Premium range raises concern about cost, impact

News last week that a premium in the range of from 3 to 6 basis points is under consideration for 2017 by the NCUA Board, as discussed in the meeting of the two-member panel, is raising some concern across the credit union system, particularly as credit unions look at the costs involved. During a board briefing at last week’s meeting, staff of the Office of Examination and Insurance recommended a share insurance premium next year because growth in insured shares in credit unions, combined with a continuing low interest-rate environment, is resulting in a slow decline in the insurance fund’s equity ratio. According to NCUA’s analysis, “the present low interest-rate environment makes it difficult to generate sufficient retained earnings to bring the equity ratio back to 1.30%,” which (since 2007) has been set as the “normal operating level” of the insurance fund. By law, the normal operating level for fund must fall between 1.20% and 1.50%.

News last week that a premium in the range of from 3 to 6 basis points is under consideration for 2017 by the NCUA Board, as discussed in the meeting of the two-member panel, is raising some concern across the credit union system, particularly as credit unions look at the costs involved. During a board briefing at last week’s meeting, staff of the Office of Examination and Insurance recommended a share insurance premium next year because growth in insured shares in credit unions, combined with a continuing low interest-rate environment, is resulting in a slow decline in the insurance fund’s equity ratio. According to NCUA’s analysis, “the present low interest-rate environment makes it difficult to generate sufficient retained earnings to bring the equity ratio back to 1.30%,” which (since 2007) has been set as the “normal operating level” of the insurance fund. By law, the normal operating level for fund must fall between 1.20% and 1.50%.

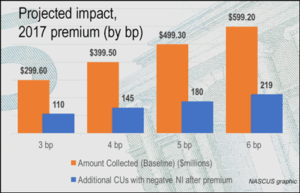

Staff showed that a premium, at the lowest end of the 3-6 bp range, would cost credit unions just under $300 million; the cost at the top end of the range would be double that (at just under $600 million). To put that into perspective, federally insured credit unions at year-end 2015 posted net income of $8.7 billion; a premium at the low end of the range would have cost credit unions about 3.4% of that amount, and about 6.9% at the high end of the range. However, NCUA emphasized that credit unions should not actually accrue for a premium until one is approved by the board.

Additionally, if a premium is in fact assessed (which NCUA also emphasized would be decided only by the board, and that the proposed range is only for credit union budgeting purposes), the agency estimated that 110 additional credit unions (at the low end of the range) would be forced into “negative net income” after payment. At the high end of the range, NCUA estimated that 219 FICUs would have a negative net income. At mid-year, those numbers represent (respectively) 1.9% of all FICUs at the low end, and 3.7% at the high end.

NASCUS President and CEO Lucy Ito said the association would stay in close contact with the agency, particularly regarding the impact on the state system, as NCUA determines its next steps about a premium. She also pointed out that a premium is not prompted by a decrease in the overhead transfer rate (which the board agreed to at last week’s meeting; the first such decrease since 2013). Rather, a premium arises from the growth in insured shares and persistent low interest rates. Indeed, a lower OTR allows for more dollars in the insurance fund, which increases the equity ratio. NASCUS estimates that with the OTR decreasing from 73.1% in 2016 to 67.7% in 2017, an additional $15 million is saved and potentially available to contribute toward the fund’s equity ratio.

LINK:

NCUSIF premium presentation materials from NCUA Bd. Meeting, Nov. 17

SEEKING CONTINUED INDEPENDENCE, CONSUMER BUREAU CHALLENGES RULING

With an eye to maintaining its independence, the CFPB last week filed for an “en banc” review of an appeals court ruling that the agency’s director serves “at the will of the president,” and may thus be removed at any time. The agency is asking the full panel of judges of the U.S. Court of Appeals for the District of Columbia Circuit to review a ruling issued last month which essentially found that the current set up for the agency (in which the director may only be removed “for cause”) was unconstitutional. “A panel of this Court has rendered a dramatic and unprecedented ruling that purports to override Congress’ explicit determination to create ‘an independent bureau’ to exercise regulatory and law enforcement authority in a particular segment of the economy,” according to the CFPB filing. “It thus sets up what may be the most important separation-of-powers case in a generation.” If the appeals court ruling stands, President-elect Trump (after taking office in January) would be free to fire the director (currently Richard Cordray, whose term is slated to expire in July 2018) and put forth his own nominee. However, if the court grants the full-panel review (which some deem likely, given the impact of the case on the bureau), the earlier appeals court decision will be stayed and the director’s tenure reverts to the statute until the appeal is heard and ruled on. Additionally, if the en banc review is unsuccessful for the CFPB, the agency could still appeal to the U.S. Supreme Court (with a stay of the lower court’s ruling possibly remaining in effect during the appeal).

MARIJUANA BIZ BANKING ‘CLARITY’ NOT SO CLEAR

If the state system was hoping for some clarity in the permissibility of serving marijuana businesses resulting from the Nov. 8 election – when eight more states legalized or expanded use of recreational or medicinal marijuana – it may yet be awhile before things clear up, especially with conflicting signals from the incoming Trump administration. Late last week, President-elect Donald Trump tapped Sen. Jeff Sessions (R-Ala.) as attorney general in his administration. Sessions – a five-term senator and a former U.S. attorney and Alabama attorney general – has signaled he’s no fan of legalized marijuana: He was quoted this spring saying “good people don’t smoke marijuana.” Trump, however, during his campaign signaled openness, at least to making medical marijuana available to very sick patients. “In terms of marijuana and legalization, I think that should be a state issue, state by state,” the president-elect said in 2015. Twenty-eight states, and the District of Columbia, have so far approved recreational or medical use of marijuana – representing an estimated 61% of the total U.S. population. Further, 301 U.S. financial institutions — including an estimated 60 or so credit unions — are serving marijuana businesses utilizing existing guidance from FinCEN and the Department of Justice. NASCUS continues to seek greater federal clarity on behalf of states that have legalized marijuana use.

EXAMINER GUIDANCE ON MBL RULE FORTHCOMING

Examiner guidance from NCUA about its new member business loan rule – which goes into effect at the beginning of next year (just six weeks away) – is imminent, according to the agency, perhaps as early as today or early next week. The supervisory guidance will be part of NCUA’s online examiners guide, and is considered critical by credit union practitioners and supervisors in how the agency will approach the new “principles-based” rule. NASCUS is sponsoring (in conjunction with the Credit Union Division of the Tennessee Department of Financial Institutions) a two-day school, Dec. 6-7 in Nashville, to give state stakeholders the latest opportunity to become intimately familiar with the rule and how it affects credit unions in their state.

LINK:

Agenda, registration for Dec. 6-7 MBL School (Nashville)

SUMMARY OUTLINES CFPB REQUEST FOR INFO ON CONSUMER ACCESS

Consumer access to financial accounts and account-related data in electronic form is the subject of a NASCUS summary of a “notice and request for information” issued by the CFPB recently. The bureau is seeking public comment about consumer access to the information, including access by entities acting with a consumer’s permission in connection with the provision of products or services that use of such information, the summary points out. The NASCUS summary outlines questions pertaining to “current market practices” noted in the request for information, as well as questions related to potential market developments.

LINK:

NASCUS summary, CFPB request for information/consumer access to financial accounts, data

BRIEFLY: Call report deadlines, CT Directors’ College upcoming; Happy Thanksgiving!

Federally insured credit unions will have until the final Sunday of the month following the end of the quarter to file their Call Reports, NCUA announced Tuesday. The new deadline takes effect with reports for the fourth quarter, 2016 (in other words, the deadline is Jan. 29, 2017). According to the agency, credit unions will now have, on average, an additional seven days to file their reports … Just a reminder: NASCUS and the Connecticut Department of Banking host the 2016 Connecticut Directors’ College, Dec. 8, in the Hartford area. Open to all area credit union directors and senior staff, the one-day session offers informative sessions on fraud risk, Cybersecurity Assessment Tool (CAT), board and supervisory committee fiduciary duties, the new CECL accounting standard – and more … Here’s to a happy, and safe, Thanksgiving holiday to everyone!

LINKS:

Press release on call report deadlines

NASCUS 2016 Connecticut Directors College Dec. 8, 9 a.m. to 3:30 p.m.; Rocky Hill

Information Contact:

Patrick Keefe, NASCUS Communications, pkeefe@nascus.org or (703) 528-5974

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.