July 2, 2020 NASCUS Report

Posted July 2, 2020THIS WEEK: States keep asset portion at 50%; Following lawsuit rejection, NCUA vows to process FOM bids; Court overturns CFPB structure (but agency will go on); NASCUS comments on reg relief, CLF, Reg D; Guidance for serving hemp-related business released; Agencies urge action on LIBOR transition; StateFocus zeroes in on CA, CT, VA, WA; Reminder – fill out your surveys; BRIEFLY: NCUA delays meeting to July 30; IN regulator Powell retires; Weak bank performance foreseen; Have a happy (and healthy) Independence Day holiday!

States’ share of total assets hovers at 50%

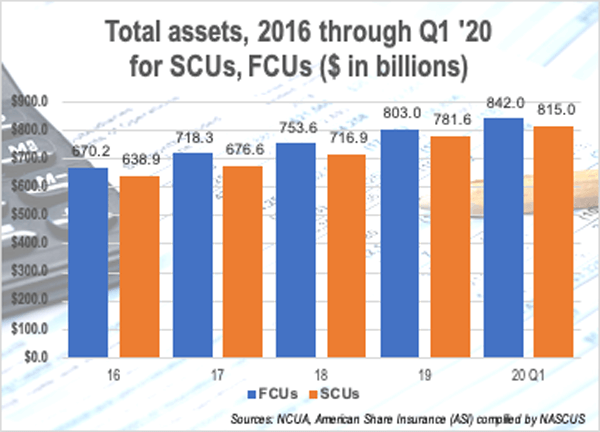

State credit unions continued to hold nearly half of all credit union assets at the end of the first quarter of the year, the latest numbers show –which do not reflect the economic downturn as a result of the impact of the coronavirus crisis.

According to the first quarter numbers for federally insured credit unions released by NCUA – and compiled by NASCUS from data gathered by American Share Insurance (ASI) – state credit unions hold just under half (49.2%) of all credit union assets, for $815 billion. The 2,051 state-chartered credit unions saw their assets expand by 4.27% in the first quarter, the numbers show. However, that is about half of the full-year 2019 asset growth of 9.12% for the state-chartered credit unions.

Memberships at the SCUs accounted for slightly more than 48% among all credit unions – totaling 59.2 million — about the same as it was at the end of last year. Membership growth at the SCUs was slightly quicker in the first quarter than for federal credit unions, expanding by 623,000 (a 1% increase); FCUs saw their numbers advance by 400,000 (a 0.6% increase from year-end 2019), according to the NCUA numbers.

“The state credit union system and dual-chartering both stood as vibrant contributors to an overall strong credit union movement at the end of the first quarter,” NASCUS President and CEO Lucy Ito said. “There is no doubt the impact of the COVID-19 pandemic will be felt by all credit unions and reflected in the next quarter’s numbers. However, the state system and all credit unions clearly entered the second quarter in solid shape, which positioned most credit unions to quickly pivot in response to the unique challenges of the second quarter and remainder of this year.”

Other numbers from the first quarter released this week showed:

- Total assets among the nation’s 5,276 credit unions were $1.6 trillion.

- Memberships at credit unions were 122.7 million nationwide.

- The total net worth ratio for federally insured credit unions (FICUs) was 11.01%, down slightly from the 11.13% posted a year earlier (end of the first quarter, 2019).

- Net income for FICUs was $8.4 billion (at an annual rate), down $5.6 billion (40%) from the same period a year earlier. The agency attributed the decline, in part, to an increase in provisioning for loan and lease losses or credit loss expenses.

- Return on average assets at FICUs was 53 basis points (bp) in the first quarter – down from 95bp posted at the end of the same period a year earlier.

LINK:

NCUA Quarterly Credit Union Data Summary 2020 Q1

NCUA plans on processing FOM bids following lawsuit rejection

An appeal of a lower court’s earlier decision upholding rules governing credit union membership rules was rejected by the Supreme Court this week, essentially ending a challenge by the banking industry to NCUA over its field of membership regulations.

The agency said it would immediately begin working on membership expansion applications affected by the court’s action.

In a statement, NCUA Board Chairman Rodney Hood said the decision provided some certainty to credit unions and the agency.

“Today’s decision by the Supreme Court ends nearly four years of uncertainty and will help the NCUA in its efforts to foster greater financial inclusion for all Americans,” Hood stated. “The NCUA will begin processing field-of-membership applications affected by this decision immediately.”

The high court declined to consider an appeal by the American Bankers Association (ABA) in its lawsuit against the NCUA over rules first issued by the agency in 2016 (and which went into effect in February 2017) concerning membership in credit unions. The banker group almost immediately filed a court challenge over the rules once they became effective; in late March 2018 a federal district court in Washington, D.C., issued a mixed ruling, upholding two parts and striking down two provisions.

Specifically, the court threw out a provision that qualifies a “combined statistical area” with fewer than 2.5 million people as a “local community” that can be served by a credit union; and another one raising to 1 million people the population limit for rural districts that may be served.

Both NCUA and the bankers decided to appeal the district court’s decision. Last summer, the U.S. Court of Appeals for the D.C. Circuit overturned sections of the lower court’s decision against the agency’s membership rules, finding that, under the Chevron deference doctrine, NCUA holds “vast discretion to define terms because Congress expressly has given it such power.”

However, the court also stated that the authority is not boundless. “The agency must craft a reasonable definition consistent with the Act’s text and purposes,” the court stated.

Last summer, NASCUS congratulated NCUA on the appeals court mostly upholding the agency’s regulation (which, with the Supreme Court’s inaction this week, means the rule stands). “We commend the agency’s efforts to maintain an effective federal charter,” said NASCUS President and CEO Lucy Ito. “We have long held that a competitive federal charter is vital to preserving a robust dual charter system and today’s ruling certainly advances that goal,” she added.

LINK:

NCUA Chairman Rodney E Hood Statement on Supreme Court’s Decision on Field-of-Membership Lawsuit

Director can be fired ‘at will,’ but CFPB will continue

In other Supreme Court action this week, the panel ruled 5-4 that Congress overstepped the Constitution in 2010 in creating the CFPB and placing it under the control of a single director, free from White House political direction. At the time, Congress, attempting to give the bureau a buffer from political influence, said the director could only be removed by the president for “inefficiency, neglect of duty, or malfeasance in office.”

But the court, in an opinion by Chief Justice John Roberts, said the agency’s director was unaccountable to the executive branch, creating an unconstitutional reduction of presidential power. “The CFPB’s single-director structure contravenes this carefully calibrated system by vesting significant governmental power in the hands of a single individual accountable to no one,” Roberts wrote.

The court found only that the agency’s structure with a single director appointed by the president who could only be removed “for cause” was unconstitutional. It rejected broader arguments that the court should strike down the bureau altogether.

The court’s decision, however, will have no impact on the agency’s existing rules or actions, according to its director. Kathy Kraninger, the current CFPB director, posted on Twitter this week that the ruling by the high court “finally brings certainty to the operations of the Bureau. We will continue with our important mission of protecting consumers with no question that we are fully accountable to the President.”

“Consumers and market participants should understand that the same rules continue to govern the consumer financial marketplace,” she added.

Last fall, the CFPB itself said it would no longer defend a provision in the Consumer Financial Protection Act limiting the president’s ability to remove the director for cause. But, Director Kathleen Kraninger said in a speech at that time, “that does not mean the Bureau will stop its work.”

Kraninger pointed to a provision in the CFPA that, should any provision of the bureau’s statute be found unconstitutional, the remainder of the act will not be affected.

Comments filed on CLF, reg relief, Reg D

NASCUS filed comment letters this week on NCUA’s rule providing temporary regulatory relief in response to the coronavirus crisis, NCUA’s changes to the Central Liquidity Facility (CLF) in response to legislation dealing with the financial impact of the pandemic, and the Federal Reserve’s easing of Reg D transfer limits. Here’s a rundown of each comment letter:

- Support for temporary reg relief during pandemic

Credit unions will be granted needed flexibility to manage liquidity and deposits to serve their members during the coronavirus crisis thanks to temporary regulatory relief extended by NCUA in an interim final rule, NASCUS wrote the agency this week.

In its comment letter to the agency on its May 28 interim final rule (IFR), NASCUS commended the agency for “taking action to provide prudent and meaningful regulatory relief to federally insured credit unions (FICUs) during these extraordinary times.” However, NASCUS also noted the state system’s past advocacy that policy makers re-evaluate “the prudence of the current regulatory capital framework for credit unions that generally relies solely on retained earnings.”

“One of our primary concerns has been the very scenario this rule attempts to temporarily attenuate: an otherwise healthy credit union experiences an influx of deposits as a ‘flight to safety’ that erodes its net worth,” NASCUS wrote. “With this modest, and temporary change, credit unions will be granted needed flexibility to manage liquidity and deposits to serve their members during this crisis.”

NASCUS noted that NCUA issued the rule as an IFR, without the usual notice as is typically required under the Administrative Procedure Act (APA), but allowed under an exception. NASCUS said it strongly supports the APA, but noted that the state system’s support of an exception “is not without limit.” This regulation, NASCUS said, presents several compelling qualities that help garner the association’s support of it as an IFR.

First, NASCUS wrote, the changes to existing rules are administrative in function and do not directly affect a credit union’s powers, authorities, or products and services. Second, the changes implemented by the IFR do not preempt, impede, or otherwise diminish state authority.

“Under the IFR, NCUA would still consult with state regulators when evaluating submitted plans,” NASCUS wrote. “Furthermore, when NCUA waives a provision as applied to a FISCU, a state’s authority to require remedial action remains unencumbered.

“Taken as a whole, the benefits of the IFR far outweigh our concerns with use of the APA exception to advance notice and comment,” NASCUS wrote.

- Backing for rule on Central Liquidity Facility (CLF)

The state system welcomes changes to the administration of NCUA’s Central Liquidity Facility (CLF), NASCUS wrote in its comment letter submitted to the agency this week.

“By increasing the CLF’s access to borrowing, reducing the barriers to credit union participation by allowing corporate credit unions greater flexibility in serving as agents, and streamlining the process by which credit unions may join and withdraw from the CLF, the changes authorized by the CARES Act and implemented by NCUA are prudent measures to strengthen the credit union system into the near future,” NASCUS wrote. “NASCUS supports this rulemaking.”

In late April, the agency released an IFR which it said was aimed at providing credit unions with greater access to liquidity by making it easier and more attractive for credit unions to join the CLF. The rule also made several amendments to conform to the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), enacted in late March. The rule was effective April 29, but as an IFR, the agency sought comments.

Regarding corporate credit union access to the CLF, NASCUS said it commends the corporate credit union network for work supporting the broader credit union system. “We urge NCUA to work with stakeholders to seek permanent changes to the CLF that would permit corporate credit unions the option to continue to serve natural person credit unions in this manner into the future.”

On natural person credit unions, NASCUS noted that under the permanent changes to the CLF made by the rule, a new CLF member no longer need wait six months before receiving an advance, and collateral requirements will in some cases be eased based on the type of asset pledged. “Both changes make it more practical for a credit union to join the CLF now which in turn expands the access to liquidity for all member credit unions,” NASCUS wrote. “NASCUS supports these changes as they substantially enhance the utility of the CLF as a contingency funding source.”

In issuing the rule as an IFR, NASCUS said it agrees with the agency that “good cause” exists. “As noted herein, a majority of these changes are cohering to changes mandated by the CARES Act. With respect to the discretionary changes, we find these changes to be consistent with the intent of the CARES Act to enhance the availability of liquidity for the credit union system,” NASCUS wrote. “Given these circumstances, it was appropriate to use the APA exception to issue this rule as an interim final

- Easing Reg D transfer limits justified

Depositors with “more urgent need for access to their funds by remote means” in light of financial institution closures caused by the coronavirus crisis justifies the Federal Reserve’s move to eliminate the six-per-month limit on transfers from savings accounts, NASCUS wrote this week.

But the state system still has some questions about the action.

In April, the Fed issued an IFR, with a request for comments, on amending Regulation D (Reserve Requirements of Depository Institutions) to delete the numeric limits on certain kinds of transfers and withdrawals that may be made each month from “savings deposits.” The Fed said then that the amendments were intended to allow depository institution members and customers more convenient access to their funds and to simplify account administration for depository institutions. There are no mandatory changes to deposit reporting associated with the amendments, the Fed added.

NASCUS noted that it agrees that many members and customers of financial institutions need remote access to their savings deposits as financial institutions stay closed or inaccessible during the pandemic. “However, the changes to Regulation D are not without challenges for financial institutions,” NASCUS added.

The association urged the Fed to clarify whether the Fed’s change for Reg D will be permanent. “Credit unions considering a change to their treatment of deposit accounts will need to adjust their core systems, re-write internal policies and procedures, absorb a loss in revenue (in some cases), and likely issue notices to their members,” NASCUS wrote. NASCUS also noted that credit unions will also likely have to consult counsel to determine applicability of other regulations to reclassified accounts as well as whether UDAP (unfair and deceptive practices) risks must be considered.

NASCUS pointed to no sunset provision for the change, and that the Fed has indicated it has no current plans to reinstate the limit.

“However, that it would take future rulemaking to return to the status quo (or some variation thereof) is by no means a certainty,” NASCUS asserted. “We recommend the supplemental material of a final rule contain an extended discussion of the FRB’s views on the permanence of the changes to provide greater context to credit unions evaluating a change to their treatment of savings deposit accounts.”

NASCUS also urged the Fed to clarify how the change for withdrawals affects funds availability required by Regulation CC. While that regulation excludes deposit accounts, NASCUS noted, after the IFR there is no significant difference between a deposit account or a transaction account. “The FRB should clarify the applicability of Regulation CC to deposit accounts from which unlimited transaction are allowed,” NASCUS wrote.

NASCUS Comments on Interim Final Rule: CLF (RIN 3133-AF18)

Guidance outlines service to hemp-related businesses

Conducting due diligence on hemp-related businesses – such as the types of information and documentation that may be required to collect from those entities – is outlined in guidance for credit unions and banks issued this week by Treasury’s Financial Crimes Enforcement Network (FinCEN).

The agency said financial institutions should obtain basic identifying information about hemp-related businesses according to their customer identification programs and risk-based due diligence processes. “For customers who are hemp growers, financial institutions may confirm the hemp grower’s compliance with state, tribal government, or the USDA licensing requirements, as applicable,” by obtaining a written attestation from the grower that they carry a valid license, or a copy of the license, FinCEN wrote in its guidance.

The law enforcement agency said the clarification contained in it the guidance “is intended to enhance the availability of financial services for, and the financial transparency of, hemp-related businesses in compliance with federal law.”

Guidance provides financial institutions with Bank Secrecy Act/Anti-money laundering (BSA/AML) risk considerations only for hemp- related businesses (that is, businesses or individuals that grow hemp, and processors and manufacturers who purchase hemp directly from such growers), the agency said. The guidance, the agency said, does not replace or supersede FinCEN’s previous guidance on the BSA expectations regarding marijuana-related businesses (also known as its 2014 Marijuana Guidance).

Don’t forget: Questions about serving hemp and cannabis businesses will be addressed in detail at the July 15 NASCUS webinar “Cannabis and Hemp: A Changing Landscape.” Deirdre O’Gorman leads the 60-minute program, which gets underway at 2 p.m. ET. The webinar is planned to provide financial institutions with the latest updates on the cannabis and hemp industries. See the link below for more information, including registration.

LINKS:

Information, registration: July 15 Cannabis and Hemp: A Changing Landscape webinar

Agencies urge LIBOR transition (with 18 months to go)

Federal and state regulators this week urged financial institutions to continue working to transition away from using LIBOR (the London Interbank Offered Rate) as a reference rate in any products, and they said supervision of this work will increase this year and next, “particularly for institutions with significant LIBOR exposure or less-developed transition processes.”

In July 2017, the United Kingdom Financial Conduct Authority said it had intervened to preserve LIBOR’s continued publication through the end of 2021 but that it could not guarantee the continuation of LIBOR after that. In a joint statement issued under the auspices of the FFIEC (including NCUA and the SLC), regulators noted the “significant effort” involved in preparing for the transition.

“While some smaller and less complex institutions may hold little to no LIBOR-denominated assets and liabilities, the change will affect almost every institution,” the exam council said. “[The] Impact is expected to be particularly significant for the largest institutions and those engaged materially in capital markets activities such as interest rate swaps, other derivatives, or hedging transactions.”

The FFIEC statement notes that financial institutions can have a variety of on- and off-balance sheet assets and contracts that reference LIBOR, including derivatives, commercial and retail loans, investment securities, and securitizations. It also notes potential references to LIBOR on the liability side, for example, Federal Home Loan Bank advances; other borrowings; derivatives; and capital instruments, including subordinated notes and trust preferred securities. “Moreover, many market participants rely on LIBOR for discounting and other purposes,” it adds.

The joint statement addresses risks to institutions, assessing LIBOR risk exposure, contract fallback language (providing for alternative reference rates), consumer impact, third-party service provider considerations, and supervisory activities.

The FFIEC agencies said that in 2020 and 2021, during regularly scheduled examinations and monitoring activities, supervisory staff will ask institutions about their planning for the LIBOR transition, including the identification of exposures, efforts to include fallback language or use alternative reference rates in new contracts, operational preparedness, and consumer protection considerations.

“All institutions should have risk management processes in place to identify and mitigate their LIBOR transition risks that are commensurate with the size and complexity of their exposures,” the regulators said. “Supervisory focus will be tailored to the size and complexity of each institution’s LIBOR exposures. Large or complex institutions and those with material LIBOR exposures should have a robust, well-developed transition process in place.”

For smaller institutions and those with limited exposure to LIBOR- indexed instruments, “less-extensive and less-formal transition efforts may be appropriate,” they stated.

LINKS:

Financial Regulators Issue Statement on Managing the LIBOR Transition

Joint Statement on Managing the Libor Transition

StateFocus looks at developments in CA, CT, VA, WA

The destiny of California’s “mini-CFPB,” Connecticut’s extension of its voluntary mortgage relief program, Virginia’s enactment of legislation aimed at curbing financial exploitation of adults, and Washington’s update of its examination focus in the wake of the coronavirus pandemic are all addressed in the latest issue of StateFocus sent to all members this week. The newsletter, provided as a member service to association members, is published monthly (or more frequently, as warranted) to shine a light on action in the states – including recent legislative and regulatory developments, as well as other issues of interest in the states to the credit union system. StateFocus is available to members only.

LINK:

NASCUS StateFocus (members only)

REMINDER: NASCUS CU member surveys due July 15

Just a reminder that a NASCUS credit union member survey gauging needs for online learning and training is due July 15. The brief, 16-question survey (estimated to take no longer than five minutes to fill out) will help the state system’s association determine the delivery mode of e-learning in order to bring the best value from NASCUS to its member credit unions. The survey was sent to all credit union members June 30, with a request that it be forwarded to the appropriate staff member responsible for each credit union’s learning or training (or both). Questions or comments? Contact NASCUS Vice President, Membership Relations Alicia Erb at [email protected].

BRIEFLY: NCUA delays July board meeting by two weeks; IN’s Mark Powell retiring; Grim picture painted for banks’ 2020 financial performance; Have a happy, healthy holiday!

The NCUA Board will meet July 30, in both open and closed sessions, rather than the previously scheduled July 16, the agency said in a release late Wednesday. The open meeting is scheduled, as per usual, for 10 a.m. with the closed meeting immediately following. As it typically has done in past years, the board has no meeting scheduled for August … Farewell and best wishes to Indiana’s Mark Powell, field manager and past credit union division supervisor of the Indiana Department of Financial Institutions (DFI), who is retiring after 46 years of service – including to the entire state credit union system. A long-time member of the NASCUS Performance Standards Committee – which guides the NASCUS Accreditation Program for state credit union supervisory programs — Mark has counseled NASCUS on issues including privately insured credit unions and state taxation practices … Weak bank financial performance, and increasing credit, operational, and compliance risks resulting from the financial impact of the coronavirus crisis are among the “key risk themes” outlined in an OCC report issued early this week. The agency said in its Semiannual Risk Perspective for Spring 2020 that banks entered the COVID-19 pandemic in sound condition but face weak economic conditions resulting from the economic shutdown in response to the pandemic that will stress financial performance in 2020. Among other things, the report states that bank profitability will suffer as interest rates (now at historic lows), past due loans and provisions for loan losses increase at the same time that operational expenses are rising … Here’s to a happy and healthy Independence Day holiday for all! Stay safe out there!

LINK:

OCC Semiannual Risk Perspective for Spring 2020

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.