April 29, ’16 NASCUS Report

Posted April 29, 2016NASCUS letter: OTR flawed, fixes suggested

Calling the overhead transfer rate methodology flawed and offering numerous recommendations to fix it, NASCUS filed a 22-page comment letter (accompanied by a 32-page appendix) with the agency this week, and was joined in commenting by state regulators, credit unions, national and state credit union trade associations, and others in doing so. Each of the letters filed, so far, have urged the agency to make changes to the status quo (see next item for more).

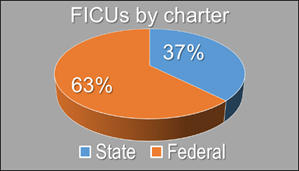

The NASCUS letter took a comprehensive look at the OTRand the agency’s use of it, particularly concentrating on NCUA’s proposition that “it has no safety and soundness examination obligations as a chartering authority,“ and that all the agency does is related to protecting the insurance fund. That view, NASCUS wrote, is without support in statute or practice. Other key points included: the current OTR approach threatens the dual-chartering system; NCUA’s role as credit union charterer and insurance fund administrator obligates it to treat FISCUs equitably; the agency’s past reviews of the OTR have been flawed; the Administrative Procedure Act (APA) applies to the OTR, and; determination of the OTR must remain with the board (and not delegated to the staff). In its calculations, NASCUS wrote, NCUA “overstates the size of the state system, and therefore over-allocates its costs to supervise the state system.” (The pie chart, for example, indicates the number of FISCUs relative to FCUs – which is “out of balance” with the way the agency allocates costs.)

The NASCUS letter took a comprehensive look at the OTRand the agency’s use of it, particularly concentrating on NCUA’s proposition that “it has no safety and soundness examination obligations as a chartering authority,“ and that all the agency does is related to protecting the insurance fund. That view, NASCUS wrote, is without support in statute or practice. Other key points included: the current OTR approach threatens the dual-chartering system; NCUA’s role as credit union charterer and insurance fund administrator obligates it to treat FISCUs equitably; the agency’s past reviews of the OTR have been flawed; the Administrative Procedure Act (APA) applies to the OTR, and; determination of the OTR must remain with the board (and not delegated to the staff). In its calculations, NASCUS wrote, NCUA “overstates the size of the state system, and therefore over-allocates its costs to supervise the state system.” (The pie chart, for example, indicates the number of FISCUs relative to FCUs – which is “out of balance” with the way the agency allocates costs.)

NASCUS also outlined more equitable ways to allocate NCUA’s operating costs consistent with Congress’ intent in creating the agency and the insurance fund, offering four alternatives: FISCUs and FCUs – and their examinations – could be treated in the same manners; NCUA could refund money imputed to state examination work directly to FISCUs; NCUA could pay out those funds to the benefit of state agencies, or; NCUA could drop a formal overhead transfer calculation and re-establish an OTR at 50% of its budget.

LINK:

NASCUS comment letter to NCUA on OTR methodology

COMMENTERS IN HARMONY: OTR CHANGE NEEDED

Joining NASCUS in commenting were nearly two dozen state agencies, credit unions, trade groups and individuals, all with a similar message: change and/or fix the OTR. And while the number of commenters was low compared to the thousands of letters the agency received over the last two years on RBC, member business lending and field of membership, the commenters by and large represented a wide swath of the credit union movement nationwide.

For example, both national trade associations for credit unions – the Credit Union Natl. Assn. (CUNA), the nation’s largest representing credit unions of both charters and state CU associations, and the National Association of FCUs (NAFCU), mostly representing FCUs – filed extensive comments. CUNA suggested that the agency is attributing too many actions to “insurance-related costs,” adding that “safety and soundness should not be a catch-all by which NCUA can allocate all of its activities for purposes of having the NCUSIF fund the agency.” NAFCU urged the agency to abandon the recently adopted policy delegating to senior staff (the director of the office of Examinations and Insurance) responsibility for setting the OTR, arguing that NCUA Board should continue to use its judgment and perspective.

NASCUS President and CEO Lucy Ito expressed gratitude to all who took time to draft and file comments. “There are common themes among the letters that we have seen, which parallel NASCUS’ views,” Ito said. “NCUA must respect and carefully consider the positions and views articulated in the letters – which we think will go a long way in helping to correct this severely flawed methodology.”

LINK:

Comment letters to NCUA (in OTR Resources)

THANKS TO CHAIRMAN MATZ AS SHE WRAPS UP TENURE AT AGENCY

Today is NCUA Chairman Debbie Matz’ last at the agency after nearly seven years at the helm (the longest tenure of an NCUA chairman), and NASCUS’ Lucy Ito thanked and praised her. “Voluntarily opening up the OTR to public notice and comment was a significant step forward in this issue, reflecting Chairman Matz’ long-held desire to bring greater transparency to NCUA. She rightly deserves credit and our thanks for that – as well as for her willingness to engage with her state agency counterparts on a variety of topics, including regulatory innovation and best practices, and to take on other crucial issues including supplemental capital. She’s moving on now – but she leaves behind a long and lasting legacy for the credit union system.”

REPORT: BSA FINES REAP BILLIONS FOR GOVERNMENT

BSA/anti-money laundering compliance has a well-deserved reputation for being complex, time consuming – and vital, particularly if a financial institution wants to avoid fines and penalties. And for good reason: The Government Accountability Office (GAO) in an April 21 report, revealed that financial institutions have been assessed about $12 billion in fines, penalties and forfeitures for violations of BSA/AML regulations since 2009 by federal banking regulators. Of that, over the seven-year period of 2009-15, about $5.2 billion was assessed on financial institutions by federal agencies for BSA/AML violations specifically; $27 million for Foreign Corrupt Practices Act (FCPA) violations, and; $6.8 billion for violations of U.S. sanctions program requirements, according to the GAO report. Further, in four of the seven years covered by the report’s findings, BSA/AML assessments were far greater than those related to FCPA or U.S. sanctions programs. GAO stated that regulators assessed penalties for failure to implement or develop adequate BSA/AML programs, and failure to identify or report suspicious activity. A footnote in the report states that NCUA officials said they had not assessed any penalties during that time period.

NASCUS/CUNA BSA Conference, Nov. 13-16, San Antonio

CECL STANDARD TO PROCEED WITH EFFECTIVE DATE EXTENDED 1 YEAR

The “current expected credit loss” (CECL) standard will be effective for fiscal years beginning after December 15, 2020 — and interim periods within fiscal years beginning after Dec. 15, 2021 — for credit unions and other “non-public” companies, the Financial Accounting Standards Board (FASB) agreed this week. The board also voted to proceed with the standard and publish details in June. Previously, the standard would have taken effect in fiscal years after Dec. 15, 2019, and interim periods within fiscal years beginning after Dec. 15, 2020. Of course, early adopters are welcome, with FASB permitting those entities who do so for fiscal years beginning after Dec. 15, 2018. In a release, FASB describes CECL as “a new accounting standard that provides timelier financial reporting of credit losses on loans and other financial instruments held by financial institutions and other organizations.” The board also stated that it expects the final standard (“Accounting Standards Update” (ASU)) will be published in June to give preparers “enough time to review and prepare for the changes by the effective dates.”

LINKS:

FASB release on adoption of CECL standard, effective date

Agenda, NASCUS Summit (Chicago, Oct. 5-7)

APPLICATIONS FOR LOW-INCOME CU ASSISTANCE GRANTS ACCEPTED JUNE 1-30

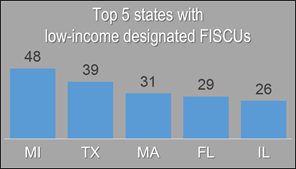

Applications for low-income credit union assistance grants by NCUA will be accepted between June 1-30, the agency announced this week – along with the scheduling of a May 11 webinar at 2 p.m. ET on the grant application process. There is no charge. The grants are made available to help the low-income institutions grow, train staff and improve security, NCUA stated in a release. According to the NCUA Office of Small Credit Union Initiatives (OSCUI), about one third of eligible FISCUs – 498 — currently hold a low-income designation, which offers credit unions flexibility in accepting non-member deposits, offering secondary capital accounts, making more business loans – and receiving grants from the agency. (Click here to view all states ranked by number of FISCU LIDs)

Applications for low-income credit union assistance grants by NCUA will be accepted between June 1-30, the agency announced this week – along with the scheduling of a May 11 webinar at 2 p.m. ET on the grant application process. There is no charge. The grants are made available to help the low-income institutions grow, train staff and improve security, NCUA stated in a release. According to the NCUA Office of Small Credit Union Initiatives (OSCUI), about one third of eligible FISCUs – 498 — currently hold a low-income designation, which offers credit unions flexibility in accepting non-member deposits, offering secondary capital accounts, making more business loans – and receiving grants from the agency. (Click here to view all states ranked by number of FISCU LIDs)

LINKS:

List of eligible grant projects, NCUA’s evaluation criteria

Online registration for May 11 webinar on grant application process

OSCUI Small Credit Union Learning Center

BRIEFLY: MBL school five weeks away; FinCEN leader says adieu; In memoriam, Tim Blasé

It’s just five weeks until the NASCUS MBL school, June 7-8 in New Orleans. And it’s just eight months until the new MBL rule does into effect. Be ready — attend the NASCUS MBL School in June and be ready when the rule goes into effect in January. But register soon — available slots for this school are filling fast! See more, including the agenda, at the link below … FinCEN Director Jennifer Shasky Calvery announced this week that she is leaving the agency next month, offering no reason or where she plans to land next. Calvery has held the job for nearly four years … Condolences to the staff of the PA Department of Banking and Securities on the death this week of Tim Blasé, director of the Office of Credit Unions. “Tim was a vital member of our management team, overseeing the work we do with credit unions. He will be dearly missed,” wrote Robin L. Wiessmann, PA Secretary of Banking and Securities, to colleagues.

LINK:

NASCUS MBL School, June 7-8, New Orleans (schedule and registration)

Number of FISCU low-income designated CUs by state (as of April 28, 2016)

State |

# of state

|

MI |

48 |

TX |

39 |

MA |

31 |

FL |

29 |

IL |

26 |

MO |

26 |

TN |

23 |

WI |

22 |

AL |

20 |

CA |

17 |

LA |

16 |

NM |

16 |

OH |

13 |

IA |

12 |

MN |

12 |

ND |

12 |

OR |

12 |

MS |

11 |

PA |

11 |

WA |

11 |

CO |

10 |

NC |

10 |

VA |

9 |

ID |

8 |

IN |

8 |

KS |

8 |

AZ |

6 |

MT |

6 |

GA |

5 |

KY |

5 |

UT |

5 |

ME |

3 |

SC |

2 |

VT |

2 |

CT |

1 |

MD |

1 |

NJ |

1 |

WV |

1 |

Information Contact:

Patrick Keefe, NASCUS Communications, [email protected] or (703) 528-5974

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.