There are now 105 countries that are exploring central bank digital currencies (CBDCs). Among them, 50 countries are in an advanced phase of digital currency exploration (development, pilot, or launch).

The Atlantic Council’s Geoeconomic Centre has released a major update to its Central Bank Digital Currency (CBDC) Tracker. According to the tracker:

105 countries, representing over 95 percent of global GDP, are exploring a CBDC … A new high of 50 countries are in an advanced phase of exploration (development, pilot, or launch).

Furthermore, the tracker details that “10 countries have fully launched a digital currency, with China’s pilot set to expand in 2023.”

Among the G20 countries, 19 are exploring a CBDC, with 16 already in the development or pilot stage. They include South Korea, Japan, India, and Russia.

Last month, the Bank of International Settlements (BIS) released a report stating that 9 out of 10 central banks globally are exploring CBDCs. The BIS said, “the emergence of stablecoins and other cryptocurrencies have accelerated the work on CBDCs.”

June 8, 2022 – The U.S. Senate voted to confirm Todd M. Harper’s reappointment to the National Credit Union Administration (NCUA) Board until April 10, 2027.

The U.S. Senate voted to confirm Todd M. Harper’s reappointment to the National Credit Union Administration (NCUA) Board until April 10, 2027.

Before joining the NCUA Board, Mr. Harper served as director of the agency’s Office of Public and Congressional Affairs and chief policy advisor to former Chairmen Debbie Matz and Rick Metsger. He is the first member of the NCUA’s staff to become an NCUA Board Member and Chairman.

“On behalf of the National Association of State Credit Union Supervisors (NASCUS) and its stakeholders, I would like to congratulate Chairman Todd Harper on his full-term confirmation on the NCUA Board,” commented NASCUS President & CEO Brian Knight. “We look forward to furthering our productive discussions on the many issues facing the credit union system with Chairman Harper, Vice-Chair Hauptman, and Board Member Hood. We appreciate their continued positive dialogue with state regulators to find solutions that benefit both state and federal charters.”

As NCUA Board Chairman, Mr. Harper serves as a voting member of the Financial Stability Oversight Council and represents the NCUA on the Federal Financial Institutions Examination Council and the Financial and Banking Information Infrastructure Committee.

“In the years ahead, my focus will remain on credit union members, the system’s resiliency and strength, and the NCUA’s readiness to respond to an evolving economic environment, credit union system, and financial services marketplace. Consistent with the law, I will also continue prioritizing capital and liquidity, cybersecurity, consumer financial protection, and diversity, equity, and inclusion,” stated Harper.

During his tenure as staff and legislative director with the U.S. House of Representatives, he contributed to impactful financial services reforms, from the enactment of the Gramm-Leach-Bliley Financial Services Modernization Act in 1999 through the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010.

“It is an honor to continue working with my fellow NCUA Board members — Kyle Hauptman and Rodney Hood — and the dedicated team of professionals at the NCUA,” added Chairman Harper.

This week, Acting Comptroller of the Currency Michael Hsu gave remarks to the DC Blockchain Summit titled “Crypto: A Call to Reset and Recalibrate.”

This week, Acting Comptroller of the Currency Michael Hsu gave remarks to the DC Blockchain Summit titled “Crypto: A Call to Reset and Recalibrate.”

By speaking at the Blockchain Summit, Mr. Hsu may have gone into the so-called belly of the beast to give his self-proclaimed crypto-skeptic message. Notwithstanding his skepticism, Mr. Hsu noted that he does see cryptocurrency’s potential, but will continue along the OCC’s “careful and cautious approach to crypto in order to ensure that the national banking system is safe, sound, and fair.”

Mr. Hsu noted that the recent collapse of the TerraUSD stablecoin and the selloff seen in other crypto assets showed risks in the asset class, and he said it also showed that much of the growth in the crypto space is “indicative of the crypto economy’s dependency on hype.”

Mr. Hsu shared three “high-level observations from the perspective of a bank regulator.”

First, he said that recent events “have revealed deep vulnerabilities in the crypto system.” He noted three in particular:

- Cryptocurrency markets are highly fragmented and cryptocurrency exchanges are prone to hacks

- Contagion risks for cryptocurrency markets are just as real as other financial markets

- Custody and ownership rights are under-developed for the size, scope, and ambitions of the industry

Second, he pointed out that the OCC’s “careful and cautious” approach has shown value in the recent market volatility, as “there has been no contagion from cryptocurrencies to traditional banking and finance.”

Third, he observed that “hype is not harmless,” and elaborated by saying that the hype of crypto and digital assets and the associated vulnerabilities “make the crypto space very dangerous for investors of modest means.”

Mr. Hsu summarized his remarks by noting that the recent market volatility involving stablecoins (and cryptocurrencies more broadly) provides an opportunity “to reset and to recalibrate the problems the industry is trying to solve.”

Courtesy of Cadwalader, Wickersham & Taft LLP

Michel Euler/Pool via REUTERS

June 1 – Jamie Dimon, Chairman and Chief Executive of JPMorgan Chase & Co described the challenges facing the U.S. economy akin to an “hurricane” down the road and urged the Federal Reserve to take forceful measures to avoid tipping the world’s biggest economy into a recession.

Dimon’s comments come a day after President Joe Biden met with Federal Reserve Chair Jerome Powell to discuss inflation, which is hovering at 40-year highs.

“It’s a hurricane,” Dimon told a banking conference, adding that the current situation is unprecedented. “Right now, it’s kind of sunny, things are doing fine. Everyone thinks the Fed can handle this. That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy,” he added.

The Fed is under pressure to decisively make a dent in an inflation rate that is running at more than three times its 2% goal and has caused a jump in the cost of living for Americans. It faces a difficult task in dampening demand enough to curb inflation while not causing a recession.

“The Fed has to meet this now with raising rates and QT (quantitative tightening). In my view, they have to do QT. They do not have a choice because there’s so much liquidity in the system,” Dimon said.

Major central banks, already plotting interest rate hikes in a fight against inflation, are also preparing a common pullback from key financial markets in a first-ever round of global quantitative tightening expected to restrict credit and add stress to an already-slowing world economy.

The inflation battle has become the focal point of Biden’s June agenda amidst his sagging opinion polls and before November’s congressional election.

Uncertainty about the U.S. central bank’s policy move, the war in Ukraine, prolonged supply-chain snarls due to COVID-19 and higher Treasury yields have rocked global stock markets, with the benchmark S&P 500 index (.SPX) falling 13.3% year-to-date.

“You gotta brace yourself. JPMorgan is bracing ourselves, and we’re going to be very conservative in our balance sheet,” Dimon added.

SOFT LANDING?

Wells Fargo & Co’s (WFC.N) CEO warned that the Federal Reserve would find it “extremely difficult” to manage a soft landing of the economy as the central bank seeks to douse the inflation fire with interest rate hikes. The CEO of the fourth-largest U.S. lender also said that Wells Fargo is seeing a direct impact from inflation on consumers’ spending, particularly on fuel and food.

“The scenario of a soft landing is … extremely difficult to achieve in the environment that we’re in today,” Wells Fargo Chief Executive Officer Charlie Scharf said at the conference.

“If there is a short recession, that’s not all that deep… there will be some pain as you go through it, overall, everyone will be just fine coming out of it,” he added.

Scharf said while the overall consumer spending is strong, growth is slowing.

“Corporations are still spending, where they can they’re increasing inventories … we do expect the consumer and ultimately businesses to weaken, which is part of what the Fed is trying to engineer but hopefully in a constructive way,” he added.

Recent Fed reports and surveys reported households on average in a strong financial position, with working families doing well, and unemployment at levels more akin to the boom years of the 1950s and 1960s. Wages for many lower-skilled occupations are rising, and bank accounts, on average, are still flush with cash from coronavirus support programs.

But confidence has waned, and in a recent Reuters/Ipsos poll the economy topped respondents’ list of concerns.

“I don’t think our crystal ball relative to the macro later this year, 2023, 2024 is necessarily any better than others. Clearly, we’re going to see with the Fed actions different impacts in different businesses,” GE CEO Larry Culp, told the conference. Still, not everyone in corporate America is seeing slowdown.

“Of the vast majority of the markets we serve are still quite strong,” Caterpillar Inc CEO Jim Umplebly said.

“And our challenge at the moment, quite frankly, is supply chain, our ability to supply enough equipment to meet all the demand that’s out there,” he added.

May 26, 2022 — The board meeting opened with a moment of silence in light of the recent tragedies across the country. The meeting agenda included one item for discussion – NCUA’s quarterly update on the National Credit Union Share Insurance Fund.

May 26, 2022 — The board meeting opened with a moment of silence in light of the recent tragedies across the country. The meeting agenda included one item for discussion – NCUA’s quarterly update on the National Credit Union Share Insurance Fund.

The Share Insurance Fund reported a net income of $54.4 million and a net position of $20.4 billion for the first quarter of 2022. The Fund’s total assets decreased to $20.6 billion at the end of the quarter from $20.7 billion at the end of the fourth quarter of 2021.

“The Share Insurance Fund continued to perform well in the first quarter,” NCUA Chairman Todd M. Harper said. “Quarterly net income rose by approximately $42 million due to the continued reduction of expected losses associated with the remaining legacy assets of the Corporate System Resolution Program. That is positive news. We are now seeing a normalization of the Share Insurance Fund’s performance to what it was before the Board decided to fold the Temporary Corporate Credit Union Stabilization Fund into the Share Insurance Fund.”

There were two credit union failures in the first quarter, both saw fraud as a contributing factor. The board noted that as a remote posture continues for many across the industry, the continued concern over fraud remains top of mind.

The NCUSIF equity ratio is projected to be 1.25% for the period ending June 30, 2022. While not at the statutory level of 1.3% it is not at a level low enough to trigger the requirement for a premium assessment.

“Although the equity ratio sits below an ideal level, it remains relatively stable,” said Chairman Harper. “Nevertheless, we continue to see a slow, steady decline of the equity ratio due to continued elevated insured share growth and low interest rates, at least from a historical perspective. As such, the NCUA Board must continue to monitor the Share Insurance Fund’s performance and remain ready to act. Such monitoring includes assessing the effects of the changing interest-rate environment on the Fund’s portfolio.”

It was reported that they are now seeing a normalization of share insurance performance. The equity ratio remains relatively stable, but the NCUA board must continue to monitor its performance

- Assessing effects of the interest rate environment

- Investment portfolio is valued based on the market

- Changes in the value of assets are expected

- Unrealized losses do not impact ratio nor trigger requirement for premium assessment

Additionally, the NCUA is working with its Investment Committee to develop a new Investment Policy which is expected to be presented to the Board by Q4 2022. As well as adjusting its investment strategy from a 7 to a 10-year ladder due to the rate environment.

At the Q2 NCUSIF update, it was noted that the report will the data from the implementation of the “S” Sensitivity rating to the CAMELS rating. It was also discussed and noted that NCUA is developing guidance for examiners to work with credit unions regarding the sensitivity to market risk and will continue to treat all credit unions equitably.

Finally, the Board gave a quick update on the latest NCUA LTCU 2022-CU-07

NCUA expects CUs to exercise sound judgment and that the considerations in the letter should not be considered all-inclusive. The Board expects the letter to lead to follow-up conversations and the NCUA expects greater FinTech rulemaking in the future.

Read the NCUA Board Action Bulletin here.

The Fed’s Board of Governors released the May 2022 Financial Stability Report, which presents key insights into the state of the American economy. What did the Federal Reserve’s latest decisive document reveal?

The Fed’s Board of Governors released the May 2022 Financial Stability Report, which presents key insights into the state of the American economy. What did the Federal Reserve’s latest decisive document reveal?

Monday, May 9, the central bank of the United States shared its biannual report on the national financial system. While the report’s purpose is to assess the resilience of the U.S. economy, it also identifies and measures significant risks.

In the most recent edition, the Fed Financial Stability Report warns of “increased uncertainty about the economic outlook.”

Important takeaways from the Fed Financial Stability Report

As of May 2022, the Federal Reserve has identified a series of risks contributing to market liquidity decline:

- Increasing interest rates;

- Russian invasion of Ukraine;

- Omicron variant news;

- Elevated inflation;

- Monetary policy tightening;

- Employment losses;

- High debt levels in China

Dr. Lisa Cook Credit: Harley Seeley for Minneapolis Fed photo

The Senate confirmed economist Lisa Cook on Tuesday to serve on the Federal Reserve’s board of governors, making her the first Black woman to do so in the institution’s 108-year history.

Her approval was on a narrow, party-line vote of 51-50, with Vice President Kamala Harris casting the decisive vote.

Senate Republicans argued that she is unqualified for the position, saying she doesn’t have sufficient experience with interest rate policy. They also said her testimony before the Senate Banking Committee suggested she wasn’t sufficiently committed to fighting inflation, which is running at four-decade highs.

Cook has a doctorate in economics from the University of California, Berkeley, and has been a professor of economics and international relations at Michigan State since 2005. She was also a staff economist on the White House Council of Economic Advisers from 2011 to 2012 and was an adviser to President Biden’s transition team on the Fed and bank regulatory policy.

Some of her most well-known research has focused on the impact of lynchings and racial violence on African American innovation.

Cook is only the second of Biden’s five nominees for the Fed to win Senate confirmation. His Fed choices have faced an unusual level of partisan opposition, given the Fed’s history as an independent agency that seeks to remain above politics.

Some critics charge, however, that the Fed has contributed to the increased scrutiny by addressing a broader range of issues in recent years, such as the role of climate change on financial stability and racial disparities in employment.

Biden called on the Senate early Tuesday to approve his nominees as the Fed seeks to combat inflation.

“I will never interfere with the Fed,” Biden said. “The Fed should do its job and will do its job, I’m convinced.”

Fed Chair Jerome Powell is currently serving in a temporary capacity after his term ended in February. He was approved by the Senate Banking Committee by a nearly unanimous vote in March.

Fed governor Lael Brainard was confirmed two weeks ago for the Fed’s influential vice chair position by a 52-43 vote.

Philip Jefferson, a economics professor and dean at Davidson College in North Carolina, has also been nominated by Biden for a governor slot and was approved unanimously by the Finance Committee. He would be the fourth Black man to serve on the Fed’s board.

Biden has also nominated Michael Barr, a former Treasury Department official, to be Fed’s top banking regulator, after a previous choice, Sarah Bloom Raskin, faced opposition from West Virginia Democratic Sen. Joe Manchin.

Cook, Jefferson, and Barr would join Brainard as Democratic appointees to the Fed. Yet most economists expect the Fed will continue on its path of steep rate hikes this year.

Courtesy of NPR/Associated Press

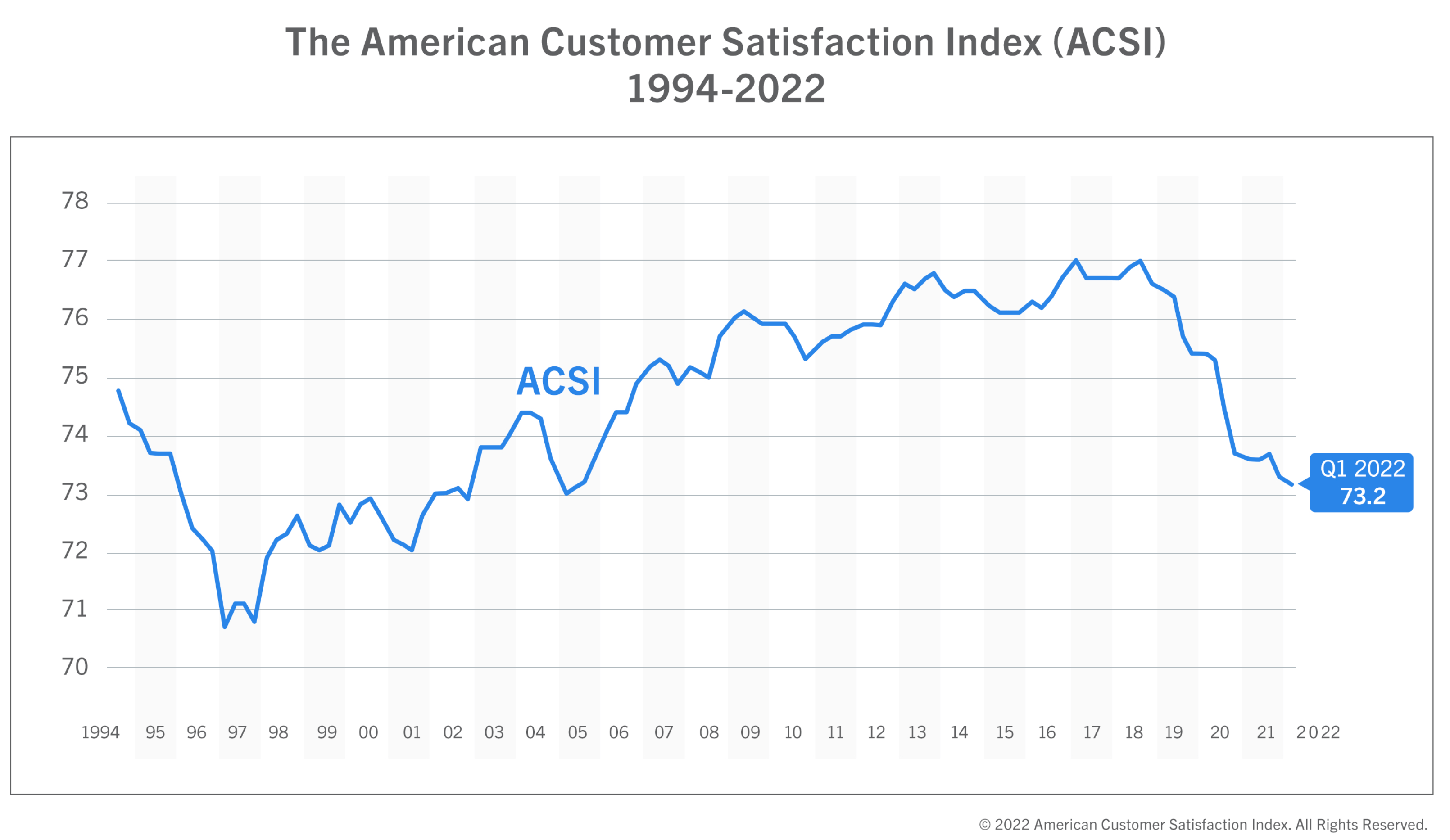

May 10, 2022 — Customer satisfaction in the U.S. is now at its lowest level in 17 years, sliding 0.1% to a score of 73.2 (out of 100) in the first quarter of 2022, according to the national American Customer Satisfaction Index (ACSI®).

Rarely has the U.S. economy faced as many challenges as it does today. While it would not be surprising that GDP growth might slow due to falling customer satisfaction, this is actually not what’s happening now.

It’s true that customer dissatisfaction has a dampening effect on discretionary household spending. It’s also true that household spending is the largest component of GDP. However, GDP, which contracted by 1.4% in the first quarter, didn’t fall due to weak consumer spending. On the contrary, annual consumer spending has been strong because of pent-up demand due to COVID-19 and because it was financed by robust household savings. GDP shrank because of weak exports. Long term, however, household savings cannot be a major source of consumption funding.

If adjusted for inflation, and once inflation itself is adjusted for the service and product quality deterioration reflected in ACSI, consumer spending will no longer prop up GDP. Supply chain problems will continue. Labor shortages will also be a factor in the foreseeable future. Both contribute to more inflation.

“Global trade, and especially international supply chains, will continue to be disrupted. Combined with the prolonged customer satisfaction decline, it’s evident the U.S. faces complicated economic challenges,” said Claes Fornell, founder of the ACSI and the Distinguished Donald C. Cook Professor (emeritus) of Business Administration at the University of Michigan. “If households continue to use savings to finance consumption, it might neutralize some of the economic pressures in the short term, but it will also create a very different economy – one where demand continues to exceed supply. And that’s not sustainable because it fosters monopoly tendencies in the sense that it will matter less if customers are satisfied or not: Sellers will continue to gain pricing power, which further fuels inflation, and buyers compete with one another while sellers don’t compete much at all.”

September 7 – 8, 2022

September 7 – 8, 2022

The Exchange (A NASCUS Initiative) is an annual issues-driven event that brings state- and federally-chartered credit union CEOs with assets greater than $10B+ together with dynamic state system regulators to identify and discuss emerging issues and trends affecting dual charters and the financial services sector.

In an effort to foster further collaboration and develop innovative solutions, NCUA, federal regulatory agencies, and/or subject matter experts may be invited to participate in part of the discussion.

Location:

Location:

Westin Denver International Airport

8300 Peña Boulevard

Denver, CO 80249

The Westin Hotel is in the Jeppessen Terminal, adjacent to the Denver International Airport.

Room rate: $259/night plus tax and applicable hotel fees.

For your convenience, NASCUS will make a room reservation for you.

- At check-in, you will need to present your credit card to pay for the room.

- Please send your ARRIVAL and DEPARTURE dates to Dr. Isaida Woo, Senior Vice President, Corporate Affairs and Education by August 10, 2022.

Event Registration:

The Exchange is by invitation only.

- There is no registration fee to participate.

- All meals will be provided by NASCUS.

Questions:

For further information, please contact Dr. Isaida Woo, Senior Vice President, Corporate Affairs and Education

Agenda

Wednesday, Sept. 7, 2022 : Location TBD

6:00 pm – 8:30 pm Reception & Networking Dinner

Thursday, Sept. 8, 2022 : Cottonwood Room

8:30 am – 9:00 am Networking Breakfast

9:00 am – 12:00 pm Collaboration and Discussion

10:00 am – 10:15 am Comfort Break

12:00 pm – 12:45 pm Working Lunch

12:45 pm – 3:00 pm Collaboration and Dialogue Continues

3:00 pm Closing Thoughts

The Changing Climate for Credit Unions

Climate change is one of the most important—if not the most important—challenges of the twenty-first century. Transformational change is necessary to confront and adapt to the increasingly severe impacts of climate change. Credit unions are in unique position to aid in this transformation.

EXECUTIVE SUMMARY

Credit unions are an integral part of the U.S. consumer finance system, offering an important alternative to commercial banks and nonbank financial service providers. As a result, credit unions have an essential role to play as financial system stakeholders mobilize to address climate change and the challenges it creates, and ultimately, as the United States undertakes a transition to a net-zero carbon emission economy.

Credit unions are an integral part of the U.S. consumer finance system, offering an important alternative to commercial banks and nonbank financial service providers. As a result, credit unions have an essential role to play as financial system stakeholders mobilize to address climate change and the challenges it creates, and ultimately, as the United States undertakes a transition to a net-zero carbon emission economy.

This research report offers an overview of the implication of climate change for credit unions, and recommendations for more effective climate risk management. It describes the climate-related physical and transition risks facing credit unions, the potential impact of climate change on credit unions, the current state of credit union approaches to climate change, and the opportunities available for credit unions from climate adaptation finance. It also provides concrete recommended actions that individual credit unions can take to begin to measure and mitigate the impacts of climate change on their organizations and the credit union system.

Now is the time for credit unions to double down on driving equitable financial services in our most vulnerable communities. Experience shows that credit unions most responsive to member needs during or immediately after climate crises are rewarded with member growth, visibility, and loyalty. Preparing now to cushion blows with flexible financing can be critical to the long-term sustainability of the institution and community.

This report offers an overview of the implications of climate change for credit unions, the risks facing credit unions, and the opportunities available for credit unions to adapt their strategies toward advancing climate solutions. Download the report and learn more about your credit union’s role in combating climate change.

![]()

Click here to download/read the report (login required)

Courtesy of Filene Research Institute

The tech giant is working with fintech CNote to help underserved communities.

The multinational technology company Apple, maybe best known for the iPhone, announced Thursday that it is working with fintech company CNote to deploy $25 million of its own money into community development financial institutions (CDFIs), low-income designated credit unions and minority depository institutions (MDIs).

The multinational technology company Apple, maybe best known for the iPhone, announced Thursday that it is working with fintech company CNote to deploy $25 million of its own money into community development financial institutions (CDFIs), low-income designated credit unions and minority depository institutions (MDIs).

According to a statement, the $25 million infusion is part of Apple’s “broader Racial Equity and Justice Initiative, an effort to address systemic racism in America and expand opportunities for communities of color.”

Apple is using the fintech company CNote to disperse the funds to several credit unions and community banks across the country. According to CNote, the credit unions receiving the funds include the following:

- ANECA Federal Credit Union in Louisiana;

- Education Credit Union in Texas;

- Hope Credit Union, which serves Alabama, Arkansas, Louisiana, Mississippi and Tennessee;

- Kaua’i Federal Credit Union in Hawai’I;

- Latino Community Credit Union in North Carolina; and

- Self-Help Federal Credit Union with locations in California, Illinois, Washington and Wisconsin.

“We’re committed to helping ensure that everyone has access to the opportunity to pursue their dreams and create our shared future,” Lisa Jackson, Apple’s vice president of Environment, Policy and Social Initiatives, said. “By working with CNote to get funds directly to historically under-resourced communities through their local financial institutions, we can support equity, entrepreneurship and access.”

“Corporations have an enormous opportunity to help communities across the U.S. thrive by changing the way they manage their cash reserves, and we’re excited to see Apple at the forefront of this emerging trend,” Catherine Berman, CEO of CNote, said. “Through our platform, we have already started moving Apple deposits into low-income communities and communities of color.”

According to CNote, the company has already deployed an initial round of Apple’s deposits to those institutions.

Article “Apple Pumps $25 Million Into Credit Unions & MDIs” Courtesy of Michael Ogden, Credit Union Times

Two senators are raising concerns following an announcement by Fidelity that it will allow customers to allocate bitcoin to their 401(k) retirement accounts.

Sen. Elizabeth Warren (D-MA) and Sen. Tina Smith (D-MN) have sent a letter to Fidelity that cites the volatile nature of bitcoin and that asks the company how it plans to deal with “significant risks such as fraud, theft, and loss” posed by the leading cryptocurrency. Investing in cryptocurrencies is a risky and speculative gamble, and we are concerned that Fidelity would take these risks with millions of Americans’ retirement savings,” the letter states.

Sen. Elizabeth Warren (D-MA) and Sen. Tina Smith (D-MN) have sent a letter to Fidelity that cites the volatile nature of bitcoin and that asks the company how it plans to deal with “significant risks such as fraud, theft, and loss” posed by the leading cryptocurrency. Investing in cryptocurrencies is a risky and speculative gamble, and we are concerned that Fidelity would take these risks with millions of Americans’ retirement savings,” the letter states.

The letter goes on to state that “bitcoin’s volatility is compounded by its susceptibility to the whims of just a handful of influencers,” and it specifically cites Elon Musk. In addition the letter asks why Fidelity disregarded the Department of Labor’s (DOL) concerns.

Available in 2023

Boston-based Fidelity Investments had earlier announced it will begin to offer bitcoin as an investment option in its 401(k) plans by the middle of 2023.

Fidelity is the largest 401(k) plan provider in the United States, acting as custodian for 23,000 plans, which have 20.4 million participants. In total, those plans represent $2.7 trillion in assets under management, according to the company.

It is also the first major 401(k) provider to offer cryptocurrency as an investment for retirement savers.

“The bitcoin option, however, will only be on offer to participants whose employers have elected to include it in their plan,” CNN reported, adding Fidelity did not specify how many employers have already signed on.

“But we have a number of clients that have committed and a number of others in the evaluation process,” said Dave Gray, Fidelity’s head of workplace platforms and products.

He expects to hear from more clients now that Fidelity has publicly announced the news, according to CNN.

“As with any other investment in a 401(k) plan, participants can elect to direct a portion of their regular savings contributions into what will be known as their digital asset account (DAA) where their bitcoin will be held,” CNN reported. “They also can elect to transfer money to their DAA from another investment they have within the plan. And they can take distributions from that account.”

Limits to be Set

“But limits will be set on how much they can contribute. Fidelity won’t allow any employer to set that limit higher than 20%,” Gray told CNN. “But employers may set the limit much lower, for example 5%. And that limit will also apply to how much money an employee can transfer into their DAA as a percentage of the 401(k)’s total assets.

There will also be a limit set on how frequently one can make “round-trip trades” into or out of the account. “We designed this from the point of view of investors that look at bitcoin as a long-term retirement savings opportunity. It’s not for intraday trading or someone looking to trade on market swings,” Gray told the news outlet.

The report notes there will be a trading fee, which has yet to be announced. And the annual fee for the administration will be between 75 and 90 basis points of the assets in the account. That’s for custody, accounting and administration of the DAA, Gray added.

Fidelity is also providing plan sponsors with materials and tools to educate participants about the risks and volatility inherent in investing in bitcoin.

Labor Department Warning

The Labor Department has issued a warning that retirement accounts must meet the minimum standards of protection for participants set by the Employee Retirement Income Security Act. The Labor Department said it is very concerned about the prospect of 401(k) participants being exposed to the extreme volatility of crypto trading.

Bitcoin, currently trading just under $40,000, is down nearly 27% in the past 12 months, and is down about 15% this year alone.