Technology & Payments

June 20, 2025: Technology & Payments Articles

- CFPB, Consumer Groups Clash Over BNPL

- Embedded Lending as a Growth Strategy for ISVs—How to Maximize Revenue Potential

- Open Banking to Survive Trump, Fintechs Say

- ICYMI: Why Embedded Finance Is a Disruptive Force Financial Institutions Can’t Ignore

CFPB, Consumer Groups Clash Over BNPL

Patrick Cooley, Payments Dive

The battle over buy now, pay later — whether it’s helpful or hurtful to users — persists even after the Consumer Financial Protection Bureau last month withdrew its rule regulating such services.

The battle over buy now, pay later — whether it’s helpful or hurtful to users — persists even after the Consumer Financial Protection Bureau last month withdrew its rule regulating such services.

Consumer Financial Protection Bureau researchers last week released a study concluding buy now, pay later services are not harmful to consumers, after the federal agency last month jettisoned a rule regulating BNPL.

The June 7 study, conducted by two economists in the CFPB’s research office, reviewed data from the six largest BNPL companies over several years and found few negative impacts on consumers who use the payment method. That was at odds with findings from a separate CFPB study, published in January, that concluded consumers who used BNPL options were piling on debt.

The clash of findings comes as the agency under President Donald Trump turns away from the prior administration’s efforts to regulate BNPL. On May 12, the bureau spiked an interpretive rule that would have regulated BNPL purchases like credit card transactions. The rule was first proposed under director Rohit Chopra, who was fired by Trump in February.

Buy now, pay later industry providers and supporters say the agency’s June study proves that BNPL does not harm consumers, while consumer advocates counter that there is nothing in the research that contradicts their view that buy now, pay later should be tightly regulated. Read more

Embedded Lending as a Growth Strategy for ISVs—How to Maximize Revenue Potential

Steven Velasquez, Payments Journal

As consumer expectations for seamless buying experiences continue to rise, independent software vendors (ISVs) that embed payments into their platforms position themselves to capture greater market share in a growing and increasingly competitive software landscape.

As consumer expectations for seamless buying experiences continue to rise, independent software vendors (ISVs) that embed payments into their platforms position themselves to capture greater market share in a growing and increasingly competitive software landscape.

Consider this: the global ISV market clocks in at USD 2.35 billion in 2025, growing to USD 5.5 billion by 2030, reflecting a compound annual growth rate (CAGR) of 18.5 percent.

With such rapid growth ahead, distinguishing your business requires more than a presence in the market—it demands forward-thinking innovation. So, how do you differentiate your business and capture a greater share of the market?

A strategic approach is essential to building scalable, adaptable solutions that support long-term growth in a rapidly evolving industry. ISVs that understand this are more successful in a crowded marketplace. How you implement these services, however, is what truly sets you apart. Your financial services framework should extend beyond payments to deliver a comprehensive, value-driven experience.

Implementing lending functionality through API integration is part of a broader approach to delivering greater value to your customers. Capitalizing on this trend now can give your business a competitive edge in a market poised for exponential growth. Analysts estimate the embedded lending market will reach USD 7.66 billion in 2025 and grow to USD 28.43 billion by 2032, with a CAGR of 20.6% from 2025 to 2032. Read more

Open Banking to Survive Trump, Fintechs Say

Justin Bachman, Banking Dive

Consumers and financial services firms will pursue their interests in data sharing, despite a move by the Consumer Financial Protection Bureau to extinguish the trend, industry experts contend.

Consumers and financial services firms will pursue their interests in data sharing, despite a move by the Consumer Financial Protection Bureau to extinguish the trend, industry experts contend.

An open banking trend allowing banks and payments players to more easily share consumer data is likely to advance, regardless of vacillating U.S. regulatory policy, industry lawyers and executives say.

The Consumer Financial Protection Bureau had decided to let open banking regulations take effect next year, but those 2026 compliance dates were thrown into question last year when bank groups sued the government to block the CFPB’s open banking rule.

Then, President Donald Trump’s return to the White House ushered in an era of dramatic deregulation in the executive branch. Earlier this month, the CFPB asked a federal judge to rule for the bank plaintiffs against what the agency’s new leaders consider an “unlawful” rule.

Despite the multi-pronged effort to kill the bureau rule, there are reasons to believe that the spirit of open banking – if not the actual letter of a law, prescribed by regulators – is likely to carry on, regulatory lawyers and fintech consultants say. Read more

ICYMI: Why Embedded Finance Is a Disruptive Force Financial Institutions Can’t Ignore

Tariq Bin Hendi, World Economic Forum

The financial system of the future won’t be built in banks — it’ll be embedded in the apps, platforms and services people already use.

The financial system of the future won’t be built in banks — it’ll be embedded in the apps, platforms and services people already use.

Redefining how financial services are accessed and delivered, embedded finance is at the forefront of fintech innovation. By seamlessly integrating payments, lending, insurance and other financial products into non-financial platforms, embedded finance is making financial interactions more accessible, seamless and intuitive. This rapid evolution is sparking discussions about the future of traditional banking institutions. But does this mean the end of banks as we know them? Probably not.

Rather than signalling the end of traditional banking, this shift offers institutions a chance to evolve. By partnering with fintechs, banks that innovate will thrive.

Global and regional growth

Globally, the embedded finance market is expected to reach $7.2 trillion in size by 2030, according to a report by Dealroom and ABN AMRO Ventures, while in the MENA region, the market, valued at $11.2 billion in 2024, is projected to soar to $37.7 billion by 2029, as reported by Research and Markets. This impressive growth underscores the increasingly vital role of this sector in transforming financial ecosystems regionally and globally. Read more

June 13, 2025: Technology & Payments Articles

- What Comes After Tap to Pay? Why Bank Leaders Should Prioritize Virtual Cards

- Walmart Is Using Its Own Fintech Firm to Provide Credit Cards After Dumping Capital One

- Remodeling Main Street: How Community Banks Can Leverage the Banking-as-a-Service Paradigm

- FTA CEO Says Open Banking Central to Fintechs’ Work

What Comes After Tap to Pay? Why Bank Leaders Should Prioritize Virtual Cards

Mark B. Egan, The Financial Brand

What started as a niche fraud-prevention tool in the early 2000s has evolved into a versatile payment instrument offering four compelling advantages:

What started as a niche fraud-prevention tool in the early 2000s has evolved into a versatile payment instrument offering four compelling advantages:

- immediate access that eliminates waiting for physical cards,

- enhanced security through unique transaction numbers,

- flexible deployment across digital environments, and

- improved spending control for organized financial management.

Virtual cards have for decades kept a low-profile — progressively gaining credibility and finding new use cases, even as they remain very much in the shadow of digital wallets and instant payment services. But as tap-to-pay fast becomes second nature and digital wallets approach maximum penetration, virtual cards may now be emerging as the next strategic lever for issuers.

This is especially true as the battle for cardholder primacy — top of wallet — intensifies. In this context, more financial institutions may see virtual cards as a differentiated offering worth spotlighting, both for their utility and for their potential to advance the conversation on pain points like payments security and digital engagement. Read more

Walmart Is Using Its Own Fintech Firm to Provide Credit Cards After Dumping Capital One

Hugh Son, CNBC

Key Points

- Walmart’s majority-owned fintech startup OnePay said Monday that it was launching a pair of new credit cards for customers of the world’s biggest retailer.

- To do so, OnePay is partnering with Synchrony, a major behind-the-scenes player in retail cards, which will issue the cards and handle underwriting decisions starting in the fall, the companies said.

- OnePay, which was created by Walmart in 2021 with venture firm Ribbit Capital, will handle the customer experience for the card program through its mobile app.

Walmart’s majority-owned fintech startup OnePay said Monday it was launching a pair of credit cards with a bank partner for customers of the world’s biggest retailer.

Walmart’s majority-owned fintech startup OnePay said Monday it was launching a pair of credit cards with a bank partner for customers of the world’s biggest retailer.

OnePay is partnering with Synchrony, a major behind-the-scenes player in retail cards, which will issue the cards and handle underwriting decisions starting in the fall, the companies said. OnePay, which was created by Walmart in 2021 with venture firm Ribbit Capital, will handle the customer experience for the card program through its mobile app. Read more

Remodeling Main Street: How Community Banks Can Leverage the Banking-as-a-Service Paradigm

Payments Journal

Community banks are the heart and soul of their localities, often providing the spark that helps small businesses achieve their goals.

Community banks are the heart and soul of their localities, often providing the spark that helps small businesses achieve their goals.

However, the emergence of new technologies in recent years means that more financial services companies are vying for a share of the smaller institutions’ markets.

In a recent PaymentsJournal podcast, Matthew Wilcox, Deputy Head of Financial Institutions Group and President of Digital Payments at Fiserv, and James Wester, Co-Head of Payments at Javelin Strategy & Research, discussed how community banks can select and implement relevant technologies and utilize the banking-as-a-service (BaaS) model to deliver a unique experience.

A Definitive Role

In addition to heightened competition, financial institutions are now serving a tech-savvy customer base with elevated expectations. Features like digital wallets, faster payment methods like Zelle or Same Day ACH, and account aggregation are increasingly becoming table stakes for every institution.

For many community banks and credit unions, incorporating all of these features can be a daunting task. However, in most cases, they don’t have to be a one-stop shop for every financial service. Read more

FTA CEO Says Open Banking Central to Fintechs’ Work

Justin Bachman, Banking Dive

The leader of the Financial Technology Association sees a federal court battle over the Consumer Financial Protection Bureau rule as critical to innovation.

The leader of the Financial Technology Association sees a federal court battle over the Consumer Financial Protection Bureau rule as critical to innovation.

As she enters her fourth year as chief executive of the Financial Technology Association, Penny Lee is engaged in one of the group’s larger legal battles: Fighting to usher the U.S. into an open banking era amid a dramatic regulatory shift.

Under Lee, the FTA has become the only litigant seeking to preserve the Consumer Financial Protection Bureau’s 2024 landmark open banking rule under Section 1033 of the Dodd-Frank Act.

Open banking allows consumers to share their financial information with a variety of financial institutions and fintechs, possibly swapping information from account to account, increasing competition in the industry. The Trump administration has said the rule is unlawful.

Lee spoke with Payments Dive on May 28, two days before the CFPB formally asked a federal judge to side with plaintiffs in their request for summary judgment against the agency’s 2024 open banking rule. The judge has yet to rule on that request. However, the Kentucky federal judge in the case ruled last month that the FTA may intervene in the lawsuit on behalf of its members, which include Brex, eBay, PayPal and Stripe. Read more

June 6, 2025: Technology & Payments Articles

- Banks Bet on Virtual Cards as the New Credit Battleground

- Klarna Takes on Banks with Debit Card as It Diversifies Beyond Buy Now, Pay Later

- PayPal Credit Moves into the Physical World

- Credit Unions: Trusted for Members in an Era of Tariffs, Uncertainty, and Rising Auto Costs

Banks Bet on Virtual Cards as the New Credit Battleground

PYMNTS.com

When Apple Pay launched in 2014, it promised a future free of plastic. Over a decade later, the ripples of that revolution are still unfolding across the way consumers pay, but not in the way observers may have expected a decade ago.

When Apple Pay launched in 2014, it promised a future free of plastic. Over a decade later, the ripples of that revolution are still unfolding across the way consumers pay, but not in the way observers may have expected a decade ago.

While digital wallets have become a staple of online and in-store payments, it’s virtual cards, once a fringe tool for tech-savvy shoppers, that are quietly emerging as the next frontier in consumer finance.

The PYMNTS Intelligence report “Digital Payments Evolution: Virtual Cards Poised to Take Off,” a collaboration with Elan, revealed that 42% of consumers in the United States used a virtual card in the last six months, primarily for online purchases and subscriptions. Plus, 65% said they’re likely to use one in the year ahead.

This could signal a potential turning point not just in adoption, but in the public’s appetite for payment tools that offer control, security and flexibility beyond what digitized physical cards can provide.

Digital wallets have already done much of the heavy lifting in familiarizing consumers with cardless payments. Today, over half of U.S. consumers store at least one card in a wallet like Apple Pay or Google Wallet. That familiarity is increasingly proving crucial to the rise of virtual cards, which don’t exist as plastic first. Instead, they’re issued and used entirely digitally, often with one-time numbers for each transaction, limiting exposure to fraud. Read more

Klarna Takes on Banks with Debit Card as It Diversifies Beyond Buy Now, Pay Later

Ryan Browne, CNBC

Key Points

Key Points

- Klarna is piloting a debit card called Klarna Card in the U.S.

- The card will also launch in Europe later this year.

- The Swedish fintech has been trying to shift its image from “buy now, pay later” poster child to a more all-encompassing banking player.

Swedish fintech Klarna — primarily known for its popular “buy now, pay later” services — is launching its own Visa debit card, as it looks to diversify its business beyond short-term credit products.

The company on Tuesday announced that it’s piloting the product, dubbed Klarna Card, with some customers in the U.S. ahead of a planned countrywide rollout. Klarna Card will launch in Europe later this year, the firm added.

The move highlights an ongoing effort from Klarna ahead of a highly anticipated initial public offering to shift its image away from the poster child of the buy now, pay later (BNPL) trend and be viewed as more of an all-encompassing banking player. BNPL products are interest-free loans that allow people to pay off the full price of an item over a series of monthly installments. Read more

PayPal Credit Moves into the Physical World

Tom Nawrocki, Payments Journal

PayPal’s ever-expanding footprint is taking a step into the past with the launch of its first physical card.

PayPal’s ever-expanding footprint is taking a step into the past with the launch of its first physical card.

Issued by Synchrony, a longtime partner in several other ventures, the PayPal Credit card can be used both online and in stores. The new offering pivots off PayPal Credit, which has long been available to customers shopping online. Eligible existing PayPal Credit customers will be notified about the option to upgrade, and the physical card will begin rolling out to U.S. customers in the coming weeks.

“PayPal Credit is one of our most popular products and customers have long been requesting the ability to use it on the go as they look for more choice and flexibility wherever they shop,” Scott Young, SVP, Global Head of Consumer Financial Services, at PayPal, said in a statement.

Forays into Physical Cards

Last year, PayPal expanded further into the physical payments space with the introduction of the PayPal Debit Card for use in brick-and-mortar stores—though it required consumers to maintain a balance in their PayPal account. The new card joins the PayPal Cashback Mastercard, giving consumers another way to pay in-store and online. Read more

Credit Unions: Trusted for Members in an Era of Tariffs, Uncertainty, and Rising Auto Costs

Tim Blochowiak, CUSO Magazine

The automotive car-buying environment continues to change in 2025 with tariffs looming, vehicle prices threatening to climb, and economic uncertainty weighing heavily on consumers’ minds.

The automotive car-buying environment continues to change in 2025 with tariffs looming, vehicle prices threatening to climb, and economic uncertainty weighing heavily on consumers’ minds.

For credit unions, these challenges are not just hurdles—they are opportunities to reinforce their essential role in the financial lives of their members. By innovating in auto finance and protection product offerings, credit unions can help members protect their investments, manage risk, and weather the storm of economic unpredictability.

The tariff threat and rising vehicle costs

Recent months have seen the auto industry bracing for the impact of new tariffs on imported vehicles and parts. While policy specifics continue to evolve, the one certainty is that costs are rising. Dealerships are already marketing “pre-tariff inventory,” “employee pricing,” and consumers are rushing to purchase vehicles before prices spike.

This environment creates anxiety for buyers, who must now consider not only the sticker price but also the long-term costs of ownership in an inflationary environment. In March 2025, the average cost of a new vehicle experienced a slight increase, with Cox Automotive reporting an average transaction price (ATP) of $47,462. This was slightly lower than the previous month’s revised ATP of $47,577. Read more

May 30, 2025: Technology & Payments Articles

- Filling a Key Gap in Check Fraud Detection

- Money Is Going Mobile: Reshaping the Future of Financial Services

- Nearly Half of All Zelle Scams at JPMorgan Chase and Other US Banks Traced to a Single Source

- Credit Unions Double Down on Financial Controls to Boost Member Growth

Filling a Key Gap in Check Fraud Detection

Tom Nawrocki, Payments Journal

In the never-ending battle against check fraud, a new capability may help address a frequently overlooked area of risk.

In the never-ending battle against check fraud, a new capability may help address a frequently overlooked area of risk.

ParaScript, a company specializing in AI-powered document processing, has introduced a feature that can detect, read, and interpret handwritten or stamped endorsements on the back of checks.

The update to Parascript’s check recognition solution, CheckXpert.AI, enables the system to identify phrases like “For mobile deposit only” or “Deposit only to account of payee.” It automatically detects the check’s orientation and matches the text against a customizable list of authorized phrases. Endorsements that appear missing, suspicious, or unauthorized are flagged immediately.

This enhancement helps ensure checks are deposited through authorized channels and reduces the risk of fraud. It’s important to note, however, that the tool doesn’t verify handwriting authenticity or match signatures to those on file—capabilities offered by some other investigative tools.

A “Practical Improvement”

There are key benefits to automating a task that continues to cause issues in remote deposits: endorsement verification. “Most fraud tools focus on signatures or altered fields, but this fills a smaller gap by making sure the back of the check says what it’s supposed to,” said Jennifer Pitt, Senior Analyst of Fraud Management at Javelin Strategy & Research. “It does this in real time, which means issues can be flagged before the check is accepted, rather than caught later in back-office review. Read more

Money Is Going Mobile: Reshaping the Future of Financial Services

Ivan Navodnyy, FinExtra

These days, it seems like everyone is glued to their smartphones, with the average person spending around 6 to 8 hours a day staring at their screens.

These days, it seems like everyone is glued to their smartphones, with the average person spending around 6 to 8 hours a day staring at their screens.

What was once a simple convenience has now become a way of life. Due to this shift, creating a mobile app has become a crucial strategy for any business seeking to succeed in the digital world. With so many people relying on mobile apps for everything from chatting and entertainment to shopping, having a well-crafted and user-friendly app becomes of paramount importance for every company to solidify competitiveness. Businesses that recognize this trend and invest in mobile app development are in a much better position to connect with their customers and stay ahead of the competition in today’s fast-paced market.

Speed is Money

In the mobile environment, those who offer not just features but instant responses win. Transferring, depositing, opening a position – everything should happen in 3-4 touches. Apps like Robinhood have made this the norm: trading has become not just accessible, but almost “intuitive”. The same is expected of CRM systems. The user won’t wait for a heavy web page to load over an unstable connection – they’ll leave. Native mobile apps allow you to maintain performance in weak signal conditions.

People really appreciate phones for their ease of use: for example, with just a few taps, you can transfer a lump sum to your counterpart in no time. We’re taking that same approach with our mobile-focused CRM. If users can access such a feature from anywhere in the world, we’re definitely tapping into a significant market. Read more

Nearly Half of All Zelle Scams at JPMorgan Chase and Other US Banks Traced to a Single Source

Daily Hodl Staff

A single company is fueling a massive volume of scams on the popular bank-owned payments network Zelle, according to a new report.

A single company is fueling a massive volume of scams on the popular bank-owned payments network Zelle, according to a new report.

Meta Platforms, through its flagship apps Facebook and Instagram, is becoming a “cornerstone of the internet fraud economy,” reports the Wall Street Journal. Citing people “familiar with the matter,” the WSJ reports Meta accounted for nearly half of all reported scams on Zelle at JPMorgan Chase between the summers of 2023 and 2024 – numbers that are similar across all US banks.

Internal Meta documents reportedly reveal a staggering 70% of newly active advertisers on its platforms promote scams, illicit goods or low-quality products. The scammers are often linked to Southeast Asian crime networks that exploit Meta’s oversight, cryptocurrencies and generative AI to flood its platforms with fake ads for puppies, giveaways and bargain goods.

Meta allows advertisers up to 32 automated “strikes” for financial fraud before banning accounts, which critics say prioritizes the company’s $160 billion ad revenue stream. Meta’s Marketplace, now larger than Craigslist, has become a scammer’s playground due to its peer-to-peer model. Read more

Credit Unions Double Down on Financial Controls to Boost Member Growth

PYMNTS.com

For small firms, punching above their weight is key to survival.

For small firms, punching above their weight is key to survival.

In financial services, where the global footprint of megabanks can cast a wide shadow over the operations of local lenders and credit unions (CUs), survival for smaller firms isn’t just about keeping up. Increasingly, it’s about outmaneuvering, outsmarting and often out-caring. Against this backdrop, winning top-of-wallet status is key for small institutions looking to drive competitive differentiation relative to larger competitors.

The latest PYMNTS Intelligence from the April/May 2025 Credit Union Tracker Series, “Going for Gold: Winning Top-of-Wallet Status for Credit Unions,” revealed that a growing segment of CU cardholders — consumers and small- to medium-sized businesses (SMBs) — place value on features that help them manage how and where they spend money. Roughly 20% of CU card users cited tools such as real-time transaction alerts, spending caps and mobile card management as important in their decision to prioritize CU-issued cards.

The emphasis on control dovetails with broader consumer trends. In an era of inflation and economic uncertainty, households and SMBs are seeking greater visibility and authority over spending. For many, rewards are nice to have — but financial control is essential. Read more

May 23, 2025: Technology & Payments Articles

- Payment Security Concerns Are Pushing US Consumers to Use Virtual Cards Online

- It’s Time for Banks to Tackle Bill Management

- Using the Card “Beyond” Payments to Find the Holy Grail

- Cash Use Declines as Cards Rise: Atlanta Fed

Payment Security Concerns Are Pushing US Consumers to Use Virtual Cards Online

PYMNTS.com

Fool me once, shame on you. Fool me twice, shame on me. Fool me thrice, won’t get fooled again.

Fool me once, shame on you. Fool me twice, shame on me. Fool me thrice, won’t get fooled again.

That’s the emerging story when it comes to shoppers and payments fraud. And with cybercriminals lurking, a growing number of U.S. consumers are ditching their plastic for virtual cards that offer stealthy, one-time-use numbers designed to outsmart digital thieves.

According to new findings from PYMNTS Intelligence report “Digital Payments Evolution: Virtual Cards Poised to Take Off,” a collaboration with Elan, 42% of U.S. consumers used a virtual card in the past six months, and a staggering 65% say they are likely to use one within the next year.

What’s driving the growth? It’s more than one in three consumers (36%) who have experienced fraud that are now more likely to use the payment method. The shift reflects a significant behavioral transformation: one catalyzed by consumers’ desire for security, flexibility and control in an era where fraud and data breaches are no longer hypotheticals but personal realities for millions.

What Is a Virtual Card?

Unlike traditional physical cards, virtual cards exist solely in digital form. They can be tied to an underlying credit or debit account but offer unique advantages: single-use or transaction-specific numbers that dramatically reduce the risk of fraud. Read more

It’s Time for Banks to Tackle Bill Management

Kurtis Lin, The Financial Brand

The “subscription economy” has exploded, consumers are struggling to manage their costs, and standalone subscription management tools have boomed. Banks are uniquely positioned to assist their customers with subscription overload, but more institutions need to get in the game.

The “subscription economy” has exploded, consumers are struggling to manage their costs, and standalone subscription management tools have boomed. Banks are uniquely positioned to assist their customers with subscription overload, but more institutions need to get in the game.

In today’s digital-first world, subscriptions have quietly taken over our lives. From streaming services and meal kits to fitness apps and cloud storage, consumers now juggle dozens of recurring charges — many of which they barely remember signing up for. The “subscription economy” has not just expanded — it has exploded — and consumers are in dire need of solutions that put them back in the driver’s seat.

Subscription Overload is Now a Crisis

According to recent studies, the average U.S. consumer spends over $270 per month on subscriptions—often without realizing it. Services that once required a one-time purchase now charge monthly or annually. While this model provides convenience and continuous updates, it also introduces financial ambiguity.

Many people sign up for free trials, intending to cancel before billing starts, but forget. Others subscribe to overlapping services (e.g., multiple streaming platforms) or hold on to apps they no longer use. The result? The average consumer is now spending around $600/year on unwanted subscriptions. This is exceptionally shocking, with US News reporting that nearly half of Americans live paycheck to paycheck and 2 out of 5 do not have an emergency savings fund. Read more

Using the Card “Beyond” Payments to Find the Holy Grail

Amanda Gourbault, Payments Journal

The Friction vs. Fraud Dilemma

The Friction vs. Fraud Dilemma

It appears that the ‘holy grail’ in payment systems is to simultaneously reduce friction and fraud, offering a seamless authentication process that does not sacrifice security. Traditionally, a secure solution was often associated with complexity, adding user friction—something consumers tend to avoid. Similarly, reducing friction typically opened doors to increased fraud, presenting a dilemma where one seemingly had to choose between convenience and security. This dichotomy has posed challenges for businesses and kept that sought after ‘holy grail’ far out of reach.

The Evolution of E-commerce and Payment Security

In the wake of the expansion of the Internet in the late 1990s, e-commerce has gained traction. Payment cards are transitioning from primarily being used in physical stores—with cardholders present, known as Card Present or Point of Sale (POS) transactions—to increasingly supporting remote purchases, referred to as Card Not Present (CNP) transactions. E-commerce has continued to expand rapidly, now accounting for an estimated 14.4% of global commerce. Concurrently with the rise of e-commerce, there has been a shift towards more secure EMV chip technology for in-store, Card Present transactions, while initiatives like 3D Secure were developed to secure online, CNP transactions.

However, possibly due to the need to balance user friction and security, some e-merchants, particularly in the U.S., have hesitated to adopt the original version of 3D Secure. This may explain why we see fraudsters increasingly targeting online, CNP transactions today. This has had a huge impact, evidenced in the staggering 73% of all U.S. card fraud last year that originated from online purchases, a significant rise from 57% in 2019. Read more

Cash Use Declines as Cards Rise: Atlanta Fed

Tatiana Walk-Morris, Payments Dive

Consumers keep using cash, but credit cards are king, the Federal Reserve Bank of Atlanta documented in its annual payment method survey.

Consumers keep using cash, but credit cards are king, the Federal Reserve Bank of Atlanta documented in its annual payment method survey.

Dive Brief:

- The percent of consumers who said last October that they’d recently made payments with cash declined to 83%, from 87% in 2023, according to the results of a survey of payment methods by the Federal Reserve Bank of Atlanta. Similarly, the proportion of survey respondents who had used checks fell to 35% in 2024, from 40% in 2023.

- The most popular form of payment for all types of transactions, including purchases and bill payment, were credit cards, according to the report. Of all the transactions tracked in the survey, 35% were made with credit cards, followed by debit cards (30%), cash (14%) and bank account methods (13%), the results showed. Checks captured just 3% and prepaid cards 2%.

- “Payment cards retained their dominance in the consumer sphere, representing two-thirds of payments by number and just over one-third by value,” said an abstract of the report by Fed researchers Kevin Foster, Claire Greene and Joanna Stavins.

The Atlanta Fed report, called the 2024 Survey and Diary of Consumer Payment Choice, surveyed 5,583 respondents last October about their spending habits from the previous 30 days with help from the Federal Reserve Bank of Boston and the Federal Reserve Financial Services. Read more

May 16, 2025: Technology & Payments Articles

- Is the D.C. Policy Pendulum Swinging in Banks’ Favor? Maybe. But For How Long?

- Chime Sets Sights on the Affluent Consumer and an $86 Billion Revenue Opportunity

- Court Allows Fintechs to Defend CFPB’s Open Banking Rule

- Younger Generations Insist on Paying Through Apps

Is the D.C. Policy Pendulum Swinging in Banks’ Favor? Maybe. But For How Long?

Steve Cocheo, The Financial Brand

The CFPB is gutting itself, pending capital rules seem about to be eased, and climate issues and reputation exams are off the table. Happy days for big banks?

The CFPB is gutting itself, pending capital rules seem about to be eased, and climate issues and reputation exams are off the table. Happy days for big banks?

Not so fast: Fitch Ratings analysts say banks must think beyond current developments to address long-term risks. They are. The banking industry has been cheered by a good deal of what’s come out of the Trump administration so far, but analysts at Fitch Ratings have a cloudier outlook.

In a report published in late April, Fitch looked at the actual and potential shifts in policy and regulations made so far. Some, such as speedier merger and acquisition approvals and the quashing of credit card late fee caps and overdraft fee limits at the Consumer Financial Protection Bureau, Fitch considers a return to status quo ante, meaning “a previously existing state of affairs.” M&A policy appears poised for a return to some normality and the fee rules never kicked in. As such, these developments are neutral for the industry’s ratings.

Other moves that may allow greater risk taking, in the name of deregulation, depart from the past and “are, on balance, negative for bank credit profiles,” according to the report. “Fitch sees limited near-term ratings risk for U.S. banks from these policy shifts,” the report continues. “However, over the medium term, an erosion of capital buffers in conjunction with evidence of higher risk appetite could pressure ratings.”

This isn’t a doomsday forecast, but really a warning to the industry to be careful. The title of the report is “U.S. Banks: Regulatory Pendulum is in Full Swing.” “What we were trying to get across is that banks need to take a long-term view,” says Christopher Wolfe, managing director. Read more

Chime Sets Sights on the Affluent Consumer and an $86 Billion Revenue Opportunity

PYMNTS.com

In 2022, as the pandemic waned, PYMNTS Intelligence found that only about 9% of consumers used digital banks for their primary financial relationships and accounts.

In 2022, as the pandemic waned, PYMNTS Intelligence found that only about 9% of consumers used digital banks for their primary financial relationships and accounts.

Since then, however, the push toward using apps and mobile devices for everyday financial needs has been less wave than tsunami, and for platforms linking with banks to deliver a range of cards, lending and account offerings, the forging of those primary relationships is gathering momentum.

Chime filed its S-1 registration statement for a proposed initial public offering (IPO) with the Securities and Exchange Commission late Tuesday (May 13). Although some key details of the listing are not included in the filing, such as the number of shares being sold, the document gives insight into the scope of the digital shift for traditional banking products, such as savings accounts and credit cards.

Chime made some distinctions tied to its business model in the statement. “Chime is a technology company, not a bank,” the filing said. The company partners with The Bancorp Bank and Stride Bank, Federal Deposit Insurance Corp.-insured community banks, to provide banking services.

Estimating the Addressable Market

Chime estimated that its serviceable addressable market offers up to an $86 billion annual revenue opportunity, calculated by multiplying the average revenues derived from “highly engaged” members of $442 by 196 million individuals earning up to $100,000 annually. That revenue opportunity can grow to an annualized pace of $426 billion by targeting consumers who earn up to $200,000 yearly, the filing said. Read more

Court Allows Fintechs to Defend CFPB’s Open Banking Rule

Katie Berry, American Banker

A federal judge granted the Financial Technology Association the right to intervene in the Consumer Financial Protection Bureau’s open banking rule, allowing the fintech industry to defend a rule on consumer financial data rights that the Trump administration refused to uphold.

A federal judge granted the Financial Technology Association the right to intervene in the Consumer Financial Protection Bureau’s open banking rule, allowing the fintech industry to defend a rule on consumer financial data rights that the Trump administration refused to uphold.

On Wednesday, U.S. District Court Judge Danny Reeves said the FTA has a substantial legal interest in the rule because its members, including fintechs and data aggregators, would be adversely affected if the rule were vacated. Penny Lee, president and CEO of the FTA, said the court’s order “gives the fintech industry a seat at the table to defend Americans’ financial data rights, ensuring that the big banks cannot dictate the future of open banking.”

The open banking rule, also known as 1033 for its section in the Dodd-Frank Act, was first initiated in 2016 and was finalized last year by former CFPB Director Rohit Chopra.

The CFPB was immediately sued by the Bank Policy Institute, the Kentucky Bankers Association and Forcht Bank, a $1.6 billion-asset bank in Lexington, Kentucky. The bankers alleged the CFPB exceeded its authority, arguing that Congress never intended for banks to be compelled to share consumers’ data with fintechs or other third parties.

When the Trump administration took over the CFPB in February, it asked for all recently finalized rules to be stayed. Then, in an unusual move, acting CFPB Director Russell Vought sided with BPI and the banks that had sued the bureau. Throughout, the FTA repeatedly sought to intervene in the case. The court held a hearing on May 5. Neither the CFPB nor BPI objected to FTA’s motion to intervene. Read more

Younger Generations Insist on Paying Through Apps

Tom Nawrocki, Payments Journal

For younger consumers who have grown up using apps to make purchases, in-app payment options are becoming a deal-breaker.

For younger consumers who have grown up using apps to make purchases, in-app payment options are becoming a deal-breaker.

Recent data shows that nearly two-thirds of Gen Z and millennial respondents say they’ll take their business elsewhere if in-app payments aren’t available. The study from NMI found that 70% of Gen Z respondents use an app to pay for something at least once a day. While only 50% of respondents reported making in-app payments weekly, a slightly higher share (55%) expect to increase their usage this year.

Most consumers say it’s important for merchants to offer app-based payments, and half would choose a business that does over one that doesn’t. These preferences stem in part from the efficiency of in-app payments, which allow merchants to serve more customers with faster point-of-sale throughput without needing additional staff.

The subscription model—automatic recurring payments for frequently used services—is also more popular among millennials and Gen Z compared to other generations. As these cohorts make up a growing share of the consumer economy, ease of use in payments is becoming even more of a necessity.

Parents Like Them Too

In addition to younger generations, busy parents are among the biggest supporters of app-based payments. Nearly three-quarters of parents with children under 25 living at home say they would prefer to pay for everything through an app if they could. Older consumers, however, are less familiar with these methods. More than half of baby boomers use in-app payments only a few times a month or less, and fewer than half say they’d pay for everything through an app if it were possible. Read more

May 9, 2025: Technology & Payments Articles

- FICO Unveils B2B Data Exchange FICO Marketplace

- Fintechs Grab a Bigger Share of Churning Accounts. How Can Banks Respond?

- Legislation Would Promote Competition in Mobile App Marketplace

- Embedded Finance Unlocks Value for Underserved Small Business Sectors

FICO Unveils B2B Data Exchange FICO Marketplace

PYMNTS.com

FICO has introduced a digital hub designed to connect organizations with data and analytics providers.

FICO has introduced a digital hub designed to connect organizations with data and analytics providers.

FICO Marketplace, announced Wednesday (May 7), offers access to data, artificial intelligence (AI) models, optimization tools, decision rulesets and machine learning models, which provide enterprise business outcomes from AI, the company said.

“An intelligent enterprise taps into its data and decision assets using AI, machine learning, and advanced analytic techniques to make incredibly informed and highly optimized decisions, as well as deliver hyper-personalized customer experiences in real time,” the release said. The company said its new hub can help companies become intelligent enterprises by unlocking value from data faster through experimentation with new data sources and decision assets to “determine predictive power and business value.”

The marketplace can also improve customer experiences, the release added, by allowing for a holistic view of each customer.

“Imagine having access to explore, experiment, and immediately deploy a rich set of third-party data that provides unparalleled insight and predictive value,” said Nikhil Behl, president for software at FICO. “Innovation doesn’t happen in isolation, and our new FICO Marketplace will facilitate the type of collaboration across the industry that drives the next generation of intelligent solutions.”

Writing on this topic last year, PYMNTS argued that it’s important for businesses to leverage both internal and external data sources to provide a 360-degree view of customers and prospects if they hope to prioritize business transformation and data management. Read more

Fintechs Grab a Bigger Share of Churning Accounts. How Can Banks Respond?

Steve Cocheo, The Financial Brand

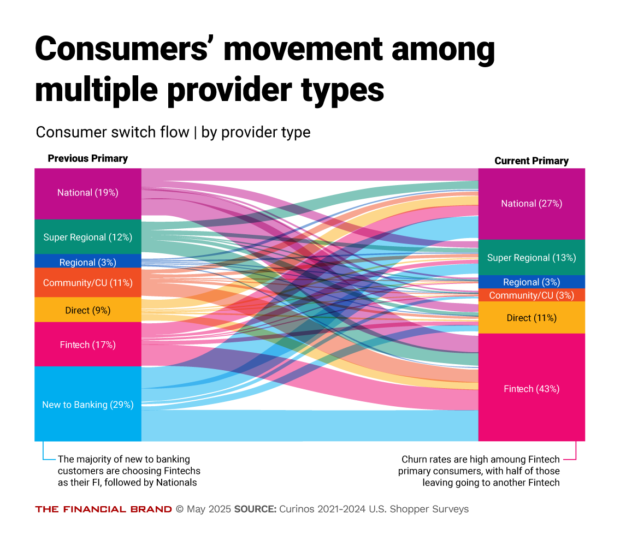

Fintechs gained a greater share of consumers who changed their primary financial provider and consumers who opened their first accounts in 2024, according to research from Curinos.

Depending on the economy ahead, fintechs could maintain the same pace for 2025 — or circumstances could support more dramatic changes: A temporary lull or dip in movement to fintechs, followed by a further significant jump.

Depending on the economy ahead, fintechs could maintain the same pace for 2025 — or circumstances could support more dramatic changes: A temporary lull or dip in movement to fintechs, followed by a further significant jump.

The broadening of fintechs’ offerings is supporting some of the growth in interest and share, Curinos notes. The company also sees a high rate of movement from fintech to fintech. About half of the people leaving fintechs in 2024 moved to other fintechs, rather than to a bank or credit union, as shown in the chart to the left.

Curinos’ study, which it has conducted for a decade, looks not at the overall share of market among banks and credit unions versus fintechs, but instead at the movement of people who switch accounts, or open accounts for the first time. Respondents aren’t necessarily closing their accounts with their original providers —but they did tell Curinos which provider they see as their primary source of service. Read more

Legislation Would Promote Competition in Mobile App Marketplace

Melina Druga, Financial Regulation News

Legislation recently introduced in the U.S. House of Representatives would promote competition and protect consumers and developers in the mobile app marketplace.

Legislation recently introduced in the U.S. House of Representatives would promote competition and protect consumers and developers in the mobile app marketplace.

The App Store Freedom Act would prohibit certain anticompetitive practices by requiring app store operators with more than 100 million U.S. users to allow users to remove or hide pre-installed apps, install apps or app stores outside of the dominant platform, and set third-party apps or app stores as default. Companies would be required to provide developers equal access to interfaces, features, and development tools without cost or discrimination. App stores would be prohibited from forcing developers to use a company’s in-app payment system, imposing pricing parity requirements, or punishing developers for distributing their apps elsewhere.

“We must continue to hold Big Tech accountable and promote competition that allows all players to enter the field. For too long, consumers and developers have borne the brunt of anti-competitive practices on major app store marketplaces,” U.S. Rep. Cammack (R-FL), who introduced the bill, said. “Dominant app stores have controlled customer data and forced consumers to use the marketplaces’ own merchant services, instead of the native, in-app offerings provided by the applications and developers themselves. The results are higher prices and limited selections for consumers and anti-competitive practices for developers that have stifled innovation.”

Embedded Finance Unlocks Value for Underserved Small Business Sectors

PYMNTS.com

The rise of embedded payments is helping to change the business models of legal and financial services companies, accounting firms, nonprofits and logistics operators, to name just a few verticals.

The rise of embedded payments is helping to change the business models of legal and financial services companies, accounting firms, nonprofits and logistics operators, to name just a few verticals.

For the payments processors serving those firms — and partnering with independent software vendors (ISVs) and other providers — helping them offer customers the payments options where and when they want them is essential.

In an interview with PYMNTS, Adam Gray, chief transformation officer at Stax, said “as an industry we are always trying to serve new markets — and for embedded payments, there are historically underserved markets that we’re seeing growth.”

These small to medium-sized businesses (SMBs), he said, are embracing technology and software, and are looking to consolidate their vendors, which means that their technology providers must serve as “one-stop shops” for ways in which they can lower costs and focus on their core specialties, without worrying about integrating payments into the mix.

In the meantime, many of those companies must handle complex transactions where, for instance, law firms set up trust and operating accounts and real estate firms handle split transactions day to day. Nonprofits, to name another example, are also faced with razor-thin margins in an uncertain economic environment, which in turn means that they need to find the best ways to keep donors and customers engaged. Read more

May 2, 2025: Technology & Payments Articles

- FinTechs and Credit Unions Increasingly Play Nice With Each Other

- The Warning Signs Looming Over Credit Card Lending

- How Credit Reporting Models Are Failing Modern Lending

- An Open Letter to Third-Party Suppliers

FinTechs and Credit Unions Increasingly Play Nice With Each Other

PYMNTS.com

Many financial technology firms have historically sought to compete with credit unions by offering their own financial services and credit products to lure credit union members into their fold. That’s no longer a hard and fast approach.

Many financial technology firms have historically sought to compete with credit unions by offering their own financial services and credit products to lure credit union members into their fold. That’s no longer a hard and fast approach.

The technology firms increasingly regard the smaller financial institutions not as competitors, but as clients. FinTechs have long partnered with the pint-sized banks as the latter seek access to the advanced technologies powering mobile banking and digital payments that digital-first consumers expect. But fewer Fintechs are now aiming to displace credit unions with their own financial services or products; instead, their focus has shifted to selling their solutions directly to them. Think of it as Silicon Valley meets small-town America, and everybody gets along.

Grasping the changing dynamics of this relationship is critical for leaders at both credit unions and FinTechs. Recent data from a forthcoming PYMNTS Intelligence study in collaboration with Velera reveals significant shifts in engagement, competitive perceptions and the perceived ease of working together. That’s even as the share of FinTechs selling to credit unions has remained relatively stable over the past four years. Call it a FinTech adjustment of attitude and strategy.

Roughly 4 in 10 FinTechs partner with credit unions to actively sell products or services to sector. In the process, they now see the business relationship as mutually advantageous, not as brass-knuckled competition. Only a year and a half ago, roughly 1 in 6 FinTechs saw credit unions as rivals. Today, just 1.9% do. What was once viewed as a battle for consumer wallets has quickly given way to a vendor-client model.

The Other Side of the Story

That’s half the story. The other half is that more than 50% of FinTechs do not currently sell their products or services to credit unions. Several key reasons contribute to this. For non-sellers, competing for credit union members as customers of their own financial products and services remains a goal. Thorny compliance and regulatory issues present a major obstacle, cited by more than 4 in 10 non-selling FinTechs as a reason for not engaging with credit unions. Roughly as many FinTechs say they don’t offer the products and services that credit unions want. There’s also a lingering perception that credit unions aren’t innovative enough to want their solutions. Read more

The Warning Signs Looming Over Credit Card Lending

Tom Nawrocki, Payments Journal

The credit card industry seems headed for uncharted waters. Inflation, better than a year ago, remains high.

The credit card industry seems headed for uncharted waters. Inflation, better than a year ago, remains high.

Nonetheless, consumers are tamping down discretionary spending as the fears of a recession loom. Government jobs—a traditionally safe, well-paying sector—are under extreme pressure, and border states and the manufacturing sector are wary of the impact of tariffs. In the current environment, issuers must expect the unexpected. In Seven Credit Card Warning Signs in 2025: Don’t Stop Lending, but Watch Out, Brian Riley, Director of Credit at Javelin Strategy & Research, looks at how this economy will affect the industry as a whole. “We’ve got to deal with what’s next,” Riley said, “and what’s next is uncertainty.”

A Season of Uncertainty

Plenty of worries are already visible in the numbers. In 2022, 3 of every 100 cardholder balances entered 90-day delinquent status. In 2025, the same metric sits at more than 7 of every 100 cardholder balances. Accounts in the 90-plus-day delinquency segment are considered extremely risky and in danger of being charged off, which diminishes credit card revenue.

Why is this happening now? Coming out of the pandemic, many lending standards were loosened so issuers could book more accounts. To get transaction volumes up again, banks brought in some shakier accounts, which become even more sensitive when the economy shows signs of trouble. Given the way FICO scores are distributed, 40% of these accounts are less than prime. That puts an awful lot of credit card holders in a dangerous spot. Read more

How Credit Reporting Models Are Failing Modern Lending

Alex Naughton, Qlarifi/The Financial Brand

Designed for a time when long-term, secured borrowing was the norm, credit scoring is struggling to adopt to BNPL. As a result, consumers are being punished not for being risky, but for engaging with modern credit tools.

Designed for a time when long-term, secured borrowing was the norm, credit scoring is struggling to adopt to BNPL. As a result, consumers are being punished not for being risky, but for engaging with modern credit tools.

Imagine a world where responsible borrowers, those who use credit products wisely, repay on time, and follow the terms as designed, are penalised by the very system that is meant to assess their financial health. This is not a hypothetical. It is the daily reality for millions of Buy Now, Pay Later (BNPL) users. The credit reporting system is no longer fit for purpose. Built for a different era, it fails to account for the dynamics of modern lending, particularly short-term, high-frequency credit products like BNPL.

Instead of helping lenders assess risk and enabling consumers to access fair credit, the current system misrepresents creditworthiness. This is not a niche issue with almost 100 million BNPL consumers in the US alone, it has wide-ranging consequences for financial inclusion, consumer protection, and fintech innovation. However, the pace and old-fashioned infrastructure of credit bureaus as they stand, don’t just affect BNPL customers, but all credit users. Think about how much better decision making would be for credit card companies if it were real-time, or how lenders could cater to so many more consumers with a more comprehensive understanding of them.

An Outdated Scoring Model

BNPL is designed to let consumers spread the cost of purchases through short-term, interest-free instalments. Used as intended, it promotes responsible borrowing. Yet if fully integrated into traditional scoring models, it would lower credit scores for these very users. Read more

An Open Letter to Third-Party Suppliers

Patrick Opet, Chief Information Security Officer, J.P. Morgan Chase

The modern ‘software as a service’ (SaaS) delivery model is quietly enabling cyber attackers and – as its adoption grows – is creating a substantial vulnerability that is weakening the global economic system.

- Software providers must prioritize security over rushing features. Comprehensive security should be built in or enabled by default.

- We must modernize security architecture to optimize SaaS integration and minimize risk.

- Security practitioners must work collaboratively to prevent the abuse of interconnected systems.

There is a growing risk in our software supply chain and we need your action

SaaS has become the default and is often the only format in which software is now delivered, leaving organizations with little choice but to rely heavily on a small set of leading service providers, embedding concentration risk into global critical infrastructure. While this model delivers efficiency and rapid innovation, it simultaneously magnifies the impact of any weakness, outage, or breach, creating single points of failure with potentially catastrophic systemwide consequences. Historically, software was distributed across diverse environments, each with unique security practices, inherently limiting the scale of any single breach. Today, an attack on one major SaaS or PaaS provider can immediately ripple through its customers. This fundamental shift demands our collective immediate attention.

At JPMorganChase, we’ve seen the warning signs firsthand. Over the past three years, our third-party providers experienced a number of incidents within their environments. These incidents across our supply chain required us to act swiftly and decisively, including isolating certain compromised providers, and dedicating substantial resources to threat mitigation. Read more

Apr. 25, 2025: Technology & Payments Articles

- What U.S. Banks Can Learn from the UK’s Banks and Neobanks

- Affirm to Report All Pay-Over-Time Loans to TransUnion

- The Rise of Programmable Wallets: A Game Changer in Digital Payments

- MoneyGram Launches Pay-by-Bank Partnership with Plaid

What U.S. Banks Can Learn from the UK’s Banks and Neobanks

Tom Nawrocki, Payments Journal

With the competition growing from the United Kingdom’s innovative chartered neobanks, retail banks have been pushed to upgrade their customers’ digital banking experience.

With the competition growing from the United Kingdom’s innovative chartered neobanks, retail banks have been pushed to upgrade their customers’ digital banking experience.

The latest developments there could set a template for U.S. banks seeking to increase their own efforts at attracting customers through digital banking.

A new report from Javelin Strategy & Research, Mobile Banking Innovations: UK Lessons for U.S. Banks, looks at what digital strategists can learn from what’s working in the United Kingdom. “Because we have open banking in the UK, the fintechs are able to get a lot more data from the major banks here,” said Lea Nonninger, Analyst in Digital Banking for Javelin and the author of the report. “This allows them to create more innovative solutions that customers can use, so that’s pushing our legacy banks as well to innovate more.”

Innovations in Peer-to-Peer Payments

The report looks at the mobile banking apps offered by one major retail bank, NatWest, and two neobanks, Starling Bank and Monzo. Neobanks rely solely on mobile and online banking to provide their services, without physical branches.

The UK has seen several neobanks arise in the past few years. Starling Bank was founded in 2014 and Monzo in 2015. The UK banking laws make it easier for these banks to get regulated as chartered banks than it has been for similar fintechs in the United States. That has also created more competition and disruptions for the legacy players, which in turn has led to more innovation. Some of these include upgraded peer-to-peer services, added value to transaction ledgers, easing the way for charitable contributions, and showcasing financial fitness. Read more

Affirm to Report All Pay-Over-Time Loans to TransUnion

PYMNTS.com

Affirm will begin reporting all its pay-over-time loans to TransUnion, beginning with those issued May 1.

Affirm will begin reporting all its pay-over-time loans to TransUnion, beginning with those issued May 1.

The buy now, pay later (BNPL) provider’s expanded credit reporting will include its Pay in 4 and longer-term monthly installments, the companies said in a Tuesday (April 22) press release. While consumers will see details about all Affirm transactions on their TransUnion credit file, the transactions will not be visible to lenders and will not be factored into traditional credit scores, according to the release.

However, as new credit scoring models are developed, the information may factor into consumers’ credit scores in the future, per the release. “Including all loans in a consumer’s credit profile is a crucial step toward making Affirm’s honest financial products even more mainstream,” Affirm President Libor Michalek said in the release.

Fifty-three percent of consumers who have not used BNPL said they would be likely or very likely to use it in the future if it could help their credit scores, according to the release. Affirm will also work with other industry stakeholders to standardize the policies for furnishing information across loan products, according to the release. Read more

The Rise of Programmable Wallets: A Game Changer in Digital Payments

Kent Henderson, Mangopay/Finextra

As digital platforms grow, the ability to process payments at scale becomes a crucial competitive advantage.

As digital platforms grow, the ability to process payments at scale becomes a crucial competitive advantage.

With transaction volumes increasing, managing the flow of money across a growing network of users, vendors, and service providers while ensuring a smooth customer experience puts increasing pressure on platforms to perform.

At every stage, there is substantial movement of funds and data that requires flexibility and control. To succeed, platforms need a scalable, unified infrastructure capable of handling high-volume multi-party transactions. This is where having the right wallet infrastructure makes all the difference.

Today, 30% of global consumer purchases are made via platforms that use wallet-based and instant payment methods. This is a clear sign of growing demand for faster, more seamless transactions.

From digital to programmable wallets

Digital wallets have dominated global e-commerce, accounting for nearly half of all online payment transactions last year – a trend set to continue with strong growth through 2030. The likes of PayPal, Apple Pay, and Google Wallet have grown in popularity among consumers, allowing them to store payment information and make online transactions. Even though these types of wallets have improved as payment technology has progressed, transitioning them to smart wallets, they fall short of offering the full capabilities that platforms need to manage and automate money movements. Read more

MoneyGram Launches Pay-by-Bank Partnership with Plaid

PYMNTS.com

Payments network MoneyGram says it has launched a partnership with Plaid.

The collaboration, announced Thursday (April 17), lets MoneyGram customers in the U.S. use Plaid’s technology to help authenticate their bank accounts, allowing for faster and more secure funding for both domestic and cross-border payments.

“This partnership with Plaid expands our global capabilities to deliver faster, more secure payments for our customers. It’s a clear step forward in our mission to make cross-border payments seamless, affordable and secure for everyone.”

The release notes an increasing number of American consumers value the ability to link their bank accounts with financial apps, prizing pay-by-bank options for their ease, speed and additional security.

“Plaid provides the most widely used and trusted network across digital financial services, covering thousands of financial institutions across the United States, Canada, Europe and the United Kingdom,” said Brian Dammeir, head of payments and financial management at Plaid. “Now, MoneyGram can leverage the power of the Plaid network to quickly and securely drive conversion, reduce bank returns and proactively prevent fraud.”

The pay-by-bank solution connects to Plaid’s network of thousands of banks and credit unions, pairing that company’s instant account verification with MoneyGram’s compliance and anti-fraud systems, the release added. Read more

Apr. 18, 2025: Technology & Payments Articles

- Pay-by-Bank Should Offer Perks

- Velera Teams Up with Zelle to Drive Faster Payments for Smaller Credit Unions

- Global Payments Doubles Down on Merchant Services With $24.25 Billion Worldpay Deal

- Stripe CEO Says Company Management Regularly Asks Customers For ‘Candid Feedback’

Pay-by-Bank Should Offer Perks

Patrick Cooley, Payments Dive

Banks must persuade merchants and consumers the payment method is an acceptable alternative to credit cards, the consulting firm suggested.

Banks must persuade merchants and consumers the payment method is an acceptable alternative to credit cards, the consulting firm suggested.

Pay-by-bank could dramatically alter the way we pay in the U.S. by decreasing costs for businesses and easing the payment process for shoppers, but the trick is getting consumers and merchants on board, according to a research paper published last month by the consulting firm Deloitte.

That means persuading multiple players in the payment ecosystem — including banks, merchants and consumers — that pay-by-bank is an acceptable alternative to traditional ways to pay such as credit cards, according to the paper, which was posted online March 11.

As the name suggests, pay-by-bank lets a shopper pay for a good or service by withdrawing money from a bank account and sending it directly to a merchant. The money is often sent via an electronic payment rail such as same-day ACH or the RTP Network, Deloitte said in the paper.

Deloitte Managing Director Chris Allen, Senior Manager Tanmay Agarwal, Senior Manager Shalina Vadivale and Manager Amol Kumar authored the paper. Read more

Velera Teams Up with Zelle to Drive Faster Payments for Smaller Credit Unions

PYMNTS.com

Velera and Early Warning Services, the company behind Zelle, are partnering to broaden real-time payment offerings for small financial institutions.

Velera and Early Warning Services, the company behind Zelle, are partnering to broaden real-time payment offerings for small financial institutions.

The agreement is designed to bring Zelle’s peer-to-peer (P2P) services to minority depository institution (MDI) credit unions, expanding their access to cutting-edge payment solutions and helping them remain competitive, according to a Monday (April 14) press release.

“If credit unions are not offering Zelle, their members are likely to look elsewhere for the convenience of a P2P payments offering,” Amy Evans, senior vice president of Strategic Solutions at Velera said in the release. “It is clear consumers appreciate the convenience, ease and reliability of Zelle, three key drivers of consumer payment preferences.”

The collaboration aligns with a wider trend among community banks and credit unions that are increasingly adopting the P2P service. Early Warning Services found that 95% of the U.S. financial institutions offering Zelle are community banks and credit unions, per the release.

Through the new partnership, Velera will guide credit unions through Zelle implementation, offering integration with existing mobile apps, data-based fraud detection, and analytics-driven reporting, the release said. For MDI credit unions, this means the potential to enhance member satisfaction, bolster trust, and strengthen local communities with a real-time payment experience on par with larger institutions. Read more

Global Payments Doubles Down on Merchant Services With $24.25 Billion Worldpay Deal

Milana Vinn, David French and Akash Sriram, Reuters

Global Payments has agreed to buy rival Worldpay from FIS and private equity firm GTCR for $24.25 billion in a three-way deal, sharpening its focus on merchant services in its race for big-business clients in a crowded payments market.

Global Payments has agreed to buy rival Worldpay from FIS and private equity firm GTCR for $24.25 billion in a three-way deal, sharpening its focus on merchant services in its race for big-business clients in a crowded payments market.

As part of the deal announced on Thursday, Global Payments will sell its slower-growing issuer solutions unit, which offers card processing and account services, to FIS for $13.5 billion. The deal will allow Global Payments to combine Worldpay’s strength in online and enterprise transactions with its expertise in serving small and mid-sized companies.

The merger creates a global payment processing company that will serve more than six million customers, process about 94 billion transactions and generate $3.7 trillion in volume across more than 175 countries.

The transaction also allows Global Payments to become a pureplay merchants business, with a customer base that includes large corporations, as well as small and medium-sized businesses. Read more

Stripe CEO Says Company Management Regularly Asks Customers For ‘Candid Feedback’

Mary Ann Azevedo, TechCrunch

Digital payments platform Stripe invites customers to join its management team meetings on a bi-weekly basis so it can get “candid feedback,” according to co-founder Patrick Collison.

Digital payments platform Stripe invites customers to join its management team meetings on a bi-weekly basis so it can get “candid feedback,” according to co-founder Patrick Collison.

In an April 8 post on X, the fintech giant’s CEO said the company has a customer join for the first 30 minutes of the meeting, which is attended by about 40 leaders “from across Stripe.” “Even though we already have a lot of customer feedback mechanisms, it somehow always spurs new thoughts and investigations,” he wrote.

It’s an interesting strategy from Stripe, which was founded in 2010 and is considered to be the highest-valued private fintech in the world (its most recent valuation was $91.5 billion).

Over the years, startups have complained anecdotally that Stripe is more focused on its larger customers than the smaller ones it set out to serve. But the company must be doing something right. Stripe’s annual letter in February penned by Collison noted that payment volume in 2024 grew to $1.4 trillion, up 38% on the year before.

Stripe also added in the letter that it is now used by half of the Fortune 100 companies, underscoring how it has catapulted from a startup working with other startups into a major enterprise player. In the post on X, Collison responded to the Cloudflare CTO’s question of when his company would get an invite with a, “Would love to have you guys…will reach out.” Read more

Apr. 11, 2025: Technology & Payments Articles

- House Votes to Kill CFPB Big Tech Payments Rule

- Metal Payment Cards Move from Luxury to Everyday as Fraud Fears Deepen

- Why the U.S. Trails the World in Faster Payments

- Why US Third-Party Vendors Need to Act Fast on DORA Compliance

House Votes to Kill CFPB Big Tech Payments Rule

Justin Bachman, Payments Dive

The measure revoking the bureau’s oversight of large technology payments players, such as Google and Block, passed on a straight party-line vote.

The measure revoking the bureau’s oversight of large technology payments players, such as Google and Block, passed on a straight party-line vote.

Dive Brief:

- The House of Representatives approved a resolution Wednesday abolishing a Consumer Financial Protection Bureau rule giving the agency regulatory authority over large tech companies that offer consumer payment tools. The Senate approved the measure earlier, on March 5.

- Last month, President Donald Trump indicated that he would sign the resolution, which rescinds the bureau’s oversight of companies that process more than 50 million consumer transactions annually.

- The CFPB rule enabling more oversight also called for stiff new penalties in cases of non-compliance.

Interest groups representing large retailers and tech companies, including Amazon, Google and Expedia, filed suit earlier this year to block the rule. The CFPB told a federal court on March 21 that it would not enforce the rule, temporarily, as the bureau’s new leaders review policies from the Biden administration.

Dive Insight:

The rule, “Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications,” gave the CFPB authority to supervise and examine nonbank technology companies that offer peer-to-peer money transfer and digital wallet services, such as Block’s Cash App, Google Pay, Apple Pay and PayPal’s Venmo.

Such tools have become commonplace, the agency said, necessitating the rule. The agency said the new interpretive rule would help to prevent fraud, protect consumers’ privacy and thwart illegal account closures. Read more

Metal Payment Cards Move from Luxury to Everyday as Fraud Fears Deepen

Pymnts.com

For decades, consumers have been bombarded with security advice designed to keep their financial data safe.

Yet, in a digital landscape increasingly fraught with sophisticated phishing schemes, brute-force attacks and data breaches, the onus still remains largely on those same individuals and business users to manage an ever-growing list of passwords.

According to a new report from PYMNTS Intelligence in collaboration with Arculus by CompoSecure, 65% of consumers struggle with remembering passwords, often resorting to risky practices such as credential reuse or relying on outdated systems like SMS-based two-factor authentication.

This glaring vulnerability is not just a nuisance for users, it can be a direct pathway for fraudsters. In fact, the report reveals that stolen or falsified credentials now account for 41% of authentication-related fraud cases, a problem exacerbated by consumers’ frustration with existing security protocols.

In today’s landscape of mounting dissatisfaction and insecurity, tap-to-authenticate metal payment cards are emerging as a promising alternative. Initially marketed as luxury items aimed at affluent customers, metal cards have gradually broadened their appeal by offering enhanced durability, perceived prestige and — most importantly — superior security features. Read more

Why the U.S. Trails the World in Faster Payments

Tom Nawrocki, Payments Journal

While faster payments have gained some popularity in the United States, many other countries have surged ahead in adoption.

While faster payments have gained some popularity in the United States, many other countries have surged ahead in adoption.

China, Brazil, and the UK have all benefited from proactive measures to promote instant payments. In contrast, the U.S. market, led by RTP and FedNow, holds a smaller share, making steady but slow progress.

What needs to happen for the U.S to catch up? Catching Up with Faster Payments, a report from Javelin Strategy & research, explores this and offers insights from countries that have successfully implemented instant payment programs.

The Factors Driving Instant Payments

In countries where instant payments have become a key part of the financial landscape, they have generally addressed an unmet need. The Chinese government built a real-time payments network that took off like a rocket. This enabled Alipay, a full suite of banking products including instant payments, to achieve ubiquitous adoption by offering merchants a convenient way to get paid.

“Alipay effectively replicated several processes that had existed for a long time in the United States,” said Hugh Thomas, Lead Analyst for Commercial Payments at Javelin, and author of the report. “That’s not a lever that the instant payment folks in the States necessarily have to pull.” Read more

Why US Third-Party Vendors Need to Act Fast on DORA Compliance

Ian Bowell, Tech Radar

How organizations can comply with The Digital Operational Resilience Act (DORA)

How organizations can comply with The Digital Operational Resilience Act (DORA)

The Digital Operational Resilience Act (DORA) has been in effect for over two months (since 17th January 2025, with the previous two years for preparation), but some organizations are still unprepared. While this regulation directly affects the financial sector of the European Union (EU), it also impacts US companies providing services to EU financial firms, including US firms providing services to their EU subsidiaries.

This is perhaps the most significant yet underrated aspect of DORA. Not only does DORA mandate higher resilience standards of EU financial institutions, but it also requires the management of third-party risk, similar to DoD CMMC, but with even more depth and detail. This means European financial institutions must be wary of third-party vendors and partners they work with, while U.S. companies that want to do business these firms must be compliant and be prepared for audits. These audits include the ability to upload metrics and data, in a Register of Information, regarding their third parties.

DORA is a prime example of how connected businesses around the world are today and why IT management and service providers must be able to adapt to new security and resilience requirements, no matter what region the regulations come from. Read more

Apr. 4, 2025: Technology & Payments Articles

- Analysis: Regtech in the US – The State We Are In

- PSR Accused of “Failure of Vision” Over Light-Touch Remedies on Card Scheme Fees

- Robinhood to Launch Banking Product

- Mastercard Courts Community Banks

Analysis: Regtech in the US – The State We Are In

FinTech Futures

Subas Roy, chairman of the newly launched International Regtech Association (IRTA), provides an insight into the state of regtech in the US and further opportunities.

Subas Roy, chairman of the newly launched International Regtech Association (IRTA), provides an insight into the state of regtech in the US and further opportunities.

The US represents the largest financial markets in the world. At the end of 2015, the size of the country’s banking sector alone was $15.9 trillion, generating a net income of $161.6 billion (according to SelectUSA).