Training for examiners is paramount to stay abreast of the latest industry trends and technologies. This event offers examiners a customized chance to enhance their critical skills and deepen their comprehension of a core set of subjects.

Training for examiners is paramount to stay abreast of the latest industry trends and technologies. This event offers examiners a customized chance to enhance their critical skills and deepen their comprehension of a core set of subjects.

As technology and methodologies continue to advance, it is essential to guarantee that examiners possess the requisite expertise and abilities to navigate a swiftly evolving landscape in various domains, including compliance, market risk, national concerns, and loan profitability.

Location: Hotel Indigo Traverse City 263 W. Grandview Pkwy Traverse City, MI 49684

Hotel Block: $85/night Click here to access the hotel block link, which expires October 6, 2023

Cost to attend: $600 Examiner Members

Questions: Click here to contact Isaida Woo

Financial struggles in Puerto Rico bite deeper than the rest of the United States

Our research shows that people in Puerto Rico have lower financial well-being compared to people in the rest of the United States, and they struggle more to make ends meet and participate in mainstream financial services. The CFPB works to ensure fair and equal access to financial products and services, especially among those who have been historically left out of full participation in the marketplace. This includes making a concerted effort to ensure that Puerto Rico and the territories are being analyzed and served just as other regions of the United States. In a recent study, we looked at how people living in Puerto Rico use financial products and services, as well as their financial well-being.

When landlords use information from a rental background check that qualifies as a “consumer report” against a tenant, they are required to tell the tenant of their decision and how to contact the company that created the background check. The federal housing agencies encourage landlords to provide this information to renters in writing. The United States Department of Housing and Urban Development, the Federal Housing Finance Agency, and the United States Department of Agriculture are reminding landlords of their obligation to inform tenants and prospective tenants of their rights. When landlords use information from a consumer report, like a rental background check, against a tenant, the Fair Credit Reporting Act requires landlords to tell the tenant of their decision and how the tenant can contact the company that created the background check. This obligation, known as the adverse action notice requirement, applies to any action against a tenant based on information from the background check, including denying a rental application, increasing the rent charged or security deposit, or requiring a co-signer. As the agencies state, providing this information in writing is the best way to ensure that tenants get the information they need, and for landlords to demonstrate they are meeting their legal obligations.

Looking at credit scores only tells part of the story – cashflow data may tell another part

Cashflow data (regular savings, accumulated savings, paying bills on time) helps predict ability to repay and repayment risk, even when accounting for credit scores. Most loan underwriting in the United States makes use of credit reporting data to evaluate repayment risk. Lenders frequently use third party credit scores, and many also develop their own proprietary models. Credit reporting data include individuals’ performance on a variety of credit products, such as mortgages, credit cards, auto loans, and student loans, as well as certain public records and some other forms of lending.1

The Consumer Financial Protection Bureau (CFPB) released a new Supervisory Highlights report which found unfair, deceptive, and abusive acts or practices across many consumer financial products. For example, auto lenders have originated loan balances above the real value of the car being purchased and engaged in illegal collection practices while servicing these loans. The latest edition of the Supervisory Highlights report covers findings from CFPB supervisory examinations completed from July 2022 to March 2023.

Director Chopra provided prepared remarks at an event hosted by the U.S. Department of Housing and Urban Development on tenant rights.

Midsession Budget Reprograms Funds for Mission Critical Priorities

Midsession Budget Reprograms Funds for Mission Critical Priorities

July 20, 2023 – The National Credit Union Administration Board held its seventh open meeting of 2023 and approved a final rule on member expulsion. The NCUA’s Chief Financial Officer also briefed the Board on the agency’s midsession budget, and the Board approved the reprogramming of surplus funds for priority and mission critical areas.

Final Rule Balances Member Rights and Congressional Intent

The NCUA Board unanimously approved a final rule that amends the standard federal credit union bylaws to adopt a policy by which a federal credit union member may be expelled for cause by a two-thirds vote of a quorum of the credit union’s board of directors.

“The final rule we are considering today strikes a balance between addressing the legitimate concerns over providing services to violent and disruptive members and providing due process rights to credit union member-owners. These rights include proper disclosures, hearings, and an appeals process,” NCUA Chairman Todd M. Harper said. “The powers granted in the Credit Union Governance Modernization Act must not be used as a tool to facilitate financial exclusion. What’s more, a federal credit union must ensure its implementation of the authority to expel members for cause is consistent and does not violate anti-discrimination laws or regulations.”

Under the Credit Union Governance Modernization Act of 2022, enacted by Congress on March 15, 2022, the NCUA had until September 15, 2023, to develop a final rule that federal credit unions may adopt to expel a member for cause.

The final rule is effective 30 days after publication in the Federal Register.

Reprogramming of Surplus Funds Supports Cybersecurity Specialists and Chartering Efforts

The Chief Financial Officer reported(opens new window) the NCUA will have an estimated $5.1 million surplus in the agency’s Operating Fund at the end of the year. Approximately one-third of the surplus is attributable to slightly lower-than-projected pay and benefit costs for 2023. Non-payroll categories, including travel, make up the remaining surplus.

The Chief Financial Officer recommended the NCUA Board approve the midsession reprogramming of $737,000 to fund four new cybersecurity support positions and two positions to assist with the NCUA’s field-of-membership and charter-expansion efforts. These reprogrammed funds will also support reasonable accommodations for employees and expenses associated with the background and security investigation for new hires.

The Board unanimously approved this request.

Said Chairman Harper, “These fiscally responsible and mission critical changes in our 2023 budget will ensure the NCUA, the credit union system, and the National Credit Union Share Insurance Fund can continue to adapt to the evolving financial, economic, and market conditions brought on by various external events and pressures, including growing cybersecurity threats and increasing applications for changes in federal credit union’s fields of membership.”

The Chief Financial Officer also reported that no Board action was needed on the capital budget and National Credit Union Share Insurance Fund’s operating budget. Additional information about the agency’s budget and expenses is available at https://ncua.gov/news/budget-supplementary-materials.

Board Meeting Speeches

CFPB Report Shows Workers Face Risks from Employer-Driven Debt

The Consumer Financial Protection Bureau (CFPB) published a report highlighting the risks employer-driven debt poses to workers. After a review of responses to the CFPB’s public inquiry, the analysis describes the growing prevalence of employer-driven debt and challenges workers and consumers face when they become indebted to an employer or an employer’s affiliate as a condition of employment. The issue spotlight delves into the use of training repayment agreement provisions (TRAPs), which can impede worker mobility, particularly when it comes to obtaining higher wages. Read more

The Consumer Financial Protection Bureau (CFPB) today sued lease-to-own finance company Snap Finance for deceiving consumers, obscuring the terms of its financing agreements, and making false threats. In a lawsuit filed in federal district court, the CFPB alleges that Snap Finance has offered and provided millions of “lease-purchase” and “rental-purchase” financing agreements in ways that have harmed consumers, including through misleading advertisements, insufficient disclosures, and interfering with consumers’ ability to understand the terms and conditions of its financing agreements. The CFPB further alleges Snap Finance’s illegal conduct continued in its servicing of those agreements, including misrepresenting consumers’ payment obligations and making false threats in collections. Read more

Today, Rohit Chopra, Director of the United States Consumer Financial Protection Bureau, and Didier Reynders, Commissioner for Justice and Consumer Protection of the European Commission, announced the start of an informal dialogue between the CFPB and the European Commission on a range of critical financial consumer protection issues. Read more

Join Us on November 28, 2023, in Nashville

With state and federal regulators placing greater emphasis on credit union management and governance, board governance must be at its best. The goal is to establish a culture of compliance and expertise that permeates from the top-down. To aid credit union leadership teams in achieving this, we invite your senior staff and directors to join NASCUS and a panel of experts in a series of sessions covering critical topics, such as:

- Regulator Perspective on Expectations, Do’s and Don’ts for the Board of Directors,

- How Credit Unions Manage Liquidity Risk and the Role of the Directors,

- National Issues Update and more.

Location: Tennessee State Library & Archives

1001 Rep. John Lewis Way North

Nashville, TN 37219

Pricing: $199 NASCUS Members | $299 Non-members

This is an in-person event.

During this in-person event, board members, committee members, and credit union management will have the opportunity to:

- Expand on skill development: Directors Colleges are designed to teach participants new skills and provide them with the tools they need to succeed in this complex industry.

- Grow your professional network: NASCUS events are great places to meet and connect with other credit union professionals and exchange ideas.

- Stay current with industry trends: Our industry is constantly evolving, and we can help you stay up to date with the latest national trends and developments.

The economy has been through the wringer for the past few years. Skyrocketing inflation in the wake of the COVID-19 pandemic brought with it a series of rapid rate rises that still may not have reached an end.

Financial fear has set in, and many vulnerable consumers are becoming even more vulnerable by the day.

In a report released by the Financial Health Network (FHN), “potentially worrying” signals were found throughout the levels of household spending. Debt has been mounting, and consumers have been increasingly reliant on high-cost credit.

Most acutely affected are those deemed “financially vulnerable” whose growing reliance on credit could impact their ability to recover from the strain.

It’s an environment that could affect US households for years to come. While some regard it as a return to “normal,” some consumers could be locked into a debt cycle that could benefit from a change.

Source: Financial Health Network

Financial Health walks a thin line.

Taking into account consumers’ spending, saving, and borrowing habits, as well as their approach to financial planning, the FHN can determine indicators of financial vulnerability.

The network found that the areas that consumers had been most affected were shown in fees and interest derived from credit and loans.

Savings have hit a new low since 2015, dropping to below 5% of incomes for the duration of 2022.

More often, consumers were leaning on credit and loan products. Gone is the financial cushion that many used to weather out the financial strain of the Covid19 pandemic. Gone too, are the pandemic-era measures that assisted in loan payments, buoying delinquency numbers.

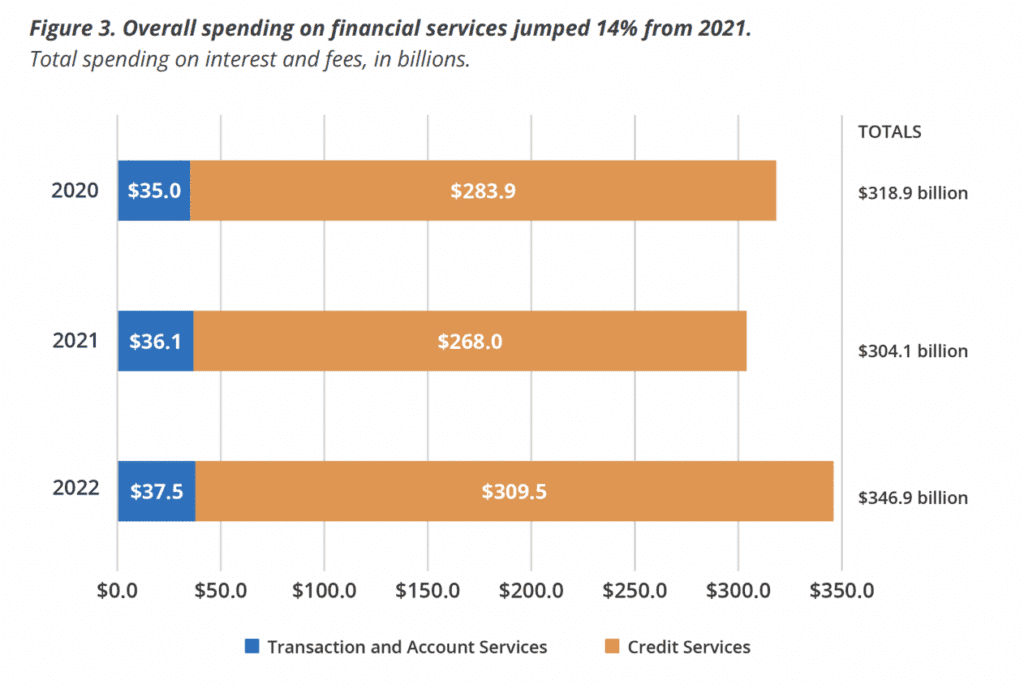

The total interest and fees paid on a variety of nonmortgage financial services increased between 2021 and 2022 by 15%. From credit card interest alone, costs grew by $20 billion.

Rate hikes are partly to blame, accounting for around one-quarter of the increase. However, increased card usage drove the majority of fees. In 2022, just over half of credit card users reported having carried a balance, with clear delineations by financial health tier.

While credit delinquencies had remained low post-pandemic, levels, have started to creep up. Total debt balances grew by $394 billion in the fourth quarter of 2022, the largest quarterly increase in 20 years. The Federal Reserve Bank of New York reported an uptick in credit card delinquency rates towards the end of 2022.

“Altogether, this paints a picture of debt that could really start to strain the checkbooks of American families,” said Meghan Greene, senior director of policy and research at Financial Health Network. “Toward the end of 2022, there were a number of signs that defaults were starting to grow, so that gives us a worrisome picture of how much debt people are carrying.”

Source: Financial Health Network.

Financially vulnerable bear the brunt

According to the survey, while the unbanked population had decreased by 1.8% within the year, those who remain unbanked are disproportionately made up of populations of color and households earning less than $30,000.

The proportion of unbanked is an ever-changing experience, according to the report. Many respondents who said they had no bank account reported closing their checking account in the past 12 months.

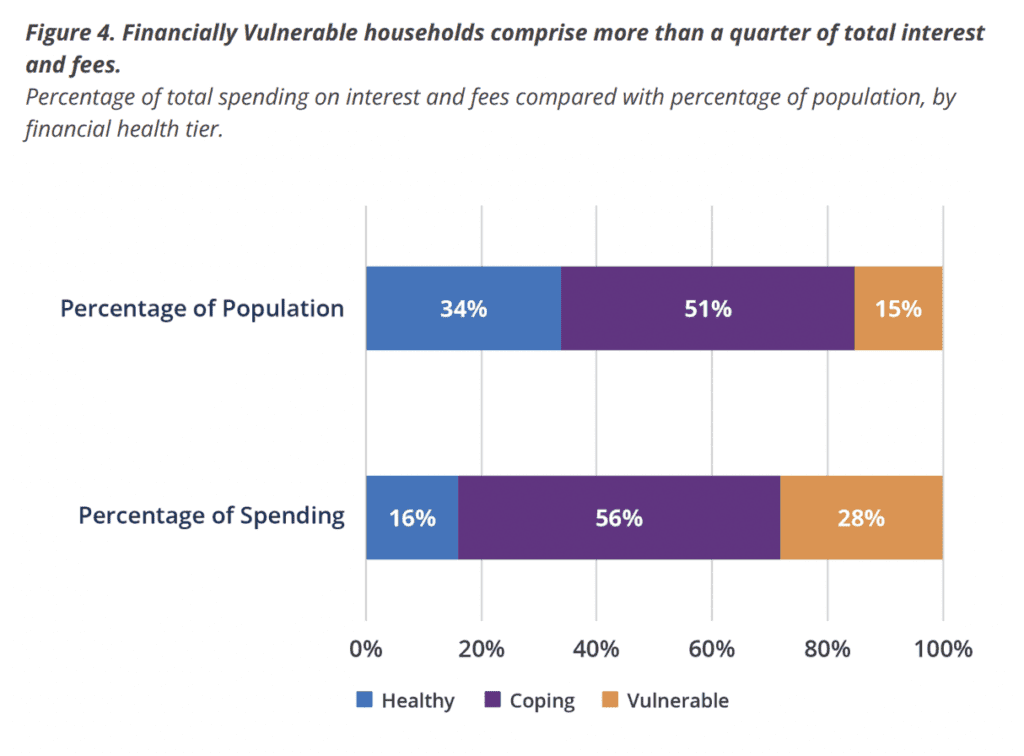

The worsening conditions of vulnerable consumers is a running theme throughout the report. In 2022, it was found that financially vulnerable households allocated 14% of their incomes to fees and interest alone, compared to an average of 1% among the financially healthy.

Individuals that are deemed to be struggling with most or all areas of their financial life spent an estimated $98 billion on interest and fees in the last year. They drove 28% of all fees and interest payments, despite only making up 15% of the population.

The report also found that Black and Latinx households had to allocate more of their income towards covering fees and interest, and a “startling” number of the demographic have had to turn to high-cost loans.

In conclusion, the FHN warned of future scenarios where an already gaping divide in financial health continued to grow wider. “The burden of increasing costs of borrowing will continue to fall disproportionately on those who are less likely to be able to afford it.”

Courtesy of Isabelle Castro Margaroli, FinTechNexus

PUBLISHED The CFPB’s 2022 Fair Lending Annual Report to Congress

The CFPB released its Fair Lending Annual Report to Congress , describing our fair lending activities in enforcement and supervision; guidance and rulemaking; interagency coordination; and outreach and education for calendar year 2022.In 2022, the CFPB’s fair lending work centered on the consumers and communities most affected by unlawful discrimination. These efforts included working with our federal and state partners to address redlining as well as confronting deep-seated discrimination in the home appraisal industry. The CFPB also released several reports shining a light on factors that may influence fair access to credit, including how medical debt affects tens of millions of consumers’ credit profiles, how people in under-resourced rural areas struggle to access financial services, and the challenges faced by justice-involved individuals and families. Read more

Office of Research blog: How are mortgages with a COVID-related forbearance performing in 2023?

In response to the COVID-19 pandemic, the federal government enacted the Coronavirus Aid, Relief, and Economic Security (CARES) Act, allowing millions of mortgage borrowers in the United States to enter public or private forbearance programs and temporarily pause their mortgage payments. In reports from May 2021 and March 2022 , the CFPB explored the characteristics and demographics of mortgage borrowers during the COVID-19 pandemic, with a focus on those who were in forbearance.In this post, we use recent data from the National Mortgage Database to compare the performance of mortgage borrowers in March 2023 to those in March 2021 that had COVID-related forbearance, were delinquent but not in forbearance, and those considered current on their payments. While we expressed concern in both 2021 and 2022 about borrowers’ ability to recover from periods of forbearance, our most recent analysis shows that the majority of borrowers in forbearance in 2021 – including Black and Hispanic borrowers – were largely able to become current on their payments by March 2023. Read more

The CFPB issues order against payment processor ACI Worldwide Corp. and its subsidiary ACI Payments Inc. (ACI) improperly initiating the Consumer Financial Protection Bureau (CFPB) issued an order against ACI Worldwide and one of its subsidiaries, ACI Payments, for improperly initiating approximately $2.3 billion in unlawful mortgage payment transactions. ACI’s data handling practices negatively impacted nearly 500,000 homeowners with mortgages serviced by Mr. Cooper (formerly known as Nationstar). By unlawfully processing erroneous and unauthorized transactions, ACI opened homeowners to overdraft and insufficient funds fees from their financial institutions. Today’s order requires ACI, among other things, to pay a $25 million civil money penalty. Read more

PUBLISHED Protecting consumers’ right to challenge discrimination

The Consumer Financial Protection Bureau (CFPB) is committed to ensuring fair, equitable, and nondiscriminatory access to credit for individuals and communities. The CFPB administers and enforces federal laws such as the Equal Credit Opportunity Act, a landmark civil rights law that protects people against discrimination in all aspects of credit transactions. Under the law, consumers targeted by race, religion, age, or any other prohibited basis with predatory lending products or practices also have the right to challenge that discrimination by bringing a lawsuit. Yet lenders engaged in discriminatory acts or practices sometimes unfairly try to make consumers sign away that right. Fortunately, many courts have rejected attempts to make people sign away crucial legal rights. Read more

CFPB Report Identifies Issues with Increased Servicemember Use of Digital Payment Apps

The Consumer Financial Protection Bureau (CFPB) released its annual report on the top financial concerns facing military families. The report highlights the growth of digital payment app usage in the servicemember community, the unique risks to servicemembers from these services, and the potential abuse from bad actors. Some servicemembers have also indicated in their complaints about incurring serious financial harm from scams and fraud when using these services, and their complaints suggest digital payment app providers often fail to provide timely and substantive resolutions. Read more

The CFPB intends to identify ways to simplify and streamline the existing mortgage servicing rules

By Rohit Chopra

Borrowing to buy a home is one of the biggest financial decisions a family will make. Mortgage servicers are the companies responsible for processing payments and managing mortgage accounts, and they play a critical role in assisting homeowners with repayment. Borrowers don’t choose these companies – servicers are chosen by the lender or investor that owns the mortgage.

Borrowing to buy a home is one of the biggest financial decisions a family will make. Mortgage servicers are the companies responsible for processing payments and managing mortgage accounts, and they play a critical role in assisting homeowners with repayment. Borrowers don’t choose these companies – servicers are chosen by the lender or investor that owns the mortgage.

In the mid-2000s, predatory mortgage practices spread throughout the country. Many large financial institutions with mortgage servicing operations experienced serious breakdowns. This resulted in a crisis where 10 million homes ended up in foreclosure between 2006 and 2014.

The foreclosure crisis was an important catalyst for the creation of the Consumer Financial Protection Bureau. Congress required the CFPB to implement new rules to make the mortgage market work better. These new rules first took effect in 2014. During the COVID-19 pandemic, we saw how these rules worked when unemployment spiked. The CFPB observed that there were places where the rules could be revised to reduce unnecessary complexity.

Last fall, the CFPB asked the public for input on ways to reduce risks for borrowers who experience disruptions in their ability to make mortgage payments, including input on the mortgage forbearance options available to borrowers. In particular, we sought input on the features of pandemic-related forbearance programs and whether there are ways to automate and streamline long-term loss mitigation assistance. We received comments from housing organizations, homeowner advocates, mortgage servicers, and many others.

Many commenters noted that borrowers seeking help on their mortgages can face a paperwork treadmill that hurts both homeowners and mortgage servicers. According to commenters, the temporary pandemic-related changes we made to the mortgage servicing rules helped alleviate this problem and get borrowers accommodations more quickly. Click here to read more

Laying the foundation for open banking in the United States

By Rohit Chopra

New digital banking technologies have the power to expand and open market access for American consumers and emerging businesses. In a more competitive market, Americans will be able to earn higher rates on their savings, pay lower rates on their loans, and more efficiently manage their finances. But the new technologies, and the competition they can fuel, have not yet reached their full potential. Consumers continue to encounter all too familiar obstacles when trying to switch banks or apply for loans.

The CFPB is working to accelerate the shift to open banking through a new personal data rights rule intended to break down these obstacles, jumpstart competition, and protect financial privacy. To do this, the CFPB is formalizing an unused legal authority enacted by Congress in 2010. This authority gives consumers the right to control their personal financial data. These rights will become a practical reality after the CFPB implements a rule that sets expectations for the market. We expect to solicit comments on our formal proposal in a few months and finalize in 2024.

But the agency must not micromanage open banking. Fair standards developed by the market to leverage our rule will be critical to the creation and maintenance of an open banking system in which consumers can vote with their feet — and exercise their data rights without being trapped by powerful incumbents and without losing control of their data.

Our proposal will recognize that the CFPB must resolve certain core issues because system participants are deadlocked or because existing approaches do not put consumers fully in the driver’s seat. But many of the details in open banking will be handled through standard-setting outside of the agency. Properly pursued, such standards can allow open banking to evolve as new technologies emerge, new products develop, and new data security challenges arise. Click here to read more

For federally insured credit unions, median asset growth and growth in shares and deposits declined slightly over the year ending in the first quarter of 2023. At the same time, loans outstanding grew at the median, according to the latest Quarterly U.S. Map Review released today by the National Credit Union Administration.

For federally insured credit unions, median asset growth and growth in shares and deposits declined slightly over the year ending in the first quarter of 2023. At the same time, loans outstanding grew at the median, according to the latest Quarterly U.S. Map Review released today by the National Credit Union Administration.

While aggregate assets in federally insured credit unions continued to grow during the year ending in the first quarter of 2023, at the median, assets declined 0.1 percent. In the year ending in the first quarter of 2022, the median asset growth rate was 5.2 percent. Nationally, shares and deposits continued to increase in the aggregate during the year ending in the first quarter of 2023, while the median growth in shares and deposits was negative 1.0 percent. In the year ending in the first quarter of 2022, the median growth rate in shares and deposits was 5.7 percent.

Loans outstanding rose 13.3 percent at the median over the year ending in the first quarter of 2023. During the previous year, loans grew by 4.6 percent at the median. The median total delinquency rate among federally insured credit unions was 38 basis points at the end of the first quarter of 2023, compared with 32 basis points in the first quarter of 2022.

Overall, 85 percent of federally insured credit unions had positive net income in the first quarter of 2023, compared with 77 percent in the first quarter of 2022. At least 70 percent of credit unions in every state and the District of Columbia had positive net income in the first quarter of 2023. The median annualized return on average assets at federally insured credit unions was 61 basis points in the first quarter of 2023, compared with 42 basis points in the first quarter of 2022.

The NCUA’s Quarterly U.S. Map Review tracks performance indicators for federally insured credit unions in all 50 states and the District of Columbia and includes information on two important state-level economic indicators: the unemployment rate and home prices.

The Corporate Transparency Act (“CTA”) takes effect on January 1, 2024. On that date, the Financial Crimes Enforcement Network (“FinCEN”) needs to have implemented a working data base to accept millions of reports of beneficial ownership information (“BOI”) by newly-formed companies required to report BOI under the CTA, as well as reports by the even greater population of existing reporting companies, which must report their BOI by the end of 2024. This is a logistically daunting task. Further, FinCEN still needs to issue final regulations implementing the CTA, including as to rules regarding access to the data base, and how the existing Customer Due Diligence (“CDD”) Rule applicable to banks and other financial institutions might be amended – presumably, expanded – to align with the different and often broader requirements of the CTA.

The Corporate Transparency Act (“CTA”) takes effect on January 1, 2024. On that date, the Financial Crimes Enforcement Network (“FinCEN”) needs to have implemented a working data base to accept millions of reports of beneficial ownership information (“BOI”) by newly-formed companies required to report BOI under the CTA, as well as reports by the even greater population of existing reporting companies, which must report their BOI by the end of 2024. This is a logistically daunting task. Further, FinCEN still needs to issue final regulations implementing the CTA, including as to rules regarding access to the data base, and how the existing Customer Due Diligence (“CDD”) Rule applicable to banks and other financial institutions might be amended – presumably, expanded – to align with the different and often broader requirements of the CTA.

On June 7, four members of the U.S. House of Representatives (the Chairpersons of the House Committee on Financial Services; the House Committee on Small Business; the House Subcommittee on National Security, Illicit Finance, and International Financial Institutions; and the House Subcommittee on Financial Services and General Government) sent a letter directed to Janet Yellen, Secretary of the Treasury, and Himamauli Das, Acting Director of FinCEN regarding the status of the implementation of the CTA.

The letter, fairly or not, is pointed. It stresses the need for more clarity and transparency regarding exactly how the CTA will apply to reporting companies. The letter is short, so it is set forth below in its entirety:

We write today to express our concerns with the Financial Crimes Enforcement Network’s (FinCEN) planned roll out to inform reporting companies of their forthcoming obligations to file beneficial ownership information with FinCEN. Specifically, we believe that press releases are insufficient to ensure that the approximately 32.6 million small businesses that will be expected to comply in 2024 understand their upcoming responsibilities.

As you know, the impending Beneficial Ownership Information collection rule will go into effect January 1, 2024. It is concerning that with six months until its effective date, FinCEN has yet to lay out a clear plan for engagement. It is highly unlikely that the 32 million small business owners know what FinCEN is let alone know to look for a press release on FinCEN’s website. As a result, there is a real possibility that these small businesses could be held civilly or criminally liable for noncompliance.

To that end, we would like to better understand FinCEN’s plans to educate small businesses. Please provide the following information: A detailed outline of how FinCEN will work with stakeholders to educate reporting companies on their filing obligations and possible penalties for non-compliance.

- A compliance guide for reporting companies to ensure they understand their responsibilities and detailed plan to distribute the compliance guide.

- A copy of any infographics that FinCEN plans to distribute to reporting companies.

- A detailed report on FinCEN’s timeline for the finalization of Rule #2 “Access Rule” and Rule #3 “CDD Rule.”

- An outline of the challenges FinCEN has encountered with the aforementioned educational program, and future hurdles FinCEN foresees.

- A detailed plan from the Treasury Department on how it will safeguard reporting companies from scammers and criminals using the beneficial ownership information collection process to obtain sensitive information from reporting companies.

- An outline of how FinCEN will field calls from reporting companies and remediate issues that may arise. This outline should include estimates on additional staffing requirements and resources needed to properly educate and assist reporting company filings.

- A detailed plan for reminder notifications for reporting companies that have not complied as the deadline approaches.

- A compliance guide for reporting company updates and changes to beneficial ownership reporting information.

- A detailed plan of your outreach to states and local governments via Domestic Liaisons to help educate small businesses

Of course, FinCEN is already loaded with existing requirements imposed upon it by Congress under the CTA and the Anti-Money Laundering Act. And, FinCEN still needs to issue proposed regulations regarding the real estate industry, among other obligations. FinCEN has approximately three weeks to respond to the above letter, which does not even touch on the concerns of banks and other financial institutions regarding the effectiveness of the CTA and how it might change CDD Rule compliance programs which have been in place for years. It remains to be seen how FinCEN will respond to this letter, and simultaneously pursue its many other obligations while devoting some of its already-limited resources to responding.

Courtesy of Peter D. Hardy , Ballard Spahr, Money Laundering News

Event Date: July 31 – August 07, 2023

Cybersecurity is everyone’s responsibility: from the Board to frontline staff to the examiner. Not only does cybersecurity remain one of NCUA Examination Priorities, recent compromises of SolarWinds and vulnerabilities of Microsoft Exchange stand as reminders the growing pervasiveness of the cyber threat. A sound cybersecurity strategy requires understanding the risk and tailoring policies and procedures to the credit union’s specific vulnerabilities and operational posture.

Cybersecurity is everyone’s responsibility: from the Board to frontline staff to the examiner. Not only does cybersecurity remain one of NCUA Examination Priorities, recent compromises of SolarWinds and vulnerabilities of Microsoft Exchange stand as reminders the growing pervasiveness of the cyber threat. A sound cybersecurity strategy requires understanding the risk and tailoring policies and procedures to the credit union’s specific vulnerabilities and operational posture.

Stay informed on the latest cybersecurity and learn how to keep your credit union protected at CUNA Cybersecurity eSchool with NASCUS. Beginning July 31, join us to help understand the risks, and procedures to put in place for your credit union’s specific vulnerabilities.

This eSchool is designed for all levels of experience and provides education and training focused on the three pillars of cybersecurity: people, processes, technology. From outsourced service provider relationships to frameworks, ChatGPT to new account and loan fraud, penetration testing to budgeting, don’t miss this dynamic event.

Who Should Attend

This eSchool is beneficial for I.T. and compliance professionals, C-Suite, risk managers and anyone needing cybersecurity training.

EST

EST