Industry News

Articles for October 28, 2022

- FHFA Announces Validation of FICO 10T and VantageScore 4.0 for Use by Fannie Mae and Freddie Mac

- UK Lawmakers Vote to Recognize Crypto as Regulated Financial Instruments

- Equifax Wants to Help KYC DeFi and NFT Users—And Keep Their Data Private

- Federal Reserve Bank of Boston: In Crypto, “DeFi” Could Offer 24/7 Access to Financial Services. But Could It Disrupt the Economy?

- Fintech Firm Upgrade Offers Top U.S. Savings Rate of 3.5% As Competition for Deposits Heats Up

FHFA Announces Validation of FICO 10T and VantageScore 4.0 for Use by Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac will accept FICO 10T and VantageScore 4.0 in a multiyear effort with the industry

Fannie Mae and Freddie Mac will accept FICO 10T and VantageScore 4.0 in a multiyear effort with the industry

Oct. 24, 2022 — The Federal Housing Finance Agency (FHFA) today announced the validation and approval of both the FICO 10T credit score model and the VantageScore 4.0 credit score model for use by Fannie Mae and Freddie Mac (the Enterprises).

As a result of FHFA’s announcement, lenders, investors and other industry stakeholders, as well as borrowers and first-time homebuyers, can expect:

- More Accurate Credit Scores: Part of the evaluation of new credit score models included extensive testing by the Enterprises to ensure that any validated and approved models met the necessary accuracy standards to treat borrowers fairly and to protect the safety and soundness of the mortgage market and the Enterprises. Both FICO 10T and VantageScore 4.0 met those standards.

- More Inclusive Credit Scores: While both Enterprises have already taken steps to expand equitable access to credit, such as enhancements to their underwiting systems, both FICO 10T and VantageScore 4.0 include new payment history information such as rent, utilities, and telecom payments when available.

- Enhanced Safety and Soundness in the Housing Market: Promoting accuracy and newer innovative credit score models in the housing finance system will ultimately lead to better outcomes for borrowers, lenders, and the Enterprises. Additionally, because both FICO 10T and VantageScore 4.0 are more accurate than Classic FICO, the mortgage market will be provided with an improved view of risk from two different credit score models.

Fact Sheet: FHFA Announcement of Credit Score Models

“Today’s decision will benefit borrowers and the Enterprises, along with maintaining safety and soundness,” said FHFA Director Sandra L. Thompson. “While implementing the newer credit score models is a significant change that will take time and require close coordination across the industry, the models bring improved accuracy and a more inclusive approach to evaluating borrowers.”

FHFA expects that implementation of FICO 10T and VantageScore 4.0 will be a multiyear effort. Once implemented, lenders will be required to deliver both FICO 10T and VantageScore 4.0 credit scores with each loan sold to the Enterprises. FHFA and the Enterprises will conduct outreach to stakeholders to ensure a smooth transition to the newer credit score models.

For nearly 20 years, the Enterprises have relied on Classic FICO. Today’s announcement is the result of a years-long effort by FHFA and the Enterprises to implement Section 310 of the Economic Growth, Regulatory Relief, and Consumer Protection Act. The new models improve accuracy by capturing new payment histories for borrowers when available, such as rent, utilities, and telecom payments.

FHFA also announced today that the Enterprises will work toward changing the requirement that lenders provide credit reports from all three nationwide consumer reporting agencies (CRAs). Instead, the Enterprises will require lenders to provide credit reports from two of the three nationwide CRAs. The Enterprises will work with stakeholders on a plan for implementing the change from a tri-merge credit report requirement to a bi-merge credit report requirement.

UK Lawmakers Vote to Recognize Crypto as Regulated Financial Instruments

Courtesy of Sandali Handagama, CoinDesk.com

Oct. 24, 2022 — The lower house of the Parliament voted in favor of adding crypto to the scope of activities to be regulated via the proposed Financial Services and Markets Bill – which already seeks to extend payments rules to stablecoins.

Oct. 24, 2022 — The lower house of the Parliament voted in favor of adding crypto to the scope of activities to be regulated via the proposed Financial Services and Markets Bill – which already seeks to extend payments rules to stablecoins.

Lawmakers in the U.K. voted in favor of recognizing crypto assets as regulated financial instruments and products in the country on Tuesday. The House of Commons, the Parliament’s lower house, met on Tuesday for a line-by-line reading of the proposed Financial Services and Markets Bill, which broadly covers the U.K.’s post-Brexit economic strategy. The lawmakers considered a list of proposed amendments to the bill, including one put forward by parliamentarian Andrew Griffith to include crypto assets in the scope of regulated financial services in the country.

The draft bill already included measures to extend existing regulations to payments-focused stablecoins, which are cryptocurrencies pegged to the value of other assets like the U.S. dollar or gold. “The substance here is to treat them [crypto] like other forms of financial assets and not to prefer them, but also to bring them within the scope of regulation for the first time,” Griffith, the financial services and city minister, said during the parliamentary meeting before lawmakers voted largely in favor of keeping the amendment in the legislative package.

The local crypto industry, which recently welcomed the news of Rishi Sunak’s appointment as the country’s new Prime Minister, stands to welcome the efforts to give legal recognition to digital assets broadly. The markets bill – and by extension the stablecoin rules – was introduced during Sunak’s time as finance minister in the Boris Johnson administration.

The crypto provision, which relies on the definition of “crypto asset” inserted by a new clause 14, “clarifies that crypto assets could be brought within the scope of the existing provisions” of the Financial Services and Markets Act 2000 relating to regulated financial activities, Griffith said. The measures could regulate crypto promotions and outlaw companies that are not authorized to operate in the country.

“The Treasury will consult on its approach with industry and stakeholders ahead of using the powers to ensure the framework reflects the unique benefits and risks posed by crypto activities,” Griffith said.

Equifax Wants to Help KYC DeFi and NFT Users—And Keep Their Data Private

Equifax and Oasis Labs will together provide a privacy-focused KYC solution for Web3 companies.

Courtesy of Mat Di Salvo, Decrypt.co

Oct. 26, 2022 — Credit reporting giant Equifax, best known for one of the largest data breaches in history, will now help build a data privacy solution for Web3 projects.

Oct. 26, 2022 — Credit reporting giant Equifax, best known for one of the largest data breaches in history, will now help build a data privacy solution for Web3 projects.

Related Reading: How Binance Is Training Law Enforcement Around the World to Combat Crypto Crime

Crypto exchange Binance has built a specialist team to teach law enforcement officers about the ins and outs of cryptocurrency. Fighting crypto crime starts with fighting the many misconceptions that have built up around it. Like the idea that cryptocurrency transactions are untraceable and anonymous, for example, and that the blockchain industry doesn’t care enough to investigate bad behavior or take action to prevent it.

Related Reading: Top NFT-Related Cybersecurity, Phishing, Hacking and Other Risks in 2022

The continued growth of the market for nonfungible tokens (NFTs) in 2022 has helped shape the zeitgeist of what has been referenced colloquially by some as the “fourth industrial revolution,”[1] defined largely by network effect (e.g., virality); rapid innovation; social, creative and civic engagement; and evolved perspectives with regard to how rights and obligations between and among parties to automated agreements are defined and enforced.

Federal Reserve Bank of Boston: In Crypto, “DeFi” Could Offer 24/7 Access to Financial Services. But Could It Disrupt the Economy?

Boston Fed researchers explore benefits, stability risks of growing “decentralized finance” system.

Courtesy of Amanda Blanco, Federal Reserve Bank of Boston

Oct. 2022 — “Decentralized finance” products and services – or DeFi – are rapidly growing in the world of cryptocurrency. By using public, digital ledgers called blockchains, DeFi aims to create a financial system that operates without any traditional central institutions, like banks.

Oct. 2022 — “Decentralized finance” products and services – or DeFi – are rapidly growing in the world of cryptocurrency. By using public, digital ledgers called blockchains, DeFi aims to create a financial system that operates without any traditional central institutions, like banks.

In theory, DeFi services such as lending, payments, investing, and crowdfunding could be executed all day, every day – with no need for a third party to verify their accuracy and reliability, said Edward Dumas, a lead markets specialist at the Federal Reserve Bank of Boston. Transactions would be secure and anonymous, with financial services available to all people.

“That’s the vision,” Dumas said. “Now, the reality of DeFi … is still in its infancy.”

Dumas said that amid the focus on its benefits, the continually evolving technology may also pose risks to the broader economy. These risks – and what they could mean to the financial system – are explored in a Supervisory Research and Analysis working paper that Dumas co-authored, “Decentralized Finance (DeFi): Transformative Potential & Associated Risks.”

In the paper, the authors note that blockchains aren’t as secure as many people believe. They warn that DeFi can become a tool for criminals and that the very interconnectedness of DeFi can also lead to vulnerabilities. “The rapid growth (of DeFi) … suggests that policymakers should start giving serious consideration to a full range of financial stability issues that could arise should such activities become systemically important,” they wrote.

Linked Report: Decentralized Finance (DeFi): Transformative Potential & Associated Risks

Dumas – who works in the Boston Fed’s Supervision, Regulation & Credit department – wrote the paper with four fellow researchers in the Bank’s Supervisory Research and Analysis Unit: Francesca Carapella, Jacob Gerszten, Nathan Swem, and Larry Wall.

They note that by using blockchains, DeFi offers transparency on near-real time transactions. Users can access a public, continuously updated record of activities generally considered to be “immutable” or unchangeable. But the researchers say that blockchains have been successfully hacked by malicious actors seeking cryptocurrency profits. And they say that even if blockchains were to become completely immutable, that may not be a good thing.

“Blockchain transactions that involve fraud or theft might not be reversed as quickly or easily as they would in traditional finance,” the researchers said.

The authors say that because DeFi has no central authority, there could be technical challenges fixing “bugs,” or mistakes, in the programs stored on the blockchains that run DeFi products and services. The researchers add that the interconnections DeFi creates between markets also present a financial risk: “A shock to one market may spread through DeFi connections to other markets.”

They also note that the censorship-resistant nature of DeFi, which aims to make it accessible to everyone, can invite criminal activity and risk-taking. “Blockchains are already being used to facilitate scams, theft, money laundering, and a variety of other criminal activity. (And they) could facilitate activities that, despite being legal, may increase the risk of financial instability,” the authors wrote.

DeFi could work together with traditional finance, or cause disruptions

Dumas said it’s still unclear how DeFi will co-exist with the traditional financial system. He said they could work in tandem, or DeFi could disrupt the traditional system and cause competition.

The researchers say that as traditional banks offer more cryptocurrency services and loans, it’s possible they may not fully realize the market’s risks, which could lead to legal issues. And it may be easier for customers to sue banks and other traditional financial firms – even in cases where they had relatively minor involvement – rather than try to determine responsible parties “on the DeFi side.”

“If a meltdown occurs in the crypto market, banks could suffer direct losses on their services and loans, create legal exposure from customers who suffered losses in the crypto market, and risk reputational damage,” they wrote. Dumas said DeFi experimentation is ongoing, and it’s important to acknowledge and plan for potential risks related to DeFi and cryptocurrency.

Fintech Firm Upgrade Offers Top U.S. Savings Rate of 3.5% As Competition for Deposits Heats Up

Courtesy of Hugh Son, CNBC

- The fintech startup’s Premier Savings account is being launched Thursday with a 3.5% annual percentage yield, according to CEO Renaud Laplanche. That is higher than any account currently tracked by Bankrate.com, senior analyst Ted Rossman said in an email.

- Upgrade’s product requires a minimum balance of $1,000 to earn the 3.5% APY. It has few restrictions apart from that.

- The rate is likely to climb further in coming months and could hit 4.5% next year if the Fed continues to raise rates, Laplanche said.

Oct. 27, 2022 — Credit card startup Upgrade is releasing a new savings account with what it says is the country’s top interest rate as competition for deposits heats up, CNBC has learned.

Oct. 27, 2022 — Credit card startup Upgrade is releasing a new savings account with what it says is the country’s top interest rate as competition for deposits heats up, CNBC has learned.

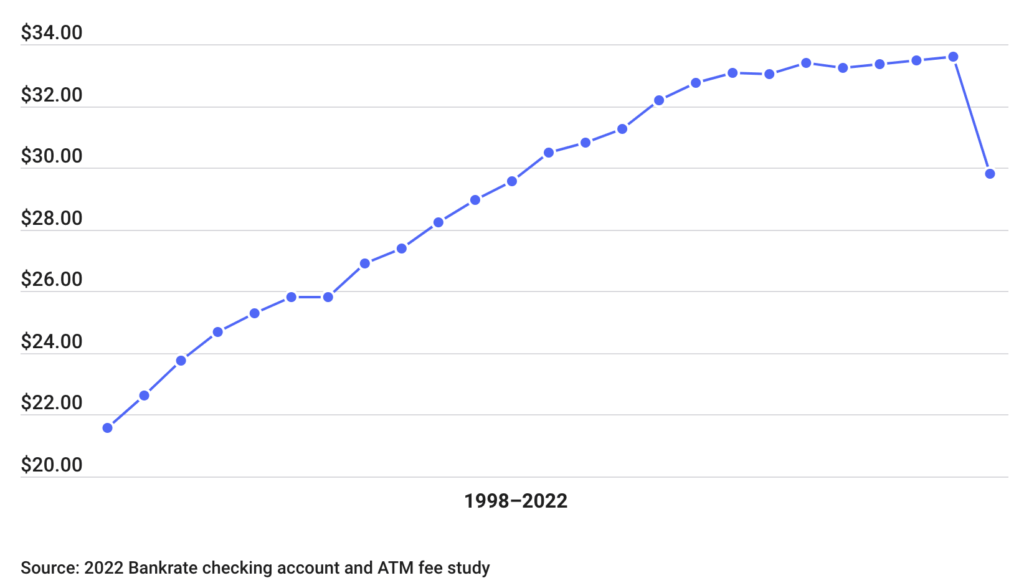

The fintech firm’s Premier Savings account is being launched Thursday with a 3.5% annual percentage yield, according to CEO Renaud Laplanche. That is higher than any account currently tracked by Bankrate.com, senior analyst Ted Rossman said in an email.

The dynamic is closely watched by banking analysts because higher funding costs affect how much the industry stands to benefit from future Fed moves. Even big banks, including JPMorgan Chase and Wells Fargo, have boosted rates for CDs recently, unlike earlier this year when it was mostly smaller institutions raising payouts, Morgan Stanley analyst Betsy Graseck said in a Sept. 30 note.

“This suggests that deposit-pricing pressure is becoming more widely dispersed across the banking industry as rates move sharply higher,” Graseck said. “We believe deposit price competition will continue intensifying from here.”

One reason for that is because fintech players are more established now than in previous rate-hiking cycles, and they tend to pay the highest rates, according to the veteran analyst.

Network effects

Upgrade, a San Francisco-based startup founded by Laplanche in 2016, can afford to pay higher rates than rivals because of its network of 200 small banks and credit unions, according to the CEO. These institutions don’t have national deposit-gathering platforms and, as a result, are willing to pay more for funding, he said.

Ironically, the next highest rate listed by Bankrate.com this week was offered by LendingClub at 3.12%. Laplanche co-founded the fintech pioneer in 2006 before departing a decade later. Similar to other fintech firms like Chime which offer banking services through smartphone apps, Upgrade isn’t a bank; it partners with institutions including Cross River Bank to offer FDIC-backed accounts.

Upgrade’s new account requires a minimum balance of $1,000 to earn the 3.5% APY. It has few restrictions apart from that; the accounts aren’t capped and don’t require users to sign up for Upgrade’s other products to take advantage of the rate, Laplanche said. Other fintech players offer higher rates on limited amounts of money. Fintech firm Current, for instance, offers a 4% APY, but only for savings up to $6,000.

Headed higher

Laplanche said his product’s rate is likely to climb further in coming months as the Fed attempts to wrangle inflation by boosting its benchmark rate, he said. “We’ll follow along with what the Fed is doing,” the CEO said. “If they continue to raise rates, there might be a point next year where we’ll pay 4.5%.”

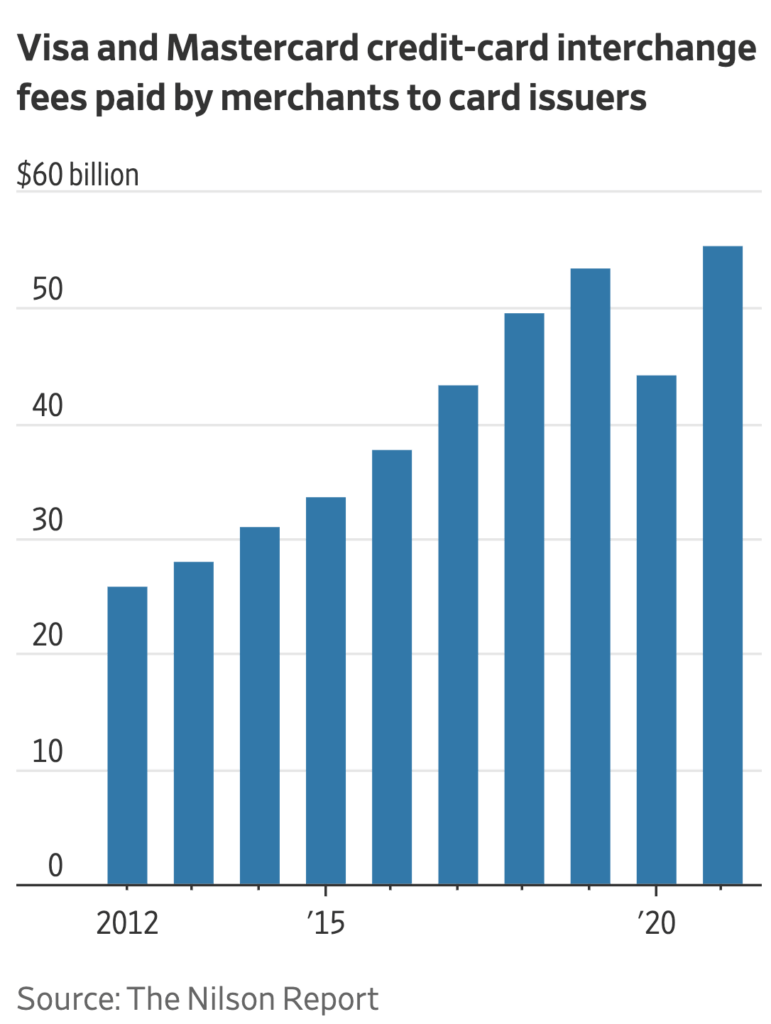

Upgrade, which was valued at $6.28 billion in a private funding round late last year, is best known for credit cards that turn monthly balances into installment loans.

That feature automates financial discipline for its users and generally reduces the interest they pay versus traditional cards. The product appears to be gaining traction; Upgrade was the fastest-growing card issuer by outstanding balances among the top 50 players, according to industry newsletter the Nilson Report.

Upgrade will continue to build products with the aim of helping Americans navigate life events, including by eventually offering car loans and mortgages, Laplanche said. And unlike many other direct-to-consumer fintech firms, Upgrade is profitable and doesn’t need to raise more funding, he said.

Articles for October 21, 2022

- US Lawmakers Introduce Bill Allowing Crypto Investments in 401(k) Retirement Plans

- Microsoft Confirms Data Breach, But Claims Numbers Are Exaggerated

- IRS Expands Key US Tax Language to Include NFTs: Newly released draft instructions for the 2022 tax year change the language from “virtual currency” to broader “digital assets.”

- Digitalization Ranks as Top Priority; Macroeconomic Conditions as Greatest Risk for Global Credit Union Movement Approaching 400-million Members

- Federal Reserve Board, Washington, D.C.: How Much Does Racial Bias Affect Mortgage Lending? Evidence from Human and Algorithmic Credit Decisions

US Lawmakers Introduce Bill Allowing Crypto Investments in 401(k) Retirement Plans

Courtesy of Kevin Helms, Bitcoin.com

Several U.S. lawmakers have introduced the Retirement Savings Modernization Act to provide 401(k) retirement savers access to a wide range of investments, including crypto assets. “With inflation at record highs, a stock market downturn, and a potential recession on the horizon, many Americans are rightfully concerned about their financial future,” said U.S. Senator Pat Toomey.

Several U.S. lawmakers have introduced the Retirement Savings Modernization Act to provide 401(k) retirement savers access to a wide range of investments, including crypto assets. “With inflation at record highs, a stock market downturn, and a potential recession on the horizon, many Americans are rightfully concerned about their financial future,” said U.S. Senator Pat Toomey.

Retirement Savings Modernization Act Introduced

The U.S. Senate Committee on Banking, Housing, and Urban Affairs announced Thursday that Senators Pat Toomey (R-PA) and Tim Scott (R-SC) and Representative Peter Meijer (R-MI) have introduced a bill called the Retirement Savings Modernization Act.

The bill aims “to bolster Americans’ retirement savings by allowing workers to diversify assets included in defined contribution plans, such as 401(k) plans,” the announcement details. “This legislation will amend the Employee Retirement Income Security Act of 1974 (ERISA) to clarify that private sector retirement plan sponsors may offer plans, including both pensions and 401(k)s, that are prudently diversified across the full range of asset classes.”

Senator Toomey opined, “With inflation at record highs, a stock market downturn, and a potential recession on the horizon, many Americans are rightfully concerned about their financial future,” elaborating: “By providing 401(k) savers with access to the same asset classes as pension plans, my legislation will open the door to a more secure retirement for millions of Americans.”

Related Reading: IRS Expands Key US Tax Language to Include NFTs: Newly released draft instructions for the 2022 tax year change the language from “virtual currency” to broader “digital assets.”

While pension plans and 401(k) plans are covered by the same law, the former have incorporated asset classes outside of the public markets since 1982. Meanwhile, the latter “almost never incorporate exposure to alternative assets due to fiduciaries’ anticipated litigation risk,” the announcement explains. The bill lists “digital assets” as a “covered investment.”

Senator Scott described: “Inflation has eroded and devalued the savings many Americans spent their lives accumulating. This bill would modernize retirement plans to ensure they can provide diverse investments with higher returns. American workers and their families deserve to go about their lives with peace of mind, knowing their hard-earned money will be secure when they choose to retire.”

Until the 1970s, most Americans working in the private sector relied on pension plans for retirement. Today, the vast majority of private sector workers rely on 401(k) plans. “However, pension plans have consistently outperformed 401(k) plans because they diversify across the full range of asset classes, putting one of every five dollars in alternative asset classes like private equity,” the lawmakers noted.

Click here to read the entire article.

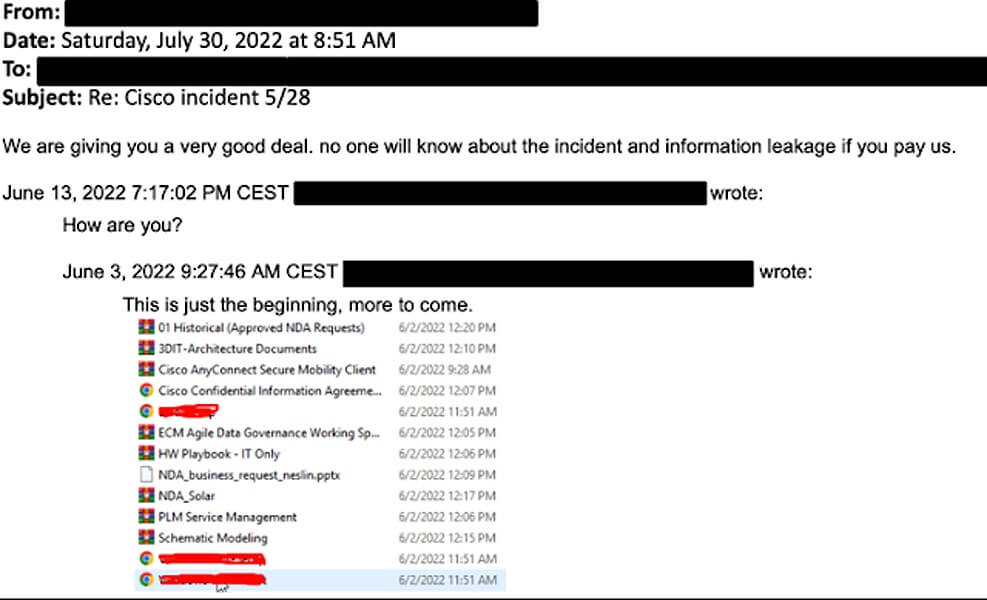

Microsoft Confirms Data Breach, But Claims Numbers Are Exaggerated

Courtesy of Eduard Kovacs, Security Week

October 20, 2022 — Microsoft has confirmed that it inadvertently exposed information related to prospective customers but claims that the company which reported the incident has exaggerated the numbers.

October 20, 2022 — Microsoft has confirmed that it inadvertently exposed information related to prospective customers but claims that the company which reported the incident has exaggerated the numbers.

Threat intelligence firm SOCRadar revealed on Wednesday that it has identified many misconfigured cloud storage systems, including six large buckets that stored information associated with 150,000 companies across 123 countries.

These buckets, which the firm has dubbed BlueBleed, included a misconfigured Azure Blob Storage instance allegedly containing information on more than 65,000 entities in 111 countries. SOCRadar described it as “one of the most significant B2B leaks”.

SOCRadar said the exposed data belonged to Microsoft and it totaled 2.4 Tb of files collected between 2017 and August 2022. The exposed information allegedly included over 335,000 emails, 133,000 projects, and 548,000 users.

The company said the leak included proof-of-execution (PoE) and statement of work (SoW) documents, user information, product orders and offers, project details, and personal information.

Microsoft confirmed on Wednesday that a misconfigured endpoint exposed data, which the company said was related to “business transaction data corresponding to interactions between Microsoft and prospective customers”. The tech giant said it quickly addressed the issue and notified impacted customers.

“The business transaction data included names, email addresses, email content, company name, and phone numbers, and may have included attached files relating to business between a customer and Microsoft or an authorized Microsoft partner. The issue was caused by an unintentional misconfiguration on an endpoint that is not in use across the Microsoft ecosystem and was not the result of a security vulnerability,” Microsoft explained.

The tech giant has thanked SOCRadar, but it’s not happy with the company’s blog post, claiming that it greatly exaggerates the scope of the issue and the numbers involved.

“Our in-depth investigation and analysis of the data set shows duplicate information, with multiple references to the same emails, projects, and users,” Microsoft pointed out.

SOCRadar has also made available a free tool that can be used to search for digital assets, hashes, and specified keywords on the dark web and darknet websites. Microsoft is disappointed that this tool has been publicly released, saying that it’s “not in the best interest of ensuring customer privacy or security and potentially exposing them to unnecessary risk”.

The company believes such tools should include a verification system to ensure that a user can only look for data pertaining to them, and not to other users.

IRS Expands Key US Tax Language to Include NFTs

Newly released draft instructions for the 2022 tax year change the language from “virtual currency” to broader “digital assets.”

Courtesy of Jesse Hamilton, Coindesk

October 18, 2022 — The U.S. Internal Revenue Service (IRS) has made a move this week to clarify at least one question for crypto investors: how taxpayers account for non-fungible tokens (NFT).

October 18, 2022 — The U.S. Internal Revenue Service (IRS) has made a move this week to clarify at least one question for crypto investors: how taxpayers account for non-fungible tokens (NFT).

The tax division of the Treasury Department released an updated draft for its 2022 instructions for form 1040 filers that swaps the old category for “virtual currency” with broader new language on “digital assets,” including an explicit recognition of NFTs.

“Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology,” according to the draft instructions. “For example, digital assets include non-fungible tokens (NFT) and virtual currencies, such as cryptocurrencies and stablecoins.”

The previous year’s “virtual currency” section of the U.S. tax-filing instructions was a narrower definition of a digital token “that functions as a unit of account, a store of value or a medium of exchange.” The final tax instructions haven’t yet been released, so the crypto section could still be tweaked before it’s official.

Crypto investors will have to calculate and report taxable income “if you disposed of any digital asset in 2022, that you held as a capital asset, through a sale, exchange, gift, or transfer,” according to the latest document.

Digitalization Ranks as Top Priority; Macroeconomic Conditions as Greatest Risk for Global Credit Union Movement Approaching 400-million Members

Expanded 2021 Statistical Report features several new categories of data

Courtesy of Greg Neumann, World Council of Credit Unions

October 18, 2022 — Despite year-to-year growth in overall membership and total assets for the global credit union movement, World Council of Credit Unions’ (WOCCU) 2021 Statistical Report shows major gaps in key product and service offerings have resulted in different priorities and risk concerns for credit unions in different parts of the world.

October 18, 2022 — Despite year-to-year growth in overall membership and total assets for the global credit union movement, World Council of Credit Unions’ (WOCCU) 2021 Statistical Report shows major gaps in key product and service offerings have resulted in different priorities and risk concerns for credit unions in different parts of the world.

As of December 31, 2021, there were a total of 393,871,631 members of 87,914 credit unions worth $3.48 trillion in assets across 118 countries.

Along with providing statistics on members, assets, savings and loans, the 2021 Statistical Report also features first-time data sets on credit union:

- Strategic priorities.

- Risk Concerns.

- Access to various products and services.

- Taxation

“Despite the COVID-19 pandemic continuing to impact credit unions across the globe in 2021, they still managed to increase membership by 5% and grow assets by 9%,” said Elissa McCarter LaBorde, WOCCU President and CEO. “For WOCCU to ensure that type of growth continues, and credit unions are able to reach even more underserved populations, we need to gather more specific data from national credit union associations than ever before. While some data sets in this report are more complete than others, this is just the first step in our plan to offer a continuously clearer picture of the challenges and opportunities credit unions face in each region of the world.”

Membership and assets up, but not everywhere

Credit unions in Africa and Latin America saw the most substantial growth in terms of membership and assets. Africa saw a 42% spike in assets—the largest worldwide. Latin America witnessed the biggest growth in membership at 16%.

Europe was the only region to see a decline in credit union assets, while Australia and New Zealand both saw declining membership.

New data provides insights into regional differences

WOCCU’s 2021 Statistical Report also provides several sets of new data obtained from national credit union associations in more than 40 countries and six regions of the world. Specifically, we asked the credit union associations to:

- Rank their top strategic priorities and risk concerns moving forward.

- Describe the level of access credit unions and their members have to certain products and services that are necessary to strengthen and grow our movement.

Strategic priorities

Digitalization is the clear top priority for credit unions overall, with 81% of respondent credit union associations ranking it at or near the top of their lists.

- 66% identified membership and asset growth as another top priority, including 83% in Europe, 80% in Africa and 57% in Asia.

Regulatory reform was a top priority for 51% of those surveyed, and easily the top priority for respondent credit union associations in North America (100%) and the Caribbean (80%).

Federal Reserve Board, Washington, D.C.: How Much Does Racial Bias Affect Mortgage Lending? Evidence from Human and Algorithmic Credit Decisions

Abstract

Abstract

We assess racial discrimination in mortgage approvals using new data on mortgage applications. Minority applicants tend to have significantly lower credit scores, higher leverage, and are less likely than white applicants to receive algorithmic approval from race-blind government-automated underwriting systems (AUS). Observable applicant risk factors explain most of the racial disparities in lender denials. Further, we exploit the AUS data to show there are risk factors we do not directly observe, and our analysis indicates that these factors explain at least some of the residual 1-2 percentage point denial gaps. Overall, we find that differential treatment has played a limited role in generating denial disparities in recent years.

Introduction

American families use mortgages to purchase their homes, to lower their housing costs when interest rates decline, and to tap into home equity for a variety of reasons including investments in human capital and small businesses. But not all families can easily get a mortgage; in particular, access to mortgage credit differs sharply by race and ethnicity, which may contribute to the wide racial and ethnic gaps in homeownership and wealth (e.g. Bhutta et al. 2020). For example, in 2018 and 2019, Black mortgage applicants were twice as likely as white applicants to have their application denied by lenders.

In order to craft policies that can address these disparities in credit access, it is crucial to identify what drives them. The landmark study of Munnell et al. (1996) found compelling evidence that discrimination played a major role in mortgage lending decisions in the early 1990’s.1 Since then, the mortgage industry has evolved in many ways, including widespread adoption of technologies such as automated underwriting that can help reduce racially biased credit decisions. Nonetheless, the wide gaps in mortgage denials present in recent data have led many to conclude that discrimination persists. Media reports and survey evidence indicate widespread beliefs that financial institutions do not treat minorities fairly.2 But it has been challenging to firmly assess the role of discrimination without detailed underwriting data on mortgage applicants similar to what Munnell et al. had collected.

In this paper, we use new confidential supervisory data collected under the Home Mortgage Disclosure Act (HMDA) to estimate the extent to which racial and ethnic discrimination by mortgage lenders continues to generate disparities in denial rates. “Discrimination” here refers to lenders treating applicants with identical observed risk factors differently on the basis of race or ethnicity—including both taste-based and statistical discrimination—which has been illegal since 1968 under the Fair Housing Act. Overall, we find that differential treatment has played a limited role in generating denial disparities in recent years, consistent with significant progress in fair lending over the last 30 years.

Rather than differential treatment, we find that group differences in risk characteristics drive most of the disparities in credit access. To start, we show that Black and Hispanic applicants tend to be more leveraged and have much lower credit scores. For example, the average credit score for Black applicants is over 40 points lower than white applicants. We also document that Black and Hispanic applicants are less likely to receive algorithmic approval recommendations from government automated underwriting systems (AUS) than white applicants. These AUS recommendations reflect the underwriting and eligibility guidelines of Fannie Mae, Freddie Mac, the Federal Housing Administration (FHA), and the Veterans Administration (VA), and are “color blind” in that race and ethnicity (or proxies like neighborhood location) cannot be used in the algorithm.

Articles for October 14, 2022

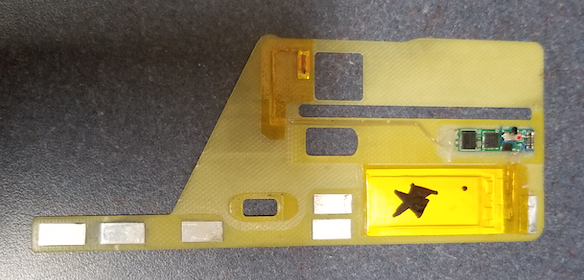

- How Wi-Fi Spy Drones Snooped on a Financial Firm

- White House to Unveil Ambitious Cybersecurity Labeling Effort Modeled After Energy Star

- US Senator Introduces ‘No Digital Dollar Act’ to Prohibit Treasury and the Fed From Interfering With Americans Using Paper Currency

- Treasury Announces Two Enforcement Actions for over $24M and $29M Against Virtual Currency Exchange Bittrex, Inc. Enforcement Actions by OFAC and FinCEN for Apparent Violations of Sanctions and Anti-Money Laundering Obligations

How Wi-Fi Spy Drones Snooped on a Financial Firm

Check your rooftops: Flying gear caught carrying network-intrusion kit

Courtesy of Thomas Claburn, The Register

Oct. 6, 2022 — Modified off-the-shelf drones have been found carrying wireless network-intrusion kit in a very unlikely place. The idea of using consumer-oriented drones for hacking has been explored over the past decade at security conferences like Black Hat 2016, in both the US and in Europe. Naomi Wu, a DIY tech enthusiast, demonstrated a related project called Screaming Fist in 2017. And in 2013, security researcher Samy Kamkar demonstrated his SkyJack drone, which used a Raspberry Pi to take over other drones via Wi-Fi.

Oct. 6, 2022 — Modified off-the-shelf drones have been found carrying wireless network-intrusion kit in a very unlikely place. The idea of using consumer-oriented drones for hacking has been explored over the past decade at security conferences like Black Hat 2016, in both the US and in Europe. Naomi Wu, a DIY tech enthusiast, demonstrated a related project called Screaming Fist in 2017. And in 2013, security researcher Samy Kamkar demonstrated his SkyJack drone, which used a Raspberry Pi to take over other drones via Wi-Fi.

Now, these sorts of attacks are actually taking place.

Greg Linares, a security researcher, recently recounted an incident that he said occurred over the summer at a US East Coast financial firm focused on private investment. He told The Register that he was not involved directly with the investigation but interacted with those involved as part of his work in the finance sector.

The Register corresponded with an individual affiliated with the affected company who corroborated Linares’s account and asked not to be identified owing to a non-disclosure agreement and employment concerns. In a Twitter thread, Linares said the hacking incident was discovered when the financial firm spotted unusual activity on its internal Atlassian Confluence page that originated from within the company’s network.

The company’s security team responded and found that the user whose MAC address was used to gain partial access to the company Wi-Fi network was also logged in at home several miles away. That is to say, the user was active off-site but someone within Wi-Fi range of the building was trying to wirelessly use that user’s MAC address, which is a red flag. The team then took steps to trace the Wi-Fi signal and used a Fluke system to identify the Wi-Fi device.

“This led the team to the roof, where a ‘modified DJI Matrice 600’ and a ‘modified DJI Phantom’ series were discovered,” Linares explained.

The Phantom drone was in fine condition and had a modified Wi-Fi Pineapple device, used for network penetration testing, according to Linares. The Matrice drone was carrying a case that contained a Raspberry Pi, several batteries, a GPD mini laptop, a 4G modem, and another Wi-Fi device. It had landed near the building’s heating and ventilation system and appeared to be damaged but still operable.

“During their investigation, they determined that the DJI Phantom drone had originally been used a few days prior to intercept a worker’s credentials and Wi-Fi,” Linares said. “This data was later hard coded into the tools that were deployed with the Matrice.”

Click here to read the entire article.

White House to Unveil Ambitious Cybersecurity Labeling Effort Modeled After Energy Star

Courtesy of Suzanne Smalley, CyberScoop

Courtesy of Suzanne Smalley, CyberScoop

Oct. 11, 2022 — The White House National Security Council will announce plans Tuesday for a consumer products cybersecurity labeling program intended to improve digital safeguards on internet-connected devices, a senior White House official told CyberScoop.

About 50 representatives from consumer product associations, manufacturing companies and technology think tanks will convene at the White House on Oct. 19 for a workshop on the voluntary effort ahead of an expected spring 2023 launch.

The White House briefly described the effort in a document it released Tuesday outlining various cybersecurity initiatives. The administration plans to start with recommending three or four cybersecurity standards that manufacturers can use as the basis for labels that communicate the risks associated with using so-called internet of things devices.

Related Fact Sheet: Biden-Harris Administration Delivers on Strengthening America’s Cybersecurity

Deputy National Security Adviser for Cyber and Emerging Tech Anne Neuberger is spearheading the initiative, which is modeled after Energy Star, a labeling program the Environmental Protection Agency and the Department of Energy operate to promote energy efficiency, the senior administration official said.

“Today when folks buy tech, they buy it for a cool feature, speed to market — cybersecurity is often an afterthought,” said the official, who requested to remain anonymous to speak candidly about the effort. “Everybody realizes that it’s an idea whose time has come.”

The administration is working with the European Union to align on standards since the White House wants products with cybersecurity labels to be sold globally.

The standards under consideration could rate products based on how often manufacturers deploy patches for software vulnerabilities or whether devices connect to the internet without a password, the official said. It is not yet clear who will verify companies’ claims.

The White House hopes the program will reward companies that invest in cybersecurity while also helping consumers find safer products. The status quo in which products hit the market quickly, leaving consumers to muddle through or ignore products’ cybersecurity features, is “not sustainable,” the official said.

In its final report, the U.S. Cybersecurity Solarium Commission recommended that Congress create a nonprofit national cybersecurity certification and labeling authority tasked with “establishing and managing a voluntary cybersecurity certification and labeling program for information and communication technologies,” including software, devices and industrial control systems.

CSC Executive Director Mark Montgomery hailed the White House decision to pursue a labeling program but warned it will be difficult to design and stand up.

Click here to read the entire article.

US Senator Introduces ‘No Digital Dollar Act’ to Prohibit Treasury and the Fed From Interfering With Americans Using Paper Currency

Courtesy of Kevin Helms, Bitcoin.com

Oct. 1, 2022 — A U.S senator has introduced the “No Digital Dollar Act to prohibit the U.S. Treasury and the Federal Reserve from interfering with Americans using paper currency” if a central bank digital currency is adopted. The bill further states: “No central bank digital currency shall be considered legal tender under section 16 5103 of title 31, United States Code.”

No Digital Dollar Act Introduced

U.S. Senator James Lankford (R-OK) announced Thursday that he has introduced a bill titled “No Digital Dollar Act to prohibit the U.S. Treasury and the Federal Reserve from interfering with Americans using paper currency if a digital currency is adopted and makes certain individuals can maintain privacy over their transactions using cash and coins.”

The bill will “amend the Federal Reserve Act to prohibit the Board of Governors of the Federal Reserve System from discontinuing Federal Reserve notes if a central bank digital currency is issued, and for other purposes,” according to the text of the bill.

Furthermore, “the Secretary of the Treasury may not discontinue minting and issuing coins under this section if a central bank digital currency is issued,” the bill details, adding: No central bank digital currency shall be considered legal tender under section 16 5103 of title 31, United States Code.

Senator Lankford explained that residents in his state have expressed to him their concern that the Treasury “could phase out paper money and transition to a digital dollar.” He stressed that many Oklahomans “still prefer hard currency or at least the option of hard currency.”

The lawmaker added, “There are still questions, cyber concerns, and security risks for digital money,” emphasizing: “There is no reason we can’t continue to have paper and digital money in our nation and allow the American people to decide how to carry and spend their own money.”

Lankford stressed: As technology advances, Americans should not have to worry about every transaction in their financial life being tracked or their money being deleted.

The lawmaker explained that “There is currently no federal statute that prohibits the Treasury from only having a digital currency.”

While the Federal Reserve is working on a digital dollar, Fed Chair Jerome Powell said this week that a U.S. central bank digital currency (CBDC) will take at least a couple of years. “We are looking at it very carefully. We are evaluating both the policy issues and the technology issues, and we are doing that with a very broad scope,” Powell said.

Treasury Announces Two Enforcement Actions for over $24M and $29M Against Virtual Currency Exchange Bittrex, Inc.

Enforcement Actions by OFAC and FinCEN for Apparent Violations of Sanctions and Anti-Money Laundering Obligations

Oct. 11, 2022 — The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and Financial Crimes Enforcement Network (FinCEN) announced settlements for over $24 million and $29 million, respectively, with Bittrex, Inc. (Bittrex), a virtual currency exchange based in Bellevue, Washington. This is OFAC’s largest virtual currency enforcement action to date. It also represents the first parallel enforcement actions by FinCEN and OFAC in this space. Investigations by OFAC and FinCEN found apparent violations of multiple sanctions programs and willful violations of the Bank Secrecy Act’s (BSA’s) anti-money laundering (AML) and suspicious activity report (SAR) reporting requirements. These enforcement actions emphasize to the virtual currency industry the importance of implementing appropriate risk-based sanctions compliance controls and meeting obligations under the BSA. The failure to take action can result in violations of OFAC and FinCEN regulations and expose exchanges and others in the virtual currency industry to potential abuse by illicit actors.

Oct. 11, 2022 — The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and Financial Crimes Enforcement Network (FinCEN) announced settlements for over $24 million and $29 million, respectively, with Bittrex, Inc. (Bittrex), a virtual currency exchange based in Bellevue, Washington. This is OFAC’s largest virtual currency enforcement action to date. It also represents the first parallel enforcement actions by FinCEN and OFAC in this space. Investigations by OFAC and FinCEN found apparent violations of multiple sanctions programs and willful violations of the Bank Secrecy Act’s (BSA’s) anti-money laundering (AML) and suspicious activity report (SAR) reporting requirements. These enforcement actions emphasize to the virtual currency industry the importance of implementing appropriate risk-based sanctions compliance controls and meeting obligations under the BSA. The failure to take action can result in violations of OFAC and FinCEN regulations and expose exchanges and others in the virtual currency industry to potential abuse by illicit actors.

OVERVIEW OF OFAC SETTLEMENT WITH BITTREX

Bittrex has agreed to remit $24,280,829.20 to OFAC to settle its potential civil liability for 116,421 apparent violations of multiple sanctions programs. As a result of deficiencies related to Bittrex’s sanctions compliance procedures, Bittrex failed to prevent persons apparently located in the Crimea region of Ukraine, Cuba, Iran, Sudan, and Syria from using its platform to engage in approximately $263,451,600.13 worth of virtual currency-related transactions between March 2014 and December 2017. The applicable sanctions programs generally prohibited U.S. persons from engaging in transactions with these jurisdictions. Based on internet protocol (“IP”) address information and physical address information collected about each customer at onboarding, Bittrex had reason to know that these users were located in jurisdictions subject to sanctions. At the time of the transactions, however, Bittrex was not screening this customer information for terms associated with sanctioned jurisdictions. This information was not voluntarily self-disclosed.

A full description of OFAC’s settlement can be found here.

OVERVIEW OF FINCEN SETTLEMENT WITH BITTREX

Bittrex has agreed to remit $29,280,829.20 for its willful violations of the BSA’s AML program and SAR requirements. FinCEN will credit the payment of $24,280,829.20 as part of Bittrex’s agreement to settle its potential liability with OFAC. FinCEN’s investigation found that, from February 2014 through December 2018, Bittrex failed to maintain an effective AML program. This included deploying inadequate and ineffective transaction monitoring on its platform resulting in significant exposure to illicit finance. Further, Bittrex’s AML program failed to appropriately address the risks associated with the products and services it offered, including anonymity-enhanced cryptocurrencies. Bittrex failed to file any SARs between February 2014 and May 2017, a period of over three years. Bittrex also failed to file SARs on a significant number of transactions involving sanctioned jurisdictions, including transactions that were suspicious above and beyond the fact that they involved a sanctioned jurisdiction. A detailed description of FinCEN’s consent order can be found here.

ADDITIONAL RESOURCES

For information on complying with virtual currency sanctions, see OFAC’s Sanctions Compliance Guidance for the Virtual Currency Industry here and OFAC’s FAQs on virtual currency here.

Articles for October 7, 2022

- FinTech Partnerships Pave Path for Branchless Banking

- When are State Money Transmission Laws Applicable? Blockchain Game Developers and FinCEN

- Mortgage Borrowers Can Challenge Inaccurate Appraisals Through the Reconsideration of Value Process

- Innovator Q&A: Digital Currency Risks May Be On The Rise, But There’s Hope For Tracking Fraud

- Crypto Contributions to US Election Campaigns Require Legal Navigation

FinTech Partnerships Pave Path for Branchless Banking

Courtesy of PYMNTS.com

Oct. 6, 2022 — The successful digital bank offers more than banking cloaked in an online wrapper.nTreasury Prime Vice President of Banking Jeff Nowicki, Emprise Bank Senior VP of Innovation and Development Emily Reisig and Zeta CEO Aditi Shekar told PYMNTS that the branchless approach has the potential to open up new opportunities to both traditional banks and FinTechs.

Oct. 6, 2022 — The successful digital bank offers more than banking cloaked in an online wrapper.nTreasury Prime Vice President of Banking Jeff Nowicki, Emprise Bank Senior VP of Innovation and Development Emily Reisig and Zeta CEO Aditi Shekar told PYMNTS that the branchless approach has the potential to open up new opportunities to both traditional banks and FinTechs.

But to get there, providers need to understand the changing needs and desires of their targeted, tech-savvy — and younger — customers. PYMNTS’ own studies show that a majority of consumers love digital banking features and are happy using digital banks and FinTechs. But fewer than 10% use them as their primary account.

Shekar noted that — with a nod to the millennials out there that opt to interact with their financial services providers online — “our generation has evolved as a digitally native generation.” And as those consumers get older, the expectations of every aspect of lives, banking included, are that the experiences will be “upgraded” to be increasingly available online.

Related Reading: Why Banking Apps Need to Be More Than Just Banking Apps

As so much of life is shifted online, Shekar said, “community is not going to be about where you live — it’s going to be about who you like to talk to and who you like to spend your time with online.” The pressure is on, then, for the banks to upgrade their digital offerings, too, enabling a seamless flow of money movement. To do so, financial institutions (FI) and FinTechs both need to understand the very real shifts happening in the households they seek to serve more adroitly.

We’re no longer in what Shekar termed “single payer mode,” where one person earns the money and spends it. The millennial generation, she remarked, is typically marked by dual income households, and younger consumers neither earn nor manage spend — or even share it — the same way as their parents.

Emprise Bank’s Reisig remarked that “there’s the pressures of technology and of innovation — the technology experiences become the new expectation of our customers.”

Linking Banks and FinTechs

In the past, said panelists, banks may have eyed FinTechs with suspicion, and consumer FinTechs may have sought to build everything in house, or eyed banking charters as a key way to create the digital bank of the future.

But Reisig said there’s room for a partnership model where FinTechs can innovate, create delightful experiences and solve frictions inherent in the digital channels emerging in financial services. Banks like Emprise, she said, can be a supportive banking partner, bringing their knowledge and expertise to bear on all manner of critical banking products.

The banks and FinTechs need a bit of connective tissue to tie their respective strengths together, Nowicki said, who added that providers including Treasury Prime can help connect the two sides of that digital banking equation. The banks, he said, bring their strengths in risk management and regulatory compliance to the table, as purely digital relationships continue to be forged between consumers and banking entities.

“It’s important for the banks that are entering into [the digital banking] space,” he said, “to keep control of certain aspects of the programs and of the relationships.” For the FinTechs, said Shekar, there’s the advantage of not having to build deep integrations with each and every bank partner.

As she noted, “I am not a compliance expert — I’m a software builder, and I like the ability to stay in my lane while still leveraging the capabilities of a bank partner and Treasury Prime at the same time.”

Click here to read the entire article.

When are State Money Transmission Laws Applicable? Blockchain Game Developers and FinCEN

Courtesy of Sheppard Mullin Richter & Hampton LLP; National Law Review, Volume XII, Number 277

Oct. 4, 2022 — The rising prevalence of crypto and virtual currencies has invited the scrutiny of several regulatory bodies who continue to grapple with the unique challenges posed by blockchain technology, FinCEN being one prime example. The Financial Crimes Enforcement Network (“FinCEN”) is an arm of the United States Department of Treasury that seeks to impede financial crimes such as money laundering and terrorist financing, and was the first financial regulator in the U.S. to address virtual currency.

Oct. 4, 2022 — The rising prevalence of crypto and virtual currencies has invited the scrutiny of several regulatory bodies who continue to grapple with the unique challenges posed by blockchain technology, FinCEN being one prime example. The Financial Crimes Enforcement Network (“FinCEN”) is an arm of the United States Department of Treasury that seeks to impede financial crimes such as money laundering and terrorist financing, and was the first financial regulator in the U.S. to address virtual currency.

Unsurprisingly, the potential misuse of blockchain technology to conceal money laundering activities—among other financial crimes—is a central issue for FinCEN, which is tasked with implementing and enforcing regulations applicable to these activities. Game developers and publishers monetizing the evolving ecosystem of blockchain games should take particular note—especially as it relates to games that facilitate in-game fungible or non-fungible token exchanges.

As background, FinCEN serves to regulate money transmitters under the federal Bank Secrecy Act. A money transmitter is typically an individual or business that engages in the transfer of funds whether they be based in real or virtual currencies. Such a transfer can occur by any means including by wire or electronic transfer. FinCEN requires all money transmitters to register with FinCEN and comply with a number of compliance obligations including regular reporting to FinCEN (particularly as it relates to user/customer identification and transaction data). On top of that, a myriad of state laws also exists that impose additional regulations on money transmitters. For instance, many states have instituted expensive licensure requirements.

To date, FinCEN has published guidance in several instances regarding its view on how convertible virtual currencies should be treated. First, in 2013, FinCEN explained that “[t]he definition of a money transmitter does not differentiate between real currencies and convertible virtual currencies” and noted that “[a]ccepting and transmitting anything of value that substitutes for currency makes a person a money transmitter under the regulations implementing the [Bank Secrecy Act].” Then, in 2019, FinCEN’s update to its original guidance in fact affirmed its 2013 interpretation and did not establish any new regulatory expectations or requirements.

To date, FinCEN has published guidance in several instances regarding its view on how convertible virtual currencies should be treated. First, in 2013, FinCEN explained that “[t]he definition of a money transmitter does not differentiate between real currencies and convertible virtual currencies” and noted that “[a]ccepting and transmitting anything of value that substitutes for currency makes a person a money transmitter under the regulations implementing the [Bank Secrecy Act].” Then, in 2019, FinCEN’s update to its original guidance in fact affirmed its 2013 interpretation and did not establish any new regulatory expectations or requirements.

Thus, under FinCEN’s interpretation, a business that serves as a middleman, accepting payment via virtual currency from one user and passing it along to another, likely qualifies as a money transmitter. In the context of blockchain games, if a game publisher plays a role as a money transmitter in an exchange of tokens—that are deemed a convertible virtual currency—between players, the game publisher is likely also subject to the Bank Secrecy Act and other money transmitter laws. As a result, each game developer that facilitates token exchanges should evaluate which legal and regulatory obligations are applicable to it, in order to maintain compliance with federal laws.

As for state money transmitter laws, such a game might or might not qualify as a money transmitter based on these facts. For instance, California’s Department of Financial Protection and Innovation regulates money transmitters in the state under California’s Money Transmission Act (Cal. Fin. Code § 2000 et seq.), but the guidance around classifying and commercializing certain virtual currency services is still evolving. Thus, if a game developer resides in California and his or her game includes any form of token exchange using virtual currencies, then consulting with an attorney to consider the specific facts would be highly advised to determine whether a license to transmit money is required in California. However, even if a California license is not required, the game developer might still need to comply with federal and other states’ licensure requirements.

Mortgage Borrowers Can Challenge Inaccurate Appraisals Through the Reconsideration of Value Process

Courtesy of Patrice Alexander Ficklin, Makalia Griffith, and Tim Lambert, CFPB

Oct. 6, 2022 — Accurate appraisals are essential to the integrity of mortgage lending. Overvaluation can decrease affordability, make it harder to sell a home or refinance, and increase the risk of foreclosure. Undervaluation can prevent a homeowner from accessing accumulated equity, whether through sale or a home equity loan. Both over- and under-valuation keep individuals, families, and neighborhoods from building wealth through homeownership.

Oct. 6, 2022 — Accurate appraisals are essential to the integrity of mortgage lending. Overvaluation can decrease affordability, make it harder to sell a home or refinance, and increase the risk of foreclosure. Undervaluation can prevent a homeowner from accessing accumulated equity, whether through sale or a home equity loan. Both over- and under-valuation keep individuals, families, and neighborhoods from building wealth through homeownership.

Homebuyers and homeowners can ask for a lender to reconsider a home valuation the consumer believes to be inaccurate. This process is often referred to as a “reconsideration of value” or “ROV.” Borrowers can point out, for example, factual or other errors or omissions, inadequate comparable properties, or provide evidence that the appraisal was influenced by prohibited bias.

Responsible lenders focused on serving their customers typically will provide borrowers with clear, actionable information about how to raise concerns about the accuracy of an appraisal. A lender’s reconsideration of value process must ensure that all borrowers have an opportunity to explain why they believe that a valuation is inaccurate and the benefit of a reconsideration to determine whether an adjustment is appropriate. While an individual lender’s reconsideration of valuation process may vary, lenders must make sure that their reconsideration of value process is nondiscriminatory and available and accessible to all.

Some lenders include information about how to request a reconsideration of value in the copies of appraisals and other home valuations required under the Equal Credit Opportunity Act Valuations Rule. Other lenders may provide information about the reconsideration of value process and a borrower’s ability to provide relevant information before an appraisal is conducted. When lenders provide borrowers with clear, plain-language notice of reconsideration of value opportunities, lenders help ensure that their reconsideration of value process is nondiscriminatory. Lenders that fail to have a clear and consistent method to ensure that borrowers can seek a reconsideration of value risk violating federal law.

Ensuring that homebuyers and homeowners can challenge inaccurate appraisals is one of many efforts that the CFPB and other federal agencies are working on to ensure fair and accurate appraisals. The CFPB has already taken the first step to implement legal requirements to limit bias in algorithmic appraisals. Regulators are also working to provide more oversight over the activities of the Appraisal Foundation, which wields enormous power over the appraisal industry. Learn more about the work of the Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) .

Innovator Q&A: Digital Currency Risks May Be On The Rise, But There’s Hope For Tracking Fraud

Courtesy of Zach Warren, Thomson Reuters Institute

Oct. 4, 2022 — In an in-depth interview with Gurvais Grigg of Chainalysis, we examine how the growth in the use of digital currency also has led to an increase in incidents of fraud involving such assets

For those not fully invested in the digital currency world, it may be tough to completely understand its scope. Although digital assets only began to be traded in 2009, the current worldwide market cap for digital currencies sits at around $1 trillion dollars, according to CoinMarketCap, and nearly $400 billion of that is Bitcoin alone.

Related Reading: Cost of Living Crisis: The Implications for Financial Crime

As digital currencies have become more prominent, however, so has fraud involving crypto. In fact, scammers captured $14 billion in digital currency in 2021, according to blockchain analysis company Chainalysis.

Those numbers can be eyepopping for compliance professionals tasked with tracking financial transactions and identifying potential fraud. Those numbers certainly captured Gurvais Grigg’s attention. Grigg, Chainalysis’s Global Public Sector Chief Technology Officer, moved to the private sector in April 2021 by joining Chainalysis after 23 years at the Federal Bureau of Investigation (FBI), most recently as Assistant Director of the FBI Laboratory. An eight-year-old startup, Chainalysis provides software that tracks blockchain transactions, providing the government and financial institution risk managers with both the tools and education around digital transactions and where money is flowing in this emerging ecosystem.

Those numbers can be eyepopping for compliance professionals tasked with tracking financial transactions and identifying potential fraud. Those numbers certainly captured Gurvais Grigg’s attention. Grigg, Chainalysis’s Global Public Sector Chief Technology Officer, moved to the private sector in April 2021 by joining Chainalysis after 23 years at the Federal Bureau of Investigation (FBI), most recently as Assistant Director of the FBI Laboratory. An eight-year-old startup, Chainalysis provides software that tracks blockchain transactions, providing the government and financial institution risk managers with both the tools and education around digital transactions and where money is flowing in this emerging ecosystem.

The past year-plus tracking digital currency transactions and fraud have only strengthened the belief that financial institutions and those with whom they work need to begin planning for digital asset risks now. Recently, the Thomson Reuters Institute caught up with Grigg to discuss why he views the blockchain and digital asset transactions as inherently transparent, emerging risks that fraud managers need to know, and what the future of digital asset transactions portends from here.

Thomson Reuters Institute: You’ve written that blockchain can actually increase transparency rather than lessen it. What about the technology makes it trackable?

Gurvais Grigg: It’s a common misconception that crypto is anonymous and untraceable. In fact, it’s quite the opposite: Cryptocurrencies operate on public, immutable ledgers known as blockchains, and anyone can look up the entire history of transactions of cryptocurrencies that use public blockchains like Bitcoin. Cryptocurrencies are more transparent than most traditional forms of value transfer.

Because the blockchain is permanent and immutable, investigators or consumers are able to see transactions in real-time or access them years later with confidence that the records have not been altered. The same is not always the case with traditional fiat investigations and other asset types. Blockchain analytics and data can significantly reduce investigation time and provide this unparalleled transparency for investigators, regulators, and compliance officers now and into the future.

Thomson Reuters Institute: Digital currency in particular has had a reputation for being where people can go to hide money or transactions. Is this reputation changing? And should it?

Gurvais Grigg: Criminals often embrace new technologies, and cryptocurrency is no exception. The early adoption of cryptocurrency by some criminals helped shape its initial reputation. And crypto remains appealing for criminals, primarily due to its pseudonymous nature and the ease with which it allows users to instantly send funds anywhere in the world, despite its transparent and traceable design. Criminals and nation state actors are turning to digital assets for many of the same reasons so many legitimate consumers: Crypto is a low cost, high speed, and secure way to transfer value.

Click here to read the entire interview.

Crypto Contributions to US Election Campaigns Require Legal Navigation

Courtesy of Todd Ehret, Thomson Reuters

Sept. 13, 2022 — As campaign fundraising heats up ahead of the US midterm elections, making political campaign contributions via cryptocurrencies requires careful navigation of federal and state law

Sept. 13, 2022 — As campaign fundraising heats up ahead of the US midterm elections, making political campaign contributions via cryptocurrencies requires careful navigation of federal and state law

The Federal Election Commission (FEC), which governs campaigns for Congress and the presidency, allows cryptocurrency contributions to political committees. State and local races across the country are a different story — campaign finance laws vary significantly. Further, the laws are quickly changing. California, for example, recently reversed a 2018 ban on the use of cryptocurrencies for campaign contributions.

“The landscape of crypto campaign contributions remains a rapidly developing area,” says Chris White, a campaign-finance specialist with the Washington DC-based law firm Wiley Rein.

In an article published on the law firm’s website in June, White and Wiley co-author Caleb Burns wrote: “As interest in the use of cryptocurrencies for political contributions has increased, states have begun to fashion their own sets of laws and regulations governing the use of cryptocurrencies in campaign finance. The approaches taken at the state level fall on a spectrum from a total ban on the contribution or use of cryptocurrencies to the explicit approval of contributions made via cryptocurrency.”

With such a rapidly changing patchwork of laws, it would be wise for professionals in this area to keep up with the legality of crypto campaign contributions.

Federal elections

A 2014 advisory opinion from the FEC gave a green light to political action committees accepting contributions in Bitcoin. Also, individual federal candidates can accept donations on the form of cryptocurrency, but the FEC prohibits using cryptocurrencies to pay for campaign expenditures.

The FEC holds that that cryptocurrencies fall under the “anything of value” catch-all areas of the Federal Election Campaign Act, which defines such contributions as “any gift, subscription, loan, advance, or deposit of money or anything of value made by any person for the purpose of influencing any election for Federal office.” Therefore, cryptocurrencies are treated similarly to “stocks, bonds, art objects and other similar items that cannot be deposited upon receipt, but will be liquidated at a later date.” The donation’s value is based on the market value of the cryptocurrency on the day of the donation.

Although the FEC specifically referenced Bitcoin in the 2014 advisory, it is presumed that the advisory would apply to other crypto assets. (The commission has a detailed guide to reporting crypto donations on its website.)

States with a green light

In addition to the FEC, Arizona, Colorado, Iowa, Ohio, Tennessee, and Washington have said contributions made via cryptocurrency are permissible.

California recently joined the list when it reversed its ban on crypto contributions after the California Fair Political Practices Commission voted unanimously to repeal the state’s ban on cryptocurrency donations and adopt new rules for accepting the funds. The new California regulation was finalized in late July and will take effect within 60 days. It requires that donations be verified via a know-your-customer (KYC) procedure and be processed through a US-based third-party payments processor registered with Treasury’s Financial Crimes Enforcement Network.

Colorado, Iowa, Ohio, and Tennessee have followed the FEC’s guidance and requirement that the donations should be fair valued at the time of the contributions, and any increases or decreases should be treated as other income or expenditure.

Conversely, Washington and Arizona are treating cryptocurrencies more like traditional forms of currency. Washington state has taken a more restrictive approach, treating crypto donations as the equivalent of cash contributions, capping them at $100, requiring them to be converted to fiat currency within five business days, and prohibiting the use of crypto for the purchase of goods and services. While Arizona stated that “committee[s] may accept an in-kind contribution in the form of cryptocurrency… and such contributions are generally subject to the same rules applicable to traditional contributions in US currency.”

“In keeping with this treatment of cryptocurrency as analogous to ‘traditional’ US currency rather than a commodity, Arizona has neither expressly approved nor expressly foreclosed the use of cryptocurrency by political committees to purchase goods or services,” explained the attorneys at Wiley in their article.

Click here to read the entire article.

Articles for September 30, 2022 Issue:

- The DeFi Financial Crime Arms Race: By Taking A Fresh Approach to Stamping Out Financial Crime We Can Build a Safer Future for DeFi.

- Related reading: FIs Seek Expert Insights on How Best to Tame Crypto

- Fintech Firms Suffer Data Breach Due To Critical Zoho Flaw

- Related event: Registration Open for NCUA Webinar on Defending Against Ransomware Attacks

- Related reading: 21 Hackers Made Over $1m on HackerOne

- Bank to Pay $13M in Mortgage Redlining Case, as Feds Target Discriminatory Loan Practices

- ICYMI: An Iowa Credit Union Sues Apple for Antitrust Violations

The DeFi Financial Crime Arms Race: By Taking A Fresh Approach to Stamping Out Financial Crime We Can Build a Safer Future for DeFi.

Courtesy of Michael Karbouris, CoinDesk

Sept. 27, 2022 — Decentralized finance (DeFi) is a vibrant and innovative ecosystem that has the potential to improve efficiency and transparency in financial markets and serve as a driving force in redefining the future of finance. Built on public permissionless blockchains, DeFi’s mission is to give anyone with an internet connection the ability to tap into financial services, which in turn promotes equal opportunity and financial democratization around the world.

Sept. 27, 2022 — Decentralized finance (DeFi) is a vibrant and innovative ecosystem that has the potential to improve efficiency and transparency in financial markets and serve as a driving force in redefining the future of finance. Built on public permissionless blockchains, DeFi’s mission is to give anyone with an internet connection the ability to tap into financial services, which in turn promotes equal opportunity and financial democratization around the world.

However, given its open nature, DeFi is undergoing the same arms race that has plagued every nascent but innovative technology and industry: fighting criminals who want to take advantage of it.

Related reading: FIs Seek Expert Insights on How Best to Tame Crypto

DeFi is no stranger to financial crime. In 2021, money laundering in crypto accounted for more than $8 billion, with almost $1 billion of this being sent to DeFi protocols. While these headline numbers are concerning, let’s put them in context. It’s estimated that somewhere between 100 and 250 times that number in fiat currency is laundered each year in traditional financial markets – most of it opaque, much of it undetected, and even less acted upon by law enforcement.

The fact that we can estimate with a much higher degree of accuracy how much money is being laundered in DeFi highlights a truth that is sometimes overlooked: DeFi is largely transparent, and a transparent market should in theory be easier to police. The ability to monitor almost every transaction is something that is still near impossible to carry out in traditional fiat markets. And yes, while privacy-oriented protocols in DeFi will likely only get more popular, the beauty of zero-knowledge proof technology is that it allows opt-in transparency while maintaining privacy through pseudo-anonymity.

When it comes to DeFi, ultimately we all want an ecosystem with integrity, one that breeds confidence for the growing crypto community. But simply looking to traditional finance (TradFi) as a model on how to achieve this is not optimal. Rather than trying to fit existing regulations tailored for TradFi markets, we should be understanding DeFi’s idiosyncrasies, focusing on the types of financial crimes that are unique to the DeFi ecosystem and that truly hurt the end user, and aligning methods of detection and prevention with crypto’s core values of decentralization and trustlessness.

The various shades of DeFi-specific financial crime

The whole point of laundering money is to make illicit income, usually generated through criminal activity, appear legal. When it comes to crypto, criminal activities such as theft and fraud can look vastly different to how they appear in traditional financial markets. This is a result of the public nature of the technology, lack of intermediaries and the pseudo-anonymity afforded by permissionless blockchains.

Fintech Firms Suffer Data Breach Due To Critical Zoho Flaw

Courtesy of Jurgita Lapienytė, CyberNews

Sept. 27, 2022 — A technology platform servicing financial technology companies fell victim to a cyberattack that exposed sensitive end-user data. Most likely, threat actors behind the breach exploited a critical vulnerability in Zoho’s ManageEngine product.

Sept. 27, 2022 — A technology platform servicing financial technology companies fell victim to a cyberattack that exposed sensitive end-user data. Most likely, threat actors behind the breach exploited a critical vulnerability in Zoho’s ManageEngine product.

Last week, the Cybersecurity and Infrastructure Security Agency (CISA) warned of a critical remote code execution (RCE) vulnerability in the Indian company’s ManageEngine program, warning it has been exploited in the wild.

Rated 9.8 out of 10 on the The Common Vulnerability Scoring System (CVSS), the bug was patched by Zoho on June 24.

Related reading: 21 Hackers Made Over $1M on HackerOne

Related event: Registration Open for NCUA Webinar on Defending Against Ransomware Attacks

“This remote code execution vulnerability could allow attackers to execute arbitrary code on affected installations of Password Manager Pro, PAM360, and Access Manager Plus. Authentication is not required to exploit this vulnerability in Password Manager Pro and PAM360 products,” Zoho said in June, urging users to upgrade immediately.

Zoho has at least 80 million customers worldwide, including big companies like Netflix, Amazon, Fortinet, Facebook, KPMG, Renault, HP, and Tesla, among others.

CISA issued a warning “based on evidence of active exploitation.” The Cybernews Research team found one instance where threat actors most likely exploited the critical flaw to breach an organization.

The hack

A threat actor hacked into the BankingLab software-as-a-service (SaaS) banking platform, servicing fintech companies, and is giving away access to its clients’ servers and customers for free. It is believed that BankingLab had been relying on ManageEngine to protect its network.

On September 24, a new user on a popular hacker forum posted the following message: “Recently, we have obtained all server permissions of BankingLab and obtained all customer data, including the transaction flow of each customer’s user [and] identity information. Now I will share the data and master key of the PAM360 password management system inside BankingLab with you, which contains the sshkey of internal services [and] various system and server passwords. Please enjoy.”

BankingLab provides a “full stack of digital banking services” to financial technology (aka “fintech”) companies, including modules for customer account management, payment processing, issuing cards, and providing loans and deposits. Its clients include Vialet, Simplex, Bankera, and Perlas Finance.