Act (TCJA), Ito said, to grandfather pre-existing non-profit organizations’ (including credit unions’) executive compensation plans in parity with for-profit entities.

LINK:

CU Journal: Credit unions outline regulatory priorities for second half of 2019

CO program looks to air issues related to cannabis banking

A program aimed at airing topics related to cannabis business issues – including banking by credit unions – is underway in Colorado with the state’s financial regulator, the Department of Regulatory Agencies (DORA), teaming up with the state’s Agriculture Department (and other agencies) to establish the Colorado Hemp Advancement and Management Plan (CHAMP). Issues under consideration include those specific to banking and insurance opportunities and challenges for hemp-related businesses, according to Mark Valente, commissioner of the financial services division at DORA. “We are committed to engaging our stakeholders in this conversation to establish forward-thinking solutions that balances protecting consumers while cultivating an environment where Colorado’s hemp industry can flourish,” Valente said in a memo distributed dto credit unions and banks in his state, which also asked them to join in the initiative.

LINK:

Colorado Hemp Advancement and Management Plan (CHAMP)

Cybersecurity challenges? Here’s a resource to consider

The Homeland Security Department’s national cybersecurity assessments and technical services gave a presentation to the NASCUS Legislative and Regulatory Committee this week, outlining services available to credit unions and other financial services providers, and state agencies, at no charge. Among them: how to identify and address gaps in organizations’ cyber hygiene. Nick Arroyo, the team lead in the division (with more than 20 years’ experience in cybersecurity), said his group provides such services as vulnerability scanning, phishing campaign assessments, risk/vulnerability assessments and remote penetration testing to interested stakeholders – all at no charge. Arroyo also told the group that his team is familiar with unique challenges faced by smaller and mid-sized organizations in meeting cybersecurity needs. For more information, see the link below.

LINK:

National Cybersecurity Assessments and Technical Services (NCATS)

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.