California Story Archive

Calif. Gov’s AI Order; CPPA on Cybersecurity Audit & Risk Assessment

Governor’s Executive Order on Artificial Intelligence

Sept. 22, 2023 — The order is rather extensive and largely calls for various state agencies and departments to conduct specific assessments, as well as provide reports on the risk AI poses to California’s energy infrastructure. It also issues guidelines for public sector procurement of generative AI based on White House and National Institute for Standards and Technology-issued guidelines.

CPPA on Cybersecurity Audit and Risk Assessment

The California Privacy Protection Agency (CPPA) recently published two new sets of draft regulations addressing cybersecurity audit and risk assessment. The CPPA has not officially started the formal rulemaking process but they will serve as the foundation for the process moving forward. Discussion of the draft regulations will be a central topic of the CPPA’s meeting on September 8. Read more

California Governor Signs Law Prohibiting Employers from Entering Noncompete Agreements

Sept. 8, 2023 — On September 1, 2023, California Governor Gavin Newsom signed Senate Bill (SB) 699 into law, prohibiting employers from entering into or attempting to enforce noncompete agreements, which are void under state law. The law is set to go into effect on January 1, 2024. Meanwhile, another bill, Assembly Bill (AB) 1076, which would reinforce the state’s broad ban on noncompete agreements, nears passage in the state legislature. Together, the bills come amid a nationwide push to ban noncompete agreements and other restrictive covenants in employment and further California’s leading public policy stance against such agreements. Read more

Addition Financial Partnering to Launch Financial Literacy Program in Preschools

Sept. 8, 2023 — Addition Financial Credit Union has joined with three other partners to launch a financial literacy program for preschools. In all, students in 15 voluntary pre-kindergarten classrooms in the Orange County School District will receive education in becoming “savvy savers and strategic spenders,” the $2.81-billion credit union said. Read more

Calf. Elder Fraud Legislation to Be Heard in Banking Committee – Impacts to FIs

Courtesy of Melissa Mecija, 10News

May 5, 2023 — SB 278 is scheduled to be heard in California’s Senate Banking and Financial Institution Committee Wednesday. The legislation would “clarify that victims of financial elder abuse can continue to hold institutions accountable when they should have known of the fraud but negligently assisted in the transfer anyway,” according to a news release from State Sen. Bill Dodd, who introduced the legislation. Read more

DFPI Launches Sweep of Investment Fraud Claiming Ties to Artificial Intelligence

Apr. 21, 2023 — The California Department of Financial Protection and Innovation (DFPI) announced today it has issued desist and refrain orders against five entities to stop fraudulent investment schemes tied to artificial intelligence (AI).

The orders find that the named entities and individuals violated California securities laws by offering and selling unqualified securities and making material misrepresentations and omissions to investors. The entities solicited funds from investors by claiming to offer high yield investment programs (HYIP) that generate incredible returns by using AI to trade crypto assets. As part of their solicitations, they used multi-level marketing schemes that reward investors for recruiting new investors. Read more

Governor Appoints Patel as DFPI Deputy Commissioner of CUs

Feb. 10, 2023 — California Gov. Gavin Newsom has appointed Purvi Patel as deputy commissioner of credit unions for the California Department of Financial Protection and Innovation (DFPI).

Feb. 10, 2023 — California Gov. Gavin Newsom has appointed Purvi Patel as deputy commissioner of credit unions for the California Department of Financial Protection and Innovation (DFPI).

The DFPI’s deputy commissioner of credit unions position plays a key role in the state regulatory operations and compliance of credit unions chartered in California.

Patel has been serving Self-Help FCU as assistant general counsel since 2022 and was part of the credit union’s executive staff from 2016 to 2022. She was also a senior fellow at New York City’s Economic Development Corporation from 2015 to 2016.

Additionally, Patel was an associate at Buckley Sandler from 2013 to 2015 and a law clerk at the U.S. District Court for the District of Puerto Rico from 2010 to 2012. She was an associate at White & Case from 2008 to 2010, having earned a Juris Doctor degree from Georgetown University Law Center. Read more

Big FOM Expansion Approved for California CU

Courtesy of Michael Ogden, CU Times

Jan. 20, 2023 — Yolo Federal Credit Union, headquartered in Woodland, Calif., has served members just west of Sacramento in Yolo County since 1954. On Wednesday, the credit union ($418 million in assets, 21,331 members) announced it received approval from the NCUA to expand its field of membership well beyond Yolo County, adding a potential membership base of more than 2.1 million people.

With help from the credit union consulting firm Dollar Associates, LLC, Yolo worked for nearly five months to secure the FOM expansion to El Dorado, Placer and Sacramento Counties. According to the U.S. Census Bureau, the population of the three counties combined is 2,106,521. This includes the entire Sacramento metro area.

The goal of the FOM expansion into these markets “is to provide a wide array of affordable financial products and services, and financial education resources to all residents, organizations and businesses of the area.” Yolo officials said they believe they can positively impact the lives of this new membership base, as well as reach underserved and unbanked people who were not able to join the credit union, until now. Read more

California’s SB 1415 Requires Notification of Income from Fees on Nonsufficient Funds and Overdraft Charges

SB 1415 was signed into law by Governor Newsom. It requires state-chartered banks and credit unions to notify the Department of Financial Protection and Innovation (DFPI) annually of the revenue they received from fees on nonsufficient funds and overdraft charges during the calendar year. These reports are due by March 1 so the DFPI can publish the information on its website by March 31.

Read More

California & Nevada Leagues to Launch First-Ever Juntos Avanzamos Chapter

California & Nevada Leagues to Launch First-Ever Juntos Avanzamos Chapter

Dec. 23, 2022 — Inclusiv Network said it has partnered with the National Association of Latino Credit Union and Professionals (NLCUP) and the California and Nevada Leagues to launch the first-ever Juntos Avanzamos-NLCUP Regional Chapter in California. The “Together We Advance” initiative is designed for credit union industry professionals who are committed to financial inclusion to remove barriers and enact real change for unbanked and underbanked communities, the organizations said. Daniel West, vice president of social impact for the Leagues, said the establishment of Juntos Avanzamos-NLCUP Regional Chapters will help leverage the collective voice of credit unions to implement real change in the way Hispanic and Latino communities access and stay connected to the U.S. banking system, the organizations said. Read More

California DFPI Issues Guidance on Crypto

Dec. 16, 2022 — The DFPI has opened multiple investigations in connection with crypto companies. Since last week, the DFPI has announced investigations into FTX, BlockFi, and Salt Lending LLC. Additionally, the DFPI also took enforcement actions against companies that offer crypto interest accounts, including Voyager Digital LLC, Celsius Network LLC, and Nexo Group. In addition to protecting consumers from harm, the DFPI is committed to being a resource for accurate information for consumers and investors on financial topics. Consumer FAQs and Tips for Investors can be found here.

Members Approve Merger That Reaches Across Country

Dec. 9, 2022 — Calif.–Members of the $266-million Parsons Credit Union here have voted in favor of merging into another credit union on the opposite coast of the country. Parsons CU will now become part of the $1.096-billion Skyla FCU in Charlotte, N.C. Skyla is the new brand for the former Charlotte Metro Credit Union.

CA: DFPI Says No MTA License Required to Issue Tokenized U.S. Dollars

Nov. 15, 2022 — Earlier this month, the California Department of Financial Protection & Innovation issued a quasi interpretive opinion regarding whether the unnamed requestor must be licensed under California’s Money Transmission Act to offer platform trading services or to issue tokenized versions of the U.S. Dollar or securities. The MTA requires persons in the business of money transmission in California to be licensed, unless exempt under the act. Cal. Fin. Code § 2030. The MTA currently defines “money transmission” as any of the following:

-

Selling or issuing payment instruments;

-

Selling or issuing stored value; or

-

Receiving money for transmission.

Cal. Fin. Code § 2003(q). “Stored value” is defined as “monetary value representing a claim against the issuer that is stored on an electronic or digital medium and evidenced by an electronic or digital record, and that is intended and accepted for use as a means of redemption for money or monetary value or payment for goods or services. The term does not include a credit card voucher, letter of credit, or any stored value that is only redeemable by the issuer for goods or services provided by the issuer or its affiliate, except to the extent required by applicable law to be redeemable in cash for its cash value. Cal. Fin. Code § 2003(x).

I refer to this as a “quasi interpretive opinion” because the DFPI merely states that it does not currentlyrequire the requestor to obtain an MTA license because the Department “has not determined whether the issuance of tokenized versions of the U.S. Dollar or securities, or their use to trade cryptocurrencies, is money transmission”. READ MORE

California Launches Cannabis Equity Grants Initiative

Courtesy of Douglas Clark, FinancialRegNews.com

Courtesy of Douglas Clark, FinancialRegNews.com

Oct. 6, 2022 — California’s Governor’s Office of Business and Economic Development (GO-Biz) is accepting applications for its Cannabis Equity Grants Program for Local Jurisdictions.

The initiative seeks to advance economic justice for populations and communities harmed by cannabis prohibition and the War on Drugs (WoD) by providing support to local jurisdictions promoting equity and eliminating barriers to enter the newly regulated cannabis industry for equity program applicants

and licensees.

In November 2016, California voters approved Proposition 64 — The Control, Regulate, and Tax Adult Use of Marijuana Act (AUMA) — which called for regulating cannabis in a manner that reducs barriers to entry into the legal, regulated market.

The program is slated to provide $15 million in fiscal year 2022-2023 to advance economic justice in the cannabis industry, with resources including technical support, regulatory compliance assistance and assistance with securing the capital necessary to begin a business.

Applications must be submitted electronically via the online application portal by Dec. 14.

Officials noted that cannabis prohibition and criminalization had a devastating impact on populations and communities statewide. Individuals convicted of a cannabis offense and their families suffer the long-term consequences of prohibition and criminalization. They have a more difficult time entering the newly created adult-use cannabis industry due, in part, to a lack of access to capital, business space, technical support and regulatory compliance assistance, authorities noted.

California Enacts Legal Protections for Cannabis Insurance Providers

Sept. 28, 2022 — Several cannabis-related bills were signed by California Governor Gavin Newsom on September 18, 2022, including Assembly Bill 2568 (AB 2568), which clarifies that it is not a crime for individuals and firms licensed by the California Department of Insurance (CDI) to provide insurance or related services to persons licensed to engage in commercial cannabis activities. Though the California Civil Code was amended in 2018 to clarify that cannabis is the legal object of a contract, and it has been tacitly understood that insurance contracts are legal in California, the intent of this new law is to remove any uncertainty and to encourage further growth of admitted insurance products for California cannabis businesses.

Sept. 28, 2022 — Several cannabis-related bills were signed by California Governor Gavin Newsom on September 18, 2022, including Assembly Bill 2568 (AB 2568), which clarifies that it is not a crime for individuals and firms licensed by the California Department of Insurance (CDI) to provide insurance or related services to persons licensed to engage in commercial cannabis activities. Though the California Civil Code was amended in 2018 to clarify that cannabis is the legal object of a contract, and it has been tacitly understood that insurance contracts are legal in California, the intent of this new law is to remove any uncertainty and to encourage further growth of admitted insurance products for California cannabis businesses.

AB 2568 adds section 26261 to the California Business and Professions Code, which states in relevant part: “An individual or firm that is licensed by the Department of Insurance does not commit a crime under California law solely for providing insurance or related services to persons licensed to engage in commercial cannabis activity pursuant to this division.”

Intent of the Law

The California Assembly’s Committee on Insurance explained the intent behind AB 2568 in a report issued earlier this year:

“The hesitancy of insurance providers to provide insurance for commercial cannabis is attributed to risk, since cannabis is classified as a Schedule I substance under the Federal Controlled Substances Act. Therefore, much of the insurance available in California is from surplus lines. This does not align with the federal government’s longstanding determination that it is in the public’s interest for states to regulate their own insurance marketplaces. Further, the argument has been refuted in federal case law brought about in Green Earth Wellness Center v. Attain Specialty Insurance Company (2016), which established that federal classification of cannabis is not relevant in an insurance provider’s determination to write an insurance policy.

It is important that commercial cannabis businesses have multiple options for insurance as they pursue licensure. AB 2568 clarifies that writing insurance for commercial cannabis does not constitute a crime, since cannabis is part of a legal, regulated market in California. This clarity will provide assurances to admitted insurers that they will not be in violation of any regulations and encourage them to provide an insurance product.”

California Privacy Protection Agency Issues Notice of Proposed Rulemaking

Courtesy of Weiner Brodsky Kider PC, JD Supra

July 25, 2022 — The California Privacy Protection Agency (Agency) recently issued a notice of proposed rulemaking to amend the California Consumer Privacy Act (CCPA) regulations to make them consistent with amendments to the CCPA and to implement provisions under the Consumer Privacy Rights Act (CPRA) establishing new rights for consumers and requirements on businesses. The Agency was established by the CPRA and tasked with implementing and enforcing the CCPA, including promulgating regulations on specific topics.

July 25, 2022 — The California Privacy Protection Agency (Agency) recently issued a notice of proposed rulemaking to amend the California Consumer Privacy Act (CCPA) regulations to make them consistent with amendments to the CCPA and to implement provisions under the Consumer Privacy Rights Act (CPRA) establishing new rights for consumers and requirements on businesses. The Agency was established by the CPRA and tasked with implementing and enforcing the CCPA, including promulgating regulations on specific topics.

The proposed regulation would, among other things, provide guidance and specific requirements for businesses that would facilitate the protection of consumer rights under the CCPA. This includes establishing requirements for disclosures and communications to consumers; establishing requirements for contracts between businesses that sell or share a consumer’s personal information and service providers, contractors, and third parties; and establishing methods for allowing consumers to opt out of the collection, use, retention, and sharing of the consumer’s personal information. The proposed regulations would also establish procedures for the Agency to enforce the CCPA, including through filed complaints and independent investigations.

Comments may be submitted to the Agency via email or mail by 5:00 p.m. on August 23, 2022, or presented to the Agency at an in-person and virtual public hearing on August 24 and 25, 2022.

Judge Rules CU Must Pay $6.3 Million in Attorney Fees After It Lost Taxi Medallion Case

San Francisco Federal Credit Union is appealing, arguing the award is patently unreasonable.

Courtesy of Peter Strozniak, Credit Union Times

July 19, 2022 — A California judge has awarded the San Francisco Municipal Transportation Agency $6.3 million in attorney fees stemming from a four-year taxi medallion legal battle that San Francisco Federal Credit Union lost.

The credit union sued the city agency alleging it breached a lender agreement. But last October, after a three-week trial, a jury found that in five of the credit union’s six breaches of contract claims, the SFMTA did not violate the lender agreement.

However, the jury also found that in one of the breaches of contract claims, the SFMTA did prevent the $1.3 billion San Francisco FCU from receiving the benefits of the lender agreement by not formally declaring an end to the taxi medallion sales program. Nevertheless, the jury also determined that the agency did not act unfairly and without good faith by not formally declaring an end to the medallion sales program.

The credit union is appealing the jury’s verdict and the attorney fees award to the San Francisco Court of Appeals.

San Francisco FCU President/CEO Jonathan Oliver said the credit union pursued this case in an effort to protect the medallion loan holders, the other credit unions who participated in the loan program and membership.

“Under the terms of our contract with the City of San Francisco, when the medallions, which were the security for the loans [and] were no longer transferable, the city was supposed to buy them back. After all, the city received all of the money from the medallion purchases,” Oliver said. “Unfortunately, when push came to shove, the city chose not to do the right thing. The parties then battled it in litigation and the jury found that the program was over. However, due to what we believe was an erroneous jury instruction, they did not find for the credit union. We are in the process of appealing the judgment including the fee award.”

While the credit union’s appeal may take up to a year to be decided, Oliver said San Francisco FCU continues to speak with the city regarding “potential avenues to resolve the situation.” The jury’s verdict held the credit union responsible for paying SFMTA attorney fees and other costs.

On July 5, California Superior Court Judge Harold Kahn filed his decision to award $6,384,137 in legal fees to the SFMTA, but he denied awarding the city agency’s expert witness fees and other non-statutory costs.

The SMFTA initially sought an award of $10,091,433.

Diana Dykstra Named Board Chair of World Council of Credit Unions

Courtesy of Peter Strozniak, Credit Union Times

Photo Credit: Alan Peebles

July 20, 2022 — Diana Dykstra, president/CEO of the California and Nevada Credit Union Leagues, was named board chair of the World Council of Credit Unions during the organization’s conference in Glasgow, Scotland on Tuesday.

She succeeded Rafał Matusiak, president of the National Association of Cooperative Savings and Credit Union-Poland.

Dykstra, who is the second female WOCCU leader, will serve as board chair for a one-year term through July 2023, WOCCU said in a prepared statement. She joined the organization’s board of directors in 2016, serving as treasurer from 2017–2020 and vice chair/secretary from 2021–2022.

“I want to thank you for this honor,” Dykstra said as she addressed 1,500 general session attendees. “I look forward to working with you in the coming year. Thank you so much.”

The WOCCU board of directors also reappointed to two-year terms current directors Dallas Bergl, president/CEO of the $581 million Inova Federal Credit Union in Elkhart, Ind.; Joe Thomas, president/CEO of the $500 million NextMark Federal Credit Union in Fairfax, Va.; and Michael Lawrence, CEO of the Customer Owned Banking Association in Sydney, Australia.

Jeff Guthrie, the new president/CEO of the Canadian Credit Union Association in Toronto, was also appointed to a two-year term. He succeeds outgoing CCUA President/CEO Martha Durdin.

Lucy Ito Named Interim CEO of Orange County’s Credit Union

Lucy Ito Named Interim CEO of Orange County’s Credit Union

The former NASCUS executive leader returns from a short-lived retirement to lead the California financial cooperative.

Courtesy of Peter Strozniak, Credit Union Times

July 11, 2022 — Lucy Ito has placed her retirement on hold to serve as interim CEO of the $2.4 billion Orange County’s Credit Union in Santa Ana, Calif., the board of directors said Monday in a prepared statement.

She succeeds Shruti Miyashiro, who is leaving OCCU to become president/CEO of the $9.8 billion Digital Credit Union in Marlborough, Mass., in August.

Ito most recently served as the president/CEO of the National Association of State Credit Union Supervisors before she retired from that position in December 2021.

Prior to NASCUS, she held leadership positions at the California and Nevada Credit Union Leagues and the World Council of Credit Unions.

Ito is both an Orange County resident and longtime member of Orange County’s Credit Union.

“On behalf of the board of directors, we are thrilled to welcome Lucy Ito to Orange County’s Credit Union as interim CEO,” OCCU Board Chair Gary Burton said in a prepared statement. “With over 30 years of operational and leadership experience in the industry, we are confident Lucy brings the knowledge, people-centered approach and proven track record to be an impactful interim CEO for our associates, members and communities.”

In the prepared statement, OCCU did not say when it expects to appoint a permanent CEO.

First Entertainment Credit Union Gives Creative Professionals the Red-Carpet Treatment in Banking

First Entertainment Credit Union has reliably served people working in film and entertainment at every level in the industry since 1967.

It was founded by employees of Warner Bros. Studios on a small production lot originally under the name Warner Seven Federal Credit Union. Over the years, it has merged with other credit unions associated with film, music and entertainment, including Columbia, MGM, Paramount, A & M Records, and Six Flags, to name a few. Eventually it was renamed First Entertainment Credit Union after switching from a federal to a state charter.

First Entertainment currently operates nine branches in Los Angeles County and manages $2 billion in assets with a team of more than 220 employees. Its membership base now stands at nearly 90,000.

Membership is available to those who work at any of the companies First Entertainment represents and their family members, and extends to anyone who lives, works, worships, attends school or operates a business in Los Angeles County.

An incredible amount of manpower goes into manufacturing the glitz and glamor associated with Hollywood and the mega stars at the forefront of film, music and other forms of entertainment. And not every actor or entertainer has a net worth in the tens of millions.

The reality is that most people who work in these industries have modest incomes, and they need to balance their finances just like the rest of us.

Since industries of this nature rarely provide traditional financial support structures that are more common with typical salary-based jobs, it only makes sense to have banking institutions that cater to those types of workers who don’t receive a W-2.

So for First Entertainment Credit Union, the idea of servicing the local community isn’t common banking jargon – it’s about providing a real resource for those who need support.

CA and NV Leagues Pledge $100k Toward Ukraine Relief Efforts

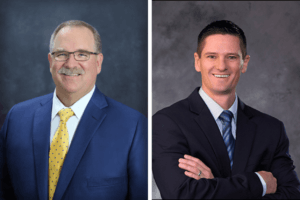

L-R: SAFE CU CEO Dave Roughton, chairman of the California Credit Union League; and Clark County CU CEO Matt Kershaw, chairman of the Nevada Credit Union League

March 18, 2022 — In the spirit of making a difference during a time of global tragedy, the California and Nevada Credit Union Leagues has pledged $100,000 toward Ukrainian financial relief efforts to help sustain credit union employees and members who are most in need as the current crisis unravels across that country.

“From thousands of miles away, we stand with our movement and remain committed to supporting Ukraine’s humanitarian plight as local credit unions, staff and members are besieged by a lack of food, water, housing, and other supplies and operational resources,” said Diana Dykstra, president and CEO of the Leagues. “Our trade association’s daily mission to help credit unions change people’s lives is emboldened during times like these, no matter where the devastation is taking place and help is needed.”

The Leagues’ contribution to the Ukrainian Credit Union Displacement Fund will directly support mitigation of both short and long-term impacts to Ukraine’s credit union system, including displaced credit union employees, members, and challenges to the country’s credit union system over the long term. The California Credit Union League pledged $75,000 and the Nevada Credit Union League pledged $25,000.

The credit union system — including state leagues, industry partners, and locally headquartered credit unions across both states and the nation — has a long history of working together to support communities during disasters at home and abroad. Brought on by war, the current emergency in Ukraine is no different as it affects residents, workers and their families through hardship and isolation.

Napa Valley Community Foundation and Redwood Credit Union Join Forces to Create Accessory Dwelling Unit Loan Product

March 16, 2022 — Napa Valley Community Foundation (NVCF) and Redwood Credit Union (RCU) have entered a first-of-its-kind partnership that aims to accelerate the adoption of accessory dwelling units (ADUs) in Napa and Sonoma Counties. The result is an innovative ADU construction loan product that will enable more homeowners to borrow the capital they need to construct second units.

Redwood Credit Union, a mission-driven, not-for-profit financial institution with 400,000 members in northern California, is managing all aspects of the ADU lending program. Napa Valley Community Foundation, a public charity that focuses on the most important challenges facing the region, including the scarcity of workforce housing, is setting aside reserves that will be available to help defray losses that the credit union may incur under new underwriting standards that take future ADU rental income into account in ways that traditional loan products do not.

Redwood Credit Union, a mission-driven, not-for-profit financial institution with 400,000 members in northern California, is managing all aspects of the ADU lending program. Napa Valley Community Foundation, a public charity that focuses on the most important challenges facing the region, including the scarcity of workforce housing, is setting aside reserves that will be available to help defray losses that the credit union may incur under new underwriting standards that take future ADU rental income into account in ways that traditional loan products do not.

“We think our collaboration with RCU will open the door to thousands of fixed-income, middle-income, and lower-income homeowners in the North Bay, people who would not otherwise be able to afford to finance an ADU,” said NVCF President Terence Mulligan. The loan product, Mulligan continued, does two things differently. “First, it allows borrowers to include a significant share of their expected ADU rental income during the underwriting process, which means a more favorable debt-to-income calculation, which generally means a bigger loan. Second, it establishes a value for the completed ADU based on future rental cash flows instead of the cost of construction, which means a more favorable loan-to-value number, which also makes more capital available.”

“We think our collaboration with RCU will open the door to thousands of fixed-income, middle-income, and lower-income homeowners in the North Bay, people who would not otherwise be able to afford to finance an ADU,” said NVCF President Terence Mulligan. The loan product, Mulligan continued, does two things differently. “First, it allows borrowers to include a significant share of their expected ADU rental income during the underwriting process, which means a more favorable debt-to-income calculation, which generally means a bigger loan. Second, it establishes a value for the completed ADU based on future rental cash flows instead of the cost of construction, which means a more favorable loan-to-value number, which also makes more capital available.”

The Association of Bay Area Governments has determined the need to identify capacity for 18,400 new housing units in Napa and Sonoma Counties during the upcoming eight-year Housing Element period (2023 to 2031). ADUs will play an important role in helping to alleviate the significant housing challenges, creating much-needed affordable workforce housing.

After Leading One CU Upward, Linda White Announces Retirement Plans; Successor Named

After Leading One CU Upward, Linda White Announces Retirement Plans; Successor Named

Courtesy of CUToday.info

May 2022 — After leading Upward Credit Union for 24 years, President and CEO Linda White has announced plans to retire. The credit union has named a successor. White plans to step down on Sept. 1, with current VP-operations Jason Mertz-Pickett selected to step into the role.

“Over the past 37 years, longer than some of our employees have been alive, I have shepherded Upward Credit Union from $3 million in assets – from being in a damp, leaky office space in a medical building – to the thriving $100 million boutique credit union it is today,” White said.

Upward CU Board Chair Annie Miller noted that during her career White has not just led the credit union but has served on numerous committees with the California Credit Union League, CUNA, CUNA Mutual, the Department of Financial Protection and Innovation (DFPI), and founding board member for the Healthcare Credit Union Association (HCUA). White is also a founding member of the Credit Union Women’s Leadership Alliance, where she will serve as executive director after her post ends at Upward.

White graduated from Western CUNA Management School in 1990, received the Distinguished Service Award along with the Grassroots Leader of the Year and the Kim Bannan Eternal Flame Award in 2012 and 2018, respectively, from the California and Nevada Credit Union Leagues, and became a Credit Union Development Educator (CUDE) in 2019.

In the People Helping People Business

“We’re in the people helping people business here at Upward, and I’m excited for the future of our credit union and thank the board for appointing me as the new CEO,” Mertz-Pricket said. “Under Linda’s direction, we have cultivated such a talented and dedicated team that connect, engage and help our members ‘soar Upward.’ My promise is that we will continue to put our members first, work as a team, and be an advocate for change.”

Prior to joining Upward, Mertz-Prickett spent 17 years with other credit unions in the bay area, working his way from a member service representative to C-Suite leader. He earned his bachelor’s degree in accounting and finance and an MBA from Western Governors University, in addition to many other industry certifications that recognize his accomplishments.

Viktoria Earle Selected as President and Chief Executive Officer of CommonWealth Central Credit Union

April 2022 – CommonWealth Central Credit Union’s Board of Directors is pleased to announce the selection of Viktoria Earle as their next President and CEO. The current CEO, Craig Weber announced his plans to retire and following his announcement, the Board began their search for the Credit Union’s next CEO. Viktoria Earle, CommonWealth’s current Chief Financial Officer was selected from a nationwide pool of candidates and will transition into her new role in May of 2022.

April 2022 – CommonWealth Central Credit Union’s Board of Directors is pleased to announce the selection of Viktoria Earle as their next President and CEO. The current CEO, Craig Weber announced his plans to retire and following his announcement, the Board began their search for the Credit Union’s next CEO. Viktoria Earle, CommonWealth’s current Chief Financial Officer was selected from a nationwide pool of candidates and will transition into her new role in May of 2022.

“After an extensive search, we are excited that the credit union’s new CEO came from within. Viktoria’s depth and breadth of experience will enable her to provide strategic direction and leadership to continue moving our credit union forward. We are excited to begin this journey and offer our support as she transitions into her new role,” said Michael F. Filice, Jr., CommonWealth’s Board Chair.

In addition to her nine years of service at CommonWealth as the Credit Union’s Chief Financial Officer, Viktoria brings her extensive experience with multi-billion dollar financial institutions. Her responsibilities covered a broad spectrum of areas including executive leadership, strategic positioning, tactical planning, product development, business partner building, Board relations and people engagement and development.

When asked about her new position, Viktoria Earle said “It is an honor to be named the next President and CEO of CommonWealth. I appreciate the confidence the Board of Directors has placed in me to lead the Credit Union. CWCCU is passionate about making a difference in the lives of our members and communities, and I look forward to continuing this mission.”

Craig Weber, who started his career at CommonWealth more than 27 years ago said, “As I bid a fond farewell to CommonWealth, a place I’ve called home for so long, I would like to thank you for the privilege of serving you. I’m confident in CommonWealth’s bright future under Viktoria’s leadership.”

Meet CA DFPI’s New Commissioner, Clothilde “Cloey” V. Hewlett

Cloey Hewlett is Commissioner at the Department of Financial Protection and Innovation. She was appointed by Gov. Gavin Newsom in September 2021 and was sworn in on December 6, 2021. Commissioner Hewlett has dedicated her career to protecting California consumers, serving as Undersecretary of the State and Consumer Services Agency and Interim Director of the Department of General Services. She has worked as Director of Moral Character Determinations for the State Bar of California, and as a partner with national and global law firms. Before her appointment, Commissioner Hewlett was the Executive Director and Chief Legal Officer for the Cal Alumni Association, where she was responsible for overseeing an organization that serves more than 550,000 alumni of the University of California, Berkeley.

Cloey Hewlett is Commissioner at the Department of Financial Protection and Innovation. She was appointed by Gov. Gavin Newsom in September 2021 and was sworn in on December 6, 2021. Commissioner Hewlett has dedicated her career to protecting California consumers, serving as Undersecretary of the State and Consumer Services Agency and Interim Director of the Department of General Services. She has worked as Director of Moral Character Determinations for the State Bar of California, and as a partner with national and global law firms. Before her appointment, Commissioner Hewlett was the Executive Director and Chief Legal Officer for the Cal Alumni Association, where she was responsible for overseeing an organization that serves more than 550,000 alumni of the University of California, Berkeley.

Commissioner Hewlett has decades of regulatory and prosecutorial experience. As Assistant District Attorney in the San Francisco District Attorney’s Office, she prosecuted high-level crimes and conducted special investigations, including embezzlement and fraud cases. And as a corporate attorney, she worked closely with her financial services clients to address the challenges they faced in a regulatory environment and to ensure they understood the law. Her experience growing up in poverty calcified her understanding of financial scams and the deep challenges faced by California consumers.

Commissioner Hewlett received a B.A. in political science from the University of California Berkeley and her J.D. from the UC Berkeley School of Law. She is a founding member of the Black Women Lawyers Association of Northern California and is committed to continuing the DFPI’s equity and outreach goals.

The California Department of Financial Protection and Innovation (DFPI) held its quarterly California Credit Union Advisory Committee meeting this past week, where attendees got to meet newly appointed Commissioner Cloey Hewlett.

“We were pleased to see she recognizes credit unions’ special purpose and mission,” said Lisa Quaranta, vice president of regulatory advocacy and compliance for the California Credit Union League.

Hewlett’s top priorities are affordable housing and greater access to banking for the unbanked and underbanked.

“Commissioner Hewlett said she believes it all begins with institutions like credit unions,” Quaranta added. “We look forward to working with her.”

DFPI’s Deputy Commissioner Position

Credit union leaders are encouraged to consider who might be a great fit for the open position of DFPI deputy commissioner in 2022.

If you have any recommendations for this important job placement, please email Lisa Quaranta.

Governor Newsom Announces Appointment of Clothilde Hewlett as Commissioner at the California Department of Financial Protection and Innovation

Sept. 29, 2021 — Clothilde Hewlett, 67, of San Francisco, has been appointed Commissioner at the California Department of Financial Protection and Innovation. Hewlett has been Executive Director and Chief Legal Officer at the Cal Alumni Association since 2016. She was a Partner at Nossaman LLP from 2009 to 2016. Hewlett was a Partner at K&L Gates LLP from 2003 to 2009 and Interim Director at the California Department of General Services from 2002 to 2003.

Hewlett was Undersecretary at the California State and Consumer Services Agency from 1999 to 2003. She was Director of Moral Character Determinations at the State Bar of California from 1991 to 1999. Hewlett held several positions at the San Francisco District Attorney’s Office from 1979 to 1991, including Assistant District Attorney and Special Prosecutions Criminal Investigator. She is a founding member of the Black Women Lawyers Association of Northern California. She earned a Juris Doctor degree from the University of California, Berkeley School of Law.

WILDFIRES: ‘EXTRAORDINARY SITUATION,’ GRANT RELIEF, & CU LESSONS

August 27, 2021 — As local credit unions and their members pivot to the whims of wildfires raging across Northern California, an “extraordinary situation” proclamation was made by the California Department of Financial Protection and Innovation (DFPI) on Wednesday for the counties of El Dorado, Shasta, Siskiyou, Tehama and Trinity.

CUAid grants — administered by the National Credit Union Foundation (NCUF) — are available for credit union employees and board members to assist with immediate disaster relief needs, such as out-of-pocket costs that may result from being evacuated.

Click here for CUAid grant guidelines, the application process, disbursement details, and more information. You can also find the grant application here. (You can also view the California and Nevada Credit Union Leagues’ disaster relief and preparedness webpage.)

Reintroduced: ‘Safe Banking Act’ and Federal Maturities Bill

March 18, 2021 — On Thursday, Rep. Ed Perlmutter (D-CO) reintroduced his landmark legislation to reform federal cannabis laws. The bipartisan Secure and Fair Enforcement (SAFE) Banking Act of 2021 (supported by the California and Nevada Credit Union Leagues and co-sponsored by more than 100 members of Congress) would allow marijuana-related businesses in states with some form of legalized marijuana and strict regulatory structures to access the banking system.

Forty-seven states, four U.S. territories, and the District of Columbia (representing 97.7 percent of the U.S. population) have legalized some form of recreational or medical marijuana, including CBD, according to a news release from Perlmutter’s office. Yet current law restricts legitimate licensed marijuana businesses from accessing banking services and products, such as depository and checking accounts, resulting in businesses operating in all cash.

In the 116th Congress, 206 members cosponsored the SAFE Banking Act and it passed the U.S. House in a broad bipartisan vote of 321 to 103, with 91 republicans and one independent voting in support. The bill also passed as part of the Heroes Act, an earlier COVID-19 relief package which was approved by the House on two separate occasions. In February 2019, the SAFE Banking Act prompted the first-ever congressional hearing on the issue of cannabis banking.

Consumer protection bill pending in California

May 28, 2020 – Recently, legislation with significant implications to California credit unions advanced in the state legislature. The COVID-19 Homeowner, Tenant and Consumer Relief Law of 2020 (AB 2501) would require credit unions and other financial institutions to halt mortgage and auto loan payments for consumers experiencing financial hardship during the COVID-19 pandemic.

Under the bill’s provisions, consumers experiencing financial hardship during the COVID-19 emergency or 180 days after, can seek mortgage forbearance for up to 180 days, without submitting documentation of the hardship. During the forbearance period, financial institutions would be responsible for any fees and taxes associated with the property, including county taxes and insurance.

AB 2501 also requires financial institutions to pause auto loan payments for borrowers experiencing COVID-19 related hardships for up to 180 days without verification of hardship. Institutions would be barred from charging fees, penalties or additional interest beyond the amounts scheduled during the forbearance.

The California Credit Union League is advocating against the legislation, which is pending in the Assembly Appropriations Committee.

New Dep. of Financial Protection and Innovation in CA

The California Governor’s Office and the state’s Department of Business Oversight (DBO) announced a plan to overhaul the department to add a more aggressive consumer watchdog function to the agency, as well as to foster technological advancement.

According to the January issue of the department’s Monthly Bulletin, Gov. Gavin Newsom (D) has proposed a $44 million plan to modernize and revamp DBO with added staff and authority. The agency would be renamed the “Department of Financial Protection and Innovation” under the plan.

According to the publication, the action is intended to “cement” the agency’s position as a premier financial regulator “and national model for consumer protection.” Proposed legislation making the change, the California Consumer Financial Protection Law, the publication stated, would give the DBO “expanded enforcement powers to protect California consumers from the regulatory retreat by federal agencies, most notably the Consumer Financial Protection Bureau (CFPB).” The publication noted that the new law would be modeled on the CFPB, with a focus on promoting innovation, clarifying regulatory hurdles for emerging products, and increasing education and outreach for vulnerable groups.

Credit union parity bill signed

Sept. 6, 2018 — Today, California Gov. Jerry Brown (D) signed a California Credit Union League-sponsored bill, AB 2862, which updates the California state credit union charter. The measure includes five provisions to clean up the code and give state-chartered credit unions parity with federally-chartered credit unions.

The provisions include:

- Allowing state-chartered credit unions to purchase and sell whole loans.

- Allowing investments in charitable donation accounts (CDAs).

- Clearly exempting credit unions from the California escrow law.

- Authorizing investments for employee benefits plan obligations without prior approval by the California Department of Business Oversight (DBO).

- No longer requiring savings capital structure policies.

The bill is effective January 1, 2019.

Broad privacy measure gives consumers right to request data

July 10, 2018 — A sweeping privacy measure, the California Consumer Privacy Act of 2018, recently passed both the State Assembly and the Senate without any opposition and was signed into law by Gov. Jerry Brown. When it goes into effect in 2020, the law will give consumers the right to request all the data businesses are collecting on them, as well as the right to request that businesses not sell any of their data.

The law also comes with strict disclosure rules about data collected by businesses, and it empowers the California Attorney General to fine businesses for non-compliance.

The bill was passed to prevent voters from passing stricter rules in November. Californians for Consumer Privacy, a group headed by real estate developer Alistair Mactaggart, had been preparing a ballot initiative to that would have gone even further than AB 375.

State fills deputy commissioner’s job

Jan. 17, 2018 — Caitlin Sanford is the new deputy commissioner of the division of credit unions for the California Department of Business Oversight (DBO), and will take the job Feb. 1. The appointment to the position was announced by Gov. Edmund G. “Jerry” Brown Jr. Dec. 29. A user experience researcher for mobile financial services at Facebook since 2016, Sanford previously held positions for Bankable Frontier Associates, a consulting firm specializing in finance solutions for low-income people. Among her roles at the firm were director of consumer insights, acting director and associate. Prior that, she was a research intern at the World Bank in Brazil, and a program assistant at the United Nations Poverty Environment Initiative in Panama and in Kenya.

What’s new in your state?

Click here to submit your state-chartered credit union news stories to NASCUS today!