(Dec. 17, 2021) NASCUS’ Ito acknowledged the agency’s efforts. “We commend the board for its thoughtful and unprecedented consideration of stakeholder feedback in finalizing the agency’s 2022 budget. On behalf of state credit union regulators and credit unions, NASCUS appreciates the downward adjustment of the 2022 proposed overhead transfer rate from 63.4% to 62.7%,” she said.

However, she asserted that the state system remains concerned about the underlying structural issues that dictate the calculation of the OTR and the federal credit union operating fee (see item below).

Finally, Ito said the state system also values the NCUA Board and staff commitment to providing more detailed explanations of new staff positions as well as clarifications in the budget justification related to state examiner equipment expenses and the payment of supervisory fees by state credit unions to their respective state regulators. “NASCUS and the state system look forward to continued open dialogue with our NCUA partners on how, together, we can assure both the safety and soundness of credit unions and the ongoing vitality of the dual charter credit union framework,” she said.

(Dec. 10, 2021) Every dollar transferred from the federal credit union savings insurance fund to fund NCUA expenses is one dollar not available to cover losses in the system and subsequently a dollar that may need to be replenished in the NCUSIF by the charging of a premium, NASCUS President and CEO Lucy Ito told the agency this week.

And that’s why it is so important for both state and federally chartered credit unions to understand and closely monitor how the agency moves money from the insurance fund and into its operating budget via the overhead transfer rate (OTR), Ito said.

Acknowledging that any discussion of the OTR is lackluster (she said, at worst, such dialog can leave stakeholders “bleary-eyed” or lull credit unions into a “deep, deep coma”), credit unions need to know and comprehend: every National Credit Union Share Insurance Fund (NCUSIF) dollar that NCUA uses to cover its expenses is one dollar less in the NCUSIF’s equity level. “This is the fundamental reason why both state and federal credit unions should take serious interest in the OTR,” she asserted.

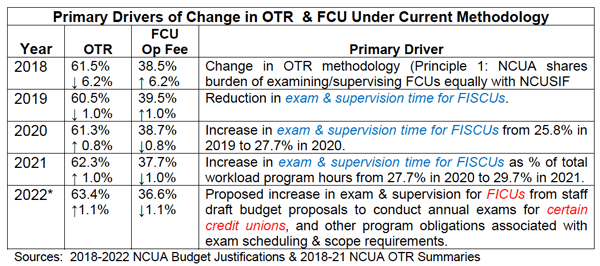

Ito made the comments this week during a public briefing and comment opportunity about the NCUA 2022 budget. The agency has proposed a 63.4% OTR for 2022, meaning that nearly two-thirds of the 2022 operating budget will be paid out of the share insurance fund (the remainder comes from federal credit union (FCU) operating fees). The operating spending plan – at $326 million — makes up 94.4% of the overall NCUA budget.

The 2022 OTR will be 110 basis points higher than the previous year’s and will be the third straight year that an increased transfer has been proposed by the agency (at 61.3% in 2020, 62.3% in 2021, and the proposed 63.4% for 2022).

Aside from taking funds from the insurance fund that could cover credit union losses, Ito said, there are two other reasons credit unions should monitor the OTR. First, NCUA’s use of NCUSIF dollars versus use of FCU operating fees to cover its expenses has the potential to imbalance the dual chartering system by disadvantaging the state system. “This is a threat to both state and federal credit unions,” she said, “because the dual charter framework is the credit union system’s most dynamic source of innovation and charter modernization.”

The third reason, she said, is the equity level of the insurance fund and the NCUA Board’s thought of raising the normal operating level (NOL) of the fund in anticipation of economic uncertainties related to the ongoing COVID-19 event. “Given the NCUA Board’s deliberations on changing the NOL to bolster NCUSIF equity, it behooves credit unions to monitor more than OTR as a mere formula used to transfer funds from the NCUSIF,” she said. “Credit unions should also be interested in what additional costs NCUA is now covering with NCUSIF dollars.”

Ito said her comments were made in the “pure spirit of state-federal regulator collaboration and in support of our shared objectives to foster a safe and sound and vibrant dual charter system that protects member-consumer best interests.”

In a nod to her impending retirement at year’s end, she thanked the board members for their “collegiality and commitment to forging a robust federal credit union system and a robust state credit union system” with state regulatory agencies during her seven-year run as NASCUS leader.

LINK:

President and CEO Lucy Ito Testifies on OTR During the 2022 NCUA Budget Briefing

(Dec. 3, 2021) The latest state supervsor to earn reaccreditation from NASCUS is the Texas Credit Union Department, following the series of in-depth reviews and assessments by a panel of veteran state supervisors.

Both Texas Commissioner John J. Kolhoff and NASCUS President and CEO Lucy Ito noted the significance of the certification.

“Reaccreditation demonstrates the value we as examiners and an agency provide to the industry and its members,” said Kolhoff, who also serves as secretary/treasurer of the NASCUS Regulator Board “Our credit union examination department ensures compliance with our laws while following best practices to meet the highest national standards in our supervision of more than $54 billion in assets across 175 credit unions. I am proud of our team for receiving the NASCUS Reaccreditation.”

Ito noted that accreditation is express evidence of an agency’s capabilities, which benefits all credit unions in the state. “This program recognizes the professionalism of a state agency’s regulators, supervisors, and staff while potentially delivering support for state law modernization and policy changes to advance state supervisory processes and best practices,” she said.

To earn the certification, a state supervisory agency must demonstrate it meets accreditation standards in agency administration and finance, personnel and training, examination, supervision, and legislative powers.

NASCUS began developing the program in 1989; it is modeled on the university accreditation concept by applying national performance standards to a state’s credit union regulatory program.

LINK:

(Nov. 24, 2021) The state system is seeking to provide its views of the proposed NCUA 2022 budget at the agency’s public briefing in two weeks, particularly the proposed increased in the overhead transfer rate (OTR) – for the third straight year — in the spending plan.

If approved, NASCUS President and CEO Lucy Ito will provide the state system’s perspective at the briefing, scheduled for Dec. 8 at 2 p.m. (and to be live-streamed via the Internet).

The overhead transfer rate (OTR) provides a portion of the funding for NCUA’s “operating budget” of $326 million (which makes up 94.4% of the overall agency budget). For 2022, the OTR will be set at 63.4%, according to the budget papers posted by NCUA. The transfer means that nearly two-thirds of the 2022 operating budget ($206.7 million) will be paid out of the share insurance fund. The remainder of the operating budget comes from “operating fees” paid by federal credit unions.

The OTR represents money that is transferred from NCUSIF to the operating budget of the agency to cover “insurance-related” expenses of the agency. The remainder of the operating budget is covered by the operating fee paid by federal credit unions.

NASCUS President and CEO Lucy Ito pointed out that the proposed 2022 OTR will be the third straight year that an increased transfer rate has been proposed by the agency (at 61.3% in 2020, 62.3% in 2021, and the proposed 63.4% for 2022). She also noted that the number of federally insured, state-chartered credit unions has been declining. At year-end 2019, there were (according to NCUA quarterly call report data) 1,953 FISCUs. By the end of the next year (2020), the number had fallen to 1,914. At mid-year 2021, total FISCUs were 1,886.

Federal credit union (FCU) numbers are also in decline, she noted – but there are still many more of those charters than FISCUs: 3,383 at year-end 2019, 3,185 at year-end 2020, and 3,143 at mid-year 2021.

LINK:

NCUA Posts 2022-2023 Proposed Budget, Sets Dec. 8 Public Briefing

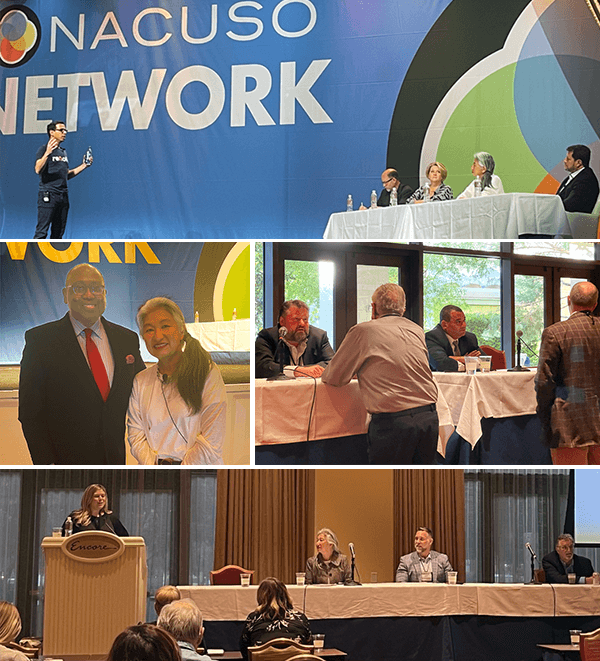

(Clockwise from top) NASCUS’s Lucy Ito (second from right) joins other judges in the “Next Big Idea” competition in listening to a presenter’s big idea. Other judges are (from left) Bill Beardsley, president of Michigan Business Connection; Becky Reed, CEO, Lone Star Credit Union; Steve Salzer, SVP enterprise risk office and general counsel at PSCU … NASCUS’s John Kolhoff (left) and Brian Knight answer questions from session participants following their presentation … Liz Winninger, President & CEO of Xtend, moderates a panel discussing “Think tanks: Why credit unions need more of them” with Ito; Chris Harper, senior director of membership at Filene; and Vic Pantea of Variable Ventures. NCUA Board Member Rodney Hood and NASCUS’s Ito take time out at the conference.

(Nov. 12, 2021) NASCUS was a prominent participant in national conference for CUSOs held this week in Las Vegas, Nev., taking roles in conferences, breakout sessions and the annual “next big idea” competition for innovative ideas that benefit service organization offerings to credit unions.

The 2021 NACUSO Network Conference, held throughout the week, looked at a variety of subjects of interest to the state credit union system. Among the NASCUS’s participation was:

- A session on credit union share insurance and how CUSOs can create more options for credit unions featured NASCUS Regulator Board Secretary/Treasurer John Kolhoff (commissioner of the Texas Credit Union Department) and association Executive Vice President and General Counsel Brian Knight. Among other things, Knight and Kolhoff discussed the importance of the strength of the dual chartering system. Knight made note of the Dual Charter Resource Initiative (DCRI), a partnership between NASCUS and credit union system organizations designed to update existing resources, and produce new ones, that support strengthening of the state charter. The pair also discussed how NASCUS is working with NACUSO and CU*Answers in support of the “CUSO Challenge,” a five-part program aimed at supporting CUSOs. Among other things, the initiative is working to facilitate de novo credit unions, enhance CUSO effectiveness in regulatory and legislative representation, study alternatives to deposit insurance, develop a scholarship fund, and gather ideas for CUSO development.

- NASCUS President and CEO Lucy Ito served as one of the judges to select the winner for the 2021 “Next Big Idea” competition, sponsored annually by NACUSO to identify innovative idea for credit union service organizations. The winner selected by the audience and the panel was RenoFi, a firm that offers home renovation loans that provide financing for up to 90% of the after-renovation value of the property. Noting that RenoFi will present its innovation at the NASCUS 2022 State System Summit (S3) next summer, Ito congratulated the winner. “Consumers have many loan options from their credit unions for other life events, but this innovation fills a long-time need. Thanks also to NACUSO for bringing this innovation – and those of the other four finalists – to the state system’s attention.”

LINKS:

(Clockwise from top left) Moderator George Hofheimer (Hofheimer Strategy Advisors), left, NASCUS President and CEO Lucy Ito and NASCUS EVP and General Counsel Brian Knight take in the Exchange discussion; Mike Williams, CEO of Colorado CU and chairman of the NASCUS Credit Union Advisory Council, enjoys the discourse; Participants are both face-to-face in Phoenix, and by virtual means.

(Nov. 5, 2021) Payment preferences, “buy-now-pay-later,” field of membership (FOM) barriers and more were all on the table at the meeting of CEOs of very large credit unions with state regulators held this week in Phoenix, sponsored by NASCUS.

The discussion was held at the two-day 2021 Exchange, an invitation-only event for regulators and leaders from credit unions with more than $10 billion in assets. The event is sponsored by NASCUS through the Dual Charter Resource Initiative (DCRI). The DCRI is a partnership, fostered by NASCUS, between the state system and key organizations within the credit union system at large. The program is committed to strengthening the state credit union charter by pursuing progressive legislation and regulation, building relationships to foster charter innovation, guarding against unnecessary federal pre-emption and expanding awareness of options available to state-chartered credit unions

Among the topics discussed by the participants were:

- Consumer behaviors with payment alternatives Venmo and PayPal and the growing tendency for Millennials and Gen Z to use their primary financial institutions as “paycheck motels” before transferring funds to a third-party payment app.

- Exploring alternative short-term loan options through “buy-now-pay-later” arrangements through payment alternatives that break payments into small installments to thwart high-interest short-term lending.

- Growing social acceptability of crypto currency as a primary payment method (particularly in Miami, Fla.) and associated risks.

- FOM barriers with digital banking and disruptions to traditional banking models.

Credit union CEOs participating included: Benson Porter, Boeing Employees’ Credit Union (BECU); Mike Ryan, Boeing Employees’ Credit Union (BECU); Mike Williams, Colorado Credit Union (and NASCUS Credit Union Advisory Council chairman); Mary McDuffie, Navy Federal Credit Union; Emily Troncoso, Navy Federal Credit Union; Bill Cheney, SchoolsFirst FCU; Gary Rodrigues, Star One Credit Union; and Brian Wolfburg, Vystar Credit Union.

State regulators participating were: Joni Kimbrell, California Department of Business Oversight; Ben Brinkley, Florida Office of Financial Regulation; Steve Pleger, Georgia Department of Banking & Finance (and NASCUS Regulator board member); Francisco Menchaca, Illinois Department of Financial & Professional Regulation; Charles Vice, Kentucky Department of Financial Institutions (and NASCUS Regulator board member); Melanie Hall, Montana Department of Administration; and Rose Conner, North Carolina Credit Union Division, (and NASCUS Regulator Board Chairman).

Participants in a first day’s panel at the NCUA DEI Summit this week were (from left) NASCUS’ Lucy Ito, CUNA’s Jim Nussle, and NAFCU’s B. Dan Berger.

(Nov. 5, 2021) NASCUS President and CEO Lucy Ito played a central role in week’s Diversity, Equity and Inclusion (DEI) Summit presented by NCUA, appearing on two panels at the three-day, virtual conference held Tuesday through Thursday.

The conference focus, according to NCUA, was on advancing DEI in the credit union system by sharing best practices, addressing challenges to advancing DEI and learning about how NCUA can support the industry in its efforts.

Ito shared the first panel with CEOs of other Washington groups representing credit unions, Jim Nussle of the Credit Union Natl. Assn. (CUNA), and B. Dan Berger of the Natl. Assn. of Federally Insured Credit Unions (NAFCU). The group discussed the credit union role in the DEI journey. The second panel featuring Ito discussed “How to Increase Gender Diversity in the C-Suite,” and included CEOs from credit unions: Mary McDuffie (Navy Federal CU president and CEO), Shruti Miyashiro (Orange County’s CU CEO), and Tracey Jackson (ResourceOne CU CFO).

In both sessions, Ito discussed the impact of DEI on herself and on the credit union system, and efforts by NASCUS and the state system at large to advance DEI along the lines of the conference’s goals.

“My thanks to NCUA, particularly Chairman Harper, Vice Chairman Hauptman and Board Member Hood, for inviting me to participate in this event – and for their personal commitments to this vital effort for the credit union industry at large,” Ito said.

(Oct. 22, 2021) NASCUS President and CEO Lucy Ito congratulated the NCUA Board for finalizing an “S” component (for market sensitivity) to the CAMEL rating system (making it now “CAMELS”) at its Thursday meeting (and adjusting the “L” component, accordingly, for liquidity). She also thanked Board Member Hood for responding to NASCUS’ recommendation to introduce the change, which he did early this year – something NASCUS has advocated for years.

“To date, 25 states have implemented CAMELS and two additional states are scheduled to do so by Jan. 1,” Ito said. “Without exception, all states that have already adopted CAMELS report a very smooth and seamless transition for credit unions including smaller asset sizes as all credit unions are already monitoring market risk under the L component. Indeed, under CAMEL, credit unions can be ‘dinged’ unfairly. If their liquidity and sensitivity to market risk are rated differently, the lower rating will prevail for the L component. The addition of the ‘S’ component will not only be fairer, it will also position both credit unions and examiners to more effectively monitor and evaluate interest rate risk as the U.S. enters an uncertain interest rate environment.”

(Oct. 22, 2021) In yet another split decision over the issue, a final rule giving CUSOs the power to originate any type of loan an FCU may originate – and give the NCUA Board more flexibility in approving permissible CUSO activities and services – was approved by the board at its meeting Thursday.

The rule will become effective 30 days after publication in the Federal Register.

On a 2-1 vote (with Chairman Todd Harper dissenting), the board finalized the rule that – from the start – has been contentious. In January, when the proposal was issued, the board voted 2-1 in favor of issuing it for comment. In September, the board voted 2-1 to bring the final rule up for consideration. Harper dissented on all three.

NCUA said that it made no substantive changes from the proposal in finalizing the rule. The agency said the final rule is intended to accomplish two things: expand the list of permissible activities and services for CUSOs to include the origination of any type of loan that an FCU may originate; and grant the NCUA Board additional flexibility to approve permissible activities and services.

By allowing CUSOs to originate any type of loan an FCU can, the list of permissible loans by CUSOs is expanded from only business loans, consumer mortgage loans, student loans, and credit cards. The list of new loans includes automobile and small-dollar (payday) loans – the two types NCUA has said would likely draw the newest involvement by CUSOs.

Harper scorned the rule, saying (as he has in the past) that its adoption will result in a “wild west” among credit unions of affording “little accountability for consumer protection.” Board Member Rodney Hood, in his comments, disregarded Harper’s concerns, asserting that CUSOs are already largely regulated under state laws. He also told the board that the new rule doesn’t go far enough: it should allow, he said, CUSOs to invest directly into financial technology companies (fintechs) without requiring the fintechs to become CUSOs. Hood said he intended to work toward that end, and other expansions of the rule, in the remaining tenure of his term.

Vice Chairman Kyle Hauptman, in his comments, suggested that the rule could be tweaked in the future, to address any emerging issues or developments.

However, both Hood and Harper stated their continued support for giving NCUA exam authority over third-party vendors to credit unions.

In its comment filed on the proposal in late April, NASCUS noted as a key concern with the proposal that possible, additional reporting requirements for state credit unions could be a result of a finalized rule. NASCUS noted that the proposal could influence state credit unions considering collaborating with FCU investors in the formation and ownership of a CUSO – a condition that prompted the association to comment.

In some states, NASCUS pointed out, CUSOs owned by state credit unions already hold expanded lending power. The association noted, however, that the NCUA proposal could end up requiring additional reporting requirements that don’t today exist for SCUs. “NASCUS opposes extension of any additional reporting requirements to SCU CUSOs resulting from an expansion of FCU powers,” the association wrote.

NCUA, however, in its commentary on the final rule, rejected that view saying that it “does not believe the effect of this rule on CUSOs in which only FISCUs have an ownership interest represents a policy change” from existing NCUA reporting requirements.

Following the meeting, NASCUS’ Ito reiterated the point the association made in its comment letter last spring that CUSOs owned by state credit unions already hold expanded lending powers with benefits accruing to members and participating credit unions alike, without raising safety and soundness nor consumer protection concerns. She said NASCUS views the final rule as a “natural evolution“ in a robust dual charter system.

“However, we note that, as finalized, the CUSO rule includes additional reporting requirements which could impact state-chartered credit unions in considering whether to collaborate with FCU investors in the formation and ownership of a CUSO. An additional concern is whether the rule adds new reporting requirements to state credit union CUSOs, because of expanding FCU CUSO powers. Is there something wrong with this picture? NASCUS will review the final rule closely and look forward to working with NCUA to resolve any unintended, negative impacts on state credit union CUSOs.”

LINKS:

Final Rule, Part 712, Credit Union Service Organizations

NASCUS comment: Proposed Rule, Credit Union Service Organizations (CUSOs) – RIN 3133–AE95

(Oct. 8, 2021) NASCUS President and CEO Lucy Ito was named this week a winner of the 33rd Annual Herb Wegner Memorial Awards, widely considered the most prestigious honor in the credit union system, for her efforts to make financial freedom achievable to all through credit unions through four decades of work.

Ito, who has announced her retirement as NASCUS leader by year’s end, was named a winner of the outstanding individual achievement award. She will receive recognition at the annual Wegner Awards dinner in February, sponsored by the National Credit Union Foundation (NCUF) and held during the Credit Union National Association’s (CUNA) annual Governmental Affairs Conference (GAC) in Washington, D.C.

“I am incredibly humbled to receive this prestigious and unexpected recognition,” Ito said. “It takes so many people for any organization to be successful. At NASCUS, our ‘secret sauce’ is our tireless staff combined with our Regulator Board of Directors, Credit Union Advisory Council, and our membership of both state agencies and credit union industry stakeholders. Together, we are more and better. I am deeply grateful to the nominators and the Herb Wegner Awards Selection Committee for recognizing the work of NASCUS, the California and Nevada Leagues, and the World Council of Credit Unions.”

(Before joining NASCUS in 2014, Ito worked for the California and Nevada Credit Union Leagues and the World Council of Credit Unions. Including her tenure at NASCUS, her career has spanned 30-plus years.)

Ito is one of two recipients of the outstanding individual achievement award, the other being Roger Heacock, retired president and CEO of Black Hills FCU in Rapid City, S.D.

Additionally, the African American Credit Union Association (AACUC) will receive the NCUF’s Anchor Award, while the Faith Based Credit Union Alliance will be honored with the outstanding organization award.

All of the awards will be presented during the NCUF’s annual dinner set for Feb. 28 at the Marriott Marquis Hotel in Washington, D.C. The event is held in conjunction with CUNA’s annual GAC, the largest yearly gathering of credit union advocates.

The awards are named in honor of the late CUNA CEO Herb Wegner, memorializing his dedication, ideas and actions to revolutionize the ways that credit unions serve their communities.

Ito announced her retirement plan last spring. NASCUS leadership is now working to name a replacement for her by year’s end.

LINK:

(Oct. 1, 2021) Rohit Chopra is now the permanent director of the CFPB, with a five-year term, thanks to a 50-48 vote by the Senate on Thursday. He took a big step toward that vote earlier in the day when the Senate voted 51-50 – with Vice President Kamala Harris casting the tie-breaking vote – to cut off debate and proceed to the final vote on confirmation. Chopra replaces acting director Dave Uejio – who himself has been nominated to be assistant secretary for fair housing and equal opportunity at the Department of Housing and Urban Development (HUD) … NASCUS President and CEO Lucy Ito will be on the panel discussing “How to Increase Gender Diversity in the C-Suite” Nov. 3 (at 2:15 p.m.) as part of NCUA’s Nov. 2-4 Diversity, Equity and Inclusion (DEI) Summit. The panel – made up of all female credit union executives – will discuss successes and setbacks on their paths to leadership, according to NCUA. They will also discuss how to increase gender diversity in the upper ranks of financial institutions. Other panelists include CEOs of NASCUS-members Orange County’s CU and Navy Federal CU – Shruti Miyashiro and Mary McDuffie, respectively.

LINK:

(Oct. 1, 2021) Noting Harper’s comments about changes to the NCUA Board, NASCUS President and CEO said mandating that at least one board member have state credit union regulatory experience should be part of the conversation. “A board member who has served as a state credit union regulator would ensure that the state perspective is considered in the board’s deliberations, establishing diversity of voices and better fostering a robust dual charter system,” she said. “State-chartered credit unions now represent more than 50% of all credit union assets nationwide. Most state-chartered credit unions are federally insured. Without at least one board member with state credit union regulatory experience, NCUA has on occasion been prone to a federal credit union bias as the chartering body for federal credit unions.”

On third-party vendor authority, Ito reiterated NASCUS’ support for it, as long as NCUA relies on state exams for technology services providers where the authority exists. Further, she said, NASCUS supports efforts to strengthen state regulatory exam and supervision of third parties providing services to state-chartered credit unions.