(Nov. 20, 2020) After some fits and starts over the last 12 months, there are signs that marijuana banking legislation in the Senate may receive at least a hearing, and perhaps even go further than that.

Late last week, Sen. Pat Toomey (R-Pa.) and expected to be elected the chairman of the Senate Banking Committee when the new Congress organizes early next year (assuming the Republicans keep the majority) voiced his interest in seeing legislation move forward.

“I am sympathetic to the idea that people who are involved in [the] cannabis industry — in an entirely legal fashion… ought to be able to have ordinary banking services,” he told reporters. He admitted that there are many details to work out, but he voiced some optimism for doing so.

In late 2019, current Banking Committee Chairman Mike Crapo (R-Idaho) – in the wake of House passage of legislation giving legal cannabis-related businesses access to financial institution services, among other things – held hearings on marijuana banking legislation. However, later in the year, Crapo said he would not support the legislation, citing concerns over the impact of the availability of marijuana on children and drug cartel use of banks.

NASCUS has consistently supported legislation that addresses the conflict between federal and state law on the provision of products and services for legitimate marijuana enterprises. The association supported the House’s Secure and Fair Enforcement (SAFE) Banking Act (H.R. 1595), which passed last year on a 321-103 bipartisan vote.

The bill – likely to be re-introduced in the next Congress, and a model for Senate action – would prohibit penalizing or discouraging a credit union or bank from providing financial services to a cannabis-related legitimate business or to a state (and its political subdivisions or Indian Tribe) that exercises jurisdiction over cannabis-related legitimate businesses.

(Nov. 20, 2020) NASCUS President and CEO Lucy Ito shared the board members’ call for vigilance, but also urged the agency to husband its resources, as NASCUS did in a comment letter last month. Writing to the agency on its proposed methodology to calculate the overhead transfer rate (OTR) – the rate at which the agency transfers dollars from the insurance fund to the agency’s operating budget to cover “insurance-related costs” – NASCUS wrote that a higher rate means the insurance fund has less resources to face financial troubles for credit unions.

“As we wrote earlier this month, every dollar the agency pulls from the insurance fund to cover the expenses of the agency is a dollar not available to cover credit union losses, such as those resulting from the financial impact of the coronavirus pandemic,” Ito said. “It also means that’s a dollar that may need to be replaced in the insurance fund through an insurance premium being charged.”

LINK:

NASCUS Comment: Request for Comment, OTR and Operating Fee Schedule Methodologies

(Nov. 20, 2020) NCUA joined the federal banking agencies Thursday in releasing a fact sheet meant to clarify Bank Secrecy Act due diligence requirements for credit unions and banks that offer services to charities and non-profits. The fact sheet, the agencies said in a release, highlights the importance of legitimate charities and nonprofit organizations having access to financial services. It also addresses the ability of those groups to transmit funds through legitimate and transparent channels, especially in the context of responding to the coronavirus. Further, the agencies said, the fact sheet clarifies that charities and nonprofit organizations as a whole do not present a “uniform or unacceptably high risk of being used or exploited for money laundering, terrorist financing, or sanctions violations, and that banks and credit unions must develop risk profiles that are appropriate for the risks presented by each customer” … With the Thanksgiving holiday coming up next week, look for NASCUS Report to be published on Wednesday, rather than Friday as per usual.

LINK:

Agencies release fact sheet clarifying BSA requirements with charities, non-profits

(Nov. 20, 2020) The threshold for exempting loans from special appraisal requirements applied to higher-priced mortgage loans under the Truth in Lending Act will remain at $27,200 in 2021, unchanged from this year’s threshold, according to an announcement this week by the CFPB and federal banking agencies.

The agencies said the threshold, effective Jan. 1, is based on the annual percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as of June 1, 2020. The higher-priced loan rules were added to the Truth in Lending Act (TILA) by the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank). The act added special appraisal requirements for higher-priced mortgage loans, including a requirement that creditors obtain a written appraisal based on a physical visit to the home’s interior before making a higher-priced mortgage loan.

NASCUS posts all actions of the CFPB affecting the state credit union system on its “Latest CFPB updates” page of the NASCUS website.

LINK:

NASCUS ‘Latest CFPB updates’

(Nov. 20, 2020) Prohibiting the authorization of additional advances to finance unpaid interest may be overly burdensome, the NCUA Board has reasoned, and it wants to remove that ban with a proposed rule it issued unanimously Thursday.

The proposal, staff told the board, emerged from the financial impact of the coronavirus crisis as members struggled to stay current on their mortgage and other loans.

Removing the prohibition on the capitalization of interest in connection with loan workouts and modifications, the board said in its proposal, would “assist a federally insured credit union’s good-faith efforts to engage in loan workouts with borrowers facing difficulty because of the economic disruption that the COVID- 19 event has caused.”

The proposal suggests that advancing interest may avert the need for alternative actions that would be more harmful to borrowers. “The proposed rule would establish documentation requirements to help ensure that the addition of unpaid interest to the principal balance of a mortgage loan does not hinder the borrower’s ability to become current on the loan,” the board said in the proposal. “The proposed change would apply to workouts of all types of member loans, including commercial and business loans.”

The proposed rule was issued for a 60-day comment period.

LINK:

Proposed Rule, Part 741, Appendix B, Capitalization of Interest

(Nov. 20, 2020) In other action at its Thursday meeting, the NCUA Board:

- Reallocated $4.3 million in its budget for COVID-related “costs and opportunities.” The agency said the reallocation – from unspent 2020 travel budgets for the agency – were needed due to increased expenses from information technology costs that support offsite examinations and remote work by agency staff. The agency also said the reallocation would be used to pay for a “pull forward from the 2021 budget” of a previously planned renovation of NCUA headquarters while much of the workforce is offsite.

- Heard a report on credit unions’ use of the voluntary diversity self-assessment. Staff noted that the credit union response rate in submitting the self assessment has risen each year since it was unveiled in 2016, when 35 responded. In 2019, 118 FICUs responded (2.3% of all credit unions). The agency said it continues to urge more credit unions to commit to filling out self-assessment, pointing out that it has nothing to do with the credit union examination process.

LINKS:

NCUA 2020 Budget Update

State of Credit Union Diversity, Equity and Inclusion

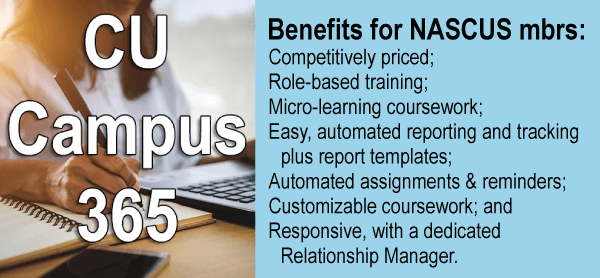

(Nov. 20, 2020) NASCUS this week officially rolled out to its members a new alliance offering customizable, affordable, on-line education developed with the Bank Administration Institute (BAI).

Under the “CU Campus 365” alliance, credit union members of NASCUS have access to education and compliance training anytime, anywhere, on affordable terms. CU Campus 365 is offered through the digital resources of BAI, a non-profit, prominent provider of research, training, and leadership programs for credit unions, banks and other financial institutions of all sizes.

NASCUS will continue its highly respected and well-attended education and training events, but CU Campus 365 delivers even more educational opportunities to the credit union system, and complements the offerings of NASCUS’ in-person education events.

A highlight of CU Campus 365 is that credit union training administrators can deploy customized training to their staff on a wide variety of subjects and disciplines. That includes choosing from a library of hundreds of courses ranging from lending laws and regulations to BSA/AML laws and regulations. Credit union staff will also be able to access training from a professional skills library that will cover coursework from effective leadership to social media marketing through CU Campus 365.

For more information about the program, see the link below.

LINK:

Welcome to CU Campus 365!

(Nov. 20, 2020) Two federal banking agencies saw action for their leadership futures this week, as a nominee for one barely failed to be confirmed to the position and another was nominated for a permanent position.

However, further progress for the two candidates – at the Federal Reserve and OCC, respectively — seems doubtful at this stage.

Meanwhile, the Senate could consider the nomination of Kyle S. Hauptman for the NCUA Board as early as the week following Thanksgiving.

On the Federal Reserve nomination: The Senate failed to confirm nominee Judy Shelton on a vote of 47-50, which was marked by bipartisan opposition to her confirmation. Shelton has proved to be a controversial candidate to sit on the central bank board: in the past, she has drawn controversy and some criticism for her expressed views about reinstituting the gold standard, questioning the effectiveness of federal deposit insurance, and the Fed’s independence from political influence.

Republican senators had vowed to consider her confirmation again (which was hobbled the first time by three senators outright expressing or voting in opposition to her, and others not available to vote after quarantining for Covid-19 exposure or infection). However, the Senate recessed Wednesday evening for the Thanksgiving holiday and won’t return until the afternoon of Nov. 30 (the Monday after Thanksgiving). That timing places Shelton’s confirmation in further doubt – on that day, the Democrats gain an additional member, Senator-elect Mark Kelly (Ariz.), who won a special election over incumbent Martha McSally (R ) Nov. 3. All Democrats have vowed to oppose Shelton’s confirmation.

On top of that, time is running short for the Senate to consider her nomination again in the coming weeks, as the current Congress winds down (and the Christmas and New Year holiday breaks loom). The new Congress will take its seats Jan. 3.

Also this week, President Donald Trump nominated Acting Comptroller of the Currency Brian P. Brooks to take the job (that is, remove the “acting” from his title) for a five-year term. Brooks was appointed to his current position by Treasury Secretary Stephen Mnuchin; he was not been confirmed by the Senate.

But the outlook for Brooks’ confirmation is similar to Shelton’s, with an added twist: In addition to growing Democratic opposition, and a dwindling calendar, Brooks will be subject to a Senate Banking Committee hearing on his nomination before he can be considered by the full Senate. Ranking Member Sherrod Brown (Ohio) has already questioned Brooks’ qualifications for the comptroller’s job; Brooks has held the acting title only since late May, and joined the OCC in April.

Nevertheless, press reports indicated late this week that Senate Banking Committee Chairman Mike Crapo (R-Idaho) intends to hold a hearing on the Brooks nomination. Further, reports also indicated that the Senate is also preparing to take up the confirmation of another (less controversial) Federal Reserve Board nominee, Christopher Waller, before Congress ends.

Meanwhile, late this week (after the Senate had already recessed for the holiday), the Senate leader published his Executive Calendar for Monday, Nov. 30 – which includes consideration of cutting off debate on the nomination of Kyle S. Hauptman to take a seat on the NCUA Board. President Trump tapped Hauptman in June to take the seat now held by Board Member Mark McWatters. He has been serving in a holdover capacity since his term expired in August, 2019.

LINK:

Senate Executive Calendar, Nov. 20, 2020

(Nov. 20, 2020) The state system made several recommendations for improving anti-money laundering (AML) effectiveness in a comment letter to federal law enforcement, responding to a call for comments issued in September.

That month, the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) issued an advance notice of proposed rulemaking (ANPR) seeking views on how to establish an “effective and reasonably designed” anti-money laundering program by amending its rules. FinCEN stated then that the amendments under consideration “are intended to modernize the regulatory regime to address the evolving threats of illicit finance, and provide financial institutions with greater flexibility in the allocation of resources, resulting in the enhanced effectiveness and efficiency of anti-money laundering programs.”

Specifically, FinCEN said its proposed amendments would clarify that an “effective and reasonably designed” AML program would assess and manage risk according to the institution’s own risk assessment process; provide for compliance with BSA requirements; and provide for the reporting of information with a high degree of usefulness to government authorities.

In its comment letter filed this week, NASCUS told the agency that the state system:

- Supports efforts to better harmonize expectations among regulators and credit unions as to the sufficiency of AML efforts and a credit union’s overall AML program.

- Recommends an explicit requirement for a risk assessment be limited to conducting one upon which the AML program is based and documenting the risk assessment. “FinCEN should allow institutions to determine the needed frequency of updating the risk assessment as well as the methodology and format of the risk assessment,” NASCUS wrote.

- Encourages FinCEN to publish its AML priorities, but cautioned against requiring those priorities to be incorporated into the risk assessment.

- Understands from stakeholders that the currency transaction report (CTR) exemption process is too burdensome, and said NASCUS encourages FinCEN to explore ways to ease the process for credit unions to exempt qualifying credit union members from CTR filing obligations.

- Recommends that on-going suspicious activity report (SAR) filing requirements be extended from 90-days to a 180-day or even annual filing requirement. “Covered entities would still be required to monitor the accounts and include a transaction history in the extended refiling,” NASCUS wrote. In addition, the association stated, should the nature of the transactions change, or new information become available, an SAR could be filed ahead of the 180-day (or annual) re-filing deadline.

LINK:

NASCUS comment letter: ANPR, Anti-Money Laundering Program effectiveness

(Nov. 20, 2020) A premium for the federal credit union savings insurance program for this year is unlikely, but the outlook for next year and beyond is not so clear following conversation by members of the NCUA Board on Thursday.

Meeting for their regular monthly meeting for November, the three NCUA Board members heard a quarterly report on the National Credit Union Share Insurance Fund (NCUSIF) that showed the assets of the fund grew significantly in the third quarter. However, that was largely because credit unions adjusted their deposits in the fund to be equal to 1% of insured shares. Total assets expanded to more than $19 billion from midyear, fueled largely by more than $1.5 billion injected by federally insured credit unions to adjust their 1% deposits.

Nevertheless, all three board members advised vigilance by federally insured credit unions going forward. NCUA Board Chairman Rodney Hood said the agency would take “all necessary actions” to ensure the fund remains strong and retains public confidence. “Vigilance needed to manage, monitor the situation.”

But NCUA Board Member Todd Harper agreed, saying that the agency must be “on guard” going forward. However, he noted that with rising assets, falling loan demand, compressed interest rates, decreased earnings and subdued consumer confidence under the pandemic-affected economy, credit unions need to be prepared for increased member delinquencies, loan defaults, bankruptcies and even credit union failures.

“We have a number of higher-risk credit unions that we were already closely supervising,” Harper said. “So it seems very likely that we will see higher than average failures over the next two years. What is more, we also know that growth in credit union assets seems likely to continue to exceed the ability of the share insurance fund to earn interest given the new reality of very low interest rates for the next few years.”

He said because the insurance fund equity ratio will continue to drop and decline, “it is really not a question of whether we will charge an insurance fund premium, but a question of when.” He indicated the timing is uncertain for a premium – next year, or even the year after that. However, he said bluntly: “Credit unions need to brace themselves for that eventual reality,” adding later that charging a premium during an economic downturn is “less than optimal.”

Harper reiterated past comments about the need for the agency to work with Congress about modifying the way the agency manages the fund going forward. He noted the FDIC’s higher reserve requirements for banks, greater administrative flexibility, and the ability to charge risk-based premiums as ripe for consideration for NCUA and credit unions.

Board Member Mark McWatters took a similar tack to Harper’s, saying he remains focused on the equity ratio of the fund. Under federal law, the NCUA Board may charge a premium if the equity level of the fund drops below 1.3%; if the equity ratio falls below 1.2%, the law demands a restoration plan that include a premium to help bring the equity back above 1.3%

McWatters indicated he wants credit unions to be prepared – and recommended that NCUA modify its policy to present a transparent calculation of the equity ratio each month (rather than every six months), with a detailed analysis of the numerator and denominator of the fraction that describes the insurance fund equity. (As of now, the agency will next calculate the equity ratio based on Dec. 31, 2020, credit union financial results.)

“The public dissemination of this information is of particular relevance as the COVID pandemic rages, and the resulting stresses on the credit union community and the insurance fund continue,” McWatters said. He added that the agency should also work with all constituencies to “address these critical issues in a transparent matter so as to mitigate the need for future premium assessments” in the context of the financial impact of the pandemic on CUs.

LINK:

NCUSIF Financial Statistics For the Quarter Ended September 30, 2020

(Nov. 20, 2020) NASCUS’ Lucy Ito expects to present the state credit union system view on the next NCUA budget – particularly its impact for the overhead transfer rate (OTR) – when the agency holds its annual budget briefing Dec. 2.

Late last week, the agency published its 2021-22 draft budget – totaling $342.5 million in 2021 and $364.2 million in 2022 – which will be the subject of the Dec. 2 briefing. The agency’s final budget is slated for approval during the NCUA Board’s Dec. 17 open meeting.

The agency primarily funds its operations through two sources: fees charged to federal credit unions (the FCU “operating fee”), and through funds transferred from the National Credit Union Share Insurance Fund (NCUSIF) to pay for “insurance-related costs” of the agency.

Budget documents posted on the agency’s website late last week show a total proposed 2021 budget of $342.5 million –down about $4.9 million, or 1.4%, from the approved budget of $347.4 million for 2020.

But that reduction would be more than made up in 2022, when the agency projects a 6.3% increase in its total budget, for a total of $364.2 million. That figure includes a $341.8 million operating budget (up $26.2 million); a $14.6 million capital budget (up $4.3 million); and $7.9 million NCUSIF administrative budget (down $218,000).

To fund its 2021 budget, the agency is estimating an OTR of 62.3% — one percentage point higher than in 2020 – with the remaining 37.7% of the budget to be paid largely by FCU operating fees. In its published budget, NCUA states that the primary driver of the increase in the estimated 2021 OTR is the rise in examination and supervision time for federally insured state-chartered credit unions.

“Calendar year 2021 marks the end of the first, five-year cycle associated with the Exam Flexibility Initiative that extended the NCUA exam time for eligible institutions,” the budget states. “The increase in budgeted time for FISCU examination and supervision for 2021 is due to program obligations associated with examination scheduling and scope requirements.”

NASCUS has voiced its concern over the years that the operations of the agency not be funded primarily by the insurance fund. In fact, in a comment letter to the agency earlier this month, NASCUS pointed out the “incontrovertible truth” that doing so means the insurance fund has less resources to face financial troubles for credit unions, unless an insurance fund premium is assessed, which is not outlined in the 2021 budget.

In fact, the 2021 budget proposal is already facing some headwinds: At the NCUA Board meeting Thursday, Board Member Mark McWatters said he does not support the proposal put forth by the staff. He said the budget proposal inappropriately omits some items, and funds other items that are not necessary for ensuring the safety and soundness of credit unions.

He did not outline the specific items in either case. However, last year, McWatters said he intended to pursue a “collegial, collaborative” path for adding consumer protection resources at the agency for the 2021 budget (such as additional staff). That, apparently, did not happen and is at least partly responsible for McWatters’ stated opposition.

The Dec. 2 budget briefing is scheduled to last one hour; it gets underway at 10 a.m. and will be live-streamed via the Internet.

LINK:

NCUA 2021/2022 Budget Justification

(Nov. 20, 2020) NASCUS has posted a new summary of a “statement of policy” on applications for early termination of consent orders from the CFPB. The summary is available to members only.

In October, the bureau issued a new policy on early termination of administrative consent orders that outlines the process for entities subject to a consent order with the agency and the “standards that the bureau intends to use when evaluating applications.”

“In order for a Consent Order to be terminated early, an entity should demonstrate that it meets certain threshold eligibility criteria, has fully complied with the terms of the Consent Order, and has a satisfactory compliance management system in applicable areas,” the agency stated. “These conditions are designed to minimize the risk of new violations of law by the company and to protect consumers.”

The bureau said last month that an application for early termination should be submitted to the agency point of contact named in the consent order. “In general, an application should demonstrate that the entity has satisfied all of the conditions for granting early termination described in the policy statement,” the agency stated. “Bureau staff will review applications and make recommendations to the Director about whether to terminate a Consent Order. Under the policy, the sole authority to terminate a Consent Order remains with the Bureau’s Director and the termination decision is at their discretion.”