Comments: Request for Comment, OTR and Operating Fee Schedule Methodologies

October 30, 2020

Gerard Poliquin

Secretary of the Board

National Credit Union Administration

1775 Duke Street

Alexandria, VA 22314

Re: NASCUS —Request for Comment: Operating Fee Schedule Methodology

Dear Mr. Poliquin:

The National Association of State Credit Union Supervisors (NASCUS)[1] submits the following letter in response to the National Credit Union Administration’s (NCUA’s) request for comments on its methodology for administering the Overhead Transfer Rate (OTR).[2] NCUA uses the OTR methodology to determine the portion of the agency’s annual budget paid by federally insured credit unions by allocation against the proceeds of the National Credit Union Share Insurance Fund (NCUSIF). After allocation to the NCUSIF. In 2017, NCUA adopted a principle based OTR methodology and committed to subjecting the principles of that methodology to comment every three years.[3] NCUA now requests comments on the four OTR principles as well as proposed changes to the FCU operating fee calculation that affect the allocation of costs to the NCUSIF.

Having reviewed NCUA’s proposal in detail, NASCUS agrees it is appropriate to re-evaluate the treatment of capital expenditures and miscellaneous revenue for purposes of calculating FCU operating fees and the OTR. We are however concerned with the increase in the OTR as reflected by the current proposal. In addition to discussing those concerns, NASCUS also offers comments regarding the four OTR principles, the notice and comment process and NCUA’s statutory authority and obligations.

NASCUS appreciates the opportunity to share our views and those of state credit union system stakeholders on this important matter. The OTR methodology, and the allocation of NCUA’s expenses takes on particular importance against the backdrop of the ongoing pandemic in the United States and resulting economic dislocation. The incontrovertible truth is that every dollar transferred from the NCUSIF to fund NCUA expenses is one dollar not available to cover the losses in the system and subsequently a dollar that may need to be replenished in the NCUSIF by the charging of a premium.[4] Furthermore, the allocation of NCUA’s operating expenses and the corresponding effect on FCU chartering fees has the potential to imbalance the dual chartering system by disadvantaging the state system in an inequitable and inorganic manner.

The OTR Methodology is Critically Important to the Dual Chartering System

For over 20 years, a majority of NCUA’s annual budget has been paid by the OTR, reaching a high of nearly 75% of NCUA’s 2016 budget.[5] This is significant because FISCUs shoulder an inordinate cost of supervising the safety and soundness of the credit union system. By number of individual credit unions, FISCUs make up only 37 percent of the total number of FICUs. However, since FISCUs make up nearly 50 percent of all insured shares, the cost of the OTR is borne equally from the funds of both FISCUs and FCUs, even though there are more FCUs whose examination costs are being charged to the NCUSIF. Put another way, FISCUs pay half the NCUSIF’s costs but are only 37 percent of the work.

Some stakeholders are apt to assert that FCUs pay an aggregate greater amount of NCUA’s overall budget when the total expense to FCUs of the operating fee and OTR are aggregated. But this assertion ignores the fact that the NCUSIF is NOT expending resources to conduct examinations on a majority of FISCUs because it relies on the exam work conducted by the states. Exam work which is paid for entirely by FISCUs.

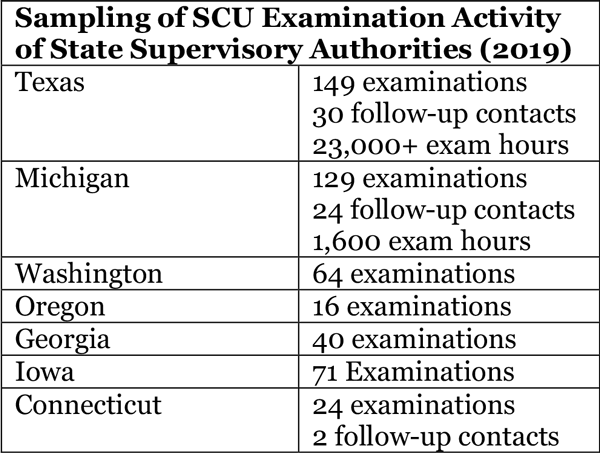

For example, in 2019, the state of Texas conducted 149 examinations, over 30 follow-up contacts and 23,000+ examination hours on state credit unions in Texas. The state of Michigan conducted 129 examinations and two dozen follow-up contacts while performing over 1,600 examination hours in its state credit unions. The state of Washington conducted 64 examinations and the state of Oregon conducted 16 exams. The Georgia Department of Banking and Finance completed 40 state credit union exams in 2019, the Connecticut Department of Banking conducted 24 examinations and 2 follow-up contacts, and the Iowa Division of Credit Unions completed 71 examinations. In addition to state examinations, state credit unions and state agencies bear costs for training state examination staff. The states of Pennsylvania, Oregon, Kentucky, Texas, Michigan, Iowa, Georgia, Connecticut, and Washington alone sent examiners to over 6,793 hours of non-NCUSIF funded training. All those examinations, and all of that training, was paid for by state credit union fees: Over $25.2 million for examination and supervision in those 9 states alone. A similar story can be told in the remaining 36 state regulatory agencies.

For example, in 2019, the state of Texas conducted 149 examinations, over 30 follow-up contacts and 23,000+ examination hours on state credit unions in Texas. The state of Michigan conducted 129 examinations and two dozen follow-up contacts while performing over 1,600 examination hours in its state credit unions. The state of Washington conducted 64 examinations and the state of Oregon conducted 16 exams. The Georgia Department of Banking and Finance completed 40 state credit union exams in 2019, the Connecticut Department of Banking conducted 24 examinations and 2 follow-up contacts, and the Iowa Division of Credit Unions completed 71 examinations. In addition to state examinations, state credit unions and state agencies bear costs for training state examination staff. The states of Pennsylvania, Oregon, Kentucky, Texas, Michigan, Iowa, Georgia, Connecticut, and Washington alone sent examiners to over 6,793 hours of non-NCUSIF funded training. All those examinations, and all of that training, was paid for by state credit union fees: Over $25.2 million for examination and supervision in those 9 states alone. A similar story can be told in the remaining 36 state regulatory agencies.

Because FISCUs pay the full cost of their state examinations, and then thru the OTR 100 percent of NCUSIF insurance reviews of FISCUs, 50 percent of FCU examination costs, 100 percent of CUSO and vendor supervision and other costs, the OTR is borne by FISCUs in lost NCUSIF dividend opportunity or as additional NCUSIF premium costs as may be the case in 2021. For FCUs however, the OTR carries an inverse benefit. The larger the OTR, the more modest the FCU operating fee. That inequitable result is one reason why the OTR methodology is so important to the state system.

Because FISCUs pay the full cost of their state examinations, and then thru the OTR 100 percent of NCUSIF insurance reviews of FISCUs, 50 percent of FCU examination costs, 100 percent of CUSO and vendor supervision and other costs, the OTR is borne by FISCUs in lost NCUSIF dividend opportunity or as additional NCUSIF premium costs as may be the case in 2021. For FCUs however, the OTR carries an inverse benefit. The larger the OTR, the more modest the FCU operating fee. That inequitable result is one reason why the OTR methodology is so important to the state system.

When the current methodology was introduced in 2017, NASCUS acknowledged it was an improvement over the then existing methodology: albeit an imperfect improvement.[6] In particular we noted that the allocation of 50 percent of FCU examination time as insurance related was a sensible compromise, but that the more accurate approach would be for NCUA to examine FCUs pursuant to Title I of the Federal Credit Union Act and the NCUSIF to review those Title I examinations in the same manner as it does for state FISCU examinations. As more NCUA annual budget expenditure categories are allocated to the NCUSIF, the 2017 compromise becomes less tenable for the state system.

Proposed Change to Treatment of the Capital Budget

NCUA proposes including the budget for capital projects within the annual budget subject to the OTR.[7]NCUA believes apportioning a proportionate share of the capital budget to the NCUSIF is consistent with the 2017 OTR methodology and represents a more equitable treatment of capital expenditures with respect to the OTR and FCU operating fees.

NASCUS agrees. The NCUSIF should bear the capital budget costs of its operations.

However, as discussed above, the allocation of the capital budget pursuant to the 4 principles might be convenient but may not be equitable as the percentages are currently defined for the methodology. For example, included in NCUA’s capital budget are the costs related to acquisition and maintenance of laptops for NCUA examiners. It is not entirely clear why the NCUSIF would carry that cost going forward. While there was a time the NCUSIF provided laptops to state examiners with NCUA’s examination software installed, today 30 of the 45 state regulatory agencies acquire and maintain their own state computers. For the remaining 15 states, the NCUSIF will end its computer lease program in 2021, and those states have begun the process of acquiring their own computers at state expense. States and state credit unions alone will bear the capital cost of computers and computer software. It would seem that the NCUSIF should carry a much smaller percentage of NCUA’s computer, software and other capital charges than NCUA allocates to its role as the FCU chartering authority.

Proposed Change to Treatment of Miscellaneous Revenue

Each year, NCUA generates revenue from the sale of reports and publications, rent from agency facilities and income from its ownership of the parking garage at Duke Street.[8] Historically, NCUA has used this “Miscellaneous Revenue” to offset the portion of its annual budget funded by FCU operating fees. NCUA is proposing changing that apportionment to credit Miscellaneous Revenue to the portion of the annual budget charged against the NCUSIF.[9]

NASCUS supports the proposed change in treatment of Miscellaneous Revenue. All sources of revenue cited in the Supplemental Material can be presumed to derive from both NCUA’s FCU chartering and NCUSIF administration functions. Apportioning Miscellaneous Revenue to credit the OTR and the FCU operating fees is most consistent with the spirit of the 2017 OTR Methodology.

Classification of CUSO and Third-Party Examination and Supervision Expenses

NCUA’s 2017 OTR Methodology classifies all “time and costs the NCUA spends supervising or evaluating the risks posed by FISCUs or other entities the NCUA does not charter or regulate (e.g., third-party vendors and credit union service organizations)” as 100 percent insurance related.[10] NASCUS disagrees that allocating NCUA work related to CUSOs and other third-party vendors as solely related to the NCUSIF is consistent with the principles of the methodology or with the practical reality of a chartering authority. As we noted in 2017, while it is true that NCUA does not charter or supervise CUSOs or vendors, it is not entirely the point. NCUA, as the chartering authority of FCUs, has an obligation to ensure that FCU CUSOs and other third parties are operating safely and within compliance of applicable rules and regulations. For example, chartering rules limit the services that an FCU’s CUSO may provide and to whom it may provide them. NCUA must ensure FCU CUSO mortgage loan originator registration in compliance with the SAFE Act. These are but a few examples, but they illustrate that NCUA has regulatory and supervisory concerns with CUSOs and other third-party vendors that are not primarily safety and soundness issues and of de minimis concern to the NCUSIF.

Just as state credit union regulators, and the Office of the Comptroller of the Currency (none of which administer a deposit or share insurance fund) have robust safety and soundness and third party vendor authority, NCUA as the chartering authority of federal credit unions would consider review of third parties, as necessary, as inherently related to their examination process even in the absence of the NCUSIF.

The allocation of third-party regulatory and supervisory work takes on an enhanced importance given NCUA’s interest in obtaining direct supervisory authority over such entities.[11] Should NCUA obtain that regulatory and supervisory authority (which NASCUS supports), ensuring equitable allocation of associated expenses will be essential.

Voluntary Self-Assessment Incentive

NCUA solicits comments on whether the agency should provide a financial incentive for FCUs that complete the annual voluntary diversity self-assessment.[12] Specifically, NCUA questions whether FCUs completing the assessment should receive a modest discount on the FCU operating fee due in the subsequent year and what NCUA could provide FISCUs to encourage FISCU completion of the self-assessment.[13] How NCUA applies its operating fee needs to FCUs is generally a matter for FCU stakeholders. It is unclear from the Supplemental Material however “how” NCUA’s offering a discount to FCUs would affect the overall annual budget funding mechanism. So long as there was no corresponding affect on the OTR from any shortfalls in operating fee funding resulting from the proposed discounts, NASCUS defers comment.

Should any incentive program NCUA implements affect the OTR or the NCUSIF, such program should be explained in detail and subject to formal notice and comment. Likewise, once NCUA has specifics for an incentive for FISCUs, such a proposal should be subject to notice and comment to allow stakeholders to provide informed feedback to NCUA.

In conclusion, we reiterate our commendation of NCUA’s commitment to publishing the OTR for notice and public comment. Ensuring NCUA has the funding needed to meet its regulatory and supervisory obligations is important, as is the prudent and equitable management of the NCUSIF to maximize the funds available to cover losses incurred within the credit union system. NASCUS welcomes the opportunity to share our views on the OTR methodology. We would be happy to discuss our comments and recommendations in detail with NCUA.

Sincerely,

– signature redacted for electronic publication –

Lucy Ito

President & CEO

[1] NASCUS is the professional association of the nation’s 45 state credit union regulatory agencies that charter and supervise over 2,000 state credit unions. NASCUS membership includes state regulatory agencies, state chartered and federally chartered credit unions, and other important stakeholders in the state system. State chartered credit unions hold half the $1.77 trillion assets in the credit union system and are proud to represent nearly half of the 124 million credit union members.

[2] 85 Fed. Reg. 53854 (August 31, 2020).

[3] 82 FR 55644 (Nov. 22, 2017).

[4] “NCUA: NCUSIF Premium May be Coming,” CUtoday.info (September 17, 2020). Available at https://www.cutoday.info/Fresh-Today/NCUA-NCUSIF-Premium-May-Be-Coming.

[5] See Overhead Transfer Rate History (1986-2017), p.2, “NASCUS Comments on OTR Methodology,” (August 29, 2017). Available at https://www.nascus.org/regulatory-resources/comment-letter-otr-methodology-august-17/.

[6] “NASCUS Comments on OTR Methodology,” (August 29, 2017).

[7] 85 Fed. Reg. 53859 (August 31, 2020).

[8] The NCUA parking garage is located beneath the complex housing NCUA’s headquarters at 1775 Duke Street, Alexandria, Virginia 22314.

[9] Id. at 53860.

[10] 85 Fed. Reg. 53855 (August 31, 2020).

[11] “Audit of the NCUA’s Examination and Oversight Authority over Credit Union Service Organizations and Vendors,” NCUA Office of the Inspector General Report #OIG-20-07 (September 1, 2020 ). Available at https://www.ncua.gov/files/audit-reports/oig-audit-cusos-vendors-2020.pdf.

[12] Section 342(b)(2)(C) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Public Law 111–203.

[13] 85 Fed. Reg. 53862 (August 31, 2020).