It says users in the United States can expect digital asset services to come in the future.

A subsidiary of the Huobi cryptocurrency exchange called HBIT Inc has received its Money Services Business (MSB) license from the United States Financial Crimes Enforcement Network (FinCEN).

A subsidiary of the Huobi cryptocurrency exchange called HBIT Inc has received its Money Services Business (MSB) license from the United States Financial Crimes Enforcement Network (FinCEN).

The Seychelles based Huobi said on Tuesday that the license creates a foundation for it to carry out crypto-related business in the U.S. in the future, as part of its strategic goals of “globalization and compliance.” The exchange is a major player, with more than $1 billion in volume in the past 24 hours, according to CoinGecko.

Before the great crypto crackdown by Chinese authorities, most Huobi users came from China, but according to the latest figures from Statista, most users in February 2022 originated from Russia and Ukraine.

The MSB license allows Huobi’s subsidiary to transmit money and operate as a fiat currency exchange, a required step by U.S. regulators to ensure FinCEN can monitor financial crimes such as money laundering.

However, it does not allow it to provide crypto-exchange services — which would require a money transmitter license. It says in the future, it expects to provide U.S. users with a compliant digital asset service.

Huobi said its subsidiaries in Hong Kong have also received asset management and securities advising licenses from the country’s Securities and Futures Commission.

The subsidiaries are also in the process of applying for a license to provide automated trading services and securities trading to become a fully compliant crypto-exchange in Hong Kong.

Huobi has been on a streak of licensing wins.

On June 21, the exchange won licenses in New Zealand and the United Arab Emirates. The latter was an Innovation License which, while not a trading license, allows it to access the local tech industry and get special tax treatment.

At the time, Huobi Group chief financial officer Lily Zhang told Cointelegraph it plans to receive its license to offer its full suite of crypto exchange services under Dubai’s Virtual Assets Regulatory Authority (VARA).

It hasn’t been all good news though, with the exchange’s Thai license revoked on June 16 after it reportedly failed to comply with local regulations. There are also rumors of significant staff layoffs and that its founder might be looking to exit the business.

Hong Kong-based crypto reporter Colin Wu reported on June 28 that Huboi intended to lay off up to 30% of its staff, with a later update on Saturday reporting rumors that Huboi founder Li Lin is looking to sell his 50% stake.

Courtesy of Jessee Coghlan, CoinTelegraph

BUREAU OF CONSUMER FINANCIAL PROTECTION [Docket No. CFPB–2022–0040] Federal Register Posting: Request for Information Regarding Relationship Banking and Customer Service

AGENCY: Bureau of Consumer Financial Protection.

ACTION: Request for information.

SUMMARY: The Consumer Financial Protection Bureau (Bureau or CFPB) is seeking comments from the public related to relationship banking and how consumers can assert the right to obtain timely responses to requests for information about their accounts from banks and credit unions with more than $10 billion in assets, as well as from their affiliates.

DATES: Comments must be received by July 21, 2022.

![]() Click here to read the full NASCUS Summary

Click here to read the full NASCUS Summary

(Member login required.)

June 29, 2022 — When credit risk is on the rise, such as during an economic downturn, credit card companies may look at reducing consumers’ available credit limits to prevent against losses. Credit card line decreases are an industry practice where a company cuts a consumer’s credit limit on an existing account. A consumer’s available credit can disappear, sometimes without warning or subsequent explanation.

June 29, 2022 — When credit risk is on the rise, such as during an economic downturn, credit card companies may look at reducing consumers’ available credit limits to prevent against losses. Credit card line decreases are an industry practice where a company cuts a consumer’s credit limit on an existing account. A consumer’s available credit can disappear, sometimes without warning or subsequent explanation.

A new CFPB report describes how credit card companies increasingly used credit line decreases during both the Great Recession and at the start of the COVID-19 pandemic. Due to the critical role credit plays in financial resiliency, especially during a downturn, we sought to examine the importance and impact of these decisions by credit card companies.

The impact of limiting available credit lines

The following highlights our key findings:

Majority of decreased credit lines were not linked to recent credit card delinquencies

Credit line decrease actions were four times as common if a consumer had a recent credit card delinquency. However, approximately 67 percent of consumers who experienced declines in their credit line showed no evidence of a recent credit card delinquency.

For these consumers, the decision may be driven by other changes in their credit profile, internal account performance data, or by changes in institution risk management unrelated to their credit standing. Credit reports don’t currently indicate whether the action was driven by the consumer’s risk or the lender’s internal decision-making.

Credit line decreases led to dramatic reductions in available credit

Our research showed that line decreases resulted in a dramatic reduction in credit available on a consumer’s impacted credit card. For consumers across different credit score tiers, the median amount of credit decreased by approximately 75 percent. Median available credit was often reduced to less than $400 for all consumers except those with superprime credit scores (generally a superprime score is 720 or greater compared to deep subprime of 579 or less).

We also showed that a credit line decrease on a consumer’s highest balance card significantly affects a consumer’s total access to credit card lines. The impact of a line decrease may be more acutely felt for consumers in lower score ranges who are less likely to have as many cards as their prime counterparts and may find it more challenging to access new credit.

Rates of credit utilization went up

The credit utilization rate – or the amount of credit used against the available credit limit – also significantly increased, with most consumers essentially “maxing out” the card.

When their available credit decreased, median deep subprime, subprime, near-prime, and prime consumers reached 94 percent of their available credit. Even for super-prime consumers, their utilization rate more than doubled from 37 percent to 78 percent. We also showed that total combined utilization also increased after a credit line decrease for all but deep subprime scored consumers. This can have an impact on their credit scores – when utilization goes up, consumer credit scores tend to go down.

Credit line decreases tend to coincide with decreasing credit scores

Credit scores declined around the time of a line decrease, and this was felt by consumers of different credit scores. The decline, however, was significantly greater if a consumer had a recent credit card delinquency. During the analysis period, median credit scores for consumers with a recent card delinquency on any card decreased between 33 and 87 points. For consumers without a recent card delinquency on any card, median scores decreased between 1 and 12 points.

Credit balances remained depressed for subprime borrowers

While prime consumers may have used other credit cards or new accounts to offset the line decrease and return to previous total card balance levels, subprime and deep subprime balances remained depressed three quarters later, meaning that subprime borrowers are likely less able to return to previous card use.

This research is part of a series looking at consumer credit trends using a longitudinal sample of approximately five million de-identified credit records maintained by one of the three nationwide consumer reporting agencies.

Read the report, Credit Card Line Decreases .

Jun 30, 2022 — Central bank leaders warned Wednesday that inflation is going to last longer than some estimated.

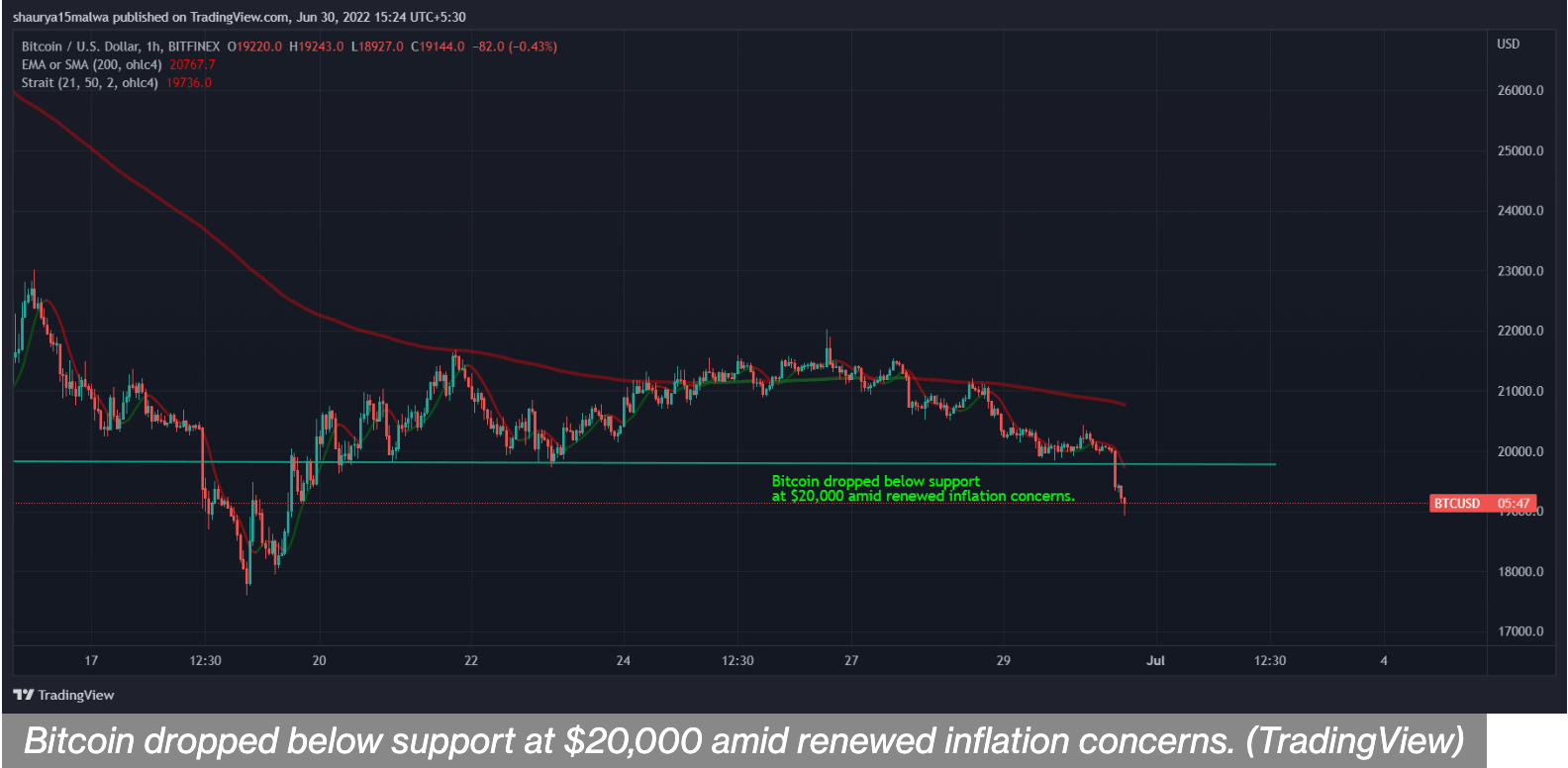

Bitcoin fell toward $19,000 during Asian afternoon hours after central bankers renewed inflation warnings at the European Central Bank’s annual forum on Wednesday.

The asset dropped 5.5% in the past 24 hours, and is on track for a record 40% monthly decline. Other large cryptocurrencies also weakened, with ether dropping 9.9% in the past 24 hours and Solana’s SOL falling as much as 11%. Total cryptocurrency market capitalization fell 4.3%.

Federal Reserve Chairman Jerome Powell reiterated the central bank’s commitment to increasing interest rates to curtail inflation. Speaking at the ECB meeting, he said he was more concerned about the challenge posed by inflation than about the possibility of higher interest rates pushing the U.S. economy into a recession.

“Is there a risk we would go too far? Certainly, there’s a risk,” Powell said. “The bigger mistake to make – let’s put it that way – would be to fail to restore price stability.”

Powell said the Fed had to raise rates rapidly, Reuters reported, adding that a gradual increase could cause consumers to feel that higher prices of commodities would persist. About a week ago, his comments suggested rate hikes could soften before next year.

U.S. equity market futures fell following Powell’s comments, with S&P 500 futures dropping 1.59% and those on the tech-heavy Nasdaq 100 falling 1.9%. Asian markets were in the red with Japan’s Nikkei 225 declining 1.54% and the Asian-focused index Asia Dow falling 1.14%.

Central banks across the globe are weighing interest rate increases amid surging price pressures. Spain reported a 37-year record inflation of 10% earlier this week, while India and China are grappling with the risks of economic contraction.

Such concerns add to already critical selling pressure on bitcoin. The crypto has traded similarly to risky technology stocks in the past few months and has fallen 58% this year.

Contagion risks from within the crypto industry, such as the possible insolvency of crypto lenders and the blowup of prominent crypto fund Three Arrows Capital, have further caused downward pressure on the asset that was otherwise conceived as a potential hedge against inflation.