May 1, 2020 NASCUS Report

Posted May 1, 2020THIS WEEK: CORONAVIRUS RESPONSE – Seven new NASCUS summaries published … Session provides economic outlook … Webinars offer operational help … CECL exemption sought … ‘wish list’ presented to Senate Committee … Trio of new Letters to CUs released … Fed deletes savings withdrawal limit … Factsheets address appraisals; Series explores mortgage lending compliance; BRIEFLY: Grants for mentoring programs available; Trades want PPP conduit unclogged

CORONAVIRUS RESPONSE

NASCUS summaries outline rules, alerts, letters …

A new batch of summaries – of NCUA letters to credit unions, new proposed and final rules and a risk alert – has been published by NASCUS and posted on the association website.

The letters to credit unions (LTCUs) summaries outline three released last month – on legislative enhancements to the Central Liquidity Facility (CLF, LTCU 20-CU-08), NCUA providing temporary regulatory relief (LTCU 20-CU-09), and changes to appraisal requirements (LTCU 20-CU-10) – that were all issued in response to the coronavirus crisis.

The letter about improvements to the CLF outlines the changes Congress has made to the lending facility as a result of the Coronavirus Aid, Relief and Economic Security Act (CARES Act) enacted in late March. Among other things, the new law increased the facility’s borrowing capacity and gave credit unions more flexibility in using it.

In the second letter, the agency offers a quick summary of last week’s temporary rule changes for credit unions’ occupancy and disposal of acquired and abandoned premises, purchase of eligible obligations, and loan participations, as well as other flexibility that is available related to supervisory committee audits, call report deadlines, and corporate governance measures.

In the third letter, NCUA outlines recent changes in appraisal requirements and changes specifically affecting federally backed mortgage loans – most of them responding to disruptions brought by the coronavirus pandemic.

The summaries of the LTCUs are publicly available; the other summaries are available to members only.

There are three new summaries of rules, one proposed and two final (although one is a temporary final rule). The proposal would, among other things, allow corporate credit unions to invest in subordinated debt instruments issued by credit unions, but would also require the corporates to fully deduct the amount of the instrument from their top capital amounts. Comments are due July 27 (after a 60-day extension added April 1).

An interim final rule (IFR) about the agency’s Central Liquidity Facility (CLF) is the other regulatory action summarized. Among other things, the IFR – which implements provisions of last month’s Coronavirus Aid, Relief and Economic Security Act (CARES Act) – provides the CLF with additional abilities to serve as “the liquidity backstop to the nation’s credit union system,” the agency said in a release. Among other things, the rule eliminates the six-month waiting period for new members to receive a loan. The rule took effect Thursday (April 29).

The temporary final rule addresses changes to NCUA’s loan participation rule for all federally insured credit unions (FICUs), federal credit union (FCU) eligible obligation rules, and FCU occupancy rules. NCUA said it is enacting the changes on a temporary basis to help FICUs remain liquid and otherwise operational during the COVID-19 crisis. (As it is related to the crisis, the summary is publicly available.)

Finally, NASCUS has summarized the agency’s “risk alert” issued April 14, which urged credit unions to pay care to cybersecurity risks associated with the increasing incidence of remote work, conference calls, and video meetings during the coronavirus crisis.

NASCUS Summary: Proposed rule, Part 704 Corporate Credit Unions (members only)

NASCUS Summary: Interim Final Rule Part 725 Central Liquidity Facility (members only)

NASCUS Summary: Temporary Final Rule Loan Participations

NASCUS Summary: 20-Risk-01 Cybersecurity Considerations for Remote Work (members only)

Session looks at economic impact of crisis …

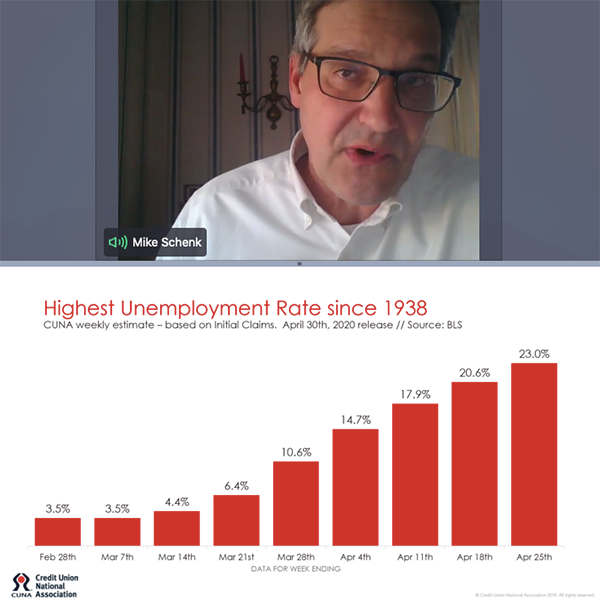

A 50-minute overview of the coronavirus crisis impact on the economy – and in particular the state credit union system – was provided Thursday in an exclusive event for NASCUS members sponsored by NASCUS and the American Association of Credit Union Leagues (AACUL). Led by Credit Union Natl. Assn. (CUNA) Chief Economist Mike Shenk (who also serves as chief advocacy officer for policy analysis for the association). In the photo, Schenk explains record unemployment rates posted as a result of the pandemic in the U.S.

The program looked at various aspects of the impact of the crisis, including on employment, consumer spending, interest rates and forecasting into the next six months to a year. Among other things, Schenk said that credit unions were in historically good shape going into the downturn. Further, he said, credit unions have proven in past crises to be “very, very resilient,” and typically come out of them with strong support from members.

Also joining in on the call were officials from state credit union leagues from across the nation.

The session was recorded and will be available at a later date for “on-demand” viewing via the NASCUS website.

Free webinars offer operational help …

A series of one-hour webinars, offered at no charge, aimed at keeping credit unions up to date about considerations related to maintaining credit union operations during the coronavirus crisis – including cybersecurity — are being offered by NASCUS beginning May 12 and running through May 27.

Presented in conjunction with CliftonLarsonAllen LLP, the six one-hour sessions — scheduled to begin at 2 p.m. ET on each date – will look at COVID-19 considerations in two areas: accounting issues and cybersecurity.

The accounting issues series looks at:

- loan modifications for credit unions (May 12);

- allowance for loan losses (May 19)

- credit review (May 26).

The cybersecurity issues series examines:

- IT operations and cyber hygiene for a remote work force (May 13)

- IT/cybersecurity risk assessment fundamentals during pandemic business continuity (May 20);

- what to expect from cyber criminals and fraudsters (May 27).

“The COVID 19 crisis has placed significant pressure on the economic and cybersecurity systems across the world, including here in the United States,” said NASCUS Vice President of Education Isaida Woo. “These timely sessions look at the key issues in cybersecurity, accounting and regulatory considerations facing the state credit union system as a result of the pandemic, and offer real insight into tackling those considerations for the benefit of members and credit unions’ service to them.”

Although the sessions are being offered at no charge, Woo said advance registration is required for the series. Registrations should be made by May 12.

Hood wants CECL exemption …

NCUA this week joined another federal financial institution regulator in calling for a credit union exemption from new accounting rules requiring estimation of expected losses over the life of loans, known as the current expected credit losses (CECL) accounting standard.

In a letter to the Financial Accounting Standards Board (FASB) NCUA Board Chairman Rodney E. Hood urged the exemption for credit unions. FDIC Chairman Jelena McWilliams penned a similar letter in March calling for an exemption for banks. Additionally, the credit union trade groups have been pushing for the call from NCUA for some time.

“I believe the compliance costs associated with implementing CECL overwhelmingly exceed the benefits,” Hood wrote. “In our current environment, I am especially concerned that adopting CECL will have a chilling effect on lending, including loans to low-income borrowers.” Hood also asserted that, for most credit unions, “implementing CECL will have an immediate negative impact on net worth.”

The NCUA chairman told the accounting group that the agency uses the incurred loss model when it supervises and examines credit unions, which Hood said nearly 70% of which hold less than $100 million in assets. Additionally, he indicated that the CECL approach would not work for smaller credit unions. “Attempting to recognize all expected credit losses, even using the weighted average remaining maturity method, is fraught with data collection challenges for the smallest of our supervised credit unions,” he wrote.

LINK:

Hood letter to FASB Urging CECL Exemption for Credit Unions

… and calls for several statutory changes …

Four areas of statutory changes that NCUA said would assist its efforts “in light of COVID-19” were outlined in a letter from the NCUA Board chairman to the chairman of the Senate Banking Committee this week.

NCUA’s Rodney Hood told Sen. Mike Crapo (R-Idaho), in an April 29 letter, that changes in the law were needed to: improve liquidity for credit unions; provide regulatory relief in the agency’s prompt correction action (PCA) framework; reconfigure lending standards; and, tweak credit union membership requirements.

In improving liquidity, Hood recommended making permanent the temporary changes for the CLF contained in the CARES Act and giving the NCUA authority to waive the limit on federal credit unions’ (FCUs) lending to other credit unions.

Hood recommended three temporary changes to the current PCA framework: Reduction in minimum capital standards for federally insured credit unions (from 7% to 6% for well capitalized, and from 6% to 5% for adequately capitalized); Waiver of net-worth restoration plan requirements for up to 180 days for credit unions that are less than adequately capitalized; increase from $5 million to $100 million for the asset threshold below which the NCUA Board can delegate decisions related to critically undercapitalized credit unions.

For lending standards, Hood advised an additional three changes: Temporarily raise the member business lending cap to 20% (from its current 12.25%) of total assets; permanently increase the FCU loan maturity limit to 30 years (from 15 years); permanently expand credit union outreach to underserved areas by authorizing all credit union charters to apply for servings areas designated as underserved (rather than only multiple common bond FCUs).

On credit union membership, Hood suggested that the Banking Committee chairman consider legislation that would remove the “reasonable proximity” requirement (or significantly amend it) in order to “permit greater flexibility for members to join a credit union.”

Separate from those recommendations, Hood also voiced his support for – following the pandemic crisis –Congress providing the agency “vendor authority” to allow the agency to better supervise for third-party cybersecurity risks.

(In a speech last week to the Mountain West Credit Union Association – delivered remotely from his home – NCUA Board Member Todd Harper also spoke out in favor of third-party vendor supervision by the agency, calling on Congress to “reauthorize” the agency’s power to do so. NASCUS supports the agency obtaining exam authority over technology service providers (TSPs) that provide services to federally insured credit unions — provided that any such authority requires NCUA to rely on state examinations of such service providers where such authority exists at the state level. Further, NASCUS supports efforts to strengthen state regulatory exam and supervision of third parties providing services to state chartered credit unions.)

3 new letters issued by NCUA this week …

A flurry of more letters to federally insured credit unions on examiner outreach, strategies for helping members, and the Paycheck Protection Program (PPP) was published this week by NCUA, all related to the coronavirus crisis.

In the letter on examiner outreach (LTCU 20-CU-12), the agency said emerging credit risks resulting from the coronavirus crisis will be the focus of questions by federal examiners when they begin contacting the institutions they review beginning next week. In prior outreach (which focused on operational status and liquidity), the agency said it had found that nearly all credit unions report full or partial service to members, although some have closed locations due to their sponsors being closed; many credit unions report their lobbies are generally closed, but the vast majority are offering lobby appointments; and, that few credit unions report a need to increase borrowings.

In its letter on strategies for helping members (LTCU 20-CU-13), NCUA outlined more than a dozen strategies addressing new funds to borrowers, temporary loan modifications and permanent loan modifications. The letter also outlines policies for monitoring and reporting loan modifications.

Finally, NCUA issued LTCU 20-CU-11, which provides an overview of changes to various lending and risk-based capital requirements at credit unions under various emergency programs developed to combat the financial impact of the coronavirus crisis, including the SBA’s Paycheck Protection Program (PPP). Among other things, the letter points out that the PPP loans are not subject to the agency’s enhanced underwriting and monitoring requirements for commercial loans. In addition, the letter notes, the loans are not included in a credit union’s net member business loan calculation for purposes of determining compliance with the statutory member business loan limit.

LINKS:

NCUA LTCU 20-CU-12: Outreach Related to COVID-19 Impact

NCUA LTCU 20-CU-13: Working with Borrowers Affected by the COVID-19 Pandemic

NCUA LTCU 20-CU-11: Regulatory Treatment for Paycheck Protection Program Loans

Fed deletes ‘6 per month’ savings withdrawal limit …

Credit unions, banks and other depository institutions may allow their members and customers to make an unlimited number of convenient transfers and withdrawals from savings accounts following action by the Federal Reserve late last week. In a release, the Fed said it had deleted the six-per-month limit on convenient transfers from the definition of “savings deposit,” which allows customers and members to make the unlimited numbers of transfers and withdrawals “at a time when financial events associated with the coronavirus pandemic have made such access more urgent.” The Fed issued an interim final rule to amend its Regulation D (Reserve Requirements of Depository Institutions) in order to make the change. The central bank noted that the regulatory limit in Regulation D was the basis for distinguishing between reservable “transaction accounts” and non-reservable “savings deposits.” “The Board’s recent action reducing all reserve requirement ratios to zero has rendered this regulatory distinction unnecessary,” the Fed said.

… Factsheets address appraisals

Two new factsheets focusing on appraisals and other valuations and their delivery in home mortgage loan applications were released Thursday by the federal consumer financial protection agency, which it said were issued in response to frequently asked questions.

The factsheets by the Consumer Financial Protection Bureau (CFPB) deal with transaction coverage and delivery of appraisals under the Equal Credit Opportunity Act (ECOA). The transaction coverage factsheet covers questions posed to the bureau since it issued its ECOA Valuations Rule in 2013. That bureau noted that that rule amended Regulation B to require creditors to provide applicants free copies of all appraisals and other written valuations developed in connection with an application secured by a first lien on a dwelling and to notify applicants of their right to receive copies of appraisals within three business days.

The delivery of appraisals factsheet, the bureau said, is intended to explain the delivery requirements for appraisals under the Valuations Rule. The rule, CFPB noted, guarantees that applicants receive important information about the value of their homes in a mortgage transaction. That information includes copies of all appraisals and other written valuations, and notification to all applicants of their right to receive the copies of appraisals and valuations.

According to CFPB, the factsheet uses illustrations to help explain the “prompt delivery” of all copies of appraisals (including what is, and is not, considered “prompt”).

Also this week, the consumer bureau issued guidance to address the pandemic’s effects on the mortgage origination process. In particular, the agency said, the guidance would “make it easier for consumers with urgent financial needs to obtain access to mortgage credit more quickly in the middle of the COVID-19 pandemic.”

Among other things, CFPB said the guidance addresses the TRID Rule’s three-day waiting period requirements, Regulation Z’s consumer recession rights and the ECOA and Regulation B’s appraisal and written valuation requirements in light of the COVID-19 pandemic.

LINKS:

Factsheets: Equal Credit Opportunity Act Valuation Rule

Series takes in-depth look at mortgage lending compliance

In addition to the coronavirus-related sessions on cybersecurity and accounting (noted above), NASCUS is also hosting (with the Massachusetts Division of Banks) a webinar series focusing on the current regulatory environment related to mortgage lending. The six, two-hour sessions – led by Michael Christians of Michael Christians Consulting LLC – begins May 5 and runs through May 21. Topics scheduled to be addressed include: TILA/RESPA integrated disclosures; ability to pay/qualified mortgages (QM); mortgage servicing; HMDA; privacy; and guidance for real estate lending during the coronavirus pandemic.

LINK:

NASCUS compliance lending webinar series, info and registration

BRIEFLY: Agency announces grants for mentoring programs; Trade groups want SBA’s E-Tran system (for PPP) unclogged

Grants of up to $25,000 each are available to help small institutions establish mentoring programs with larger, low-income-designated credit unions to “provide expertise and guidance in serving low-income and underserved populations,” NCUA said this week. The total amount of grants available is $125,000, the agency said in a release; it added that small, low-income credit unions designated as minority depository institutions (MDIs) may apply for mentoring grants from May 1 through June 30. NCUA said that credit unions selected for the mentoring program will participate in agency-led group meetings and training relevant to their needs and will share progress on the mentoring partnerships … Credit union and banking trade groups signed a joint letter this week to the SBA urging it to resolve access problems with its E-Tran system, which that agency is using to receive (and process) PPP loan requests. The system has been blamed for bogging down PPP loan submissions (and approvals. “Quite simply, it is taking too long to submit loans and get these funds where they need to go,” the groups said in their joint missive.

LINK:

NCUA: Mentoring Grants Available to Help MDIs

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.