Sept. 11, 2020 NASCUS Report

Posted September 11, 2020THIS WEEK: States stake claim to half of all CU assets; Comment backs leveraging tech in exams; Policy commits NASCUS to DEI; NCUA Board considers final appraisals rule; Summary outlines proposed QM definition; CUAC to meet twice this month; ‘Tech sprints’ begin later in September; Pierre Jay Award nominations open; BRIEFLY: Webinar focused on FCU FOM; Cyber Summit kicks off next month; So does NASCUS/CUNA Cybersecurity E-School

States stake claim to half of all assets

among U.S. credit unions at mid-year

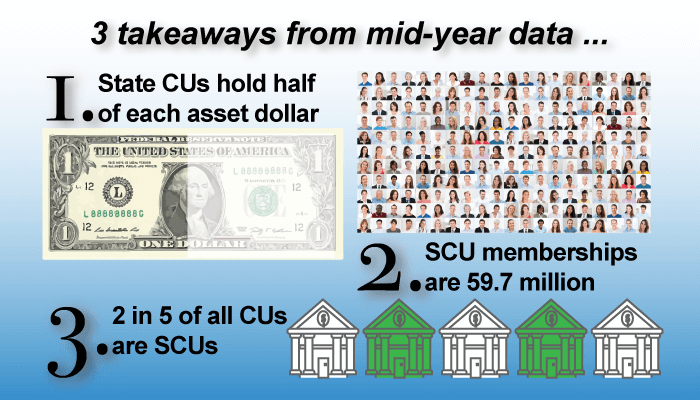

State-chartered credit unions (SCUs) now hold virtually half of all assets in U.S. credit unions, according to mid-year data released last week by NCUA, and figures compiled by NASCUS. According to the figures, SCUs (both federally and privately insured, as reported by American Share Insurance (ASI)) held $880 billion of the total $1.77 trillion held by all U.S. credit unions.

Since at least year-end 2018, state credit unions have inched closer to the 50% mark as their growth matched or exceeded that of federal credit unions. Over the most recent, past quarter, savers poured money into credit unions in a “flight to safety” as they faced the financial impact of the coronavirus crisis. SCU assets grew at a rate of about three to two over that of federal credit unions (FCU), with states adding $64.1 billion during the second quarter and federals adding $46.7 billion.

Since the end of 2019, state assets have advanced by 12.6% (with much of that in the second quarter), and federals by 10.9%.

On the membership side, SCUs now count just under 60 million (59.7 million); FCUs count 63.9 million. Memberships grew in both the first and second quarters of the year for both charter types, but slowed slightly in the second quarter for both, according to the numbers. Even so, SCUs continued to outpace their FCU brethren in member growth by a rate of five to four.

The number of credit unions overall continued to decline, however, in the first half of the year. According to the numbers, there were 5,274 SCUs and FCUs as of June 30, compared to 5,347 at year-end 2019. Most of those that went off the rolls were FCUs (about 71%). Overall, at midyear, there were 2,042 SCUs and 3,232 FCUs.

“Clearly members see their SCUs as sources of strength and safety during the pandemic, as they funnel their excess funds there,” said NASCUS President and CEO Lucy Ito. “Safety and soundness of SCUs no doubt play a critical role in savers’ minds. But flexible regulation state-by-state must also be a factor as members recognize their credit unions can effectively meet their needs.”

The NCUA numbers on federally insured credit unions also showed:

- An overall net worth ratio of 10.46% (down from year-end 2019 of 11.37%);

- Return on average assets (ROAA) of 0.57% (down from 0.93% at the end of last year).

The credit union ROAA at mid-year compares favorably to that of banks, which the FDIC released two weeks ago. Those numbers showed bank ROAA of 0.36% at mid-year (down from 1.38% at mid-year 2019).

LINK:

NCUA Quarterly Credit Union Data Summary, 2020 Q2

Comment backs leveraging tech in exams

Leveraging technology in the examination and supervision process – largely through off-site work — would have a number of benefits to the credit union system, but doing so needs to take into account the differences between the state and federal systems, NASCUS wrote in a comment letter last week.

Responding to NCUA’s request for information (RFI) on leveraging technology in the examination and supervision of federally insured credit unions, NASCUS cited support for the agency’s approach. The association pointed out that many state regulators already have acted to reconfigure their exam and supervision programs to make the most of off-site work – even before the coronavirus crisis hit with its full force on the financial system.

NASCUS noted that shifting to primarily off-site exams and supervision would result in such benefits as an enhanced cooperative supervisory relationship with state regulators, a reduction in the burden on federally insured credit unions and cost savings to the federal insurance fund for credit unions.

In June, NCUA issued the RFI, which it characterized as a “comprehensive study of alternative procedures to modernize the agency’s examination program.” The agency said the objective of modernizing is to improve its efficiency and effectiveness, particularly by supporting a predominately offsite examination and supervision model that takes advantage of “new and emerging approaches and techniques to utilizing data and technology.”

NASCUS agreed that was a legitimate goal. However, the association noted that the differences between federal credit unions and federally insured, state-chartered credit unions (FISCUs) should be taken into consideration. “For FISCUs, NCUA performs insurance reviews rather than full scope examinations, and primarily relies on Reports of Examination (ROE) issued by state regulatory agencies,” NASCUS wrote.

“It will be of critical importance to the success of an offsite examination program for FISCUs that NCUA continue to rely, to the fullest extent, on examinations conducted by state regulators,” NASCUS added. “To do otherwise would be to negate any benefit of reduced burden on FISCUs from offsite examination.”

LINK:

NASCUS Comments on Strategies for Future Examination and Supervision Utilizing Digital Technologies

New policy pledges NASCUS to DEI

NASCUS has committed itself to become an even more diverse, equitable and inclusive organization for all members, supporters, leaders, employees and others under a new policy adopted by the association’s leadership last week.

Under the new DEI policy adopted by the organization’s leadership – the NASCUS Regulator Board and the NASCUS Credit Union Advisory Council – the association has pledged that all employees, volunteer leadership, members, vendor affiliations, and supporters feel valued and respected regardless of gender, race, ethnicity, national origin, age, sexual orientation or identity, education, or physical ability.

The policy also notes NASCUS’ devotion to fostering diversity, equity, and inclusion within its leadership and staff and throughout the state credit union system and infusing these principles into everything the organization does.

“Following the killing of Mr. George Floyd in late May and countless other African-Americans before him, we realized the country was at an inflection point and we could no longer remain silent,” said NASCUS President and CEO Lucy Ito. “While NASCUS published a statement expressing solidarity with the Black community, both NASCUS leadership and management were moved to go beyond our initial public statement and ensure that our words are validated by our actions in cultivating diversity, equity, and inclusion across all of our undertakings. Our new policy sets the foundation for further action and implementation in the governance and operations of NASCUS and empowers us to take steps to address systemic racism in the credit union industry.”

LINK:

NASCUS policies, updated August 2020

Board to consider finalizing interim appraisals rule

A final rule on real estate appraisals will be considered by the NCUA Board at its regular monthly meeting, scheduled for Thursday (Sept. 17) in Alexandria, Va.

The 10 a.m. session is the board’s first meeting since July 30. The board typically skips an August meeting.

NCUA issued an interim final rule (IFR) on the issue on April 21; the rule became effective that date as well and remains in effect through year’s end. The IFR defers the requirements for a credit union to obtain an appraisal or written estimate of market value for up to 120 days following the closing of a transaction for certain residential and commercial real estate transactions. The rule, according to NCUA, was issued to provide credit unions with regulatory relief to respond to the financial effect of the coronavirus pandemic. Similar rules were issued by federal banking agencies for banks.

However, NCUA asked for comments on the IFR and NASCUS (in a June 5 letter) lent its support on behalf of the state system.

“Appraisals and written estimates of market value are important tools to enhance safety and soundness of lenders as well as consumer protection for borrowers,” NASCUS wrote. “We note that the IFR is not waiving the requirement for appraisals or written estimates of market value where applicable. Rather, the IFR provides credit unions an additional 120 days in which to obtain the appraisals or written valuation.”

NASCUS also pointed out that the rule stresses credit unions are expected to use all available information to establish a valuation of the collateral and to adhere to appropriate underwriting standards in analyzing creditworthiness and repayment ability. “In addition, nothing in the IFR prevents or discourages a credit union from obtaining appraisals or written estimates of market value prior to loan closing,” NASCUS wrote.

NASCUS also supported issuing the rule as an IFR with an immediate effective date.

Also on the agenda for next week’s meeting:

- A board briefing on the agency’s Modern Examination and Risk Identification Tool (MERIT);

- “Customer Identification Program Exemption” under the Bank Secrecy Act;

- And a board briefing on the National Credit Union Share Insurance Fund’s latest quarterly performance.

LINKS:

NASCUS Comments on Interim Final Rule: Real Estate Appraisals (RIN 3133-AF17) (June 5)

NCUA Board Sept. 17, 2020 meeting agenda

Summary boils down proposed new QM definition

A new summary of the CFPB’s proposals affecting the expiration of the Jan. 10, 2021 “GSE Patch” has been published by NASCUS and is available on nascus.org. The summary is available to members only.

In June, the bureau published two notices of proposed rulemaking regarding the patch. The first proposed amending the general “qualified mortgage” (QM) definition in Regulation Z to replace the debt-to-income (DTI) limit with what the agency called a “price-based approach.” The agency said it was proposing that approach because the agency preliminarily concluded “that a loan’s price, as measured by comparing a loan’s annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumer’s ability to repay than DTI alone.”

In addition, CFPB proposed, for eligibility under the general QM definition, a price threshold for most loans as well as higher price thresholds for smaller loans, which it said is “particularly important for manufactured housing and for minority consumers.” The agency said it also proposes that lenders take into account a consumer’s income, debt, and DTI ratio or residual income and verify the consumer’s income and debts.

The second NPRM would extend the GSE Patch to expire upon the effective date of a final rule regarding the first NPRM’s proposed amendments to the general QM loan definition in Regulation Z, CFPB said. “The Bureau is proposing to take this action to ensure that responsible, affordable credit remains available to consumers who may be affected if the GSE Patch expires before the amendments take effect as defined in the first NPRM,” according to a release.

CFPB sets two sessions for CU advisory group …

The group that advises the CFPB on credit union issues will meet twice this month, on successive weeks, along with other advisory groups to the agency via conference calls on two key issues: consumer finance law and the impact of the COVID-19 pandemic on consumers and financial markets.

Both meetings are open to the public, but advance registration is required.

On Tuesday (Sept. 15), the Credit Union Advisory Council (CUAC) will join with the Community Bank Advisory Council (CBAC), and the Consumer Advisory Board (CAB), to meet with the bureau’s taskforce on federal consumer financial law to share recommendations on improvements to the current state of federal consumer protection laws, regulations, and practices. The bureau said the taskforce’s meeting with the groups is “part of the taskforce’s ongoing public outreach effort to solicit feedback to inform its work.”

Last October, when the bureau announced establishment of the taskforce, CFPB said it would be charged with “examining ways to harmonize and modernize federal consumer financial laws” by studying the existing legal and regulatory environment facing both consumers and financial services providers. The group is charged with reporting back to Bureau Director Kathleen Kraninger.

Deadline for registering for the event, held via conference call, is Monday (Sept. 14)

The following week, on Sept. 23, the credit union and other advisory groups will again gather via conference call to discuss with CFPB the impact of the COVID-19 pandemic on consumers and financial markets and other regulatory matters – including those related to the bureau’s unified regulatory agenda. That meeting is also open to the public, but advance registration (by Sept. 22) is required.

LINKS:

RSVP to Sept. 15 joint CFPB advisory group conference call with taskforce on federal consumer financial law (deadline is noon ET Monday, Sept. 14)

… and schedules ‘tech sprints on adverse action notices

And there’s more to come from the bureau starting in October with a series of “tech sprints” aimed at developing innovative approaches to electronically delivered adverse action notices.

However, if you want to participate in the first set of the series, you have to register by close of business today (Friday, Sept. 11).

The CFPB said the first of the “sprints” set for Oct. 5-9 will be held virtually; they are intended to generate “actionable ideas” and help inform future disclosure policy options in a range of markets, the agency said. It added that teams participating in the event will be charged with showing how electronically delivered adverse action notices can improve on current notices. Three goals are the target:

- Accuracy – using accurate information to take adverse action;

- Anti-discrimination – preventing illegal discrimination in credit decisions;

- Education – helping consumers fare better in future credit applications.

“The disclosures and disclosure methods that participants develop do not necessarily need to meet every legal requirement (including E-SIGN requirements) as long as the ideas developed fulfill or better realize the three goals discussed above,” the agency said. “The problem statement suggests some ways to improve upon existing notices, or participants may have their own ideas. If they choose, Tech Sprint participants may apply to use their disclosure solutions in market under the Bureau’s Trial Disclosure Policy.”

CFPB said it seeks disclosure experts, designers, developers, consumer advocates, consultants, technologists, and legal or compliance specialists from a range of professional backgrounds. Participants may apply as a team or apply as individuals and later be formed into a team, the agency said.

LINK:

CFPB’s first tech sprint on October 5-9, 2020: Help improve consumer adverse action notices

Nominations open for 2020 Pierre Jay Award

Nominations for the NASCUS 2020 Pierre Jay Award – which recognizes the individuals, programs or organizations whose contributions have benefited the state credit union system in a significant way – opened this week. Deadline for the nominations is close of business Oct. 26.

Nominations for the NASCUS 2020 Pierre Jay Award – which recognizes the individuals, programs or organizations whose contributions have benefited the state credit union system in a significant way – opened this week. Deadline for the nominations is close of business Oct. 26.

The award honors those who have demonstrated outstanding service, leadership and commitment to NASCUS and the state system. It was first conferred in 1997 and has been presented to an individual nearly annually since then. It honors the first Commissioner of Banks in Massachusetts, Pierre Jay. The 2019 winner was Mary Hughes, former acting director, Idaho Department of Finance.

Any person, program, or organization who or that has made a significant contribution to the state credit union system is eligible to be nominated. Nominees do not necessarily need to be affiliated with NASCUS. Examples of individuals, programs or organizations to be nominated include credit union organizations, volunteers (including committee members), staff members, or chief staff executives; and, state/federal organizations, state/federal lawmakers, state/federal regulators, or others.

Nominees for the 2020 award will be considered by a six-member panel, which reflects the association’s diverse membership from the state credit union system. Those are: Rose Conner, chairman, NASCUS Regulator Board; Mike Williams, chairman, NASCUS CU Advisory Board; Robert Cashman, president & CEO, Metro Credit Union; William J. Mellin, president & CEO, New York Credit Union Association; Mary Hughes, 2019 Pierre Jay Award winner; and Lucy Ito,president & CEO, NASCUS (ex officio).

LINK:

Pierre Jay Award: Details, nomination form

BRIEFLY: Webinar focuses on FCU FOM; CISA Cyber Summit kicks off next week; NASCUS/CUNA Cybersecurity E-School on the horizon Oct. 6

The NASCUS Legislative and Regulatory Affairs Committee this week hosted a no-cost webinar on the current state of FCU field of membership rules. The session outlined the favorable outcome for for NCUA in the American Bankers’ Association (ABA) litigation against the agency over its 2017 FOM rule, the final revisions now taking effect for FCU FOM, and what is permissible for FCUs in single common bond, multiple common bond, or community fields of membership … The third annual National Cybersecurity Summit – a four-week series of webinars on key cybersecurity issues – gets underway Wednesday (Sept. 16) and runs through Oct. 7. Sponsored by the federal Cybersecurity and Infrastructure Security Agency (CISA), the webinars run through every Wednesday beginning Sept. 16. Themes for the sessions include: Key Cyber Insights (Sept. 16), Leading the Digital Transformation (Sept 23), Diversity in Cybersecurity (Sept. 30) and Defending our Democracy (Oct. 7). See the link below for more information … Speaking of cybersecurity, the NASCUS/CUNA Cybersecurity E-School kicks off Oct. 6 with nine sessions to be held over five weeks. Among the topics scheduled to be covered are data privacy laws, top threats, targeted internal and independent audits, and practical applications of artificial intelligence (AI), machine learning and other tech uses. See the link below for additional details, including registration.

LINKS:

3rd Annual National Cybersecurity Summit

NASCUS/CUNA Cybersecurity E-School (including registration)

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.