The financial industry is facing a reality check. Amid unprecedented economic uncertainty, rising consumer debt, and growing delinquency rates, traditional collections strategies are falling short.

Years of inflation, rate hikes, and market volatility have created a high-stakes environment for both lenders and borrowers. What once worked is no longer enough. Banks and lenders can’t afford to lean on outdated, one-size-fits-all approaches to servicing that risk alienating customers and delivering diminishing returns. It’s time for a smarter, more adaptive way forward.

Fortunately, innovative technologies have begun to emerge that enable banks to deploy smarter, more tech-driven approaches that treat collections as a strategic function rather than an afterthought. By leveraging more agile approaches and modern tools, lenders can protect revenue, strengthen customer relationships, and enhance compliance while reducing operating costs and complexity.

The Problem with Legacy Collections Approaches

For decades, collections have been reactive. Financial institutions lack the visibility to proactively identify high-risk populations and instead wait until an account is delinquent before engaging with borrowers, often through aggressive tactics like repetitive phone calls, generic payment notices, and rigid repayment plans. These traditional methods come with major flaws:

- They frustrate customers. Borrowers facing financial stress don’t respond well to generic, impersonal outreach. This leads to avoidance, not resolution.

- They don’t leverage data. Traditional collections approaches fail to incorporate predictive insights that could help lenders engage borrowers at the right time, in the right way.

- They are operationally inefficient. Call-heavy, manual collections processes are expensive, time-consuming, and difficult to scale.

Financial institutions that fail to evolve risk worsening collections performance, escalating operational costs, and eroding customer trust. The status quo is no longer sustainable — it’s time for a change.

Smarter Collections: A Data-Driven, Customer-Centric Approach

To adapt to today’s economic landscape, banks need to rethink how they approach collections by replacing rigid, arbitrary practices with flexible, intelligent strategies designed to strengthen both performance and borrower retention.

A modern collections strategy should be:

- Proactive, Not Reactive: Instead of waiting until a borrower falls behind, banks must leverage predictive analytics to identify at-risk accounts earlier. By using behavioral data, transaction patterns, and AI-driven insights, lenders can engage before delinquency escalates, offering solutions that prevent default and reduce roll rates on challenged consumer accounts.

- Personalized and Flexible: Customers expect the same level of personalization in financial services as they do in retail, entertainment, and travel. This means offering customized repayment plans, digital self-service options, and outreach through preferred communication channels – whether that’s email, SMS, chat, or even emerging AI-driven platforms. Collections success relies on borrower engagement, which means meeting your customers at the right time, with the right options, via the right channel.

- Tech-Enabled and Scalable: The right technology can completely transform collections. Advanced automation, self-service platforms, and AI-powered decisioning tools allow banks to optimize recovery efforts while reducing costs. By shifting away from legacy systems and labor-intensive, call-heavy operations, financial institutions can improve efficiency and outcomes simultaneously.

- True, Lifecycle Solutions: Banks can engage partners with expertise in post-origination credit and delinquency management. By relying on domain specialists, institutions gain access to advanced modeling that not only mitigates risk across the credit lifecycle but also unlocks precise, high-impact recovery levers available in the latest stages of delinquency.

The Compliance Factor: Staying Ahead of Regulatory Changes

While changes in administration may shift the regulatory environment, banks shouldn’t be complacent. Consumer protection remains a key focus, and institutions that fail to prioritize fair, transparent, and compliant collections practices risk reputational damage and legal consequences.

Beyond regulatory concerns, banks must also recognize that compliance is a business advantage. Borrowers today have more options than ever when it comes to financial products, and institutions that prioritize ethical, customer-centric servicing and recovery strategies will foster stronger long-term relationships. Customer acquisition costs are high, and the institutions that proactively incorporate compliance into their collections strategies won’t just mitigate legal risk—they’ll enhance customer trust, differentiate themselves from competitors, and drive higher recovery rates.

The Business Case for Smarter Collections

Investing in a modern collections strategy isn’t just about mitigating losses—it’s a strategic business decision. When done right, collections can:

- Improve recovery rates by optimizing outreach and repayment options, banks are able to mitigate losses and drive greater revenue, even from troubled assets.

- Enhance customer retention by treating collections as a continuation of the customer relationship, not the end of it. With better tools and intelligence, financial institutions can find solutions to cure delinquency and support their borrowers.

- Increase operational efficiency by reducing reliance on manual, resource-intensive processes. The long neglected collections and recovery space is rife with opportunities for automation and smarter systems.

The collections landscape has fundamentally shifted. Financial institutions still relying on rigid, outdated processes will struggle to keep up. Consumers expect flexibility, regulators demand compliance, and banks need results. The lenders that embrace smarter, data-driven collections strategies will not only see stronger recovery rates but will also position themselves as trusted, customer-centric institutions in a highly competitive market. The shift is already here, and adaptation is essential.

Courtesy of Katie Quilligan and Anna Burke, The Financial Brand

Amid a downbeat economic outlook and sagging consumer confidence, Americans’ views about their personal financial situation have remained relatively stable over the past year.

A majority say they’re in only fair (40%) or poor (17%) shape, according to an April 2025 Pew Research Center survey. Fewer say they’re in excellent (7%) or good shape (36%). This is very similar to how the public felt a year ago.

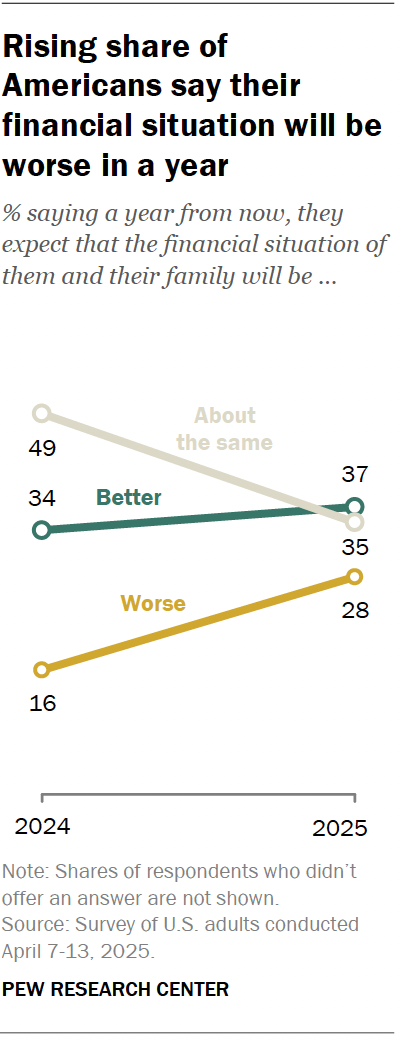

What has changed is the public’s outlook on the future. Roughly three-in-ten adults (28%) say they expect the financial situation for them and their family to be worse a year from now. This is up significantly from 16% who said this in May 2024.

What has changed is the public’s outlook on the future. Roughly three-in-ten adults (28%) say they expect the financial situation for them and their family to be worse a year from now. This is up significantly from 16% who said this in May 2024.

The share of adults who say their situation will be better a year from now has increased only marginally, from 34% in 2024 to 37% today. And the share saying things will be about the same has fallen from 49% to 35%.

Meanwhile, 48% of Americans say they have emergency or rainy day funds that would cover their expenses for three months in case of sickness, job loss, economic downturn or other emergencies.

Views on present circumstances and what might happen in the future differ substantially by income.

- Current situation: Only 20% of lower-income adults say they’re currently in excellent or good shape when it comes to their personal financial situation. This compares with 47% of middle-income adults and 74% of those with upper incomes.

- Future outlook: Looking ahead, 34% of upper-income adults say they expect their financial situation to be worse a year from now. Smaller shares of middle- and lower-income adults say the same (27% and 28%). The share of upper-income adults expressing this level of pessimism has roughly tripled since last year (up from 11%). The increase has been more modest among lower- and middle-income adults.

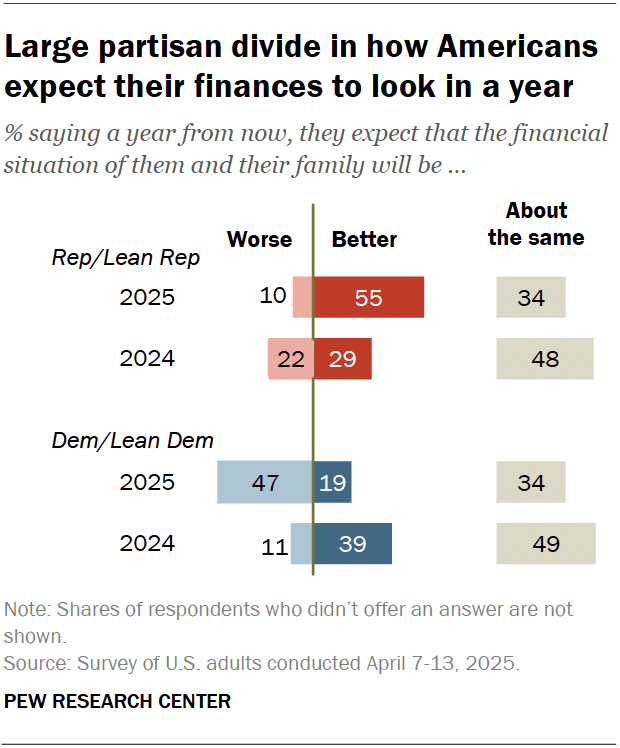

There are partisan differences as well. Republicans and Republican-leaning independents are more likely than Democrats and Democratic leaners to say their personal finances are in excellent or good shape (49% vs. 38%). But a year ago, Republicans were less likely than Democrats to say this (40% vs. 44%).

Views about what the next year will bring have changed for both groups.

- Republicans are now more optimistic: 55% say they expect their financial situation will be better a year from now, compared with 29% who said this in 2024.

- Democrats are more pessimistic: 47% of Democrats say they expect their financial situation to be worse in a year, up from 11% in 2024.

Financial pain points for the public

The survey also asked about specific financial challenges Americans are facing. About one-in-four adults say they’ve experienced each of the following in the past year:

- Had trouble paying for medical care for themself or their family (27%)

- Borrowed money from friends or family (26%)

Roughly one-in-five Americans have experienced these things in the past year:

- Had problems paying their rent or mortgage (21%)

- Had problems paying their daily transportation costs (20%)

- Had trouble paying for child care (20% among adults with a child younger than 18)

- Had to get food from a food bank or food pantry (19%)

Smaller shares say they’ve experienced these things:

- Taken out a payday or short-term loan (14%)

- Been laid off or lost their job (10%)

We asked about some of these issues last year, and the findings were similar. However, the share who say they’ve had trouble paying their rent or mortgage has decreased somewhat, from 24% in 2024.

Lower-income adults are much more likely than middle- and upper-income adults to have faced each of these challenges in the past year. For six of the eight challenges we asked about, lower-income adults are about twice as likely as those in the other two income groups to have had these experiences.

For example, 44% of adults with lower incomes say they’ve borrowed money from friends or family in the past year. This compares with 21% of middle-income and 11% of upper-income adults. Similarly, 36% of lower-income adults say they’ve had trouble paying their rent or mortgage, compared with 17% of middle-income and 5% of upper-income adults.

Positive financial experiences

At the same time, many Americans have made financial progress over the past year.

- 47% say they’ve been able to save money for the future (up from 42% in 2024).

- 46% say they’ve gone on a vacation.

- 36% say they’ve gotten a pay raise at their current job or gotten a better job (up from 32% in 2024).

The survey also asked about specific financial challenges Americans are facing. About one-in-four adults say they’ve experienced each of the following in the past year:

- Had trouble paying for medical care for themself or their family (27%)

- Borrowed money from friends or family (26%)

Roughly one-in-five Americans have experienced these things in the past year:

- Had problems paying their rent or mortgage (21%)

- Had problems paying their daily transportation costs (20%)

- Had trouble paying for child care (20% among adults with a child younger than 18)

- Had to get food from a food bank or food pantry (19%)

Smaller shares say they’ve experienced these things:

- Taken out a payday or short-term loan (14%)

- Been laid off or lost their job (10%)

We asked about some of these issues last year, and the findings were similar. However, the share who say they’ve had trouble paying their rent or mortgage has decreased somewhat, from 24% in 2024.

Lower-income adults are much more likely than middle- and upper-income adults to have faced each of these challenges in the past year. For six of the eight challenges we asked about, lower-income adults are about twice as likely as those in the other two income groups to have had these experiences.

For example, 44% of adults with lower incomes say they’ve borrowed money from friends or family in the past year. This compares with 21% of middle-income and 11% of upper-income adults. Similarly, 36% of lower-income adults say they’ve had trouble paying their rent or mortgage, compared with 17% of middle-income and 5% of upper-income adults.

Click here to read the entire article.

Courtesy of Kim Parker and Luona Lin, Pew Research Center

Recently, a divided United States Supreme Court held that a cannabis product manufacturer could face civil liability under the Racketeer Influenced and Corrupt Organizations Act (RICO) if a consumer suffered a personal injury that created a business or property loss to the consumer.

Specifically, the Court concluded that an employee could state a claim under RICO for losing his job after testing positive for THC when the product he took was advertised as being THC-free.

Unfortunately, this post won’t be replete with Napoleon Dynamite references (although now we want to watch that beautifully stupid piece of cinema and write such a post). Instead, at the risk of sounding like grumpy lawyers and alarmists, this case could dramatically alter the landscape of cannabis marketing and substantially change the industry as a whole.

Our preferred style at Budding Trends is to write for the cannabis industry and not for naval-gazing lawyers, but in this instance it is important for cannabis operators to understand what the Supreme Court said, and what it didn’t say, about RICO liability for cannabis companies.

So, What’s This All About?

In the case, Medical Marijuana, Inc. v. Horn, the Court addressed the sole and broad question of “whether civil RICO categorically bars recovery for business or property losses that derive from a personal injury.”

The facts are relatively straightforward:

Douglas Horn, a commercial truck driver who injured his back and shoulder in an automobile accident, treated his injuries, in part, with a product called “Dixie X.” That product is a tincture infused with CBD that is advertised as “CBD-rich” and containing “0% THC.” A few weeks after ingesting “Dixie X,” Horn’s employer selected Horn for a random drug screening. The test detected “THC” in his system, and Horn’s employment was subsequently terminated. Horn alleged to have ingested no other products that could have contained THC and sent a sample of “Dixie X” for third-party lab testing, the results of which confirmed some presence of THC.

Horn sued the manufacturer of “Dixie X,” Medical Marijuana, Inc., in a United States District Court in New York alleging, among other claims, a civil RICO claim. The complaint contends Medical Marijuana is a RICO “enterprise” that distributes and sells “Dixie X,” and that Medical Marijuana’s false and misleading advertising constituted mail and wire fraud and that those crimes represented a “pattern of racketeering activity.” The district court dismissed Horn’s RICO claim on summary judgment because RICO only affords relief to plaintiffs who suffer business or property injuries. Horn’s injury, according to the lower court, was merely a personal one. As any business or property injuries Horn allegedly suffered stemmed from a personal injury, the district court further reasoned that RICO offered Horn no redress.

Horn appealed that ruling to the United States Court of Appeals for the Second Circuit, which disagreed with the district court’s conclusion and reversed that decision and remanded the matter back to the district court for continued litigation. In doing so, the Second Circuit characterized Horn’s personal injury as one regarding his personal employment and, therefore, a business injury under the RICO statute. As such, the court rejected the notion that RICO imposes an “antecedent-personal-injury bar” to recovery. That holding added to the existing circuit split on the issue, and the High Court decided to review Medical Marijuana’s appeal.

The Supreme Court, at the outset of its opinion affirming the Second Circuit, made clear that the sole question it was deciding was: “whether civil RICO bars recovery for all business and property harms that derive from a personal injury.” Answering in the negative, the Court sent Horn’s RICO claim back to the trial court, allowing Horn’s RICO claim to fight another day – treble damages and all (more on this below).

The Court’s opinion was not unanimous, however, and was not split on perceived political lines. Justice Amy Coney Barrett authored the majority opinion, which was joined by Justices Sonia Sotomayor, Elena Kagan, Neil Gorsuch, and Ketanji Brown Jackson. Justice Jackson also filed a concurring opinion, and Justices Clarence Thomas and Brett Kavanaugh filed dissents, the latter of which was joined by Chief Justice John Roberts.

What Is RICO?

RICO was passed in the 1970s and imposes both criminal and civil penalties for a “pattern of racketeering activity.” Racketeering activity is broadly defined and includes not only the sale of illegal drugs but also wire and mail fraud, both of which can be implicated when a product is intentionally mislabeled and sent to a customer.

Originally aimed to aid in mafia prosecutions, the law now operates to punish those that commit crimes that constitute a pattern. While significant criminal penalties can befall a RICO defendant, the civil penalties are nothing to sneeze at. In addition to attorneys’ fees and litigation costs, a successful RICO plaintiff can recover treble damages. That is, a successful RICO plaintiff can recover as much as three times the actual damages incurred. That’s a heavy sword.

What Does This Mean for Cannabis Operators and Service Providers?

The bad news is that RICO claims carry the possibility of criminal penalties (yeah, that means prison time) or significant money damages (again, up to three-times actual damages plus attorneys’ fees and costs). And the Horn opinion, at least on its face, provides plaintiffs’ attorneys a blueprint of sorts to assert more civil RICO claims.

But the good news is that cannabis companies can mitigate against the risk of RICO liability by ensuring that their practices remain fully compliant with state laws in which they operate.

I’ve seen arguments about whether this is a hemp case or marijuana case. After all, in 2012 the term “hemp” was not included in the Controlled Substances Act; rather, most of the cannabis sativa plant was included within the definition of “marijuana.”

I’m willing to be turned around on this but I’m not yet sold that the effort to distinguish marijuana and hemp under these facts is a worthwhile exercise under current law. Because the underlying claim relates to the labeling of the product, I believe wire and/or mail fraud claims would apply with equal force to either marijuana or hemp companies engaged in the shipment of mislabeled products. And there may be more instances of overlap not addressed by the Court.

The takeaway for cannabis operators: While you can’t eliminate the chances of being sued for anything, don’t mislabel your products and then you’re less likely to face the kind of claim filed by Horn.

Conclusion

There are few acronyms that strike fear in a defense lawyer like RICO. Regardless of how you feel about the wisdom of the policy, RICO is an extraordinarily wide-reaching law and its application to the hemp industry poses a threat that has probably seemed more theoretical than pressing in the minds of hemp operators. Not anymore.

Notably, the Court recognized Congress was the proper place to decide the scope of RICO. Hemp operators should consider whether a tweak to the RICO law could exempt their products from its scope. In the meantime, be careful out there. Stay vigilant.

At the 2025 RSA Conference in San Francisco, Secretary of Homeland Security Kristi Noem delivered a blistering keynote that reignited a fierce national debate over the future of cybersecurity governance in the United States. Her address was not just a critique of the Cybersecurity and Infrastructure Security Agency (CISA), it also was a declaration of intent to radically reshape federal cybersecurity priorities under the Trump administration.

Noem accused CISA of drifting from its original charter of protecting critical infrastructure and federal networks by expanding its mission into the controversial realm of combatting misinformation. Calling CISA the “Ministry of Truth,” Noem argued that CISA’s counter-disinformation efforts during prior election cycles represented a dangerous and improper extension of federal authority.

In her remarks, Noem laid the foundation for a sweeping overhaul of CISA – now under way – and across the whole of the Department of Homeland Security (DHS). In her vision, CISA is being stripped back to its “core functions” of cyber threat response, support for local infrastructure security, and federal system hardening.

“I know the press has covered the role of homeland security and what we have done in CISA thus far with some of the reforms and efficiencies as a bad thing. I would encourage you to say just wait until you see what we’re able to do. There are reforms going on that are going to be much more responsive,” Noem stated.

As part of CISA’s redirection, the Trump administration has begun reducing CISA’s workforce, with reports indicating that up to 1,300 positions spanning both federal staff and contractors being eliminated. These cuts come amid an escalating threat environment in which nation-state actors like China and Russia are aggressively targeting U.S. infrastructure and other sensitive sectors.

Meanwhile, the administration has also put forth a proposed reorganization of the Department of State that could gut its Bureau of Cybersecurity and Digital Policy. Annie Fixler, director of the Center on Cyber and Technology Innovation at the Foundation for Defense of Democracies, told the House Committee on Foreign Affairs Subcommittee on Europe Tuesday that the reorganization “appears to put its cybersecurity efforts at risk and contradict guidance to integrate cybersecurity and digital economy efforts.”

The contradiction of the Trump administration’s cyber agenda across the board is becoming increasingly difficult to ignore. While Noem frames the changes as a refocusing of priorities and a push for efficiency, security experts and former officials warn that the retrenchment will dangerously weaken national resilience against cyber-attacks.

Former CISA director Chris Krebs, who led the agency through its high-profile efforts to secure the 2020 election, has voiced grave concerns that scaling down CISA during a time of growing foreign aggression amounts to unilateral digital disarmament. Other cybersecurity leaders echo his concerns, describing the cuts as destabilizing and shortsighted.

At the center of this storm is the Chinese state-sponsored Salt Typhoon espionage campaign that has compromised U.S. telecommunications systems, including those of Verizon and AT&T. The Federal Bureau of Investigation has issued warnings and national security experts have testified before Congress that China’s ability to infiltrate and remain undetected in such systems presents a dire threat.

Salt Typhoon is not an isolated case; it follows on the heels of Volt Typhoon and other long-term Chinese campaigns which have successfully embedded within critical infrastructure networks including water systems, energy grids, and emergency communications.

Click here to continue reading

Courtesy of Anthony Kimery, Biometric Update

The National Association of State Credit Union Supervisors (NASCUS) is pleased to announce the one-year appointment of Purvi Patel of the California Department of Financial Protection and Innovation (DFPI) to the NASCUS Regulator Board.

“It’s an honor to serve on the NASCUS Regulator Board. I’m excited to contribute my knowledge as a state financial regulator and credit union advocate to the NASCUS leadership and its members. I look forward to collaborating with fellow state regulators and industry leaders to support and strengthen the state credit union system,” commented Patel.

“It’s an honor to serve on the NASCUS Regulator Board. I’m excited to contribute my knowledge as a state financial regulator and credit union advocate to the NASCUS leadership and its members. I look forward to collaborating with fellow state regulators and industry leaders to support and strengthen the state credit union system,” commented Patel.

Patel brings more than 15 years of experience in financial regulation, legal compliance, and community economic development. As Deputy Commissioner of Credit Unions at the DFPI, she oversees the chartering, regulation, supervision, and examination of 110 state-chartered credit unions with a combined $160 billion in assets.

“We’re pleased to see Purvi take on an expanded role with NASCUS,” said Brian Knight, President and CEO of NASCUS. “Her regulatory expertise and industry insight are valuable assets as we advance our mission to support a robust and growth-oriented state charter option.”

Prior to joining DFPI, Patel served as Assistant General Counsel at Self-Help Federal Credit Union and practiced law in the private sector, focusing on financial services compliance and corporate litigation. She served as a law clerk at the U.S. District Court for the District of Puerto Rico and holds a Juris Doctorate from Georgetown University Law Center.

Patel’s combined experience as an attorney, regulator, and advocate for community development brings a distinct and valuable perspective to the NASCUS Board.

To learn more about the NASCUS leadership and organization, visit: https://www.nascus.org/about-nascus/

Finastra’s VP, Product Management Pete Longo stopped by CUbroadcast to share his insights on how smaller financial institutions can modernize their core banking.

Pete explains how they are doing this, using the term “toll boothing” — as well as sharing what this modernization looks like exactly, relating it to a power strip to plug in when needed.

In addition, he discussed what this modernization means for a smaller financial institution, helping them better compete and better serve their audiences.

Lastly, Pete provided some advice for smaller FIs in looking for a core banking provider that will allow them to grow with the latest technology.

A recent cybersecurity report finds that nearly one in five middle market organizations experienced a data breach in the last year, despite the fact most executives are confident in their security measures.

The report, the 10th annual RSM US Middle Market business Index Special Report: Cybersecurity 2025, said that while reported breaches have fallen significantly since 2024, companies need to remain diligent in their cybersecurity efforts. The report was created by RSM US in partnership with the U.S. Chamber of Commerce and looked into cybersecurity trends, strategies and concern in the midsize business marketplace.

The report said larger companies (between $50 million and $1 billion in revenue) were twice as likely as smaller companies (between $10 million and $50 million in revenue) to suffer a breach in the past year. Twenty-four percent of larger company respondents reported a breach, compared to 12 percent of smaller companies. The data also shows, however, that smaller firms seem to lag in cybersecurity budgets and staffing when compared to their larger counterparts, the report said.

“While this year’s survey results are encouraging, the drop in reported breaches may be attributed to normalization following a spike in 2024 due to the sanctions and disruption in the financial network related to the Russia-Ukraine conflict,” Tauseef Ghazi, national leader of security and privacy with RSM US LLP, said. “With the increasing complexity of attacks, it’s also possible that some companies may not have identified the presence of an attacker in their systems. This means continued vigilance is necessary, especially with the augmentation of AI to support malicious activities.”

The report also found that U.S. firms are prioritizing cybersecurity, with 91 percent of respondents who said they expect their company’s cybersecurity budget to increase in the coming year. The report recommends firms take advantage of consultants who could help drive automation to solve problems at a lower cost.

The report also found that the percentage of firms carrying cyber insurance has increased from 76 percent last year to 82 percent this year. Firms are also implementing strategies to limit business disruptions with 52 percent of respondents saying they are developing crisis or disruption communications plans, 51 percent developing a business continuity plan, and 50 percent implementing a disaster recovery plan for critical systems.

“As the cyber landscape continues to evolve, it’s more important than ever for businesses to understand and incorporate advanced technologies to bolster their cyber posture,” Christopher D. Roberti, Senior Vice President for Cyber, Space and National Security Policy at the U.S. Chamber of Commerce, said. “As we enter this new era of risk and uncertainty, the U.S. Chamber is advocating for a collaborative approach to cybersecurity, emphasizing the importance of public-private partnerships and industry-led standards to enhance our collective security and resilience.”

By Liz Carey, Financial Regulation News

The possible reclassification of marijuana under the federal Controlled Substances Act is sparking debate about dismantling barriers to interstate commerce and the future of the industry.

While many states have created regulated marijuana markets for medical or recreational use or both, federal law remains a roadblock to nationwide market integration. According to a report titled “Where Will Weed Win” by Robin Goldstein, director of the Cannabis Economics Group at the University of California, Davis, the future of the industry depends on federal regulatory outcomes.

The future of rescheduling or descheduling marijuana remains uncertain, with many executives and operators in the $32 billion marijuana industry wondering whether it will happen under the Trump administration.

“To deschedule, I’d be shocked if it happened in the next five years, and I’d be surprised if it happened in the next 10,” Frank Colombo, managing director at Viridian Capital Advisors, a New York-based, cannabis-focused investment banking and data analytics firm, told MJBizDaily.

Navigate the Evolving Cannabis Banking Landscape at the NASCUS 2025 Symposium in New Mexico

This two-day symposium brings together credit union leaders, compliance specialists, cannabis industry experts, and key stakeholders for a deep dive into the complexities and opportunities within cannabis banking.

Rescheduling versus descheduling

Opinions vary about the impact of rescheduling or descheduling will have on the marijuana industry. Although rescheduling – as opposed to descheduling – marijuana to Schedule 1 is unlikely to result in interstate commerce, it would grant federal tax benefits to licensed cannabis businesses under Section 280E of the Internal Revenue Code, according to Goldstein’s report.

“Schedule 3 doesn’t do much beyond 280E relief,” said Avis Bulbulyan, CEO of California-based cannabis consulting firm Siva. “280E doesn’t apply to you if you’re Schedule 1 or Schedule 2. It doesn’t change the supply chain or dynamics, but it could open opportunities for listings on stock exchanges.”

If marijuana is rescheduled, it would require additional legislation, such as SAFE Banking, to enable interstate commerce, Bulbulyan said. States also would have to decide whether to tax cannabis products that are imported into their jurisdiction, he said.

Rescheduling marijuana could result in a moderate expansion of the pharmaceutical cannabis market. But any cannabis-based products likely would have to be approved by the Food and Drug Administration before they could be sold in pharmacies. But the cost to enter the market for FDA-approved medicine might not generate ample returns to be worth it.

“Business models in this market segment are typically built around patents and health insurance, which would probably not translate well to weed,” according to the “Where Will Weed Win” report. “The product is already widely available in generic forms that could not be patented and markups over production costs could not compete well with the margins of most profitable pharmaceutical products.”

Who would be winners and losers in cannabis space?

Descheduling would likely legalize interstate commerce for the industry, which would accelerate its growth, according to the report.

It also could result in federal government regulation of the industry and taxation of marijuana products, which would slow the industry, create new costs for struggling businesses and make it more difficult for licensed cannabis businesses to compete with the illicit market.

Viridian’s Colombo said Western states such as California, Oregon and Washington, where cultivation is cheaper – and perhaps Oklahoma – would be the winners under a descheduling scenario. The biggest losers would be cannabis multistate operators that have built indoor cultivation facilities in states where it’s not practical to grow marijuana outdoors.

States also would be losers because descheduling would cut into their tax revenue. “Every state that legalized for medical or adult-use/rec did it for a reason,” Colombo said. “Caring about the patients is not one of them. It’s jobs and taxes. “There would be no reason for anyone to build an indoor cultivation facility in New York if they didn’t have to. “If you could put a regional production facility in Tennessee and ship to New York, you would do that. “New York doesn’t want to do that. There’s a lot of jobs and taxes coming from cultivation facilities in New York.”

Hemp-derived THC is X factor

Interstate commerce might not be legal for the marijuana industry, but it is for businesses that produce intoxicating hemp products and have captured a substantial share of legal cannabis dollars, according to Goldstein’s report.

“Many THC products now being sold in thousands of stores in hemp states are equivalent to licensed cannabis products being sold in other states,” the report said. That’s why states such as California and Missouri want to regulate or ban it, Colombo said. “They know which side their bread is buttered on,” he said. “They’re making taxes on (marijuana) but not hemp.”

Bulbulyan agrees.

“A governor in a state that has an adult-use program has a piggy bank, and they’re not going to let go of it and allow hemp,” he said. States trying to stamp out intoxicating hemp products argue that they are unsafe, untested and sold to minors. But such claims are merely excuses, Colombo said.

Given that the intoxicating hemp industry is growing faster than the marijuana sector indicates that consumers are voting with their wallets. They know the products aren’t tested, but they’re still buying it because it’s more convenient, Colombo said.

“Convenience stores and gas stations sell beer as well and manage not to sell it to minors,” he said. “Is it possible to have sales of intoxicating hemp products and still protect minors? “Yeah, of course it is.”’

Margaret Jackson, MJBizDaily.com

The agency’s restructuring will merge the supervision of large, midsize, and community banks

The Office of the Comptroller of Currency (OCC) is set to implement an organizational restructuring that removes the division dedicated to supervising community banks. Effective June 2, the regulator will combine the Midsize and Community Bank Supervision with the Large Bank Supervision function to create the Bank Supervision and Examination line of business.

Greg Coleman, who currently serves as senior deputy comptroller of Large Bank Supervision, will lead the newly formed Bank Supervision and Examination office. Meanwhile, Beverly Cole, who oversees Midsize and Community Bank Supervision, will retire after 43 years with the agency.

The OCC says the restructuring is designed to better address current challenges, streamline operations by aligning similar functions, and improve efficiency. By blending the supervision of large, midsize, and community banks, the agency aims to enhance collaboration and more effectively respond to bank-specific or emerging issues.

However, the Independent Community Bankers of America (ICBA) has pushed back against the plan, urging the OCC to maintain a dedicated supervision framework for community banks and calling the merger “counterintuitive.”

With policymakers demanding stronger financial oversight, the ICBA argues it is counterintuitive to consolidate supervisory approaches for institutions with vastly different business models and risk profiles. “This change marks a step in the wrong direction and contradicts the agency’s own stated commitment to tailoring supervision based on a bank’s size, complexity and risk profile — rather than applying a one-size-fits-all model,” the group said.

It added that the removal of a dedicated supervision for community banks threatens to weaken the nuanced oversight that effective community bank supervision requires and undermines the tailored regulatory approach they rely on.

As a result, the group has urged the OCC to maintain a dedicated supervision framework for community banks, one that acknowledges their unique role, ensures balanced oversight, and safeguards the stability and choice they offer consumers and local economies.

Written by Banking Exchange staff

The Consumer Financial Protection Bureau (CFPB) said Friday (April 11) that it will not prioritize enforcement of a regulation requiring a registry of nonbank financial companies that have broken consumer laws and are subject to federal, state or local government or court orders.

“The Bureau will instead continue to focus its enforcement and supervision activities on pressing threats to consumers,” the CFPB said in a Friday press release. “The Bureau is further considering issuing a notice of proposed rulemaking to rescind the regulation or narrow its scope.”

The regulation, “Registry of Nonbank Covered Persons Subject to Certain Agency and Court Orders,” was announced by the CFPB in June.

The Bureau said at the time in a press release that the regulation required covered nonbank companies to register with the CFPB when they have been caught violating consumer law and to provide an attestation from a senior executive that the company follows any relevant orders.

It added that the registry is meant to help law enforcement across the United States identify and stop repeat offenders.

“Too many American families have been harmed by corporate repeat offenders in a rinse-and-repeat cycle of illegality, where bad actors see fines and penalties as the cost of doing business,” then-CFPB Director Rohit Chopra said at the time. “Throughout our economy, we have seen fraudsters and scam artists get caught in one part of the country and restart their scheme in a new place hoping to not get caught again.”

Regulators did not offer up cost-benefit analyses as to how the expanded disclosures would impact and improve earlier procedures — and what the impact might be, ultimately, to firms and their end customers — PYMNTS reported at the time.

Commenting on the registry when it was proposed, the U.S. Chamber of Commerce said in a March 2023 letter to the CFPB that “in publicizing information that is already public, the Proposed Rule would not help consumers. In contrast, the Proposed Rule would impose very real costs upon consumer financial services companies that are subject to its requirements, including by driving up compliance costs through an unlawful executive attestation requirement … specifically, the contemplated public disclosures will lack critical context, particularly when a final order does not disclose potential weaknesses in the agency’s case, the reasons the company chose to enter a settlement agreement and whether the company admitted fault.”

The CFPB said in its Friday press release that it aims to give “regulatory relief” from the registration requirements for small loan providers.

Key Points

- The share of borrowers applying for adjustable-rate loans jumped to the highest in over two years.

- Mortgage rates jumped 20 basis points in one week.

- Homebuyers pulled back, despite much higher inventory of homes for sale.

Mortgage rates jumped to the highest level since February last week, dampening overall demand and sending homebuyers in search of riskier loans with lower rates.

Total mortgage application volume fell 8.5% last week compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances, $806,500 or less, increased to 6.81% from 6.61%, with points decreasing to 0.62 from 0.63, including the origination fee, for loans with a 20% down payment.

Applications for a mortgage to purchase a home dropped 5% for the week and were 13% higher than the same week one year ago. Demand from buyers may be higher than a year ago, but there is 30% more active inventory on the market than there was last year at this time, according to Realtor.com. That suggests the annual comparison should be much larger, as low inventory was blamed for weak sales last year.

“Economic uncertainty and the volatility in rates is likely to make at least some prospective buyers more hesitant to move forward with a purchase,” said Mike Fratantoni, senior vice president and chief economist at the MBA.

Home prices are also higher than they were a year ago, and that has more borrowers looking to lower their potential monthly payments. Adjustable-rate mortgages offer lower interest rates but are considered riskier because they have a shorter fixed term and then can adjust higher.

“Given the jump in rates, more borrowers are opting for the lower initial rates that come with an ARM, with initial fixed rates closer to 6 percent in our survey last week,” said Fratantoni, noting a full percentage point jump in the ARM share in just a week.

“The ARM share at 9.6 percent was the highest since November 2023, and this reflects the share of units. On a dollar basis, almost a quarter of the application volume last week was for ARMs, as borrowers with larger loans are even more likely to opt for an ARM,” he added.

Applications to refinance a home loan dropped 12% for the week but were 68% higher than the same week one year ago. Rates at this time last year were 32 basis points higher.

Mortgage rates moved lower to start this week, as markets were far calmer than they were last week. But experts warn there is likely more volatility to come.

“Despite the friendly move and the relative calm, this still isn’t an environment where it makes sense to take anything for granted in terms of today’s rates being available beyond the present day,” said Matthew Graham, chief operating officer at Mortgage News Daily.

The Office of the Comptroller of the Currency will merge its large, midsize and community bank supervision units into a single office, according to an agency announcement on Wednesday.

According to the OCC, the change — which will result in a unified bank supervision and examination division — aims to streamline oversight and reduce inefficiencies at the regulator, which oversees nationally chartered banks.

“Blending the large, midsize and community bank supervision activities will allow for the seamless sharing of expertise and resources to address bank-specific issues or novel needs and provides opportunities for career development and progression for the agency’s entire examination workforce,” an agency release stated. “To ensure [our] approach to supervision evolves to better address today’s challenges, align similar functions within the agency, and leverage opportunities for efficiencies.”

Deputy Comptroller Beverly Cole, who oversees the agency’s Midsize and Community Bank Supervisory unit, will retire after over four decades at the agency. Senior Deputy Comptroller Greg Coleman, currently overseeing large bank supervision, will lead the new unified division.