Oct. 27, ’17 NASCUS Report

Posted October 27, 2017Trump expected to sign repeal of ‘Arbitration Agreements’ rule

Repeal of the “Arbitration Agreements” rule under the Congressional Review Act (CRA) is expected to be signed by President Donald Trump within days, following the Senate vote this week. The repeal of the rule – issued by the Consumer Financial Protection Bureau (CFPB) earlier this year, and which would have allowed consumers to join in class actions over disputes about financial products, including credit cards and bank accounts – was passed Tuesday in the Senate by a one-vote margin (a tie-breaker cast by Vice President Mike Pence). The House passed the resolution earlier this year.

Under the CRA, once a rule is repealed it may not be reissued in substantially the same form – nor may a new rule that is substantially the same be issued – “unless the reissued or new rule is specifically authorized by a law enacted after the date of the joint resolution disapproving the original,” according to the statute, enacted in 1996.

Before the repeal vote in the Senate, the Treasury Department Monday weighed in, in an unusual action, issuing a report which essentially panned the rule, detailing seven “defects” it found. Bank and credit union trade groups also urged Senators to reject the rule.

Previously, the rule had prompted another uncommon action: a regulator-to-regulator face-off between the Office of the Comptroller of the Currency (OCC), and the CFPB. The OCC, in the person of Acting Comptroller Keith Noreika, claimed that the consumer bureau had ignored its own data when promulgating the rule, which the OCC asserted, because of its own analysis, “will raise the cost of credit.” CFPB Director Richard Cordray had countered that the OCC analysis used “flawed statistics” and misstated the effects of the bureau’s arbitration rule on community banks.

Meanwhile, the outlook for more congressional CRA action on recent CFPB rules is unclear. The payday lending rule, issued this month, while not widely supported among financial institutions, is not considered a likely repeal candidate, as the level of industry opposition to the rule has been far less strident than the arbitration rule.

GAO FINDS GUIDANCE SUBJECT TO CONGRESSIONAL REVIEW

A policy statement issued four years ago as guidance by federal banking agencies on “leveraged lending” is a “rule” subject to the requirements of the Congressional Review Act (CRA), the Government Accountability Office (GAO) wrote in a letter late last week to a senator. In its Oct. 19 letter to Sen. Pat Toomey (R-Pa.), GAO wrote that “Interagency Guidance on Leveraged Lending (Interagency Guidance or Guidance),” issued jointly in March 2013 by the OCC, the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC), contains the policy statement which is, GAO said, a rule for purposes of the CRA. Toomey had asked GAO to issue an opinion on the guidance document.

GAO noted that congressional review is assisted by CRA’s requirement that all federal agencies, including independent regulatory agencies, submit each rule to both Houses of Congress and to the Government Accountability Office (GAO) before it can take effect. The guidance issued by the banking agencies, GAO found, is a “general statement of policy” designed to assist financial institutions in providing leveraged lending to creditworthy borrowers in a sound manner. “As such, it is a rule subject to the requirements of CRA,” GAO wrote.

NASCUS – as recently as last week during the NCUA budget briefing – has argued that, because the overhead transfer rate (OTR) methodology is an NCUA Board statement of general applicability and future effect designed to implement and interpret the Federal Credit Union Act — it clearly falls within the scope of the Administrative Procedure Act (APA). GAO wrote in its analysis about the banking guidance that “CRA adopts the definition of rule under the Administrative Procedure Act (APA), which states in relevant part that a rule is ‘the whole or a part of an agency statement of general or particular applicability and future effect designed to implement, interpret, or prescribe law or policy or describing the organization, procedure, or practice requirements of an agency.”

NASCUS has urged NCUA to seek public comment on the OTR at least every three years, whenever the methodology is changed, and any time the OTR changes by more than 2% (in either direction) in any given year.

SUMMARY OUTLINES PROPOSAL ABOUT MORTGAGE SERVICING RULES

Proposed amendments to Regulation Z, mortgage servicing rules (issued in 2016) are outlined in a new summary posted by NASCUS recently. The amendments, which refer to the timing for servicers to transition to providing modified or unmodified periodic statements and coupon books in connection with a consumer’s bankruptcy case, were issued as an interim final rule, are effective on the day they were issued (Oct. 19). However, comments are due Nov. 17.

The NASCUS summary notes that CFPB is concerned that a 2016 provision of its mortgage servicing rules imposes too narrow a window for compliance and may provide insufficient guidance as to when or how servicers must comply with the timing requirements for providing periodic statements under certain circumstances. The interim final rule gives servicers a 10-day window to provide a modified notice at the end of a 180-day period.

The summary notes that, based on the comments received, CFPB will consider whether to revisit this rule.

ONE IN SIX PRIVATELY INSURED CUS NOW FHLB MEMBERS

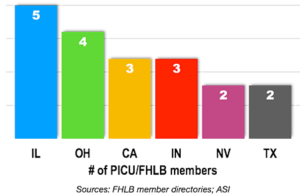

At least one in six privately insured credit unions are now members of Federal Home Loan Banks (FHLBs) around the country, as the credit unions take advantage of legislation adopted three years ago. The state with the most memberships: Illinois, with five, according to information from the FHLBs compiled by NASCUS.

At least one in six privately insured credit unions are now members of Federal Home Loan Banks (FHLBs) around the country, as the credit unions take advantage of legislation adopted three years ago. The state with the most memberships: Illinois, with five, according to information from the FHLBs compiled by NASCUS.

In late 2015, Congress adopted legislation that opened the door for the credit unions to join the banks, which provide liquidity to financial institutions primarily to support mortgage lending. Prior to the legislation (the Fixing America’s Surface Transportation Act (FAST Act), H.R. 22), only federally insured credit unions were eligible to join the banks. The first privately insured credit union joined in June 2016, following issuance of guidance from the Federal Housing Finance Authority (FHFA), the regulator of the FHLBs.

This summer, FHFA finalized regulations for the credit unions’ membership in the banks. The final rule allows non-federally insured credit unions to submit their request to their state regulator for a share insurance determination at the same time as the credit union submits its initial application to the FHLB. This starts a six-month waiting period if the state regulator does nothing. However, if the state authority says it will not make a determination, the credit union can go straight to the FHLB for membership.

LINK:

NASCUS Summary: FHFA Final Rule FHLB Membership for Non-Federally Insured Credit Unions

ONE-DAY PROGRAM TAKES DEEP DIVE INTO COMMERCIAL LENDING

A one-day program about commercial lending, focusing on lending and leased property, is scheduled for Dec. 5 in Nashville. Running from 8:30 a.m. to 4:30 p.m., the MBL Symposium looks at the leading topics in the commercial/member business loan realm, including: investment real estate underwriting (parts 1 and 2); BSA/AML and the commercial loan; investment real estate documentation; investment real estate risk management practices, and; commercial lending and loan participations. Sponsored by NASCUS and the Tennessee Department of Financial Institutions, the program will be held at the DFI’s offices in Nashville (at the Department of Financial Institutions). Cost is $349 for members, $399 for non-members.

Other NASCUS events coming up in November include:

- Nov. 6: NASCUS Executive Forum (Rocky Hill, Conn.)

- Nov. 7: CECL Training (Charlotte, N.C.)

- Nov. 12-15: BSA Conference (Las Vegas)

- Nov. 28: NASCUS Mortgage Symposium (Newton, Mass.)

LINKS:

Agenda, registration for Dec. 5 MBL Symposium

NASCUS educational events, November ’17 (and beyond)

‘MEET AND GREET’ SET IN ILLINOIS FOR STATE CREDIT UNIONS

CEOs of state chartered credit unions in Illinois are invited to gather Nov. 13 in Naperville for a “meet and greet” with NASCUS, the Illinois Credit Union League and the Illinois Department of Financial and Professional Regulation (IDFPR), following a state “Governor’s Advisory Board” meeting in the city. The three groups are sponsoring a 3:45 – 5:15 p.m. reception for Illinois state-chartered credit unions to get to know the IDFPR’s office, and to learn more about NASCUS. The event will be held at the league’s offices at 1807 West Diehl Road in Naperville. Representatives of all Illinois state-chartered credit unions are welcome to attend; there is no charge. To RSVP for the event (by Nov. 6), or for more information, contact NASCUS Vice President of Member Relations Alicia Valencia Erb at [email protected] or (703) 528-0874.

LEG/REG COMMITTEE MEETS BY TELECONFERENCE NEXT WEEK; JOIN IN!

The NASCUS 2017-2018 Legislative and Regulatory Committee holds its monthly conference call this upcoming Wednesday at 3 p.m. On the agenda: CFPB developments, NCUA proposed rules and Regulatory Reform agenda, and more. All members and other interested members of the state system are welcome to join in; contact NASCUS Executive Vice President and General Counsel Brian Knight for more information at [email protected].

BRIEFLY: New commissioner named in North Dakota; strong showing for members-only Equifax telecon

Lise Kruse will succeed Bob Entringer as commissioner of the North Dakota Department of Financial Institutions; Entringer retires Nov. 30, after 35 years of service to the NDDFI. He was named commissioner in 2011 (and reappointed last year). Kruse joined the department in 2004 as a financial institutions examiner; her most recent position is chief examiner of banks. The appointment of commissioner, made by Gov. Doug Burgum (R), requires confirmation by the state senate … More than 140 phone lines were dialed in (and likely more listening in groups) for our members-only call this week on the Equifax data breach; we covered background on the breach, protecting credit unions and members, the legal fallout and the public relations consequences for the company. Members have access to a recording and transcript of the call (as notified in an email this week from NASCUS’ Lucy Ito). Contact NASCUS VP of Member Relations Alicia Valencia Erb for more information at [email protected], or (703) 528-0874.

Information Contact:

Patrick Keefe, [email protected]

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.