NASCUS urges NCUA: consolidate state rules

Rules affecting federally insured state-chartered credit unions (FISCUs) should be consolidated in one place – following the example of other federal regulators — and numerous other changes should be considered in NCUA’s rules, including shortening how federal share insurance is described. In its comment letter this week to NCUA on its 2016 Regulatory Review, NASCUS touched on eight specific areas where the agency could ease regulatory burden, with an emphasis on the impact on FISCUs. At the core of NASCUS’ recommendations – once again — is that the agency consolidate in one section all of its rules applicable to FISCUs, making it easier for state credit unions to understand which rules apply to them – and thereby facilitating compliance among credit unions and reducing confusion between state and federal examiners.

“In the past, NCUA has rejected our recommendation while noting that we were free to provide credit unions and examiners a consolidated version of the rules of our own making,” NASCUS wrote. “Suffice to say, a third party’s reorganization of the rules is unofficial and no substitute for official, properly organized rules. We note both the Consumer Financial Protection Bureau (CFPB) and the Financial Crimes Enforcement Network (FinCEN) undertook reorganization of their rules to make those rules more accessible, searchable, and understandable. NCUA should follow their example.”

In other recommendations, NASCUS touched on regulations related to CUSOs, the agency’s appeal process, appraisals, share insurance, bond coverage, supervisory committee audits and verifications, and NCUSIF advertising.

LINK:

NASCUS comment letter/ Regulatory Review (2016)

TEXAS EARNS REACCREDITATION (4TH STATE TO DO SO THIS YEAR)

Texas is the latest state to earn reaccreditation by NASCUS, continuing the Lone Star State’s status that began in 1996, when the Texas Credit Union Department was first accredited. The state was last accredited in 2011. The TCUD regulatory program, with 16 examiners, supervises 185 credit unions chartered by the state (three of which are privately insured), with total assets of more than $34.9 billion. Earlier this year, Kansas, Idaho and Vermont earned reaccreditation from NASCUS. In total, 26 state agencies have earned NASCUS accreditation, which is valid for five years and subject to annual review. The review process enables the accredited agency and the NASCUS Performance Standards Committee (PSC) to measure progress and improvement within each agency. “Congratulations to Texas for earning again this distinction,” said NASCUS President and CEO Lucy Ito. “Accreditation creates a benchmark of standardized regulatory procedures and best practices, as well as a methodology for measuring effectiveness. It’s credible evidence of the agency’s capabilities, recognizing their professionalism of commitment.”

LINK:

Details about the NASCUS accreditation program

FEDERAL PANEL SEEKS CYBERSECURITY INPUT

Information about current and future status of cybersecurity – including trends and promising approaches – is being sought by the Commission on Enhancing National Cybersecurity, according to a Federal Register announcement published this week. Among other things, the panel is seeking information on critical infrastructure, insurance, research and development, and identity and access management. The 12-member commission (housed in the U.S. Department of Commerce), was established and appointed earlier this year by President Obama to make “detailed recommendations” for strengthening cybersecurity, including “bolstering partnerships between Federal, State and local government and the private sector in the development, promotion, and use of cybersecurity technologies, policies, and best practices.” The “request for information” seeks input by Sept. 9.

LINK:

Request for information: cybersecurity current, future

‘DIGITAL GUIDEBOOK’ FROM AGENCY OFFERS TRAINING OPPORTUNITY

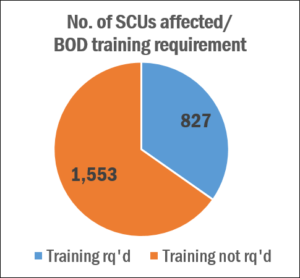

NCUA this week published its guidebook on digital services, designed to help credit unions meet the digital needs of their members. Titled “Going Digital: Strategies for Providing Digital Services,” the guidebook (available on NCUA’s Small Credit Union Learning Center) provides step-by-step instructions on creating a strategic plan for analyzing members’ needs and tailoring digital products to meet those needs. In its announcement, NCUA pointed out that “going digital” covers parts of an internal analysis credit unions should perform when considering adoption of mobile services – including training staff to use and promote services to members. Also in need of training about digital services: credit union directors. According to preliminary results of the NASCUS 2016 State System Profile, at least 10 states require ongoing education and/or training for credit union board members. Those states supervise more than one-third of all state-chartered credit unions, who themselves hold $154 billion in assets, and count 13.6 million members. Among the states reporting ongoing board member education requirements: CO, GA, IA, IL, MD, MS, MT, OH, PA and TX. (Sources for graphic: NCUA, ASI)

NCUA this week published its guidebook on digital services, designed to help credit unions meet the digital needs of their members. Titled “Going Digital: Strategies for Providing Digital Services,” the guidebook (available on NCUA’s Small Credit Union Learning Center) provides step-by-step instructions on creating a strategic plan for analyzing members’ needs and tailoring digital products to meet those needs. In its announcement, NCUA pointed out that “going digital” covers parts of an internal analysis credit unions should perform when considering adoption of mobile services – including training staff to use and promote services to members. Also in need of training about digital services: credit union directors. According to preliminary results of the NASCUS 2016 State System Profile, at least 10 states require ongoing education and/or training for credit union board members. Those states supervise more than one-third of all state-chartered credit unions, who themselves hold $154 billion in assets, and count 13.6 million members. Among the states reporting ongoing board member education requirements: CO, GA, IA, IL, MD, MS, MT, OH, PA and TX. (Sources for graphic: NCUA, ASI)

LINK:

NCUA “Going Digital” guidebook

SURVEY SHOWS MORE THAN 1 IN 10 DON’T KNOW WHERE TO START WITH CECL

When it comes to the new “current expected credit loss” (CECL) accounting standard, nearly one in four credit union and bank representatives said they had not taken any action on it yet, according to a recent survey – and 11% noted that they were unsure where to start. The survey, released late last month by the financial information firm Sageworks, did point out that about two-thirds of financial institutions have begun considering the new standard, which takes effect in 2021 and affects loan loss accounting. For those agencies and credit unions that are looking for a place to start on the issue, the Oct. 5-7 NASCUS State System Summit in Chicago offers a jump-off point: an in-depth session the second day of the conference, titled “The Changing Allowance Account: Adapting to CECL, or Not.” For more information about the 2016 Summit, including registration, see the link below.

LINK:

2016 NASCUS State System Summit (Chicago, Oct. 5-7); agenda, registration

BRIEFLY: More outflow from CFPB; Joint technology team meets on AIRES

More from CFPB (and on our website): “Guiding principles for the future of foreclosure prevention” outlines consumer protections as the federal government’s “Home Affordable Modification Program” (HAMP) foreclosure relief program is set to expire, and; a Governmental Accountability Office (GAO) study which analyzed and reviewed CFPB’s rulemaking processes and documents associated with four Small Business Review (SBREFA) panels … The NASCUS/NCUA Technology Development Team (TDT) met recently to test the latest version (2.39) of the Automated Integrated Regulatory Examination System (AIRES) before it is released publicly. A combination of Visual Basic and Microsoft Excel, Access and Word programs, AIRES is used by examiners to complete examinations on their laptop computers. State/NASCUS representatives on the group are Ashley Lieske (WI) and Dana Owen (TN)

LINKS:

Consumer protections in foreclosure outlined

GAO study on CFPB’s small business review panel

Information Contact:

Patrick Keefe, NASCUS Communications, [email protected] or (703) 528-5974

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.