Industry & Regulation

June 20, 2025: Industry & Regulation

- Fed Announces Meeting to Discuss Easing Bank Leverage Rules

- Financial Sector Changes Tack on Climate Goals as Tide Turns

- Credit Unions and the Underserved: Cannabis Businesses

- In a Radically Deregulatory Environment, the Locus of Risk Has Shifted

Fed Announces Meeting to Discuss Easing Bank Leverage Rules

Pete Schroeder, Reuters

The Federal Reserve will consider plans to ease leverage requirements on larger banks at a meeting later this month, kicking off what is expected to be a broad effort to reconsider bank rules.

The Federal Reserve will consider plans to ease leverage requirements on larger banks at a meeting later this month, kicking off what is expected to be a broad effort to reconsider bank rules.

The U.S. central bank announced the board meeting, scheduled for June 25, to discuss changes to the so-called “supplementary leverage ratio,” which requires banks to set aside capital against assets regardless of their risk.

The meeting will be the first following Fed Governor Michelle Bowman’s confirmation as the central bank’s top regulatory official. It could be the first of several rule-easing projects at the Fed as Bowman, a Republican tapped by President Donald Trump, has charted an ambitious plan for overhauling how the central bank regulates and monitors some of the nation’s largest and most complex banks.

The Fed did not provide any details on the proposal under consideration, but banks have clamored for years for changes to the supplementary leverage ratio, potentially by exempting traditionally safe assets or revising the formula used to calculate the requirement. Read more

Financial Sector Changes Tack on Climate Goals as Tide Turns

Kenza Bryan, Financial Times

Banks caught between sustainable investing backlash and EU clean energy push

Banks caught between sustainable investing backlash and EU clean energy push

Banks’ climate goals are falling like dominoes. HSBC has told investors to expect a rejigged energy strategy and climate targets in the second half of the year, while Royal Bank of Canada has dropped its sustainable financing target altogether and UBS has pushed back a target to cut its greenhouse gas emissions to net zero by a decade. Wells Fargo is no longer aiming for net zero by mid-century.

All these banks are, or have previously been, members of the UN-convened Net-Zero Banking Alliance, which launched in 2021. It is one of the major financial sector collaborations to have ledthe way on climate target-setting after the 2015 Paris accord, when almost 200 countries agreed tolimit the global temperature rise to well below 2C and ideally to 1.5C above pre-industrial levels.

Last month, in a sign of how far the tide has turned against sustainable investing in the past four years, NZBA members voted to water down the standard they are held to for cutting emissions from their lending. They argued it was no longer realistic to align their portfolios with a world in which warming is limited to 1.5 °C.

“There was an assumption you can move the market purely by stewardship… that was perhaps over-optimistic,” says Nina Seega, director of the Centre for Sustainable Finance at the Cambridge Institute for Sustainability Leadership. Read more

Credit Unions and the Underserved: Cannabis Businesses

Emily Claus, CUSO Magazine

In 2012, Washington and Colorado became the first states to legalize recreational cannabis use, a move that quickly resulted in similar legislation from states across the nation, skyrocketing the herb’s popularity and legality.

In 2012, Washington and Colorado became the first states to legalize recreational cannabis use, a move that quickly resulted in similar legislation from states across the nation, skyrocketing the herb’s popularity and legality.

Today, nearly 25% of the country’s population (62 million) report using cannabis, and nearly half of all states in the US allow recreational cannabis use, while even more allow it for medical purposes. In total, 39 out of 50 states have legalized some form of cannabis use, while many of the remaining states actively have legalization bills on the table.

As cannabis becomes increasingly commonplace and legal, the number of cannabis related businesses and dispensaries needed to meet demand increases alongside it. These businesses require large amounts of capital but are often denied banking and lending services from traditional financial institutions, due to a lack of federal policy. As a result, these businesses are forced to rely on cash or seek out alternative and often risky means to secure capital and conduct transactions.

For institutions that are willing to put in the work needed to help these businesses, there is no shortage of benefits they can bring in return. However, despite the wealth of opportunity and growth for credit unions in this area, many are hesitant to work with cannabis clients on account of the increased due diligence, compliance, and risk associated with them. The good news for credit unions, though, is that with the right partner, it’s never been easier to figure out if taking advantage of this opportunity is the right move for your credit union, and if so, what it would take to get started. Read more

In a Radically Deregulatory Environment, the Locus of Risk Has Shifted

Paul Davis and Phil Buffington, American Banker

It may feel like financial institutions are catching a regulatory break — but the smarter ones know better than to get too comfortable.

It may feel like financial institutions are catching a regulatory break — but the smarter ones know better than to get too comfortable.

Across Washington, we’re witnessing one of the most aggressive deregulatory waves in years in the form of a fast-moving reversal of many Biden-era reforms affecting fintech partnerships, consumer protection, enforcement priorities and reputational risk.

For banks and fintech companies, the instinct may be to celebrate and view the moves as a green light with fewer constraints, fewer reporting requirements and more room to experiment. After years of what some viewed as regulatory overreach, it feels like the guardrails are coming down.

Astute leaders know this moment demands something different. Everyone should remain vigilant about possible future shifts and the changing risk environment.

Deregulation doesn’t erase risk. It means that risk has changed — and in many cases, become harder to spot, measure and prepare for. Leadership requires a recognition that regulatory easing simply shifts how and where risk shows up. Read more

June 13, 2025: Industry & Regulation

- OPINION: When It Comes to CAMELS, ‘M’ Should Stand For ‘Modernization’

- PODCAST SERIES CDFIs: Serving the Underserved and Making Missing Markets

- OCC Rejects Call to Rescind Preemption Rule

- Sen. Marshall Expected to Shift Focus to NDAA After Credit Card Competition Act Falls Short Again

OPINION: When It Comes to CAMELS, ‘M’ Should Stand For ‘Modernization’

Stephen Scott, American Banker

The Halting Uncertain Methods and Practices in Supervision, or HUMPS, Act, recently advanced by the House Financial Services Committee, marks a rare moment in bank regulatory reform: It takes aim at an open secret.

The Halting Uncertain Methods and Practices in Supervision, or HUMPS, Act, recently advanced by the House Financial Services Committee, marks a rare moment in bank regulatory reform: It takes aim at an open secret.

Namely, that the CAMELS supervisory ratings framework — long a cornerstone of prudential oversight — harbors a vulnerability that distorts outcomes and undermines trust in the supervisory process.

The “M” component of CAMELS, which purports to assess the quality of a bank’s management, has long been acknowledged as the most subjective and opaque element of the supervisory scorecard. Where capital, assets, and earnings can be evaluated through financial statements and stress tests, “management” assessment has remained a kind of regulatory black box.

The HUMPS Act calls time on that ambiguity. It directs the Federal Financial Institutions Examination Council to revise the CAMELS rating system by establishing clear, objective standards for each component, and eliminating or reforming the subjective “management” component, to focus instead on measurable risk governance and internal controls.

In short, the bill demands that supervisory judgment rest on firmer ground, and for that it deserves cautious support. But let’s be clear: Eliminating the “M” altogether would be a mistake. Read more

PODCAST SERIES CDFIs: Serving the Underserved and Making Missing Markets

Episode 1: What are CDFIs? (Financial First Responders)

Episode 1: What are CDFIs? (Financial First Responders)

Elise Balboni, Surekha Carpenter, Lisa Cook, Donna Gambrell, Cathi Kim, Jonathan Kivell, Sadie McKeown, Carlos Naudon, Carmi Recto, Jacob Scott, Christina Travers; Federal Reserve of New York

A small subset of the U.S. financial system called Community Development Financial Institutions, or CDFIs, supports economic growth at the local level. The industry is comprised of different types of institutions operating in different ways. Each works to achieve a common mission: improving economic outcomes for underserved communities. Research from the New York Fed shows the industry is growing and changing. In this episode we hear from Federal Reserve Governor Lisa Cook, the New York Fed team doing CDFI research, a researcher from the Federal Reserve Bank of Richmond, and CDFI leaders. Our guests speak about the impacts and challenges of mission-driven lending and opportunities to scale this work.

Episode 2: Who are CDFIs? (Neighbors Helping Neighbors)

Episode 3: The Making Missing Markets Initiative

OCC Rejects Call to Rescind Preemption Rule

Gabrielle Saulsbery, Banking Dive

Acting Comptroller Rodney Hood called preemption a “cornerstone of the dual banking system.”

Acting Comptroller Rodney Hood called preemption a “cornerstone of the dual banking system.”

Acting Comptroller of the Currency Rodney Hood rejected calls from state banking regulators to rescind the OCC’s preemption rule Monday, standing behind preemption as a “cornerstone of the dual banking system.”

“The OCC’s regulations are consistent with federal law, Supreme Court precedent, and the [executive orders],” Hood wrote in a letter to Conference of State Bank Supervisors CEO Brandon Milhorn. “The OCC will not rescind its regulations and will continue to vigorously support and defend federal preemption.”

Milhorn wrote Hood in May to argue that the Office of the Comptroller of the Currency’s preemption rule, in which federal law supersedes state law in terms of regulations affecting national banks, violated two of President Donald Trump’s executive orders, Supreme Court precedent and the “best reading” of the Dodd-Frank Act.

One of the executive orders, EO 14267, requires agency heads to eliminate regulations that are anti-competitive. Read more

Sen. Marshall Expected to Shift Focus to NDAA After Credit Card Competition Act Falls Short Again

CUToday

With Sen. Roger Marshall’s (R-KS) efforts to add the Credit Card Competition Act to the GENIUS Act apparently failing, the next step for the Senator is the National Defense Authorization Act, acknowledged America’s Credit Unions and the Defense Credit Union Council.

With Sen. Roger Marshall’s (R-KS) efforts to add the Credit Card Competition Act to the GENIUS Act apparently failing, the next step for the Senator is the National Defense Authorization Act, acknowledged America’s Credit Unions and the Defense Credit Union Council.

As CUToday.info reported, Marshall’s latest effort has apparently failed, with Senator John Thune (R-SD) filing for cloture Monday, making it very unlikely amendments will be added to the legislation.

“We’re pleased to see the Senate is focused on passing important legislation that will provide real legal structures around stablecoins and it won’t be bogged down by poison pill amendments that are harmful to American consumers, like the CCCA,” said ACU SVP of Advocacy Greg Mesack. “We’re pleased to see the Senate is focused on what matters, which is trying to provide regulatory structure for an important evolving financial product.”

But both Jason Stverak, Defense Credi Union Council chief advocacy officer, and Mesack expect Marshall will begin his efforts again, now focusing on the NDAA.

“We fully expect that when something like the NDAA or appropriations bills move, Marshall will be back at it, and we’re going to be there—representing credit unions and the millions of members that use credit unions—to push back,” Mesack said. Read more

June 6, 2025: Industry & Regulation

- Banks’ Links to Private Credit Could Pose Systemic Risk, Says Boston Fed

- Regulators Prepare to Ease Post-Financial Crisis Banking Rules

- Is the Surge in High-Yield Savings a Windfall — Or a Warning?

- CFPB Tells Employees to Pack Up Offices as Mass Firings Loom

Banks’ Links to Private Credit Could Pose Systemic Risk, Says Boston Fed

Eric Platt, Financial Times

Report highlights how direct lenders are forging increasingly close ties to more tightly regulated financial groups.

Report highlights how direct lenders are forging increasingly close ties to more tightly regulated financial groups.

Bank lending to the $1.6tn private credit industry may pose systemic risks to the US financial system during an economic downturn, the Federal Reserve’s Boston branch warned on Wednesday. Boston Fed economists said in a paper that US lenders were exposing themselves to a new channel of risks by offering finance to non-bank groups that specialise in making loans directly to companies.

The report underscores how the booming private credit industry, led by groups such as Blackstone, Apollo and Ares, is forging increasingly close links with the much more tightly regulated traditional banking sector.

“Banks’ extensive links to the private credit market could be a concern because those linksindirectly expose banks to the traditionally higher risks associated with private credit loans,” JoséFillat, Mattia Landoni, John Levin and Christina Wang of the Boston Fed said in the report .

The report adds to a widening body of evidence that details how regulated banks have helped propel private credit lenders in the wake of the 2008 financial crisis, when safeguards were put in place to curtail the risks regulated lenders were taking. Those rules discouraged banks from underwriting loans to businesses that were highly indebted or to companies that did not generate enough cash to service their debts. Banks instead began lending to private credit funds that underwrote those loans in their place, supercharging the industry’s growth. Read more

Regulators Prepare to Ease Post-Financial Crisis Banking Rules

PYMNTS.com

Regulators are reportedly preparing to loosen banking restrictions imposed following the 2008 financial crisis.

Regulators are reportedly preparing to loosen banking restrictions imposed following the 2008 financial crisis.

As Politico reported Saturday (May 31), financial regulators are close to finishing a proposal that would scale back the rules on how much of a capital cushion big banks must maintain to handle losses and remain afloat during economic calamities.

The proposal is being developed by the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corp. (FDIC), and could be released in the months ahead, the report said, citing two sources familiar with the plan.

The report added that Treasury Secretary Scott Bessent, who is handling the administration’s financial regulatory agenda, said recently that reducing capital requirements is a “top priority” for federal banking agencies, with action on the issue expected “over the summer.”

“The 2024 election ushered in the largest turnover among federal financial regulators in the history of our country, and that’s starting to bear fruit,” said Ed Mills, a Washington policy analyst at Raymond James, who added that big banks were “back in the driver’s seat.”

As Politico noted, the efforts mark a major shift from last year, when regulators under President Joe Biden were advocating a plan that would require big banks to have even larger capital cushions, much to the industry’s dismay. Read more

Is the Surge in High-Yield Savings a Windfall — Or a Warning?

Matt Doffing, The Financial Brand

Key Takeaways

- As consumer interest in CDs wanes, high-yield savings accounts are gaining in popularity, drawing institutional strategies away from traditional term deposits.

- But institutions counting on high-yield products to grow customers and drive primacy may find that savings accounts are not as “sticky” as they once were.

- To drive sustained growth, high-interest products need to be integrated into product suites that broadly serve customers’ needs, not just deliver yield.

Everyone appears to want high-yield savings accounts.

Everyone appears to want high-yield savings accounts.

Banks, credit unions, and depositors have shifted focus from term deposits to liquid and floating rate deposits. What could that mean for deposit competition and institution profitability? Deposit experts say institutions need to be mindful of the good, the bad, and the ugly elements of meeting demand for high-yield savings and money market accounts.

The Good: HYSAs May Allow Cost Reductions

Looking at data on which deposit products have grown since the end of 2024, banking has seen a stark reversal: Certificate of deposit growth has become negative, and liquid account growth — high yield savings account and money market accounts — has become positive.

According to data published by Curinos at the end of April, monthly growth in CD volumes has stopped, dropping to negative growth rates first in October 2024, even though institutions offer top-of-the-market rates. On the other hand, the average monthly growth in savings and money markets reached 0.9% in February, the latest data available. Read more

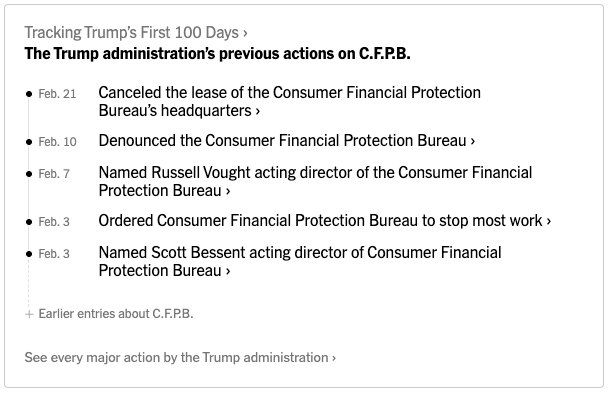

CFPB Tells Employees to Pack Up Offices as Mass Firings Loom

Evan Weinberger, Bloomberg Law

The Consumer Financial Protection Bureau wants employees based in its Washington headquarters to come collect their personal belongings—a sign that the agency is confident a federal appeals court will allow the gutting of its workforce.

The Consumer Financial Protection Bureau wants employees based in its Washington headquarters to come collect their personal belongings—a sign that the agency is confident a federal appeals court will allow the gutting of its workforce.

CFPB employees who used to work out of the agency’s offices at 1700 G Street NW in Washington began receiving an email from the agency’s facilities unit May 22 with those instructions.

The email, obtained by Bloomberg Law, directed employees to a digital sign-up sheet. That sign-up sheet, also reviewed by Bloomberg Law, gave employees the option to collect their belongings on June 3, 4, 5, or 11 between 8 a.m. and 4 p.m.

Acting CFPB Director Russell Vought locked agency staff out of the headquarters building in early February and has blocked the vast majority of them from entering since. A few staff members have been allowed to come to the headquarters to work on rulemaking and other efforts, according to multiple sources. Vought has also had the CFPB’s name removed from the building.

That Vought is telling CFPB employees to come collect their personal belongings is a sign that he’s confident the US Court of Appeals for the District of Columbia Circuit will overturn a lower court ruling that blocked an attempt to fire nearly 1,500 members of the approximately 1,700 people who worked at the CFPB at the beginning of 2025, according to multiple sources who requested anonymity to avoid retaliation. Read more

May 30, 2025: Industry & Regulation

- Supreme Court Exempts Fed from Trump Firings

- The CFPB Wanted Medical Debt to Be Left Off Credit Reports. That’s Changed Under Trump

- CFPB to Yank ‘Unlawful’ Open Banking Rule

- Related Reading: Amid Rule 1033 Uncertainty, Banks Urged Not to Retreat on APIs

- How Student-Loan Crisis Will Show Up in the Economy

Supreme Court Exempts Fed from Trump Firings

Caitlin Mullen, Banking Dive

A carve-out in last week’s emergency decision on agency official firings “poses a puzzle” because the Fed’s independence rests on the same foundations as other agencies, a dissenting justice wrote.

A carve-out in last week’s emergency decision on agency official firings “poses a puzzle” because the Fed’s independence rests on the same foundations as other agencies, a dissenting justice wrote.

Dive Brief:

- The Supreme Court last week exempted the Federal Reserve from its order granting the Trump administration’s emergency request to uphold the firing of officials at the National Labor Relations Board and the Merit Systems Protection Board.

- The Fed “is a uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States,” the majority wrote in Thursday’s order.

- Justice Elena Kagan, joined in a dissenting opinion by Justices Sonia Sotomayor and Ketanji Brown Jackson, called the Fed exception “out of the blue,” saying she was “glad to hear it, and do not doubt the majority’s intention to avoid imperiling the Fed.” But the exemption “poses a puzzle,” because Fed independence “rests on the same constitutional and analytic foundations” as other federal agencies, Kagan said.

Dive Insight:

The Justice Department had asked for a stay on a D.C. Circuit Court order reinstating Gwynne Wilcox of the NLRB and Cathy Harris of the MSPB, both Democrats appointed by former President Joe Biden, after President Donald Trump removed them without cause earlier this year.

While the case proceeds, the Supreme Court’s order allows Wilcox and Harris’ firings to stand – a move lower courts had blocked, citing precedent from Humphrey’s Executor v. United States. In that 1935 case, the Supreme Court determined the president couldn’t oust commission members before their terms expire, except for malfeasance or dereliction of duty. Read more

- Related Reading: Supreme Court Temporarily Allows Independent Labor Board Firings; Impact On FTC, NCUA Ousters Is Unclear

The CFPB Wanted Medical Debt to Be Left Off Credit Reports. That’s Changed Under Trump

Vanessa Romo, NPR

David Deeds is in financial trouble, and he’s hoping a federal court in Texas can help get him out of it. Deeds, who is 62 and owes tens of thousands of dollars in medical debt from cancer treatment, is involved in a complicated lawsuit filed by credit industry groups over the Consumer Financial Protection Bureau’s medical debt rule.

David Deeds is in financial trouble, and he’s hoping a federal court in Texas can help get him out of it. Deeds, who is 62 and owes tens of thousands of dollars in medical debt from cancer treatment, is involved in a complicated lawsuit filed by credit industry groups over the Consumer Financial Protection Bureau’s medical debt rule.

The rule, finalized in January just weeks before the end of the Biden administration, would have banned the reporting of medical debt from credit reports. At the time, the agency reported 15 million Americans would benefit from the change, removing $49 billion in medical debt from records. It was set to go into effect in March.

But new leadership appointed by President Trump now runs the CFPB. And the agency hasn’t just reversed its position on the consumer protection rule — last month, it joined forces with the plaintiffs who filed the suit trying to block it. The agency has not returned a request for comment from NPR.

Over the last few months, Judge Sean Jordan from Texas’ Eastern District has twice ordered a stay, delaying the rule’s start date to July 28. He is likely to make a ruling on whether or not to vacate it by mid-June. The outcome of the suit, filed on the same day the rule was issued, has important financial implications for Deeds, as well as the millions more whose medical debt has negatively impacted their credit scores. Read more

CFPB to Yank ‘Unlawful’ Open Banking Rule

Justin Bachman, Banking Dive

That move bends to bank groups that filed a lawsuit last year to block the Consumer Financial Protection Bureau rule aimed at making it easier for consumers to move their financial accounts.

That move bends to bank groups that filed a lawsuit last year to block the Consumer Financial Protection Bureau rule aimed at making it easier for consumers to move their financial accounts.

Dive Brief:

- The Consumer Financial Protection Bureau has determined that a 2024 rule authorizing open banking is “unlawful” and should be scrapped, 15 years after Congress enacted legislation to make it easier for consumers to switch financial institutions, the agency told a federal court.

- The bureau plans to vacate the rule as part of a lawsuit in Kentucky, the CFPB’s chief legal officer, Mark Paoletta, wrote in a federal court filing Friday. “After reviewing the Rule and considering the issues that this case presents, Bureau leadership has determined that the Rule is unlawful and should be set aside,” the agency wrote in a status report filing.

- The Bank Policy Institute, which represents most of the large U.S. banks, said the bureau had acknowledged the rule’s “clear legal deficiencies,” according to a Friday in a press release. But Financial Technology Association CEO Penny Lee, in a statement Friday, called the CFPB decision “a handout to Wall Street banks, who are trying to limit competition and debank Americans from digital financial services.”

Dive Insight:

The CFPB passed its final rule in October, drawing an immediate lawsuit from BPI, the Kentucky Bankers Association and Kentucky-based Forcht Bank.

The banking groups argued that the rule, under Section 1033 of the Dodd-Frank Act, imposed heavy compliance costs and did not address liability issues around fraud and misuse of consumers’ financial data. The plaintiffs also said the bureau had exceeded its authority under the act in formulating the rule. Read more

- Related Reading: Amid Rule 1033 Uncertainty, Banks Urged Not to Retreat on APIs

How Student-Loan Crisis Will Show Up in the Economy

Justin Lahart, Wall Street Journal

Millions of Americans suddenly owe billions of dollars in student debt after years of forbearance

Millions of Americans suddenly owe billions of dollars in student debt after years of forbearance

Key Points

- Millions of student loan borrowers are newly delinquent, sinking credit scores, with economists forecasting a GDP trim.

- The Trump administration began collections for defaulted loans, a shock for many, especially those new to repayment.

Millions of Americans had their student-loan payments put on pause during the pandemic. Now they are back on the hook again.

For borrowers, this means that every month, money that they presumably used to spend elsewhere is going to pay off debt instead. Many who aren’t paying are now considered delinquent or defaulted, a status that sinks credit scores. Around 5.6 million borrowers were marked newly delinquent on their student loans in the first three months of this year. That will strain personal finances. At the same time, it creates fresh challenges for the broader economy.

Borrowers have been required to repay their student loans for some months now. But just this month, the Trump administration began putting millions of defaulted student-loan borrowers into collections, and threatened to confiscate their wages, tax refunds and federal benefits. The collections process was standard before the pandemic. But it is still likely to be a shock to those who haven’t experienced it before, or who forgot what it was like. Read more

May 23, 2025: Industry & Regulation

- States May Not Obtain Civil Money Penalties Under the Consumer Financial Protection Act

- Related Reading: CFPB Seeks to Block States from Enforcing Federal Laws

- Federal, State Police Warn of Rising Trend of ‘Bank Jugging’ Targeting Credit Unions & Banks

- All You Need to Know about the Durbin-Marshall Credit Card Bill

- NASCUS Summary of the May 2025 NCUA Board Meeting

- Related Reading: NCUA Invites Stakeholder Feedback on Operations and Initiatives

States May Not Obtain Civil Money Penalties Under the Consumer Financial Protection Act

Jeffrey Ehrlich, Jonathan Ellis, Grace Greene Simmons; McGuireWoods LLP/JD Supra

There has been much speculation that States will fill the void created by the Trump Administration’s drastic scaling back of the Consumer Financial Protection Bureau.

There has been much speculation that States will fill the void created by the Trump Administration’s drastic scaling back of the Consumer Financial Protection Bureau.

Congress authorized both state attorneys general and state regulators (like New York’s Department of Financial Services and California’s Department of Financial Protection and Innovation) to enforce the Consumer Financial Protection Act (CFPA), except against national banks and federal savings associations.

Under that authority, States may enforce the CFPA’s prohibition on engaging in UDAAPs, and they may also have authority to enforce the CFPA’s separate prohibition on violating “Federal consumer financial law,” a term that the statute defines to include “the enumerated consumer laws”: TILA, FCRA, the FDCPA, EFTA, RESPA, and others.

But while States may enforce these laws against state-chartered banks, credit unions, and non-depositories that offer or provide consumer-financial products and services, there is one way in which States could never match what the Bureau might have done. Since its inception, the Bureau has been awarded over $5 billion in civil money penalties. A careful reading of the CFPA suggests that, unlike the Bureau, States may not obtain civil money penalties under the CFPA.

To be sure, the CFPA provides that any person who violates the statute “shall forfeit and pay a civil penalty pursuant to this subsection.” This seems to suggest that any CFPA plaintiff could obtain a penalty. But the same subsection later says that no penalty may be imposed unless “the Bureau gives notice and an opportunity for a hearing” or “the appropriate court has ordered such assessment and entered judgment in favor of the Bureau.” And it also says that “[t]he Bureau may compromise, modify, or remit any penalty.” These requirements suggest that penalty may be imposed in matters only where the Bureau is at least a party. Read more

- Related Reading: CFPB Seeks to Block States from Enforcing Federal Laws

Federal, State Police Warn of Rising Trend of ‘Bank Jugging’ Targeting Credit Unions & Banks

Peter Strozniak, Credit Union Times

Criminals follow and rob victims after making branch or ATM stops; law enforcement urges vigilance.

Criminals follow and rob victims after making branch or ATM stops; law enforcement urges vigilance.

Credit unions often issue warnings to help members avoid fraud, and now federal and state investigators are spotlighting a rising violent trend known as “bank juggling” that could threaten the safety of members and bank customers alike when they leave their branches. Last week, Maryland Attorney General Anthony G. Brown announced the arrest of seven individuals allegedly tied to two criminal organizations involved in bank-juggling incidents.

These crimes occur when suspects follow victims from a credit union, bank, or ATM and rob them. In Maryland, the suspects targeted the $190 billion Navy Federal Credit Union, Bank of America, Capital One and Wells Fargo. According to the Maryland Attorney General’s Office, the two groups stole more than $ 155,000 from at least 34 victims. Bank juggling cases have also surged in Virginia, Florida, Texas, and California, according to various media outlets.

The Maryland investigation found that the suspects identified victims as they exited financial institutions and then approached them with firearms or physical force to carry out the robberies, Brown said. Initially, victims were robbed in parking lots at their credit union or bank as they entered their cars. Read more

All You Need to Know about the Durbin-Marshall Credit Card Bill

Electronic Payment Coalition

Megaretailers like Walmart, Target, and Home Depot are working to convince their allies in Congress to pass corporate welfare legislation paid for by American consumers.

Megaretailers like Walmart, Target, and Home Depot are working to convince their allies in Congress to pass corporate welfare legislation paid for by American consumers.

These Main Street job killing corporations want to impose new government mandates on how retailers process credit cards. It means the data and fraud protection you expect; rewards you use to pay for everyday items like gas and groceries; and convenience you have come to expect when using a credit card would all go away. This is exactly why the Durbin-Marshall Credit Card Bill is strongly opposed by a diverse and wide-ranging set of organizations and industries, including labor unions, small business owners, financial institutions including credit unions and community banks, policy institutes, trade associations, think tanks, and airlines.

FACT 1: INTERCHANGE HAS NOT INCREASED

The rate of interchange has remained flat for the past seven years, as merchant sales have grown substantially. The only reason a merchant would pay more for interchange is because their sales went up proportionately.

FACT #2: INTERCHANGE IS NOT THE SECOND LARGEST EXPENSE FOR MOST BUSINESSES

Data shows that credit card interchange is NOT among small businesses’ top expenses. The average small business pays for rent, wages and benefits, taxes, advertising, inventory, utilities, insurance and cost of managing cash – one of the very smallest costs, at ~1%, is accepting credit card payments. Read more

NASCUS Summary of the May 2025 NCUA Board Meeting

The May 2025 meeting of the National Credit Union Administration (NCUA) Board was held with Chair Kyle Hauptman as the sole board member.

The session included two primary briefings: a financial overview of the National Credit Union Share Insurance Fund (NCUSIF) and an update on the agency’s Voluntary Separation Program (VSP). Additional operational adjustments and strategic planning initiatives were also discussed.

The session included two primary briefings: a financial overview of the National Credit Union Share Insurance Fund (NCUSIF) and an update on the agency’s Voluntary Separation Program (VSP). Additional operational adjustments and strategic planning initiatives were also discussed.

NCUSIF Financial Overview & Performance

The financial performance of the NCUSIF for the first quarter of 2025 reflected steady improvement. The fund reported a net income of $1.2 million, marking an increase from the previous quarter. Total assets stood at $23 billion, while reserves reached $242 million, a $5 million rise compared to Q4 2024. The equity ratio as of Q4 was 1.30% and is projected to decline slightly to 1.26% by June 30, 2025, largely due to continued growth in insured shares.

No credit union failures were recorded in the first quarter. CAMELS code 3 credit unions decreased from 715 to 679, with associated assets falling by $16.1 billion to $172.6 billion. CAMELS code 4 and 5 institutions saw a modest decline from 135 to 129 credit unions, though their total assets increased by $1.8 billion to $20.3 billion. Notably, 90% of insured shares remain within CAMELS 1 and 2 rated credit unions. Read more (login required)

- Related Reading: NCUA Invites Stakeholder Feedback on Operations and Initiatives

May 16, 2025: Industry & Regulation

- US Poised to Dial Back Bank Rules Imposed in Wake of 2008 Crisis

- Examiner Discretion Takes Center Stage in CAMELS Debate

- In Wake of President’s EO, America’s CUs Outlines Numerous Rules It Wants to See Rescinded

- CFPB Kills Proposal to Rein in Data Brokers

US Poised to Dial Back Bank Rules Imposed in Wake of 2008 Crisis

Martin Arnold, Kate Duguid and Claire Jones, Financial Times

US authorities are preparing to announce one of the biggest cuts in banks’ capital requirements for more than a decade, marking the latest sign of the deregulation agenda of the Trump administration.

US authorities are preparing to announce one of the biggest cuts in banks’ capital requirements for more than a decade, marking the latest sign of the deregulation agenda of the Trump administration.

Regulators are in the next few months poised to reduce the supplementary leverage ratio, according to several people familiar with the matter. The rule requires big banks to have a preset amount of high-quality capital against their total leverage, which includes assets such as loans and off-balance sheet exposures such as derivatives. It was established in 2014 as part of sweeping reforms in the wake of the 2008-09 financial crisis.

Bank lobbyists have been campaigning against the rule for years, saying it punishes lenders for holding even low-risk assets such as US Treasuries, hinders their ability to facilitate trading in the $29tn government debt market and weakens their ability to extend credit. “Penalising banks for holding low-risk assets like Treasuries undermines their ability to support market liquidity during times of stress when it is most needed,” said Greg Baer, chief executive of the Bank Policy Institute lobby group.

“Regulators should act now rather than waiting for the next event.” Lobbyists expect regulators to present reform proposals by the summer. The mooted loosening of capital rules comes at a time when the Trump administration is slashing regulations in everything from environmental policies to financial disclosure requirements. Read more

Examiner Discretion Takes Center Stage in CAMELS Debate

Kyle Campbell, American Banker

As freshly appointed agency heads aim to refocus their approaches to supervision, an emerging question is how much discretion will be left for bank examiners — if any at all.

As freshly appointed agency heads aim to refocus their approaches to supervision, an emerging question is how much discretion will be left for bank examiners — if any at all.

Regulators and lawmakers have already sought to remove one key discretionary tool by barring the consideration of reputational risks. But some policy specialists want them to go further.

During a recent House Financial Services Committee hearing, Republican members and witnesses representing the banking industry called for curtailing — if not outright eliminating — the management component of the so-called CAMELS ratings, which are central to determining a bank’s safety and soundness. CAMELS stands for capital adequacy, asset quality, management, earnings, liquidity and sensitivity to market risk, and banks are assessed on each of those metrics by their federal regulators, though their individual ratings are not made public.

“While this framework in theory evaluates six factors, it is the management rating — or the ‘M’ — that dominates as a factor in the composite rating,” said Sarah Flowers, a top regulatory affairs official with the Bank Policy Institute, during that hearing. Read more

In Wake of President’s EO, America’s CUs Outlines Numerous Rules It Wants to See Rescinded

Frank Diekmann, CU Daily

Following an executive order earlier this year from President Trump, America’s Credit Unions has sent a 23-page letter to the Office of Management and Budget (OMB) that outlines numerous rules from NCUA and other regulators it wants to see rescinded.

Following an executive order earlier this year from President Trump, America’s Credit Unions has sent a 23-page letter to the Office of Management and Budget (OMB) that outlines numerous rules from NCUA and other regulators it wants to see rescinded.

Executive Order 14219—“Ensuring Lawful Governance and Implementing the President’s ‘Department of Government Efficiency’ Deregulatory Initiative—was published in February and is designed to “commence the deconstruction of the overbearing and burdensome administrative state,: according to the order.

America’s Credit Unions noted Executive Order 14219 directs agencies to identify regulations that are “unconstitutional or premised on unlawful delegations, which extend beyond the best reading of their statutory authority, or that address major issues without clear Congressional authorization.”

The letter sent to the OMB—which at one point was headed by Jim Nussle, who currently is president and CEO of America’s Credit Unions—was signed by James Akin, head of regulatory advocacy with the trade group.

Among the rules America’s Credit Unions wants to see rescinded:

- NCUA’s Succession Planning Rule

America’s Credit Unions said the rule “conflicts with the EO because its private costs exceed any demonstrated public benefit and it burdens small businesses in unforeseen ways.” - NCUA’s Record Retention Rule

The trade group said the Record Retention rules are “overly prescriptive and outdated, especially for smaller credit unions,” and have “…translated into burdensome retention of a vast array of documents and data, often for indeterminate periods, out of caution…” Read more

CFPB Kills Proposal to Rein in Data Brokers

Katie Berry, American Banker

The Consumer Financial Protection Bureau has withdrawn a proposed rule aimed at protecting consumers from having their personal and financial information sold by data brokers.

The Consumer Financial Protection Bureau has withdrawn a proposed rule aimed at protecting consumers from having their personal and financial information sold by data brokers.

The CFPB withdrew the proposed rule, which was proposed in December under former CFPB Director Rohit Chopra, in a notice scheduled to appear in the Federal Register Thursday. The notice said that the proposed rule is being withdrawn “in light of updates to Bureau policies,” noting that “although the proposed rule intended to implement portions of the [Fair Credit Reporting Act], in many respects it did so in a manner not aligned with the Bureau’s current interpretation of the FCRA, which it is in the process of revising, and its changed policy objectives.”

The rule sought to limit data brokers from selling personal financial information on consumers such as Social Security numbers and phone numbers. Data brokers profit by selling data.

The Consumer Data Industry Association, which represents consumer reporting agencies, told the CFPB in April that the proposed rule was arbitrary and capricious, in violation of the Administrative Procedure Act. Read more

May 9, 2025: Industry & Regulation

- CFPB Plans to Revisit Open Banking Rule Despite Staff Cuts

- Navigating FinCEN’s Actions on Huione Group: Strengthening Defenses Against Money Laundering

- Illegal Debanking Under Scrutiny: New Task Force Signals DOJ Enforcement Shift

- Banks Are Keeping Credit Card Rates High Even After the CFPB Rule They Blamed for High APRs Was Killed

CFPB Plans to Revisit Open Banking Rule Despite Staff Cuts

Evan Weinberger, Bloomberg Law

- Biden-era rule allows sharing of bank, credit card data

- Trump administration weighing vacature of rule in lawsuit

The Trump administration is poised to reopen a Biden-era rule allowing customers to share their sensitive bank data with third-party fintechs and potentially vacate it, according to multiple sources.

The Trump administration is poised to reopen a Biden-era rule allowing customers to share their sensitive bank data with third-party fintechs and potentially vacate it, according to multiple sources.

The Consumer Financial Protection Bureau is leaning toward reworking its open banking rule, which allows customers to share their deposit account and credit card information with fintechs, such as online investment company Betterment or PayPal Holdings Inc.’s Venmo service, the sources told Bloomberg Law.

The CFPB will likely reopen the rule amid requests from banks about potential liability for data breaches and the ability to charge for access to data, according to a source familar with the matter who wasn’t authorized to speak publicly. Banks also want to be able to block companies that abuse their access to customer data from the open banking system, the source said.

It’s unclear whether the administration will look to add to the existing rule or eliminate it altogether, but supporters of the regulation are worried about any further delays to its implementation.

“Reopening this rulemaking means stalling financial innovation and prolonging uncertainty for both businesses and consumers in America,” said Steve Boms, President and CEO of FDATA North America, an open banking advocacy organization.

Acting CFPB Director Russell Vought fired most employees in the agency rulemaking unit that would rewrite the open banking rule, as part of an April reduction-in-force plan that eliminated 1,500 of the agency’s approximately 1,700-member workforce. Read more

- Related Reading: CFPB Announcement Regarding Enforcement Actions Related to Buy Now, Pay Later Loans

Navigating FinCEN’s Actions on Huione Group: Strengthening Defenses Against Money Laundering

Kelly A. Lenahan-Pfahlert, Ballard Spahr

On May 1, 2025, the Financial Crimes Enforcement Network (FinCEN) released a Notice of Proposed Rulemaking (NPRM) regarding the Huione Group, a foreign financial institution located in Cambodia. This proposal, enacted under section 311 of the USA PATRIOT Act, suggests prohibiting U.S. financial institutions from forming or maintaining correspondent banking relationships with Huione Group. The NPRM identifies Huione Group as a significant money laundering concern, based on its purported role in facilitating unlawful financial activities.

On May 1, 2025, the Financial Crimes Enforcement Network (FinCEN) released a Notice of Proposed Rulemaking (NPRM) regarding the Huione Group, a foreign financial institution located in Cambodia. This proposal, enacted under section 311 of the USA PATRIOT Act, suggests prohibiting U.S. financial institutions from forming or maintaining correspondent banking relationships with Huione Group. The NPRM identifies Huione Group as a significant money laundering concern, based on its purported role in facilitating unlawful financial activities.

Following an investigation, FinCEN found that Huione Group was involved in laundering at least $4 billion in illegal proceeds between August 2021 and January 2025, with the funds distributed as follows:

- Approximately $37 million was linked to cyber thefts conducted by North Korea;

- Around $36 million originated from scams known as “pig butchering”;

- About $300 million was related to various other cyber fraud schemes.

Section 311 of the USA PATRIOT Act grants the Secretary of the Treasury the authority to identify foreign jurisdictions, financial institutions, or types of transactions that pose significant money laundering concerns. Upon such identification, the Secretary can impose special measures to mitigate risks to the U.S. financial system. These special measures can range from requiring enhanced record-keeping and reporting to prohibiting certain types of banking relationships. Read more

Illegal Debanking Under Scrutiny: New Task Force Signals DOJ Enforcement Shift

Vinson & Elkins LLP, JD SUpra

On April 28, 2025, the U.S. Attorney’s Office for the Eastern District of Virginia (“EDVA”) and the U.S. Department of Justice’s (“DOJ”) Civil Rights Division (“CRT”) announced the formation of the Eastern District of Virginia Equal Access to Banking Task Force.

On April 28, 2025, the U.S. Attorney’s Office for the Eastern District of Virginia (“EDVA”) and the U.S. Department of Justice’s (“DOJ”) Civil Rights Division (“CRT”) announced the formation of the Eastern District of Virginia Equal Access to Banking Task Force.

This new Task Force is dedicated to investigating claims of “debanking”—the unlawful denial, restriction, or termination of banking services based on a customer’s political views, religious beliefs, or other prohibited factors.

EDVA and CRT established the Task Force in response to growing concerns that banks and other financial institutions were improperly denying services to individuals or organizations for ideological reasons, rather than for legitimate business or compliance purposes. These concerns were highlighted in a January 23, 2025, Executive Order from President Trump, which aimed to “protect and promote fair and open access to banking services for all law-abiding individual citizens and private-sector entities alike.” Echoing this message, CRT Assistant Attorney General Harmeet K. Dhillon stated, “No customer should be refused credit or other financial services for discriminatory or unlawful reasons.

Scope and Focus of the Task Force

The Task Force will leverage EDVA, CRT, and Virginia Office of the Attorney General resources as well as coordinate with federal regulatory agencies as needed. Its work will include reviewing compliance with:

- The Equal Credit Opportunity Act (ECOA), which prohibits discrimination based on race, religion, national origin, sex, marital status, or age in any aspect of a credit transaction; Read more

Banks Are Keeping Credit Card Rates High Even After the CFPB Rule They Blamed for High APRs Was Killed

Hugh Son & Gabrielle Fonrouge, CNBC

Key Points

Key Points

- Banks quickly raised interest rates to record levels and added new monthly fees on credit cards last year when a Consumer Financial Protection Bureau rule threatened a key revenue source for the industry.

- Now they’re far more reluctant to reverse those steps, even after bank trade groups succeeded in killing the CFPB rule in federal court last month.

- Synchrony and Bread Financial, two of the biggest players in the business of issuing branded credit cards for the likes of Amazon, Lowe’s and Wayfair, are keeping the higher rates in place, executives said in recent conference calls.

Last year, banks quickly raised interest rates to record levels and added new monthly fees on credit cards when a Consumer Financial Protection Bureau rule threatened a key revenue source for the industry.

Now, they’re far more reluctant to reverse those steps, even after bank trade groups succeeded in killing the CFPB rule in federal court last month. Synchrony and Bread Financial, two of the biggest players in the business of issuing branded credit cards for the likes of Amazon, Lowe’s and Wayfair , are keeping the higher rates in place, executives said in recent conference calls.

“We feel pretty comfortable that the rule has been vacated,” Synchrony CEO Brian Doubles said on April 22. “With that said, we don’t currently have plans to roll anything back in terms of the changes that we made.” His counterpart at Bread, CEO Ralph Andretta, echoed that sentiment, “At this point, we’re not intending to roll back those changes, and we’ve talked to the partners about that.” Read more

May 2, 2025: Industry & Regulation

- First 100 Days: Upcoming Regulatory Signals for Fraud and Financial Crime

- Financial Services Republicans Approve CFPB Cuts

- PODCAST: Private Civil Consumer Financial Services Litigation to Partially Fill CFPB Void – Part 1

- OPINION: States Should Take Charge of Gathering Beneficial Ownership Data

First 100 Days: Upcoming Regulatory Signals for Fraud and Financial Crime

KPGM

Actions impacting Fraud, BSA/AML/CFT, Bribery/Corruption, and Sanctions

Actions impacting Fraud, BSA/AML/CFT, Bribery/Corruption, and Sanctions

KPMG Regulatory Insights

- All-Time High Risks: Reported fraud at an all-time high and continued evolving risks (with use of AI, linkages to cyber risk, etc.) by potential threat actors ‘at scale’

- Shifting Investigations/Enforcement: Administration directives change enforcement focus (e.g., Foreign Corrupt Practices Act focus on cartels and transnational criminal organizations) but do not change underlying regulations/laws

- Regulatory Tailoring: Anticipate agencies to continue amending/tailoring regulations (e.g., narrowing Beneficial Ownership Information reporting), applying them to a specific subset of companies (e.g., foreign-owned, largest by size)

Under the new Administration, financial crimes enforcement is being recalibrated to target the priorities of the Administration and focus enforcement on “higher risk” areas while promoting economic growth and innovation. Signals for and indicators of regulatory change can be seen across:

- Fraud, including focusing on fraud against the government (e.g., fraud, waste, and abuse), focusing on consumer-related fraud, shifting enforcement of cryptocurrency/ digital assets activity, and redirecting White Collar fraud enforcement

- Financial Crimes Regulatory Framework (BSA/AML/CFT), including prioritizing areas of “higher risk,” narrowing application of the BOI reporting requirements, enhancing oversight of cross-border transactions in priority areas, and potentially finalizing amendments to certain AML/CFT program requirements (e.g., SARs filing requirements)

- Bribery and Corruption, including temporarily suspending new FCPA investigations and redirecting DOJ investigations priorities to foreign bribery that benefits cartels and transnational criminal organizations

- Sanctions, including expanding the application of sanctions to a broader group of entities (e.g., intermediaries), extending recordkeeping requirements, and reconsidering the role of certain task forces

Fraud: In its latest Data Book Report, the FTC highlights that fraud losses reported by consumers and companies in 2024 totaled more than $12.5 billion, a 25 percent increase over losses reported in 2023. Regulatory signals from the new Administration suggest a broad focus on fraud prevention, including actions to protect both the government and consumers. Read more

Financial Services Republicans Approve CFPB Cuts

Jasper Goodman, Politico

The committee’s measure would also dissolve the U.S.’ top audit watchdog and fold it into the SEC.

The committee’s measure would also dissolve the U.S.’ top audit watchdog and fold it into the SEC.

House Financial Services Republicans approved legislation Wednesday that would slash funding for the Consumer Financial Protection Bureau and dissolve the Public Company Accounting Oversight Board into the Securities and Exchange Commission as part of the party-line, GOP megabill that is central to President Donald Trump’s agenda. The panel voted along party lines, 30-22, to advance its portion of the GOP package, which is expected to include sweeping tax, energy and border policy changes. Financial Services Republicans say their section of the bill will produce more than the $1 billion in savings it was instructed to find.

The measure would slash the amount of funding the CFPB has access to by almost 60 percent. The bureau’s funding, which is derived from the Federal Reserve, would be capped at 5 percent of the central bank’s operating expenses under the proposal — down from the current limit of 12 percent. The legislation would also dissolve the U.S.’s top audit regulator, the Public Company Accounting Oversight Board, and fold it into the SEC.

Financial Services Chair French Hill (R-Ark.) said at the markup that his committee “will do its part to reduce the deficit and decrease direct spending so that Congress can enact pro-growth tax policies.” Democrats offered more than three dozen amendments that were shot down by Republicans throughout the nine-hour markup. They also put up procedural hurdles that slowed down the start of the meeting.

Democrats offered an array of amendments aimed at bolstering the CFPB, which has been a longtime GOP target. They also offered provisions aimed at boosting the supply of affordable housing, protecting the independence of the Federal Reserve and targeting the Trump family’s crypto businesses. Read more

PODCAST: Private Civil Consumer Financial Services Litigation to Partially Fill CFPB Void – Part 1

Ballard CFS Group, Consumer Finance Monitor

The podcast we are releasing today is part 1 of a re-purposed webinar we produced on March 25 titled “The Impact of the Election on the CFPB – Part 4.”

The podcast we are releasing today is part 1 of a re-purposed webinar we produced on March 25 titled “The Impact of the Election on the CFPB – Part 4.”

As a result of the diminishing impact of the CFPB on enforcing the consumer financial services laws, we expect that void to be filled by state government enforcement agencies and private civil litigation, including class and mass actions. Our webinar will focus on private civil litigation. Our featured guest for this webinar was Ira Rheingold, Executive Director of the National Association of Consumer Advocates. He was joined on the panel by Thomas Burke, Dan McKenna, Jenny Perkins, Joseph Schuster, and Melanie Vartabedian, litigators in our firm’s Consumer Financial Services Group.

The podcast began with Ira observing that state enforcement agencies and plaintiffs’ class action lawyers will be taking a careful look at enforcement actions voluntarily dismissed by the CFPB to ascertain whether the complaints should be re-filed by them in federal or state court. We then proceeded to discuss the following areas where the panelists are predicting an increase in private civil litigation during 2025 and beyond:

- Increased FCRA litigation, especially in ID Theft (Jenny, Ira).

- The use of AI and corporate responsibility for ensuring that it does not create unfair or discriminatory practices (Ira).

- Increased retail bank litigation, including EFTA claims (Ira, Tom).

OPINION: States Should Take Charge of Gathering Beneficial Ownership Data

Kyle Mack, American Banker

Among the many regulatory shifts under the new administration is the Financial Crimes Enforcement Network’s recent exemption of U.S. companies from reporting beneficial ownership information, or BOI.

Among the many regulatory shifts under the new administration is the Financial Crimes Enforcement Network’s recent exemption of U.S. companies from reporting beneficial ownership information, or BOI.

BOI refers to the individuals who ultimately own or control a company, directly or indirectly. Fincen argues that requiring U.S. companies to file this information is a “burdensome” regulation. Under the interim rule, they will no longer need to submit initial, updated or corrected BOI reports. However, foreign companies must still comply with these requirements.

Critics of BOI reporting raise concerns about privacy and data security. Some small-business owners fear government overreach or worry that disclosing ownership information could expose them to data breaches or misuse by unauthorized parties. It is important to note that this information isn’t public — it’s stored securely by Fincen and is only accessible to law enforcement and financial institutions conducting due diligence.

Another common concern is the compliance burden placed on small businesses, which may lack the time or resources to navigate new reporting obligations. While Fincen has provided guidance and support, the current design adds red tape and increases the risk of penalties for noncompliance. The result is a system that penalizes the very businesses it’s intended to protect. Read more

Apr. 25, 2025: Industry & Regulation

- OPINION: Time To Think the Unthinkable About Bank Regulation

- How Long Will Big U.S. Banks Continue to Lead the World?

- Credit Union Regulator Sheds Over 200 Employees in Buyout Offers

- Related reading: FDIC Aims to Reduce Workforce by 1,250

- Fed Regulation, Supervision Take Backseat in Independence Fight

OPINION: Time To Think the Unthinkable About Bank Regulation

Dan Davies, the Financial Times

The bank supervisors of the world are, through speeches and “Dear CEO” letters, warning their charges of the need to prepare for elevated geopolitical risk.

The bank supervisors of the world are, through speeches and “Dear CEO” letters, warning their charges of the need to prepare for elevated geopolitical risk.

This might be mere irony or subconscious projection, but financial regulation has its own geopolitical issues — arguably more serious than anything faced by the banks themselves. Consider the so-called Basel III endgame, the last stage of the post-crisis regulatory reforms for banks.

This was agreed in 2017 and initially meant to be implemented from the start of 2022. The current state of play is that the EU has delayed some of the key points to 2026, the UK has delayed the whole thing to 2027 and the US does not even have a full proposal.

With the appointment of Michelle Bowman, a past critic of the endgame, to the post of Federal Reserve vice-chair for supervision, and Treasury secretary Scott Bessent’s most recent speech seemingly rejecting the whole principle of Basel standards, there have to be doubts as to whether the full Accord will ever be globally implemented. Whatever happens next in American politics, the bank lobbyists are very efficient — the endgame was already delayed and diluted under the Biden administration.

Uncertainty about global co-operation is beginning to spread. It is noticeable that the FinancialStability Board, which once led the way on climate risk, cyber risk and shadow banking, is going tospend 2025 working on a review of its own processes as its major deliverable. The Basel Committeeon Bank Supervision itself will be responding this year to the collapses of Silicon Valley Bank andCredit Suisse in 2023 by developing “tools” and perhaps some principles for “effective supervisoryjudgment”, rather than any new regulations. Read more

How Long Will Big U.S. Banks Continue to Lead the World?

Telis Demos, The Wall Street Journal

The trade war threatens the global dominance and growth of America’s megabanks

The trade war threatens the global dominance and growth of America’s megabanks

America is the China of banking.

While the U.S. may import more manufactured goods than it exports, it runs a large trade surplus in one notable business: financial services. The overall U.S. trade surplus for financial services in 2024 was about $130 billion, according to data from the U.S. Bureau of Economic Analysis.

Some of that reflects quirks of global money flows, like U.S. firms managing offshore funds. But it also includes things such as trading commissions, underwriting and mergers-and-acquisitions advice. Categories including those services collectively represented a nearly $10 billion surplus last year.

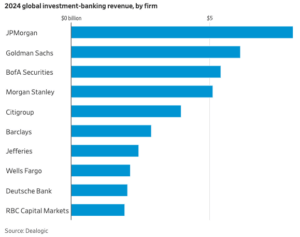

This plays out in practice in global league tables for advising on deals and fundraising. The rankings have tilted sharply toward American banks in the period since the 2008 financial crisis. Last year, U.S. banks occupied the top five spots for investment-banking revenue worldwide, and were seven of the top 10, according to Dealogic.

So when it comes to a global trade war, U.S. megabanks could become collateral damage. Many of Europe’s champions retrenched over the past 15 years, while Chinese and Asian powerhouses have limited heft beyond their region. A long-lasting trade war could begin to change the playing field. Read more

Credit Union Regulator Sheds Over 200 Employees in Buyout Offers

Evan Weinberger, Bloomberg Law

- NCUA sought 18% workforce cut through voluntary departures

- Agency roiled by Trump’s firing of Democratic board members

Around 220 employees at a federal regulator overseeing credit unions accepted voluntary resignation offers as the Trump administration continues its push to slash the federal workforce.

Around 220 employees at a federal regulator overseeing credit unions accepted voluntary resignation offers as the Trump administration continues its push to slash the federal workforce.

The employees had applied for the administration’s deferred resignation program or a voluntary separation incentive payment as of Wednesday, according to multiple people familiar with the matter who requested anonymity to avoid potential retaliation. The agency had been seeking 217 voluntary resignations, or 18% of its approximately 1,200-person workforce, according to documents obtained by Bloomberg Law. The NCUA didn’t immediately respond to a request for comment.

The cuts came after Elon Musk’s Department of Government Efficiency arrived at the regulator’s offices earlier this month. President Donald Trump last week fired two Democratic board members, former Chairman Todd Harper and Tanya Otsuka, adding to the state of uncertainty at the agency.

Other federal financial regulators, including the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency, are also offering voluntary resignation programs to cull their workforces.

‘Mission Critical’

The NCUA board can deny early resignation applications from employees it deems to be “mission critical.” But with only NCUA Chairman Kyle Hauptman on the board following the firings of Harper and Otsuka, it’s unclear whether the agency’s leadership would have a quorum to make such decisions.

Employees whose voluntary resignation requests are denied can be paid at a time-and-a-half rate while they continue to work at the NCUA, a source familiar with the agency’s programs said. The Trump administration began offering deferred resignations soon after the president took office in January. The program allows participating federal workers to be put on administrative leave and paid through September. Read more

- Related reading: FDIC Aims to Reduce Workforce by 1,250

Fed Regulation, Supervision Take Backseat in Independence Fight

Kyle Campbell, American Banker

Federal Reserve officials are battling to maintain their political independence on monetary policy, but the same cannot be said for their regulatory and supervisory authorities.

Federal Reserve officials are battling to maintain their political independence on monetary policy, but the same cannot be said for their regulatory and supervisory authorities.

Instead, central bank officials have downplayed their ability to set their own banking oversight policies rather than boisterously defend it from the Trump administration’s efforts to bring it under more direct executive control.

Some policy analysts and observers see the Fed’s disparate treatment of its authorities as a pragmatic choice. Facing pressure on multiple fronts, Karen Petrou, managing partner at Federal Financial Analytics, said the Fed was wise to bolster its monetary independence — and fortunate to have had it explicitly exempted from the Trump administration’s overtures.

“The Fed is lucky to have maintained the Trump administration’s agreement to its monetary policy independence in the executive order the president issued on that point,” Petrou said, referring to a February action making independent agencies more accountable to the White House. “That was not a foregone conclusion.”

Petrou added that the legislative history and the academic literature that establish and justify the Fed’s monetary independence do not clearly apply to its regulatory and supervisory functions. Read more

Apr. 18, 2025: Industry & Regulation

- CFPB’s Vought Wants to Strip Away ‘Guidance’ En Masse

- Related Reading: CFPB Shifts Enforcement to States, Stops Nonbank Oversight

- Filene Research Files: Evaluating the Single Financial Services Regulator Question (2009)

- Federal Reserve Prepared to Intervene in Financial Markets if Liquidity Issues Arise, Says Boston Fed President

- Judge Scraps US Rule Capping Credit Card Late Fees at $8

CFPB’s Vought Wants to Strip Away ‘Guidance’ En Masse

Dan Ennis, Banking Dive

The bureau’s acting director said the Biden administration used guidance as a substitute for formal regulation and gave eight CFPB offices two weeks to save any previous guidance they deem necessary.

The bureau’s acting director said the Biden administration used guidance as a substitute for formal regulation and gave eight CFPB offices two weeks to save any previous guidance they deem necessary.

Consumer Financial Protection Bureau Acting Director Russ Vought wants to take “guidance” down a peg.

In a memo Friday, Vought ordered the heads of eight offices within the bureau, including enforcement and supervision, to review by April 25 any guidance documents the agency has issued, with the aim of rooting out instances when guidance was used as a substitute for the more formal regulation process.

“The use of guidance to regulate is unlawful and deprives the public of fair notice of what conduct is prohibited,” Vought wrote in the memo seen by Fox Business and American Banker. “The Bureau will no longer engage in this practice. Effective immediately, Bureau components may not issue guidance documents that purport to create rights or obligations binding on persons or entities outside the Bureau.”

Vought laid out several parameters into which CFPB guidance should fit, including that guidance should state in a disclaimer that it is not legally binding. Guidance, he said, should refer to recommended practices, and the bureau should make clear that noncompliance limited to the guidance itself, will not trigger any enforcement action. Read more

-

Related Reading: CFPB Shifts Enforcement to States, Stops Nonbank Oversight

Filene Research Files: Evaluating the Single Financial Services Regulator Question (2009)

George Hofheimer, Filene

The current U.S. financial services regulatory environment is going through changes. This report explores those changes and the implications for credit unions.

The current U.S. financial services regulatory environment is going through changes. This report explores those changes and the implications for credit unions.

Executive Summary

Today, it is commonplace to hear policymakers, industry participants and analysts speak about how our financial services regulatory system has failed us. Recent events have underscored this sentiment with unprecedented actions by the NCUA and the U.S. Treasury. To ensure you are informed about the issues and decisions ahead of us, this report explores the much anticipated reregulation of the financial services sector in the United States.

The fact that major changes to our current financial regulatory system are coming raises at least three questions for credit unions:

- What major changes are likely to occur?

- How will these changes affect credit unions?

- What should credit unions do to prepare for these changes or to become involved in the policymaking process that leads to these changes?

What is the research about?

This report explores the forthcoming reregulation of the financial services sector in the United States with a special focus on the impact a single financial services regulator may have on the credit union system. This specific topic is examined because a variety of political, economic, and social trends foreshadow its creation, and credit unions stand against the creation of such an entity. The analysis is based on an extensive and independent review of existing academic and policy research on this topic. Read more

Federal Reserve Prepared to Intervene in Financial Markets if Liquidity Issues Arise, Says Boston Fed President

Ayesha Aziz, Coin Market Cap/Yahoo Finance

The U.S. Federal Reserve, represented by Boston Fed President Susan Collins, has stated it is prepared to intervene in financial markets if necessary, but only if liquidity issues arise or market conditions become disorderly.

The U.S. Federal Reserve, represented by Boston Fed President Susan Collins, has stated it is prepared to intervene in financial markets if necessary, but only if liquidity issues arise or market conditions become disorderly.

Despite concerns raised by recent market volatility, particularly following President Trump’s tariff announcements, Collins emphasized that current liquidity conditions remain stable. However, she made it clear that the central bank has tools at its disposal to address any market disruptions.

Collins noted that the Fed had previously acted quickly to stabilize markets, such as during the 2020 COVID-19 crisis, and would do so again if required. Although she acknowledged the broader market challenges, including rising yields in U.S. Treasuries, she underscored that there are no immediate liquidity concerns at this time. The Fed has maintained its position of monitoring the situation and has emphasized that its policy tools are flexible and varied, not limited to interest rate changes.

The yield on the 10-year U.S. Treasury has surged to 4.5%, marking a significant shift in the bond market. This movement, along with the uncertainty created by Trump’s tariff policy, has fueled concerns about potential instability in the $29 trillion Treasury market. As volatility continues, some market experts are speculating about a potential liquidity crunch, particularly in hedge funds that may be unwinding risky positions. Read more

Judge Scraps US Rule Capping Credit Card Late Fees at $8

Jonathan Stempel, Reuters

A federal judge on Tuesday threw out a U.S. Consumer Financial Protection Bureau rule capping credit card late fees at $8, after the agency agreed with opponents that the rule adopted during President Joe Biden’s administration was illegal.

A federal judge on Tuesday threw out a U.S. Consumer Financial Protection Bureau rule capping credit card late fees at $8, after the agency agreed with opponents that the rule adopted during President Joe Biden’s administration was illegal.

U.S. District Judge Mark Pittman in Fort Worth, Texas granted a joint request by the CFPB and a coalition of six business and banking groups including the U.S. Chamber of Commerce and American Bankers Association to scrap the rule.

Pittman, an appointee of President Donald Trump, agreed with both sides that the rule violated the Credit Card Accountability and Disclosure Act of 2009 because it prohibited card issuers from charging fees “reasonable and proportional to violations.”

The rule capped late fees for issuers with more than 1 million open accounts unless they could prove higher fees were necessary to cover their costs. It had been part of Biden’s crackdown on “junk fees,” and was intended to reduce the typical late fee from about $32. The Trump administration is reversing many Biden-era rules and policies that it considers unfriendly to business.

In a March 2024 lawsuit against the rule, the business and banking groups accused the CFPB of overstepping its authority and ignoring Congress’ intent that fees be high enough to deter late payments and compensate card issuers for their costs. Read more

Apr. 11, 2025: Industry & Regulation

- Big Banks Quietly Prepare for Catastrophic Warming

- House Strikes Down $5 Overdraft Fee Limit, Sending Issue to Trump

- Banks Don’t Pay Tariffs, but Tariffs Will Cost Them

- Why Does Everyone Want to Be a Bank Now?

Big Banks Quietly Prepare for Catastrophic Warming

By Corbin Hiar & E&E News, Scientific American

Morgan Stanley, JPMorgan, and an international banking group have quietly concluded that climate change will likely exceed the Paris Agreement’s 2 degree C goal and are examining how to maintain profits.

Morgan Stanley, JPMorgan, and an international banking group have quietly concluded that climate change will likely exceed the Paris Agreement’s 2 degree C goal and are examining how to maintain profits.

Top Wall Street institutions are preparing for a severe future of global warming that blows past the temperature limits agreed to by more than 190 nations a decade ago, industry documents show.

The big banks’ acknowledgment that the world is likely to fail at preventing warming of more than 2 degrees Celsius above preindustrial levels is spelled out in obscure reports for clients, investors and trade association members. Most were published after the reelection of President Donald Trump, who is seeking to repeal federal policies that support clean energy while turbocharging the production of oil, gas and coal — the main sources of global warming.

The recent reports — from Morgan Stanley, JPMorgan Chase and the Institute of International Finance — show that Wall Street has determined the temperature goal is effectively dead and describe how top financial institutions plan to continue operating profitably as temperatures and damages soar. “We now expect a 3°C world,” Morgan Stanley analysts wrote earlier this month, citing “recent setbacks to global decarbonization efforts.”

The stunning conclusion indicates that the bank believes the planet is hurtling toward a future in which severe droughts and harvest failures become widespread, sea-level rise is measured in feet rather than inches and tropical regions experience episodes of extreme heat and humidity for weeks at a time that would bring deadly risks to people who work outdoors.

The global Paris Agreement, from which the U.S. is withdrawing under Trump, aims to limit average temperature increases to well below 2 degrees Celsius. Scientists have warned that permanently exceeding 1.5 degrees — a threshold the world breached for the first time last year — could lead to increasingly severe climate impacts, such as the demise of coral reef ecosystems that hundreds of millions of people rely on for food and storm surge protection. Read more

House Strikes Down $5 Overdraft Fee Limit, Sending Issue to Trump

Stacy Cowley, New York Times

Lawmakers also struck down a rule giving the Consumer Financial Protection Bureau supervisory power over tech companies’ payments apps.